Robocash Reviewed | Fully Automated P2P Lending

Robocash is an international peer-to-peer lending platform. The Robocash peer-to-peer network operates with loan originators. The platform offers a 12 percent yearly return at a minimum entry deposit of 10 EUR. Robocash is owned by Robocash Holding Group, a financial organization that provides financial aid and instruments to people all over the world.

Types of Loans on Robocash

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Robocash Loan Characteristics

Loan duration15 - 60 Days

CurrencyEUR

Buybacks Yes

Collateral No

Available inEurope

Returns rate12 - 13%

Default Rate2%

Recovery Rate100%

FeesNone

Bonuses1%

Robocash Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Robocash?

Robocash is a fully automated (no manual investment) Peer-to-Peer lending platform founded in 2017 that operates out of Croatia. However, the parent company Robocash Holdings is a much larger, more prominent international financial organization.

Robocash Holdings has offices in Switzerland, Singapore, Russia, the Philippines, Spain, Latvia, Kazakhstan and India. The loans offered on Robocash P2P platform all originate from the countries Robocash Holdings operate in.

Lender/Borrower Ecosystem

The four loan originators that are hosted on Robocash's platform service's borrowers all over the world. All loan originators belong to Robocash. Whether or not the P2P platform Robocash is actually a loan originator aggregator or really just one big loan originator is up for debate.

- Prestamer (Located in Spain)

- Robocash Riga

- Robocash Latvia

- Tez Finance (Located in Kazakstan)

All companies are owned by Dr. Sergey Sedov, a Russian entrepreneur who holds a PhD in economics from the Institute of Economics at the Russian Academy of Science.

Loans issued on Robocash are by and large unsecured consumer loans. The loan agreements are up to a €1000 and the borrower must pay the sum back within 30-60 days though conditions may vary per "loan originator." Because the service on Robocash is so automated it is difficult to determine what the ecosystem really looks like. There is also a lack of transparency associated with the borrowers which is further reinforced by not letting investors choose the loans they want to fund. In general, it's rather difficult to understand why a lending service wouldn't allow their investors to choose the loans they would like to fund. This is a serious red flag and should invoke feelings of skepticism.

Investors on Robocash experience little cash drag on their portfolio as new loans are issued rather frequently on Robocash. Other positive features of Robocash are 100% buyback guarantee on all loans and no fees to use Robocash's service.

General Data

| General | Data |

| Origin | Russia |

| Founded | 2017 |

| Offices | Russia, Croatia, Singapore, Vietnam, India, Spain, Kazakhstan |

| Loan Type | Consumer Lending |

| Sign Up Bonus | €10 |

| Fees | 0% |

| Interest Rates | 12% |

| Min Deposit | €10 |

| Investment Duration | 15 - 60 Days |

| Secured Lending | Yes |

| Currency | EUR |

How to Borrow?

Robocash functions like a loan originator aggregator. It is not possible to receive loans from Robocash. However, borrowers may visit their website to find out more about their local partners and if those local partners exist within country they may contact them.

Registration & Withdrawal

It takes a few minutes to register. After verifying an address, number and standard KYC, users can deposit. There is a €10 minimum deposit after which, users can automatically invest. The website itself is very user friendly, and Robocash makes frequent successful updates to their level of transparency and website quality.

It is recommended to deposit in euroto avoid loss on currency exchange, as most of the platform operates with EUR.

For free euro deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. Robocash does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

Marketplace

Robocash is available to EU and EEA residents, and currently they have plans to expand further.

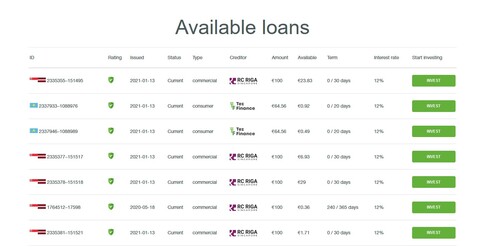

Robocash's primary marketplace is not open to manual investing. There is only the automated service. The loans that can be seen in the image above cannot actually be individually selected. Robocash's secondary marketplace is open only to lenders who have owned a loan note for longer than 6 months.

Most loan agreements last between 15 - 60 days. In general, Robocash's marketplace is inadequate in terms of choice, clarity and transparency.

Risks Involved

Every buyback guarantee is only as good as the company that provides them. Robocash is at high risk because investors don't actually know where their money is going.

Most platforms experience a large list of risks but the risks are not fixed in magnitude per platform. Most platforms will both experience an economy risk or an inflation risk at different levels of severity.

The most concerning and severe risk of the list for Robocash is number three, management risk. Platforms that are highly centralized like Robocash suffer from potential mismanagement. Perhaps not now with the current executive officer, but with who ever may succeed him. As an investment platform the goal is to be profitable and withstand the test of time.

If it were not for the absence of manual investing, and one person owning all of Robocash's financial services, Robocash would appear to be a relatively safe and even highly recommended investment.

Investment Strategy

It is not possible to implement an investment strategy with Robocash. Investors may determine the parameters of their auto-investing tool, but are limited by Robocash's investment model as a whole.

Robocash is comparable to Mintos and Swaper in this regard. It outclasses Swaper because the platform hosts multiple loan originators. However in comparison to Mintos, it struggles in transparency and options to diversify.

For the investors interested implementing an investment strategy or have hopes of becoming active investors, October may be a suitable platform that will fit your needs. But for those who are not interested in being an active part of their portfolio growth, then Robocash's auto-invest features may be exactly what you're looking for.

Customer Service

Robocash has a great customer service team. Finding answers to queries on both their resourceful pages and with their support staff is a very smooth process. The dedication to customers on Robocash exceeds many of their competitors. In such an industry, customer service can define the quality of a platform.

Robocash can also be found on Telegram, though they do not offer an active chat forum, simply announcements.

Transparency & Security

The fact there is no option to manually invest and no secondary market should be critically observed. Such decisions make it difficult to determine if the loans are really going to where they should be going. Without the ability to know where the capital is going, Robocash could easily turn their platform in a ponzi scheme. It can't be stressed enough that there is really no reason to not provide a manual invest option.

Crisis Management

Although it is not possible for investors to be aware of this, the majority of investors' portfolios on Robocash are lent out to the private sector, the stock market, and similar financial institutions. Due to the great performance of the stock market during COVID-19, Robocash has found itself to be profitable. On the other hand, Robocash was only able to be profitable because of their diversified portfolio. There were in fact some borrowers that defaulted on their payments.

Robocash has a well funded buyback guarantee. They were able to bail out their failing borrowers and stay afloat because of their lucrative progress lending to the private sector.

Our Readers Have Asked:

Is it safe to invest with Robocash?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take, the higher your reward as well as the chances of losing your investment.

How much money will I make with Robocash?

Robocash suggests that investors on their platform make anywhere from 11 - 15 percent in annually in returns.

What are the risks?

Investors on Robocash have experienced a 2 percent default rate. Investors can expect that 1/50 loans on Robocash will default. This is one of the lowest default rates in the industry but there are still platforms out there with even lower default rates.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Robocash is certainly one of the hard working ones.

Where is Robocash located?

1 George Street, #10-01, Singapore, 049145

Watch & (L)earn

Discover more about Robocash in this short but informative video.

Pros, Cons and the Verdict

Pros

- No Fees

- BuyBack Guarantee

- Auto-Investing

- High Yield

- Low Minimum Entry

- Stable Marketplace

Cons

- Lack of Transparency

- No Manual Investing

- Lack of Diversification

Robocash is a great platform. Their track record is clean and profitable, they lend to borrowers all over the world, and they make investors successful. Not only is the platform excellent in terms of profit, the experience itself is comfortable and easy. Perhaps Robocash understands it as they know how to invest better than their users and they are likely right. The problem here is that this is the reason alternative finance was founded in the first place - to move away from banks that chose our investments rather than us. After all, it's Peer-to-Peer lending.

Robocash, although a great platform, has it's setbacks. The inability to manually invest is a big one, but an even bigger one, is the fact that it is all owned by the same individual. In terms of diversification, as a loan originator aggregator, there should be more options to invest from other loan originators.

We believe Robocash could be a great part of a diversified portfolio, but investors should be skeptical and wary of where their money is actually going.