Housers Reviewed | A P2P Lending Giant's Ups & Downs

Housers is a P2P platform focused on Markets in Spain, Portugal and Italy. Housers was founded in 2015 in Spain by Alvaro Luna and Tono Brusola.

The platform's online reputation is very weak. Trustpilot reviews average a 3.3/5. This is considerably low, and a huge indicator that the users on the platform are by and large unsatisfied. That being said, review sites such as TrustPilot can be very misleading. Angry customers always look for as many places as possible to vent their anger, but on the other hand a happy customer will rarely do the same, which manifests in an echo chamber of dissatisfaction.

Despite the negativity surrounding Housers, this review will try to bring to light some of Housers more redeeming features, to find out why Housers is often counted among the best p2p platforms.

Types of Loans on Housers

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Housers Loan Characteristics

Loan duration6 - 120 Months

CurrencyEUR

Buybacks No

CollateralYes

Available inEU

Returns rate5 - 18%

Default Rate32%

Recovery RateUndisclosed

FeesEUR 2.5/Month

BonusesEUR 25

Housers Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Housers?

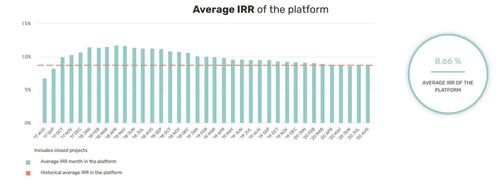

Housers is a real estate peer-to-peer lending company, like its competitors EstateGuru or CrowdEstate, is well designed, easy to use and in general a comfortable experience. The platform advertises an 8.66% internal rate of return or IRR on their projects. This is a relatively low IRR all things considered.

Users should be skeptical when considering this yearly return as many other P2P lending platforms offer a higher yearly return with an actual safety net. Housers does not have a safety net for its lenders, they offer no buyback guarantee. And even though all property investments are backed by actual property as assets, per Housers, all investors are at high risk of losing their capital.

Lender/Borrower Ecosystem

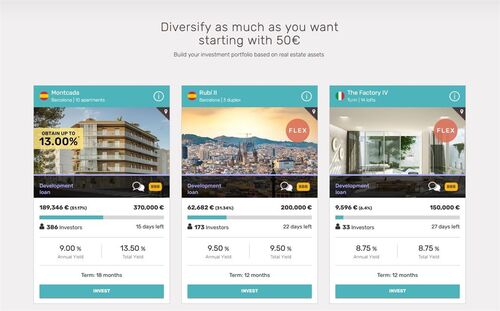

The borrowers on Housers are real estate professionals, whether they are rental companies, renovators, land lords or hotel tycoons. Housers will support any professional or personal endeavor that has to do with property. There are three different types of property loans users can opt for.

- Buy to rent

- Buy to sell

- Development loan

On Housers, users invest money into projects that operate in their occupational industry.

- Buy to rent are 5 - 10 year loans. Lenders issue capital to companies who then rent the properties out, their monthly rental earnings then become monthly payments to lenders.

- Buy to sell are 12-24 month loans. Lenders issue capital to companies who renovate and rejuvenate properties to increase their market value. There are no monthly or periodic payouts. After the properties are successfully sold then lenders see a return on their loans.

- Development loans are 12 - 36 months. Lenders will be funding projects that require extra funds during construction or other property related issues. These loans have monthly pay outs of interest and at the end of the loan agreement lenders receive their principal.

All loans come with the option to exit early.This is a relatively well designed strategy for diversification and something P2PIncome would welcome on other P2P lending real estate platforms.

General Data

| General | Data |

| Origin | Spain |

| Founded | 2013 |

| Offices | Spain, Italy & Portugal |

| Loan Type | Mortgage Lending |

| Sign Up Bonus | 50 € |

| Fees | 12.5% on Profit |

| Interest Rates | 5% - 18% |

| Min Deposit | 50 € |

| Investment Duration | 6 - 120 Months |

| Secured Lending | Yes |

| Currency | € |

How it Works?

Investing with Housers in Five Steps

- Claim Your Bonus

- Sign up

- Fill in your personal details

- Verify Identity

- Invest Money

Juan Antonio Balcázar, Housers’ CEO, states that “every project that is completed proves that our business model is a consolidated one. Returns like these being offered by our projects are very difficult to find in the market. For our investors, it is fundamental that Housers has already financed 281 projects of which 96 have already been returned. Other platforms like ours that are now restarting their path will have to prove their capacity to manage these returns. I think this makes us the trusted crowdlending platform for our investors”.

Source: Housers.com

How to Borrow?

Housers offers mortgage loans directly on their platform. Investors need to fill out basic information regarding the type of loan they would like, how much funding, the amount of collateral. After which, the amount of interest and LTV is indicated.

Registration & Withdrawal

Registering on Housers is incredibly easy. It really is one of the more well designed, intuitive websites in the P2P lending space. It takes just a couple of minutes to get set up and is available internationally. The main currency of the platform is EUR, so it is advisable that users deposit with a EUR bank.

For free EUR deposits we recommend the following online banks:

These online banks are highly recommended to use as they have no fees for currency exchange, which will in turn prevent unnecessary additional costs. Users may also deposit with PayPal and a number of other online payment merchants.

Marketplace

Housers offers two marketplaces on their platform, their primary market place is where users can invest into properties. Their secondary market, like on all other platforms, exist for lenders to opt out of or opt in to loan agreements at a marked up or down price. One of the nicer aspects of the second market is there is no transaction fee, unlike on Mintos or EstateGuru.

Housers charges a 10% performance fee on capital earned on their platform. This is an unreasonably high number, and is a huge deterrent to potential P2P lending investors. A 10 % fee, an 8.66 % IRR and very high risk for investor capital makes Housers a very questionable decision.

Investment Strategy

The market comprises of high end and luxury properties in countries that are well established and considered safe: Spain, Portugal and Italy. Housers appeals to investors who believe in these areas and who have the competency to determine the value and projected value of a property.

There is no automatic investing options on Housers. Nor is there an agenda to have it implemented. The upside is that users are in some sense forced to read up on their investments and do their own proper due diligence.

The downside is, part of the big appeal behind P2P lending is that it is an investment tool for all individuals from all walks of life. P2P lending is supposed to give individuals outside of the small finance sector a chance to let their money work for them.

There should be a seamless and secure element of investing in P2P lending, which is difficult to identify on Housers. A nice user interface is a necessary feature on an online platform but a pleasurable user experience is what determines its success for the platform and its lenders. Housers fails to come to the same level of reliability that it's eastern neighbors possess.

Risks Involved

- Default Risk - when a loan defaults there is no guarantee that lenders will see even their principal return.

- Inflation Risk - the risk of inflation where a users capital is locked up whilst slowly lowering its value due to economic despair.

- Management Risk - the fees associated on the platform and the general health of Housers employees.

- Marketplace Risk - The risks associated with Housers itself going bankrupt. In such a case, a legal team would take over liquidating Housers and redistribute the remaining capital. In such an event lenders can expect to see a substantial reduction in their capital and returns.

- Callable Risk - Loans can be paid back early, meaning less or no return in interest.

- Liquidity Risk - Being able to cash out capital is a serious matter for investors. Housers does have a secondary market but it is not an effective investment strategy.

- Economy Risk - If there is an economic collapse borrowers are less likely to pay back their debt as they most likely won't have the means. Similar to the default risk but on a larger scale.

- Pricing Risk - The risk associated with Housers ability to properly identify who is a good borrower and who is a bad one.

When assessing risk of any investment it is important to analyze their statistics, profits, earnings, credit score and growth.

Housers track record has yet to prove itself. From their first three months of operation Housers was able to bring their lenders back a 10 - 12 % return on their lenders funds. Over time this number steadily decreased until the average we know today of 8.66%.

Online reviews and ratings of Housers are dramatically low. A group of investors by the name of CNMV have filed lawsuits against Housers and the P2P platform has already undergone police investigations. Other Spanish organizations such as Afectados Housers has formed in order to fight Housers in legal battles. Afectados represents Spanish investors who claim to have been financially injured by Housers.Considering the amount of negative experiences and unsatisfied investors on Housers we highly recommend our readers to consider very carefully if Housers is worth the risk.

Customer Service

Customer Service has both an email address and a hot line. Both channels of communication are rather slow and could use improvement regarding response time as well as quality of messages.

Support email : support@housers.com

Support hot line : +44 (20) 38075972

Transparency & Security

One of Housers most redeeming factors is their transparency. For all of their faults they are incredibly open for all of their users to assess and criticize. It can be said with full confidence that Housers is a legitimate platform with the decent intention of bringing alternative finance services to Western Europe.

All their statistics are shown in depth on their website, it is very easy to understand the numbers per its presentation. Their FAQ is easy to follow and comprehensive. Their blog posts are updated monthly, their Facebook group is also active, dealing with their public image and all that entails. What P2PIncome likes most is their YouTube channel. Users can observe the Housers team, their new implementations and explanations straight from their CEO.

Although, a company that was founded in 2015, should be more established in these areas, Housers, clearly makes a commitment to making their platform better for their users.

Housers does in fact reach all the prerequisites for an awesome P2P lending platform. Unfortunately, for whatever reason certain aspects of their platform hinders them from becoming an attractive platform for potential P2P lenders.

Aspects include:

- 10 % performance fee for profitable loans

- No safety net for lenders

- Very low reward and a very high risk

Housers can not be considered to be a safe site, but it can certainly be considered transparent. This approach to business is generally a good one, which will prove itself over time. If Housers could provide more trust and reliability to its users at a slightly higher return Housers could be an ideal platform.

Unique Features

Housers separates itself from the market by its niche location of operations in Spain, Italy and Portugal. Their focus on real estate implies that all loans are backed by a mortgage. Users should feel safe in the companies ability to recover funds and protect investor principal and accrued interest.

Unfortunately, Housers shows it's ability to recover funds and protect users' capital, still needs improvement. While they have a strong user base it is difficult to determine if Housers unique features out weighs the cost of being a high risk platform. Users may have a more enjoyable experience on sites like EstateGuru where can they be assured all principal is protected as well as a part of their promised interest.

Crisis Management

There are no real formal reports on the side of Housers to detail their approach to Covid. By speculation of their statistics one can easily see that the number of unique registered users, funds raised, and IRR are lessening considerably every month.

It is regretful that the company has only said that they are unaffected by COVID-19 when their numbers suggest otherwise. It is also disappointing considering how dedicated Housers is to transparency. Housers stated they were largely unaffected. They released an article that everything was back to normal and that at Housers, it was business as usual.

Their statistics could imply otherwise. Hopefully the statistics in the months to come will help reflect Housers comments and the company will be able to identify its downfalls and fix them before it is too late.

Our Readers Have Asked:

Is it safe to invest with Housers?

In 2017, Housers became the first real estate based peer-to-peer lending platform to be authorized by a regulated government body. The Comisión Nacional del Mercado de Valores (CNMV), the Spanish equivalent of the SEC in the US gave Housers the green light to continue their business activities.

To show both sides, Housers has started and finished 85 projects in Europe with hundreds more still ongoing. Housers has processed hundreds of millions of loans and have left hundreds if not thousands of investors satisfied.

How much money will I make with Housers?

Housers proclaims that investors on their site make anywhere between 5 - 18 percent in yearly returns.

What are the risks?

Investors on Housers can experience a 32 percent default rate on their loan contracts. This is alarming considering all projects on Housers are backed with a mortgage. Implying, Housers is somehow losing both their investors principal and the rights to their properties. We would consider Housers a very high risk platform.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a Ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. It would seem that Housers is still finding a permanent place among P2P lending platforms.

Where is Housers located?

Calle de Dulce Chacón, 55, 28050 Madrid, Spain

Watch & (L)earn

Discover more about Housers in this short but informative video.

Pros, Cons and the Verdict

Pros

- Manual Selection

- Easy to Use

- Secondary Market

- Very Transparent

Cons

- High Default Rate

- Low IRR

- No Auto-Invest

- High Fees

- No BuyBack Guarantee

- Unsuccessful Fund Recoveries

At first glance Housers appears to be a risk. Users are vocally and passionately unsatisfied. Reviews online would suggest to stay away from Housers and that investors' money is better lent elsewhere.

Housers has been in operations for five years and has returned to their investors over 48 million EUR. As well, investors can expect to see an 8.66% IRR on their investments. But this is not enough. It would be unfair to label Housers as unreliable. Rather, it's a company that could still use improvements. At this time we could not recommend P2P lending enthusiasts to join Housers. However, in the future, if the platform is able to upgrade some of its features to justify a 10% performance fee, no buy back guarantee, risk of investor principal, then Housers will retain their title of P2P pioneers.