Heavy Finance - Reviewed | Investing in European Agribusiness

HeavyFinance is an award-winning peer-to-peer agricultural-investment platform on which farmers can access the funds they need, and you can profit in the process. If you're wondering how much money there could possibly be in agribusiness, you might be in for a huge shock. According to the World Bank, "agribusiness is a 5-trillion-dollar industry that accounts for more than 10% of global consumer spending." After all, human beings need to eat, and that means someone has to farm fruit, vegetables, meat, dairy, and other essentials. Farmers work tirelessly to make sure grocery stores are stocked, and to achieve that goal, they need need land, farmhands, capital, machinery, seeds, and more.

HeavyFinance helps farmers purchase and develop land, purchase equipment, pay laborers, purchase seeds, irrigate, advertise, deliver, and everything else involved in the food-to-table supply chain. In addition to its primary market, HeavyFinance has an active secondary market, as well as a sophisticated auto-invest tool. Investors enjoy annual returns of around 12%, on loans ranging from €7,000 to as much as €300,000. HeavyFinance also maintains an informative blog, with one section devoted to Farmers News, and another to Investors News.

Types of Loans on Heavy Finance

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Heavy Finance Loan Characteristics

Loan duration4 - 48 Months

CurrencyEUR

Buybacks No

CollateralYes

Available inBG, LT, LV, MD, PL, PT

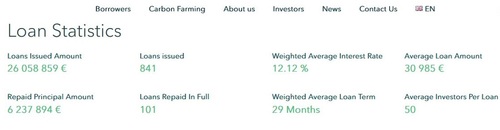

Returns rate12%

Default Rate3%

Recovery RateUndisclosed

Fees1%

BonusesNone

Heavy Finance Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

HeavyFinance.com Pros & Cons for Investors

Pros

- Collateralized Loans

- Attractive Interest Rates

- Large Marketplace

- Low Fees

- Regulated Platform

- Excellent ESG Policies

Cons

- Minimal Diversification

- Limited Banking Options

Investing with HeavyFinance

When you invest with HeavyFinance you invest in the future of agriculture throughout Europe. The money allows farmers to till arable land, irrigate farms that are slowly drying out, increase the bee population, feed cattle and dairy cows, expand vineyards, rent or purchase heavy machinery, and fund other farming projects. Land and heavy machinery are often used as collateral, which is how the company got its name.

One of the advantages to investing in agriculture is that it's heavily subsidized. States throughout the EU commit billions of euro to agriculture, which reduces the risk you face when lending money. Furthermore, asset-backed loans are inherently safer than other loans, as there is something tangible securing the loan. Because many of the loans are long term, you won't enjoy much liquidity on HeavyFinance, but the returns are quite attractive.

Types of Investments

HeavyFinance focuses exclusively on agri-food loans, but that's a huge sector with numerous sub-sectors. Among the types of loans found on HeavyFinance marketplace are a €25,000 loan for a bee farm in Lithuania that seeks to hire more workers. On the other hand, there might be a listing for a €75,000 loan for a vineyard in Portugal to install a drip-irrigation system. Some of the loans are only a few months in duration, while others are for 3 or 4 years. The interest rates also vary greatly, based on the credit-worthiness of the borrower, the amount and duration of the loan, and the collateral offered by the borrower. Simply state, the only thing all these loan offerings share is that they're related to farming and agriculture.

Auto-Investment Tool

HeavyFinance has an excellent auto-invest tool, designed to make your investment experience easier and more time-efficient. You can set your investment options based on the Investment Amount, the range of Interest Rate you'd like to earn, the Loan Duration, the Risk Class of the loan (based on the HeavyFinance's credit assessment), the Loan Type, and Loan-to-Value (LTV) Ratio. Any field left blank will remain open to all qualifying loans, meaning, the more options you want, the fewer of these you should set. On the other hand, investors who have very specific goals and risk tolerance might want to limit themselves to only a few loans by setting each filter.

Once you've set the filters and selected Create, the tool will continue to invest your money based on those filters until you change them. You can set the tool to automatically reinvest any profits, or you can choose to withdraw those payments once they've cleared. You can also set several investment strategies and toggle them as you see fit. You're entirely in control; the tool merely serves as a convenience.

Borrower Data Verification

Unlike most p2p platforms, HeavyFinance originates its own loans. It does not work with loan originators. This means they are directly responsible for the due diligence processes, including borrower-data verification, credit assessments, collateral valuation, and so on. Because they're taking on so much risk, HeavyFinance is extremely vigilant in its processes. It inspects the actual property being collateralized, as well as conducting in-depth assessments of the borrowers' credit history, current debt, profit margins, business plan, and other relevant information. This might help explain the impressively low default rate of 3%.

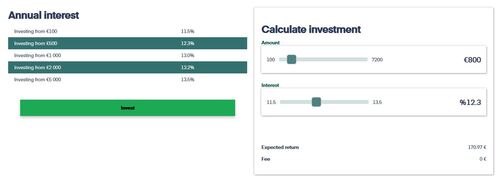

Rates and Returns

The interest rates on HeavyFinance loans range form 10% to 15%, with loan-duration ranging from 4 months to 48 months. This means you should expect an annualized weighted return of approximately 12%. In other words, once you take interest rates and amortization into account, and subtract the occasional default, you should enjoy returns of around 12%.

Who is HeavyFinance?

HeavyFinance is a company that focuses on modern solutions to farming problems. They offer collateralized loans, sell loan shares via their p2p platform, and provide carbon-farming guidance to farmers to help reduce carbon emissions. The company has offices in several countries, and their experienced team includes financial experts, farming experts, and sustainability experts. HeavyFinance believes in the importance of agri-food, which is why the work exclusively within that sector.

Lender/Borrower Ecosystem

Whereas the majority of p2p sites work with loan originators, listing loans those originators have already issued, Heavy Finance originates and issues its own loans. Those interested in borrowing money via the platform can select the Borrowers tab on the homepage and fill in the free online application. The site promises to reply "within one working day." Loans range from 6 months to 48 months, from €7,000 to €300,000, and from 10% to 14.5% annual interest. The payment-frequency options are monthly, quarterly, semi-annual, and annual. As with most loans, the interest rates are linked to the credit-worthiness of the borrower.

Once a loan is issued, it is made available for investment via that site, where investors can shares of the loan and earn a profit from the interest. The minimum investment is only €100, and there is no maximum. The average loan amount is around €30,000, and the average portfolio on HeavyFinance is approximately €600. Investors keen to purchase shares of several loans can sign up for the HeavyFinance newsletter, which includes announcements about new offerings.

General Data

| General | Data |

| Origin | Lithuania |

| Founded | 2020 |

| Offices | Lithuania, Poland, Bulgaria, Portugal |

| Loan Type | Agricultural |

| Sign Up Bonus | None |

| Fees | 0.1% - 1% |

| Interest Rates | 10% - 15% |

| Min Deposit | €100 |

| Investment Length | 4 - 48 months |

| Secured Lending | Yes |

| Currency | EUR |

Registration & Withdrawal

The registration process on HeavyFinance is quite simple. First, locate the green Register button on the right side of the home page. This will take you to a registration page where you will select either Investor or Borrower. After selecting Investor, you will have to fill in the online registration by providing your email, generating a password, and agreeing to the site's User Terms and Privacy Rules. P2PIncome's financial expert advise you read the user terms on any site you plan to use regularly, especially when you plan to give them access to your financials.

While that completes the "registration" process, it's only the beginning of the actual process. You will still need to undergo the Know Your Customer (KYC) process. This involves proving you are an adult (18+) citizen of the EU, and that you have an EU bank account. You will also need to activate either a Paysera account or a Lemonway account. Once you have completed the process and received confirmation, you will be able to deposit money and begin investing.

You are under no obligation to invest, but the site does reserve the right to terminate your account for prolonged inactivity. That being said, the minimum deposit/investment is a mere €100.

Languages

If you prefer working in a language other than English, you'll be pleased to know the HeavyFinance webpage is available in Lithuanian, Polish, Portuguese, Bulgarian, Latvian, and German. To toggle between languages, look for the small flag-icon at the top of the page. Select the flag to open a drop-down menu with other languages, each represented by the relevant flag.

Marketplace

The HeavyFinance marketplace, which they call the Projects List is packed with investment listings, each with its own detailed page. Each listing has a Summary, which provides details about the borrower, the loan, and the project. You'll find out how much land is being farmed, for example, and what the farm produces. You'll learn a bit about the history of the farm, and whether the borrower has successfully paid back other loans from HeavyFinance. You'll also find out what the farmer intends to do with the money, such as expanding the farm, purchasing seeds, advertise a new product, or purchase equipment.

Each listing has a picture gallery, which really helps get a sense of how that farm operates. After all, a vineyard/winery looks nothing like a dairy farm, and neither look like a corn farm. By viewing these high-quality color photographs, you're able to put yourself in the farmer's shoes. Below the Summary is the Loan Information, and bellow the gallery is the Business Information. The Loan Information lets you know how much has been Raised, how much is Remaining, how much time is Left, the estimated Return Rate, the loan's Risk Rating, the Loan Period, the LTV, the Country in which the farm is located, the Repayment Type, the current Number of Investors, and what Security Measures are in place to protect your capital.

The Business Information includes the Declared Land and the Owned Land (usually in hectares), and the farm's Revenue of the past few years (in euro). Below that are the details of the Security Measures, whether Land, Machinery, or other, as well as the Value and Valuation Method. Next comes the Annual Interest, which may be fixed, but is often dependent on the amount invested. For example, you might enjoy 11.5% on a €100 investment, but 13.2% on a €2000 investment, even though it's the same project. To make things easier, HeavyFinance supplies an interface on which you can Calculate Investment returns for that project. Simply enter the amount you plan to invest, and the calculator will adjust the interest rate accordingly.

The final section reports the Project Risks, which you should certainly look over before investing your money.

Risks Involved

Transparency & Security

At the bottom of the HeavyFinance project-lists page you'll find a Transparency section and a Legal section. At P2PIncome, we recommend you invest some time into reading these documents, not just with this specific platform, but with any of them. Among the documents in the Legal section are the General Terms and Conditions, Reliability Assessment Rules, Loan Restructuring Policy, a detailed ESG Policy, and even a detailed Business Continuity Plan.

In the Transparency section you'll find a description of the Investment Risks, the site's Privacy Policy, Cookie Policy, and Monitoring Policy. You'll also find a description of the Fees you'll pay, and a link to the Statistics page. In addition, you can find monthly Portfolio Performance Reviews in the Investor News section of the site's blog.

Our Readers Have Asked:

Is it safe to invest with Heavy Finance?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, HeavyFinance has carved out an important place in the P2P investment market, and as a regulated entity they are safer than many other P2P sites.

Which credit bureau does Heavy Finance use?

Credit bureaus are an integral part of the American loan market, but they are not used in Europe. Instead, lending companies and banks assess credit-worthiness based on their own metrics, including monthly income, income-to-debt ratio, collateral, financial reputation, criminal record, and other factors.

What minimum credit score needed to get a loan from Heavy Finance?

Because Europeans don't use credit bureaus, they don't use credit "scores" in the sense you might be thinking. Instead, they use their own rubric, which can't really be compared to the numeric system used in the US.

How to become an investor at Heavy Finance?

To invest on the HeavyFinance platform, you must register for an account, complete the KYC process, and deposit funds. Once you're been greenlighted, study the marketplace, and try to select projects that suit your financial goals.

How much money will I make?

The reported returns on HeavyFinance are slightly over 12%, which is very good for the p2p business. For example, a €10,000 investment at 12.5% interest should enjoy returns of almost €3000 over the course of 4 years.

What are the risks?

Indeed, it's important to understand that even with collateral, the risk of losing your entire investment is very real. It's not likely, but it can happen. If a loan goes to collections and the collateral is a combine, HeavyFinance's agents have to be able to sell the combine before they can pay anyone back. That's never a guarantee. As such, you should never invest money you cannot afford to lose.

Why do I need to submit ID verification?

With all the scams on the internet, it's important that a company confirms they're working with an actual person, and have that person's permission to move their money around. Just imagine if someone pretending to be you invests your money.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Heavy Finance Located?

Heavy Finance is headquartered at A.Mickevičiaus g. 5-101, Vilnius, Lithuania. They also have offices is Poland, Bulgaria, and Portugal.

Verdict

Agribusiness is a 5-trillion-dollar industry, and will continue to thrive as long as human beings need to eat. With the advent of eco-friendly farming, and the need to sustain more people than every before, the farming industry is here to stay. There's a lot of wisdom to investing in things humans need, and HeavyFinance is a great platform in that regard. Assess each project carefully and invest wisely, and you're likely to make very good money with Heavy Finance.