P2PIncome - Find the P2P Lending Company That Fits Your Investment Needs

P2PIncome investigates the risks and potential gains of peer-to-peer (P2P) lending and crowdfunding. We compare and contrast the world's top P2P platforms, assessing such things as minimum deposits, interest yields, regional compatibility, risk management, and platform features. We search far and wide so that we may be able to put forth an accurate representation of the P2P market. On P2PIncome, we rank the different sites in order of profitability and security.

Most P2P websites offer great returns with low risk. We cover each to the smallest detail so that it is easily understandable and accessible for all.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Alternative Investments

Average Returns

8 - 15%

Minimum Investment

USD 10,000

Signup Bonus

Various

Registered users

450,000

Total funds invested

USD 3.5 Billion

Default rate

2.5%

Regulating entity

U.S. Securities and Exchange Commission

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, PayPal

Withdrawal methods

Bank Transfer, Bank Card, PayPal

P2PIncome reviews Yieldstreet, one of the very best alternative finance platforms in the world. Open to all US citizens, Yieldstreet is a multidimensional investment platform with everything from short-term notes and managed funds, to real estate and art. Learn whether Yieldstreet is right for you.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Market Type

Agri-business

Average Returns

12%

Minimum Investment

EUR 100

Signup Bonus

Prizes

Registered users

8000

Total funds invested

EUR 36 Million

Default rate

3%

Regulating entity

European Crowdfunding Service Providers

Buyback guarantee

Secondary market

Payment methods

Paysera, Lemonway

Withdrawal methods

Paysera, Lemonway

HeavyFinance is a peer-to-peer lending and investment platform focusing on the agri-food market. Read this detailed review to learn whether you should add HeavyFinance to your investment portfolio.

Market Type

Business Loans

Average Returns

8 - 9%

Minimum Investment

EUR 500

Signup Bonus

EUR 20

Registered users

10,000

Total funds invested

EUR 80 Million

Default rate

0%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Debitum Network is an innovative fintech platform that wishes to bridge fiat and crypto into one platform. Debitum Network is a loan originator aggregator with an 8 percent average for investors. Read our analysis on Debitums strengths and weaknesses as a peer-to-peer lending platform.

Market Type

Consumer Loans

Average Returns

12.5%

Minimum Investment

EUR 10

Signup Bonus

1% for 90 days

Registered users

11,000

Total funds invested

EUR 230 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Wire Transfer

Withdrawal methods

Wire Transfer

With institutional backing and a sophisticated algorithm, Esketit is a promising peer-to-peer platform. Esketit is a subsidiary of Creamfinance, and lists consumer loans from its parent company and sister subsidiaries. The platform's average interest rate is around 12%, and the minimum deposit is only 10 euro. Esketit is one of very few p2p sites that accepts cryptocurrencies, and if you happen to have deep pockets, look into their loyalty program, which starts at 25,000 euro.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Business Loans

Average Returns

3 - 7%

Minimum Investment

EUR 20

Signup Bonus

EUR 20

Registered users

43,000

Total funds invested

EUR 1 Billion

Default rate

3%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

October specializes in small risk business loans specifically to SME's in Europe. October has a great track record of fund recoveries, a solid mission and a very strong foundation. October's business and risk strategy is worth the time to read.

Market Type

Consumer Loans

Average Returns

8 - 25%

Minimum Investment

INR 50,000

Signup Bonus

None

Registered users

250,000

Total funds invested

INR 32.34 Billion

Default rate

7 %

Regulating entity

Reserve Bank of India

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer

Withdrawal methods

Bank Card, Bank Transfer

Faircent is only available to Indian residents and citizens. Faircent offers very high returns and a proven method of making investors profitable. Faircent is one of the few P2P lending platforms around the world to be fully regulated and compliant with all of their legal obligations.

Market Type

Consumer Loans

Average Returns

6 - 36%

Minimum Investment

USD 1,000

Signup Bonus

USD 25

Registered users

4.7 Million

Total funds invested

USD 85 Billion

Default rate

10%

Regulating entity

U.S. Securities and Exchange Commission

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Lending Club is one of the oldest P2P lending platforms in the world. They are solely based in the USA. They are audited, publicly traded and fully compliant with SEC regulations.

Market Type

Real Estate

Average Returns

14.41%

Minimum Investment

EUR 500

Signup Bonus

None

Registered users

16,000

Total funds invested

EUR 22 Million

Default rate

Undisclosed

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Paysera, Mangopay

Withdrawal methods

Paysera, Mangopay

In this detailed review, P2PIncome's financial experts assess the real-estate platform InRento. As a peer-to-peer platform focusing exclusively on first-rank mortgages being sold for long-term rental income, InRento offers an excellent low-risk investment option to add to your portfolio.

Market Type

Mortgage Loans

Average Returns

5 - 18%

Minimum Investment

EUR 50

Signup Bonus

1%

Registered users

135,000

Total funds invested

EUR 140 Million

Default rate

32%

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

Housers is one of Europe's largest real estate P2P lenders. They have become internationally recognized through their market choice. Housers marketplace consists of luxury properties from Italy, Spain and Portugal. Find out more in the review.

Market Type

Consumer Loans

Average Returns

6%

Minimum Investment

USD 25

Signup Bonus

USD 50

Registered users

Undisclosed

Total funds invested

USD 23 Billion

Default rate

3%

Regulating entity

U.S. Securities and Exchange Commission

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, Credit Card

Withdrawal methods

Bank Card, Bank Transfer, Credit Card

Prosper is the first ever P2P lending platform to come out of the US. They are second in the US only to Lending Club. Prosper specializes in consumer loans, micro finance and debt consolidation.

Market Type

Charitable Loans

Average Returns

0%

Minimum Investment

USD 50

Signup Bonus

USD 25

Registered users

40,000

Total funds invested

USD 1.68 Billion

Default rate

4%

Regulating entity

Self-Regulated/SEC Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Credit Card, Debit Card

Withdrawal methods

Bank Transfer, Credit Card, Debit Card

Kiva is a P2P lending platorm built to help low income families find a consistent cash flow to survive. Lenders take no interest on the credit they provide but have the ability to lend out the same capital to multiple borrowers.

Market Type

Real-Estate

Average Returns

6.4%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

32,000

Total funds invested

EUR 136 Million

Default rate

Undisclosed

Regulating entity

German Chambers of Industry and Commerce

Buyback guarantee

Secondary market

Payment methods

Bank Transfers

Withdrawal methods

Bank Transfers

Rendity is an Austrian fintech company that originates real-estate development loans and sells notes from those loans on its marketplace. In addition, Rendity offers 3 high-yield savings programs with varying degrees of risk. The average yield on Rendity is around 6.4%, which is also the rate of the medium-risk savings plan.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

14.41%

Minimum Investment

EUR 500

Signup Bonus

0.5%

Registered users

16,000

Total funds invested

EUR 22 Million

Default rate

0%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

EvoEstate has been acquired by InRento.

Who We Are:

We are a team of debt-consolidation and asset-management professionals determined to provide a transparent and all-encompassing library of the available peer-to-peer sites and relevant industries.

We review individual companies, their unique traits, strengths and weaknesses. We regularly write blogs regarding market movement and sentiment, sharing our P2P lending experience on various websites.

We are incredibly interested in the field of new and innovative financial technologies (fintech).

We invest in the companies that peak our greatest interest. Which we then document in review and present to our readers.

Defining P2P Lending:

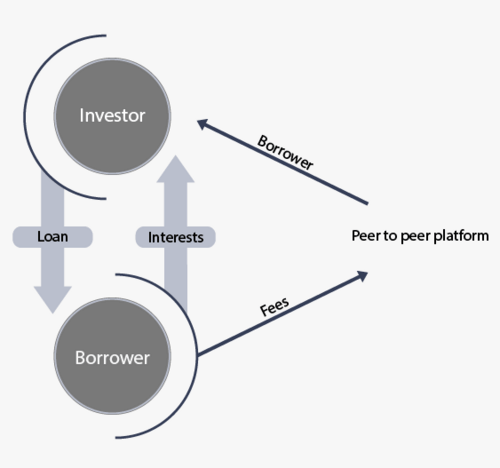

Peer to peer lending is an online marketplace where individuals from all walks of society come together to borrow and lend money to one another, instead of from a bank. The borrower gets better rates than with a traditional bank loan and the lender reaps the benefits of compounding interest.

The borrower sets how much money he needs. The p2p lending site will vet the information and set an interest rate. Lenders are shown all the different projects for which borrowers are looking for money. The lender lends as much money as he wants and gets back a monthly deposit, based on the amount invested.

Before we entered modern society, the average person was unable to easily earn an income through lending their money. It was either impossible to gather the necessary start up capital or overly cumbersome due to the amount of regulation involved. This was a problem which plagued America, Europe, and the rest of the world. It was very difficult to legally make passive income with your savings.

P2P lending has changed the rules of the game. P2P sites are platforms to legally loan your money, to make earn on interest rates just like banks do.

Hundreds if not thousands of users can collaborate with small to large payments, to peer-to-peer micro-finance projects. The users which invested are then given a monthly return which is agreed upon with each individual platform, ranging from 4-36%.

The P2P market comprises AltFi (alternative finance) or DeFi (decentralized finance).

AltFi

Alternative Finance can also be understood as financial channels, practices and processes that exist outside of traditional financial systems like banks and capital markets. They usually come in the form of an online application or website market and exhibit a democratized financial model such as crowdfunding, peer-to-peer lending, revenue based financing. Alternative Finance still uses fiat in order to operate their market places.

DeFi

Decentralized Finance is built directly on top of alternative finance but comes in the form of a cryptocurrency. It provides all of the same features as alternative finance but at a supposed greater level of security and transparency. By utilizing blockchain technology for transparency and crypto assets as collateral, DeFi maintains that it improves the structure of alternative finance.

Why P2P Lending is An Important Financial Tool:

Peer to Peer lending is revolutionary, it provides those with a limited amount of capital the ability to invest in small amounts to see real gains. Investors and P2P lending platforms generally disclose an average return of 10%, the lowest being 4 and the highest being 36.

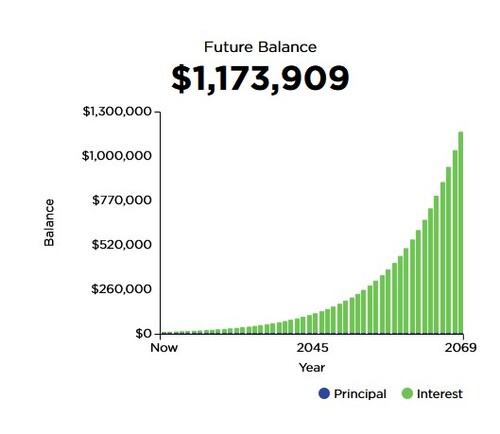

Four percent or even ten percent may seem like a small return on an investment and poses the question why is it worth investing in? The answer comes in two parts. Any potential investment has to consider two things, longevity and consistency. More specifically, it is the product of compounding interest that enables money to grow in exponential rates. A ten percent return on a principal of 10,000 USD, not a cent more, for a time period of 50 years will leave an investor a millionaire. Good investments are the product of time not luck. The second part, is the consistency of return. It is of no benefit to receive an incredibly high rate of return if the risk is losing all or even half of all the capital invested.

Investments need to be lengthy and reliable in order for them to be truly profitable.

Peer-to-Peer lending offers lengthy, reliable loans with the option to re-invest at the end of every loan contract. Loans range anywhere from 1 day to 20 years, with many sites that offer auto re-investing for such loans. Such an infrastructure is in-fact easy to use, profitable, secure and at a very cost friendly barrier of entry.

Why do Borrowers Use P2P Loans:

Usually, borrowers use p2p lending sites because they need a loan and are unable to receive one from a traditional bank.

Since the implementation of 2008/09 financial regulations have only become more difficult to comply with. Getting a loan from the bank is not as easy as it used to be. P2P lending sites give an opportunity to the people that the banks would not consider. Banks might consider these loans to be too high a risk, but so far, p2p lenders have kept it under control. Most platforms report a very low default rate, so individuals have felt secure investing billions of dollars, helping to secure funding for countless companies and borrowers.

Historically speaking, when a company couldn't get a loan from a bank, it would have to sell equity to make ends meet or shut down. P2P platforms give borrowers another avenue to explore, before having to give up on their business.

P2P Lending vs Traditional Investing:

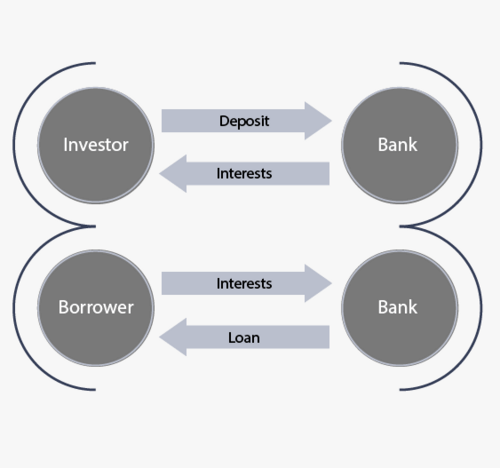

To take a look at how banks and P2P lending systems operate from a functional perspective

How Banks Lend Money:

How Peer-to-Peer Lending Works:

Peer-to-Peer Lending platforms are ultimately trying to replace the already existing financial structures in our societies. They do so by providing the same services, at a more attractive rate, while giving the lender far more control over the investment. As a lender on a p2p platform, you know exactly who you will be lending the money too and what the money will be used for, giving you the option to lend to the people and projects you believe in. There is a great degree of decentralization that comes with peer-to-peer lending sites.

Leaving money in the bank is no longer an optimal solution to wealth growth, interest rates are too low generally ranging at 1 - 2% a year if not lower.

When you put your money in the bank, the bank does not keep it. Banks pool together all the money which is put into savings accounts and lends it to other people. If even half the users of any bank all decided to withdraw all their money on the same day, the bank would go bankrupt. The interest rates you get from the bank are the "payment" you receive, as thanks for them lending out your money. You might be happy to see any sort of return, but 1 to 2 percent is barely enough to keep up with inflation, meaning that your money is actually dropping in value from year to year. If your inflation is larger than the interest rates you have earned, you lost money.

Peer-to-Peer lending addresses this inequality by providing individuals the option to lend their capital to the people of their choosing at significantly higher returns. In the end of the day there is no ultimate investing strategy and choice. There is no one size fits all. Investing is based on various aspects and what might fit for you and be profitable for you might not for somebody else. There are still objective ways of determining whether or not there are other aspects of traditional wealth growth.

But, what is assured, is that simply leaving your money in a bank is ultimately detrimental to wealth growth.

Traditional Forms of Wealth Growth:

P2P Lending is not necessarily better than traditional forms of investing it just might be a better fit.

Traditional Investments can include:

- Mutual Funds

- Bonds

- Stocks

- Real Estate

Traditional investment options are the products of 16th century economic thought. Mainly, you have stocks, bonds, mutual funds, and real estate. They are quite different to each other, but have similarities in terms of high barrier for entry and the rather low interest rates.

Mutual Funds

Mutual Funds are investment vehicles that consist of multiple investors pooling their capital together to rake in larger profits. Mutual funds prove to be a great to grow wealth, the only concern is that there are many mutual funds to choose from. Many of which do not produce desirable results. Successfully investing with mutual funds requires the investor to do their due diligence on the human resources of the fund.

Bonds

Bonds are loans that are given out to either governments or businesses by investors. They are slow, but they are steady. It is more common to find government issue bonds. Government issued bonds are a very safe to grow wealth. The interest rates are vary depending on the location and duration, but are generally around to 2 - 3 percent. It's not a quick way to the top but it will ensure a smooth ride.

Stocks

Stocks are shares of a company. By buying stocks you are given a share of the company's profit in the form of dividends. Some people hold onto stock for the long term to receive dividends, while others buy low and sell high to make as much money as possible. Stocks can be relatively safe but stocks are still prone to high volatility. Fees on stock exchanges are also unreasonably high and due diligence as well financial literacy is required to be a successful stock market investor.

Real Estate

Real estate, land and property have for millenia has been the ideal investment. People will always need homes and rent is a sustainable form of income. On the other hand, real estate is expensive, land costs a fortune, buildings require maintenance and repair. Finding a tenant is not a guarantee and due diligence is required on the housing market. Owning a property requires a completely different skill set of its own.

Why Invest in P2P Lending:

P2P platforms give you a fantastic opportunity to utilize your wealth, to create more wealth. Unlike with traditional forms of investment, you don't have to invest that much and are still able to accrue high interest rates. P2P lending starts off for as little as just $1 and can net you a compounding 10% return on investment. That being said, you should start off with more than 1 $ USD, unless you're happy with compounding around 10 cents at a time for the next year.

Investing in debt is a safer money guarantee as opposed to investing in equity. When a company becomes insolvent it is the debt that gets paid back first. Different companies have set in motion protocols and procedures to ensure that capital on their system is safe to use. Loans are often secured by collateral or first rank mortgages to ensure that if capital is taken away there are means for the lenders to get their capital back. P2P Lenders can loan out to businesses without worry because these businesses offer collateral, they have a means to produce income and the lender is the first priority account to the borrower.

How We Rank Websites:

We take several attributes into account to determine the quality of a P2P platform.

A simplified overview of how we conduct our analysis:

- We look at a company's backing, who is the face or faces behind the machine. Very often management incompetency is the sole reason for a company's decline.

- We measure their default rate, we compare that percentage with the amount of principal returned and interest accrued.

- We gauge their security, collateral offered and their ability to successfully complete fund recoveries.

- We read the fine print. We seek to answer the question, will this company go above and beyond to protect an investors capital?

- We check out their customer service. From every angle possible, we determine if the support team is of quality.

- We live test the user experience and transparency, how much does the company commit to informing the users.

- And lastly, we invest and tell our readers how it all panned out.

Identifying a Good P2P Lending Platform:

Ultimately what P2PIncome is looking for is which P2P lending platform that will bring the highest return on investment (ROI). If a company appears to have a trustworthy foundation, good track record and a high enough level of security then we test those companies out. We are always looking for a high internal rate of return (IRR). Often companies will offer a high return on your investment but caution very high risks. Others promise very low risks at very low rewards.

Very often, the platforms with low risk and low reward may bring about significantly greater gains than the ones who have a high risk and high reward. The burden of success is on the platform and their ability to manage a lender-borrower ecosystem at the same efficiency a traditional bank would have.

Some companies offer loans that pay out in 5 weeks, some only offer loans that pay out in 5 years. Both theoretical companies have the potential to be good P2P lenders but the reality is the numbers and percentages mean nothing if the companies can not handle defaulted loans and fund recoveries. There is a high standard P2P lenders need to abide by. They must have fool-proof due diligence, their legal teams need to be top-notch. They must maintain healthy relationships with both the borrowers and lenders and on top of all of this, they must do all of this better than the local bank.

All mentioned aspects of the companies are of utmost importance. We observe, study and analyze them to the smallest detail. We leave no bits of data behind so we can provide our readers a holistic representation of P2P lending.

Unique Types of P2P Lending:

P2P is a gateway to finance, it too comes with a lot of variance. Different P2P systems exist to administer security, good faith, transparency, and offer different risks and rewards based on the types of loans. The variables don't stop there, a lot goes in to determining who is a risk-worthy borrower and who is not. Not every company has the same methodology in determining credit worthy borrowers. Some platforms arguably don't do their due diligence at all. As a result, they are placed in the bottom of the list.

The types of P2P lending platforms:

- Loan Originators

- Loan Originator Aggregators

- Real Estate P2P Lenders

- Unsecured Lenders

- Secured Lenders

- Cryptocurrency Lenders &/or Stablecoins

It's common knowledge that a certain number of loans are prone to default. Each company comes with it's formulas for risk mitigation and aversion.

These types of risk management strategies include :

- Collateral

- Due Diligence

- Credit Score

- State Guarantee

- BuyBack Guarantee

- Group Guarantee

- Debt Restructure

- Mortgage/ LTV

- Litigation

- 3rd Party Bank and Legal firm in-case of insolvency

Each strategy comes with its pros and cons. In general what we look for is how these strategies are implemented and when. How many of these strategies are used, how does it affect the overall P2P lending and experience and lastly, whether or not it's justified when compared to the IRR of the platform. Risk should always be inversely related to reward.

How to Invest with Peer-to-Peer Lending Platforms in Five Steps?

Read Our Reviews:

_tn.png)

Explore our review table above where our analysts have put the time and dedication to digest and condense the most important features, strengths and weaknesses of the top Peer-to-Peer platforms.

Choose Your Investment Platform:

_tn.png)

Choose what works for you! Peer-to-Peer platforms offer various different types of loans with different parameters regarding profitability. Choose whether you would prefer personal loans, mortgage loans, business retail loans, movie production loans and litigation loans. All come with their own unique circumstances for returns and losses.

Verify Your Identity:

_tn.png)

You will quickly find that different Peer-to-Peer platforms not only vary in type and business model but also in degrees of risk. Some platforms offer high returns at the risk of high defaults such as Bondora, Mintos and Crowdestor. But some platforms offer low returns at arguably no risk such as, October or Prosper. In general, we advise our investors to invest in loans that are backed by some form of guarantee or collateral in the case of a defaulted borrower, this will help retrieve and protect principal.

Determine Your Risk Level

_tn.png)

All Peer-to-Peer platforms require rigorous customer verification. This is money we're talking about here and P2P platforms take it very seriously. In order to fight against identity fraud and credit card fraud companies require extensive information as to who you are and what you are doing on their platform. Expect to produce your passport, other forms of identification, credit card verification and address verification. For businesses, the requirements are far more demanding. Businesses should have their articles of association, registration with the state, license, owners verification, representative of account verification and perhaps more upon request of whichever Peer-to-Peer site. While this may be tedious process we highly caution against any site that does not follow these protocols. They are industry standard for very good reason.

Grow Your Portfolio with P2P:

_tn.png)

Select your method of payment. Some platforms only allow bank transfer such as Reinvest24, others like PeerBerry, allow credit card, bank transfer and a few online payment merchant services. We would advise to use your credit card if possible, bank transfers take up to three days. Choose loans that you understand. Loans that come with collateral will always yield a lower percentage but have a much lower chance of defaulting. Try to aim for loans with collateral, it will overall lead to a better investing experience. Peer-to-Peer lending was designed to be foolproof. As long as you choose the right platform and stick to loans that are not high risk you can trust your money will grow fabulously.

P2P Lending Helps People Gain Financial Independence:

If you're interested in P2P investments you have come to the right place. Compare our experiences to yours, learn from our mistakes and take a greater step to financial independence.

Ultimately, we believe that P2P investments provide everyone the opportunity to materialize a second flow of income. Lending money on P2P platforms is affordable, accessible, liquid on many sites and profitable. Alternative Finance has taken the world with a strong grip. And people are interested.

Traditional financial institutions are wavering at the presence of this grip. If you're interested don't just take our word for it, follow our blog and let us show you.

P2PIncome's desire is to provide the individuals of today the tools to be a part of our modern financial revolution.