P2PIncome's Portfolio Continues to Thrive Despite War

Please read P2PIncome's most recent investment-portfolio report for 2025.

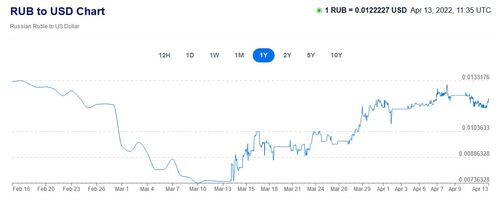

In our monthly report for February 2022 we addressed the fall of the Russian ruble resulting from waves of international sanctions imposed after President Vladimir Putin's military invaded Ukraine. We reported how top-tier p2p platforms like PeerBerry and Iuvo Group were shunning Russia investors and the ruble; and we assumed, as did much of the world, that there was no floor to catch the ruble's descent. It turns out much of the world was wrong.

In a move National Public Radio (NPR) referred to as "Financial Alchemy," long-time Putin ally Elvira Nabiullina, governor of the Russian Central Bank, mitigated the effects of sanctions by requiring all Russian businesses to convert no less than 80% of the dollars they earned overseas into rubles. She also imposed tax hikes (a 12% tax on the purchase of dollars, and increasing interest rates to 20%), and limited the amount one could take out of the country to $10,000. As a final move, she banned the trade of foreign-owned Russian securities. Add to that the fact that Russia's export of natural gas remains strong, and that China and India continue to trade with Russia, and it seems the Russian economy will live to fight another day.

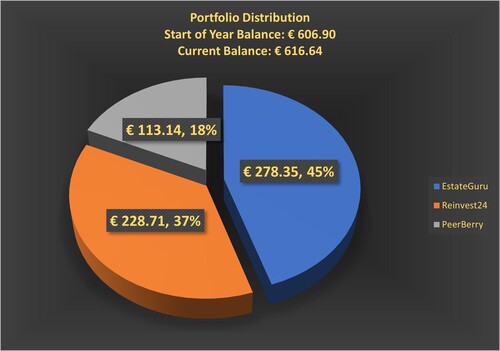

Overview of Our Current Portfolio

The political crisis has not directly affected our portfolio, as none of our investments were linked to Russia, Ukraine, or the ruble. There was some concern regarding PeerBerry's decision to suspend all activities in the affected region, only because that had the potential to hurt their market share, but the platform took actions to protect their investors and we saw nothing during the month of March that justified concern. Our investments on all three platforms continued to profit, albeit not as much as in previous months. We had balances on all three accounts, and we reinvested those balances. We look forward to increased gains over the next few months, as those new investments begin to earn.

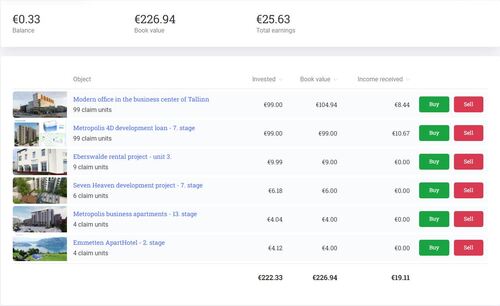

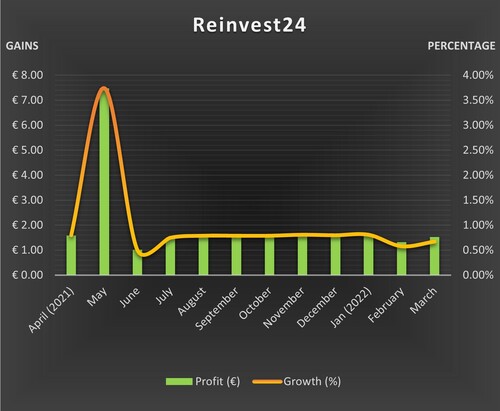

Reinvest24

Our earnings for March were a touch better than those for February, at 0.67% growth, up from 0.58 the month before. Still, we want to get back to +0.75% growth, which means investing our balance. The problem, as we mentioned last month, is that you can't purchase notes on the Primary Market for less than 100 euro, meaning our 24-euro balance would have to be invested on the Secondary Market. That entails fees that would temporarily reduce our total book value, but we should recoup those fees relatively quickly. We chose properties in Switzerland, Latvia, Germany, and Estonia, and we're looking forward to reporting on them next month.

Reinvest24 - Our Account Figures - March 2022

February Balance: € 227.18

March Gains/Losses: € 1.53

March Balance: € 228.71

Monthly Increase: 0.67%

Total Increase to Date: 11.96%

Our investments on Reinvest24 earned 1.53 euro over the month of March, bringing our total balance from 227.18 euro to 228.71 euro—an increase of 0.67%. We invested our 24-euro balance on the Secondary Market, where we invested in a few projects, including a hotel in Switzerland, a small apartment complex in Germany, a bullet loan for a renovation in Riga, and a business complex in Moldova. To be sure, we paid a bit in fees, and we might even see a slight decrease in total book value for the month of April, but we anticipate good long-term profits from rental dividends.

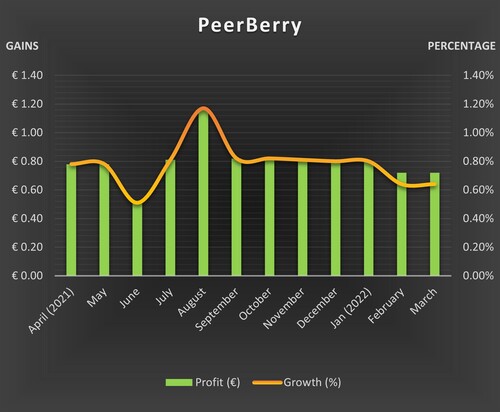

PeerBerry

PeerBerry was among the first p2p platforms to respond to the Russian invasion of Ukraine. Their user-wide email informed us that they would suspend all activities in the affected areas, and cease to move money in rubles until further notice. This was an important step, as it reassured investors that PeerBerry's crisis-management team was on top of things. Having spoken in the past with CEO Arūnas Lekavičius, we were not at all surprised by this timely response to a serious crisis. This is the standard we've come to expect from PeerBeery, and one of the reasons we consider them among the very best peer-to-peer lending platforms on the market today.

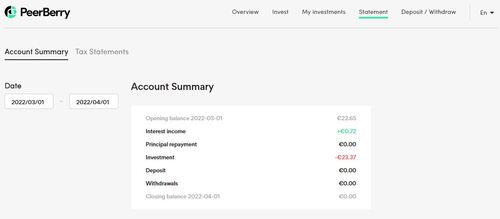

PeerBerry - Our Account Figures - March 2022

February Balance: € 112.42

March Gains/Losses: € 0.72

March Balance: € 113.14

Monthly Increase: 0.64%

Total Increase to Date: 11.05%

We concluded the month of February with 112.42 euro in our account, and gained another 0.72 euro during the month of March, for a total of 113.14 euro. The increase of 0.64% was the same as the month before, when rounding to 2 decimal places, but obviously sightly lower in absolute terms. As in the case of Reinvest24, we'd like to see slightly higher gains, but it's too early in the year to call this a trend. Besides, the upheaval in Europe could be affecting the market, even if just slightly. Only time will tell. Furthermore, we had a balance we reinvested, and we'll see how that affects to totals over the next few months.

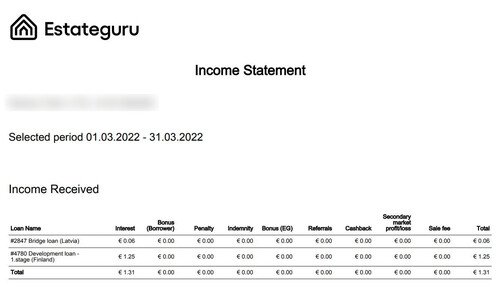

EstateGuru

Our experience with EstateGuru took a bad turn when we found ourselves struggling to justify their approach to late-payments and potential defaults. Over the course of the past two months, however, the situation worked out, and the seem to be back on track. Nevertheless, a quick glance of their trends indicates a level of instability we don't see from the other two platforms. Gains of 0.31% and 0.11% in June and July 2021 (respectively), compared with 1.2% and 1.05% in October 2021 and February 2022 (respectively) make for a bit of a rollercoaster ride.

EstateGuru - Our Account Figures - March 2022

February Balance: € 277.04

March Gains/Losses: € 1.31

March Balance: € 278.35

Monthly Increase: 0.47%

Total Increase to Date: 9.76%

We concluded the month of February with a balance of 277.04 euro, and we earned another 1.31 euro in March, for a grand total of 278.35 euro—a gain of 0.47%. That's hardly impressive, but as we've mentioned in the past, EstateGuru is a somewhat volatile platform. Poor performing months like this will be offset in the next quarter, when 3 of our loans will come to term. All in all, our increases since opening the account have been 9.76%, which is quite good. It will be interesting to see whether 2022 is a bullish year for EstateGuru. We certainly hope so.

Comparing Platforms

As we conclude the first quarter of 2022, we find ourselves relatively satisfied. While EstateGuru only yielded 0.47% this month, their average return for the quarter was 0.7%, which is acceptable. If we pan out to the 12-month average, they come in at the anticipated 0.75%. Similarly, Reinvest24 yielded 0.67% for the month, and an average of 0.69% for the quarter. Their 12-month average was the best of the 3 platforms, at 0.99%. Peerberry's results were also quite good: a monthly yield of 0.64%, a quarterly yield of 0.69%, and an 12-month yield of 0.78%.

| Platform | Balance | Payout | Yield |

| Reinvest24 | € 227.18 | € 1.53 | 0.67% |

| PeerBerry | € 112.42 | € 0.72 | 0.64% |

| EstateGuru | € 277.04 | € 1.31 | 0.47% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

P2PIncome's financial experts want to see these platforms succeed, because that's good for everyone. We're very happy to see EstateGuru bounce back after a slightly problematic year. Similarly, we're thrilled with how PeerBerry has addressed the crisis in Europe, and we have only good things to say about them as a platform. That being said, if you look over the numbers, there's no denying Reinvest24 must be our top pick. The 12-month averages are well above those of EstateGuru and PeerBerry, and we suspect that will remain the case in the months to come. If you must choose only one of these platforms, go with Reinvest24 and enjoy the added value of rental dividends.