French Investors Should Consider These P2P Platforms

There's a saying in French: Les petits ruisseaux font les grandes rivières, which translates as, "Little brooks form great rivers." The idea is that small amounts can eventually add up to major sums. That's the idea behind investment. You're not trying to win the lottery. You're trying to develop passive-income streams that will continue to grow, long term, till you have enough money for retirement and beyond. One of the very best ways to accomplish those financial goals is to invest in the ever-growing peer-to-peer lending market, and in this article we will discuss which platforms are best for French investors.

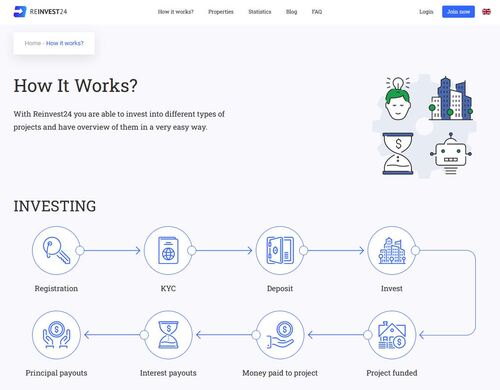

Reinvest24

Not only are p2p sites a great source of passive income, but the real-estate p2p sites are often the best of the lot, because in addition to the interest you collect, you also collect rental dividends and capital gains. In other words, you lend money and collect the interest on the loan, and once the borrower has refurbished the property, you either collect a percentage of the rent, or the borrower sells the property you collect part of the profits. In some cases, the rental income continues for years, even after the borrower has paid back the entire loan. If you're interested in that sort of contract, Reinvest24 is the place to go.

You'll be impressed by the Reinvest24 marketplace. Every listing includes a copiously detailed investment prospectus. The listing starts with a precise address, pop-up Google Maps interface, and gallery of photos and renditions. Below the gallery is the Object Overview, which explains what type of investment is offered, as well as the relevant data: Annual Interest, Bonus Interest (i.e. dividends), Payment Frequency (usually monthly), the Collateral securing the loan, the Duration of the loan, and the Country in which the project is located (a minor redundancy, to be sure). A small tracker next to the Object Overview indicates the total Loan Amount, how much of that amount has been funded, and even provides an investment calculator.

Below the investment details is a summary of the project, with a description of The Area and The Property, followed by a section about the project type. When describing the area, Reinvest24 provides important data about how the investment fits it with the financial scheme of the project. For example, a development project is an exclusive residential area will include a description of the standard of living in the area, as well as the sort of amenities one can find nearby. Similarly, the property description will indicate important details, such as the projected square-meterage of the residence, how many floors and rooms the home with offer, and whether it will have pool, a car garage, and other luxuries.

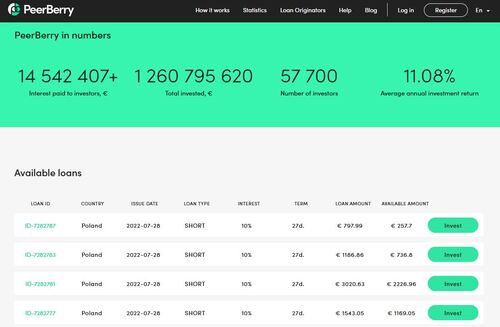

PeerBerry

PeerBerry has an excellent long-term track record, and thousands of satisfied users. The site crossed the 1-billion-euro-invested mark in 2021, and reports an average annual investment return over of slightly over 11%. Led by CEO Arūnas Lekavičius, PeerBerry places an emphasis on financial security, with its unique double-guarantee. All loans are secured with a money-back guarantee, as well as a "group" guarantee, both of which are offered by PeerBerry's business partners. If the borrower fails to repay a loan, the lender receives 100% of the principle. If a loan originator falters financially, the "group" of business partners fills in the missing funds.

PeerBerry's marketplace is packed with loans notes, large and small. On any given day, one will find several hundred investment opportunities from all over the European Economic Area. The marketplace provides all the important details you need to make a smart decision. In addition to the Loan ID and Country, you'll find the Issue Date, Loan Type, Interest Rate, Term, and Available Amount. The interest rate ranges from 9% to 12%, while the term (i.e. duration) of the loan can be as short as one month or as long as two years.

The marketplace has several filters that help you zero in on the kinds of loans you prefer. For example, under Loan Types, you can select from Short-term, Long-term, Real Estate, Leasing, and Business. You can also filter by Country, or by Loan Originators, as well as by Remaining Terms In Days, Available Amount, and Interest Rates. If you're not interested in adding to an existing loan, select Exclude My Investments. If you tend to choose the same types of loans often, go to My Saved Filters and create your own filter to use in the future.

Mintos

Mintos is one of the top p2p sites, offering everything from personal loans and wedding loans, to invoice financial and cash advances. The platform has managed over 8 billion euro in investments, with an average interest rate of 11.75%. Mintos works with a long list of loan originators covering the entire financial landscape. The site also has a very active secondary market, where over 75% of Mintos' active investors have make nearly 40 million transactions. Mintos successfully managed the regulatory and global challenges that ravaged much of the p2p market back in 2020, and today Mintos stands among the very best p2p platforms in the world.

Mintos works with a long list of loan originators, so it's not surprise that both their primary and secondary marketplaces are so active. Users will find a long list of loan options, including agricultural loans, mortgage loans, invoice financing, and even pawnbroking loans. Mintos lists over 50 lending companies and subsidiaries on its site, including some major players: Cream Finance in Poland, Credifiel in Mexico, DelfinGroup in Latvia, the entire Eleving Group, which spans all over Europe, and Sun Finance, which also covers all of Europe.

Each listing includes a Type, such as Short-Term Loan, or Pawnbroking Loan, followed by the Mintos Risk Score. This score helps gauge the credit-worthiness of the borrower on a scale of 1 through 10, with 10 being a perfect credit rating. Most loans have a score of 6. Next comes the Lending Company, followed by the Remaining Term. Many of the loans have terms of only a couple of months, but there are a few long-term loans in the mix. The next section lists the Initial Principle, Interest Rate, and amount Available for Investment. Each of the parameters has its own filter, so if you want to search specifically for short-term loans with high interest rates and low credit scores, you can do so with a few simple selections.

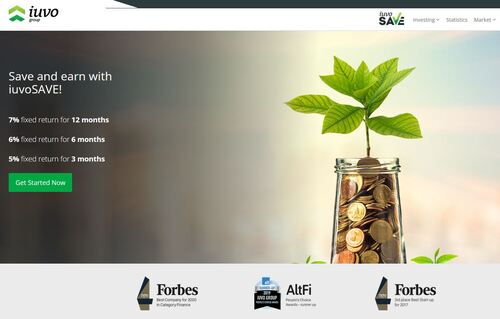

Iuvo Group

If you're interested in a peer-to-peer lending platform with its own savings account, look no further. Iuvo Group is an award-winning platform on which you can invest and save. On their marketplace, Iuvo lists dozens of investment opportunities, mostly in the form of consumer loans, and reports average annual returns of approximately 9%. In addition, IuvoSave offers members a high-yield savings program that can be set up for fixed returns ranging from 5% to 7%, depending on duration. Iuvo boasts over 30,000 users, and crossed the 250,000,000-euro-invested mark back in 2021.

Iuvo's marketplace offers numerous loans from a long list of loan originators. Among the better-known originators are VivaCredit, EasyCredit, Fast Finance, Access Finance (Biala Karta) and Kviku. Loans are listed in five currencies: the Bulgarian lev, the Romanian leu, Polish złoty, the Russian ruble, and of course, the euro. Users have access to a currency exchange tool that ensures the best rates when moving from one currency to another. While the majority of investments are in euro, a solid 40% are in lev.

The Iuvo marketplace is quite detailed. It includes the flag of the country in which the loan was originated, followed by an ID number, Issue Date, Loan Type, and the Loan Originator. Thereafter, you'll find the Score Class, which ranks the borrower's credit from A to E, with A being perfect credit. Next is the Guaranteed Principle (which is always 100%), followed by the Loan Amount and current Balance, the Interest Rate, Term, and Installment Type. Finally, there is the Status of the loan, whether current of in delay, amount Available for Investment, listed in euro. The average interest rate on Iuvo is 7%, while most of the loans are in the C and D classes. Payments are usually made in 14-day installments.

RoboCash

Robocash takes a unique approach to investment with its fully-automated (i.e. Robo) platform. Rather than having you spend your time pondering which investments are best, Robocash does all the work for you. All you need to do is set the parameters and deposit some money. The proprietary algorithm makes sure to locate and invest in the kinds of loans that meet your requirements. With over 25,000 registered users and over 400,000,000 euro invested, this is a platform for busy investors ready to free up some time by allowing computers to streamline their investment processes.

There are both positives and negatives to automated investment. On the one hand, you don't have to bother with the decision-making process, which is convenient. If you're simply to busy to manage a portfolio and aren't in a position to pay a financial management service, this is the easiest way to do things. On the other hand, you're entrusting your money to a robot. It's kind of like trusting a self-driving car: Some people feel perfectly safe, while others need to feel they're in control. Regardless, the primary market offers interest rates averaging 12%, with a duration between 15 days and 60 days. All loans are secured, and the minimum investment is a mere 10 euro.

Dedicated users, meaning those who have held notes on Robocash for over 6 months, have access to the secondary marketplace, and that is open to manual investment. On the Robocash homepage, you'll find a useful investment calculator that allows you to estimate how much money you'll make over a given period of time. Individuals are allowed to invest up to 25,000 euro per year, while other legal entities are limited to 15,000 euro. Using this calculator, you'll find that 10,000 euro invested for 180 days at 12% interest will yield 592 euro of profit, while 720 days at 11.5% will yield 2,268 euro of profit.

Best P2P Platforms for French Investors

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

Verdict

Choosing the perfect p2p platform isn't easy. There are so many out there, and every person has their own approach in to finances. The site in this article represent the best of peer-to-peer pending in the European Economic Area, and investors in France should take a good look at each of them. If they all seem good to you, go ahead and invest in all of them. On the other hand, if you're looking for just one "ideal" platform, our top suggestion is Reinvest24. The nature of real-estate investment is that you have 3 sources of income (interest, rental dividends, capital gains) rather than just one. As a result, the total combined return (yield plus capital growth) is nearly 15%, and that's a very attractive rate for any investor.