P2PIncome | How Profitable is Peer-to-Peer Lending?

Have you heard of peer-to-peer lending but are a bit skeptical of lending your money? We understand. Who wouldn't be skeptical of lending out money? The reason why peer-to-peer lending is so attractive to so many investors is because new lending platforms provide a few brilliant solutions to assuage the fear of risking money.

Before we get into that, let's discuss the benefits of lending money.

"Give a man a gun and he can rob a bank. Give a man a bank and he can rob the world." - Tyrell Wellick

Our good friend above us Mayer Rothschild, the father of modern banking. He realized the benefits to owning a bank and established one of the biggest banks in Europe. Banks are incredibly profitable institutions that base their entire existence on lending money to people. The banks don't fear borrowers defaulting because they have the means to sustain themselves. Furthermore, banks have the societal necessity to not have to worry too much. Because banks effectively secure capital, citizens rely on the banks as a means to get capital. Without a bank, there is no secure capital.

For the vast majority of history this was the case. In order to live in a functioning society we needed banks. Today that is not the case. Today there are hundreds if not thousands of online financial tools that would enable us to operate as our own banks, while maintaining our own financial security. Banks take the capital you deposit and invest or lend it. That is how they are able to provide interest. Peer-to-peer lending platforms are doing the same thing except instead of the bank choosing where your money goes, you do. And the interest is substantially higher.

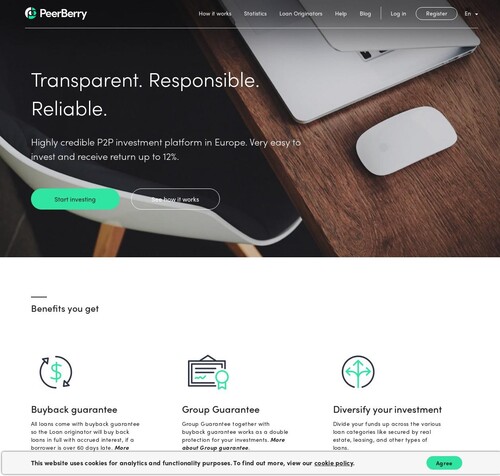

PeerBerry

PeerBerry was founded in Latvia in 2017 as a peer-to-peer lending platform for consumer loans. The platform aggregates several loan originators to service their lender/ borrower ecosystem. PeerBerry is often acclaimed as the fastest growing peer-to-peer lending platform. The platform is constantly increasing their size of investors, the number of loan originators and offered loans. Despite originating as a personal finance lending platform, PeerBerry has expanded to offer a wide variety of loans to their investors. Investing on Peerberry requires a 10 EUR minimum and yearly rewards range from 9 to 12 percent.

PeerBerry is a great platform for a lot of reasons but a few reasons in particular classify PeerBerry above their competitors. PeerBerry's infrastructure is protected by PeerBerry's dual buyback guarantee which is in effect a protocol to deal with defaulting borrowers. The first part of this protocol determines that if a loan is late for 15 or 30 days, depending on the loan, the loan originator buys the loan back and provide principal and accrued interest. If the loan originator itself can not continue to service the loan, then all the loan originators on PeerBerry's platform step in to support the falling loan originator.

PeerBerry also has a very easy to use auto-investing tool as well as a wide range of diversified loans. On PeerBerry you can find loans that will span either a very long time or a short term. You can also find loans for business loans, real estate loans, consumer loans and auto loans. The marketplace is ever expanding and investors can find good value loans being listed daily.

PeerBerry has an active investor based and in their marketplace they offer a wide variety of loans from a wide variety of countries. PeerBerry was founded by one of Europe's most successful lending groups, Aventus. Aventus initially offered loans on Mintos' platform, shortly after experiencing Mintos' success, Aventus created PeerBerry. Aventus is also PeerBerry's largest source for loans in their marketplace. There are a lot of diversified platforms but we do not find that many of them have such an well thought-out elaborate approach to protecting investors funds in such a marketplace. PeerBerry is an incredibly transparent company, users can find out all of the information necessary on both PeerBerry as well as their loan originators.

P2PIncome has direct experience with PeerBerry, having invested €100 on the platform in final quarter of 2020. To learn more about the P2PIncome investment portfolio, and PeerBerry's performance, take a look at our portfolio reports.

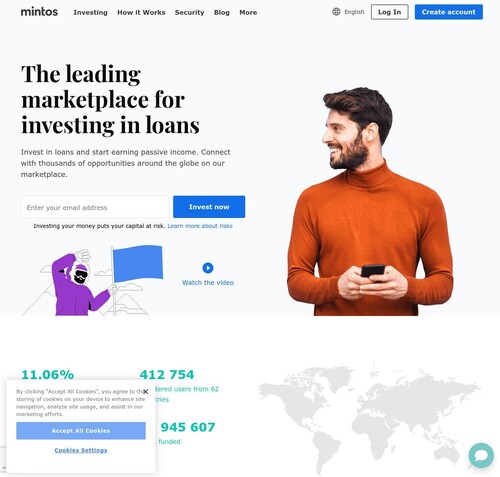

Mintos

Mintos is an industry titan in comparison to many platforms. Mintos processes over a billion EUR in loans per year and have been consistently growing in every aspect. Mintos continues to lead and innovate the European market. Mintos was founded in 2015 but only saw real growth in 2017. Mintos also aggregates a number of loan originators on to their platform to issue loans. Investing on Mintos requires a 10 EUR minimum and yearly rewards range from 9 - 20 percent.

Mintos has really set the bar for most of the peer-to-peer lending platforms. The platform "Bondora" was really the first platform to give users an auto-invest feature but the returns were minimal. Mintos, however, changed the game when they provided multiple auto-investing strategies, each of which provided significantly higher returns than on any other platform. To make it even more interesting, Mintos gave investors the option to design their own API so that they could use their own investing bots and software on Mintos. This wasn't the only thing that made Mintos different though. Mintos was effectively the first platform to establish a volatile secondary market. All of a sudden investors can opt in and out of their loan contracts. By providing ample amounts of liquidity Mintos was able to further justify the value of their ecosystem.

Mintos also has buyback guarantees on all of their loans. They are highly diversified, they have loans from every single loan industry including but not limited to: auto loans, consumer loans, business loans and real estate loans. There is also a wide range of risk and returns that are available on Mintos. Mintos is really a great platform for beginner investors who want to dip their feet in the water of peer-to-peer lending. The platform has all the features that would entice any peer-to-peer investor.

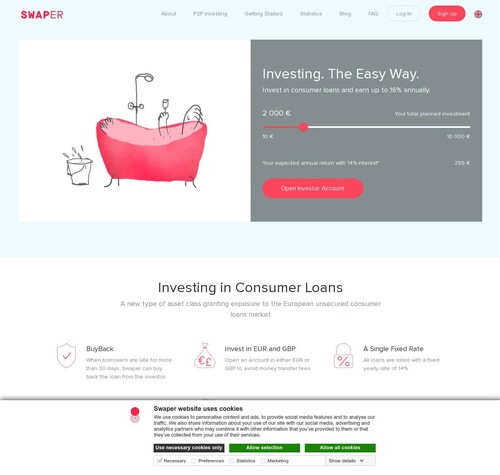

Swaper

Swaper is a peer-to-peer lending platform founded in 2016 in Latvia. It is currently owned by Marina Tjulnova. Swaper serves to be an easy auto-investing solution for investors who are not as interested in doing their research. There is a 10 EUR minimum deposit and investors can expect to receive a fixed 14 percent yearly return on their investment. For investors who are holding more than 5000 EUR in their portfolio the returns are 16 percent.

Swaper works closely with one loan originator called Wandoo Finance. During the creation of Swaper the company relied heavily on Wandoo's capital and support. All loans on Swaper come from Wandoo Finance, however, all buyback guarantees are issued by Swaper. Swaper as a business entity is responsible for all of the investments made on their platform. Swaper, as far as our knowledge goes, is the only platform to guarantee the loans of their loan originators. All loans on Swaper are short term they range between 30 to 60 days and the loans range from 50 to 1000 EUR.

Investors who deposit more than 5000 EUR automatically receive an additional 2 percent return on their principal. Swaper has no processing fees on their platform other than a 1 - 2 percent on their secondary market. The rate depends on the fluctuation of the market and loan. Loans on Swaper should compound roughly 10 to 12 times a year. There is some concern regarding the transparency of Swaper and the lack of a manual investing option.

ReInvest24

Reinvest24 is a real estate platform that provides temporary equity in exchange for loans. The platform establishes business relationships with local partners and formulates rental properties that will yield good returns. Investors then purchase from this already established network of high yielding rental properties and purchase temporary equity. The temporary equity provides returns and if a sale of the property is made, which is a part of Reinvest24's business plan than investors also benefit from the increase in equity value. Investments on Reinvest24 start at 100 EUR and yearly returns range from 14 - 16 percent.

Loans on Reinvest24 span from 1 month to 24 months. Since investors hold temporary equity, if there are any changes or fluctuations to the value of the property the investor is also exposed to that change. Reinvest24 during the course of their loan contracts try to sell the property. This is all explained in each loan offered on their platform, a structure for both rental yields and capital gains. There are no fees associated with Reinvest24 other than a 1% fee per transaction on both the primary and secondary market. Reinvest24's secondary market adds a lot of liquidity to their platform and provides investors with another feature to add to their investment strategy.

We found that Reinvest24 is a great platform and have documented in our seventh monthly report an increase in capital gains on Reinvest24. We were highly pleased with the result. Reinvest24's strategy attempts to give investors two forms of income, one frequent which is the rental payments. The second is less predictable and not always a guarantee – the capital gains. The three types of loans on Reinvest24 are bullet loans, development loans and rental loans, all of them have different risk levels and therefore different pay outs.

What Are Other Reasonable Investing Avenues?

There are many great options when it comes to investing, there are stocks, real estate, bonds, small businesses, crypto currencies, even college courses. It's difficult to suggest which is better or what would make you more money. Most of these situations are very circumstantial. The more appropriate question here is, what can you afford to invest in?

Real Estate

Investing in real estate requires large amounts of capital, at the very least 50,000 USD to begin and the yield is infamously low. Real estate also requires maintenance costs and if anything goes wrong then the owner is liable.

Stocks

Firstly, To invest in stocks you also need a few thousand USD or EUR. Stocks can grow in value if you invest wisely, and you could see a 10 percent rise in value per annum, which is fine, as it's more or less what you would find with peer-to-peer lending, but the fees with stocks will also reach hundreds or thousands if not properly observed.

Crypto

It can be very easy to invest in crypto, but the fees can be very high if not properly managed. Whether you are purchasing, or sending fees on Bitcoin's or Ethereum's networks, you can reach up to 100 USD per transaction. Not to mention, crypto is highly volatile and in its current state, it's tantamount to gambling.

Bonds

Bonds are very safe forms of investment, as returns are somewhat low. If you live in a country with a stable economy and GDP, we think everyone should be investing in bonds. They are a great way to retain capital. However, if you want to risk a bit more to earn significantly higher returns, then bonds should be only a part of your diversified portfolio.

Small Businesses & College

You could invest in a vending machine, an online drop shipping store, or some kind of skill that you could use to sell later. There are a lot of examples often touted by finance gurus on Instagram, LinkedIn, TikTok, Twitter – you name it. All of them suggest to create something that will create a secondary source of income. While their "12 steps to success" may not be true, the need to create a secondary income is true. These things are possible, but require a lot of work. Vending machines, drop shipping, marketing or creative skills all require a large degree of time and work.

Is Peer-To-Peer Lending More Profitable Than Other Asset Classes?

Peer-to-peer lending is not necessarily more profitable than other asset classes, but it does not need to be. Profit is important, but it needs to be accompanied by security. The money you're investing needs to come with collateral that will ensure if something goes wrong, that your principal at the very least is protected. Crypto is profitable until it crashes and 70% of the market cap is wiped out, which has happened on several occasions.

So if It’s Not More Profitable Why Peer-To-Peer Lending?

Peer-to-peer lending is impressive because it has a low barrier of entry. You can start investing from 10 USD or EUR. It serves a real world problem and provides much needed credit to groups and industries that really need it. Investors of every size are able to earn safely because of it. Prior to peer-to-peer lending, if you wanted to invest you needed at least a 1000 USD just to start. Now you only need 10 USD. The amount of people who now have access to money that simply grows for them has exponentially increased.

Peer-to-peer lending is not for the billionaires, millionaires or even the people with a few hundred thousand in the bank. Peer-to-peer lending, as an investment, is for the people who can't afford to buy a Tesla or Apple stock. Or for the people who don't even have enough money to make ends meet because they are trapped in a rut. P2P is for your average Joe.

Verdict

Choosing the right peer-to-peer lending and investment platforms is a complex issue. There are many excellent options, including all the sites mentioned herein. That being said, the financial experts at P2PIncome would like to recommend PeerBerry for three reasons. First, it's an easy-to-use site. Second, PeerBerry is highly transparent. Third, we've tested the site, and found it highly reliable in terms of returns. If you're looking for consistent returns of 9 to 12%, consider PeerBerry.