P2P Lending | PeerBerry or Swaper?

PeerBerry and Swaper

Our reviews of the top P2P sites provide detailed analysis of the best sites for investors and borrowers alike. In addition, side-by-side comparisons are a great way to narrow down your search once you have a few names in mind. To that end, we'll be comparing two European sites that deal in consumer loans: PeerBerry and Swaper. Both sites are open to retail investors and both offer attractive features such as buyback guarantees and double-digit returns.

As we increase the resolution, however, we find significant differences between the two platforms. For example, do you know which sites offers higher returns? Do you know which site is better at addressing late loans and defaults? Do you know which site has more investors? These and other details are the subjects of our comparison piece.

A History of PeerBerry

PeerBerry entered the market in 2017, when Lithuanian lending giant Aventus Group decided originating loans wasn't their only way to make money. Within three years the platform had grown into a major player on the European lending market. In November of 2020, CEO Arūnas Lekavičius announced that "[t]he challenges of this year helped us to show and to prove who we are and how good our partners are. Our investors see us as one of the most reliable and transparent alternative investment platforms in Europe." This confident declaration suggested PeerBerry had weathered the worst of the global pandemic and was ready to move onward and upward.

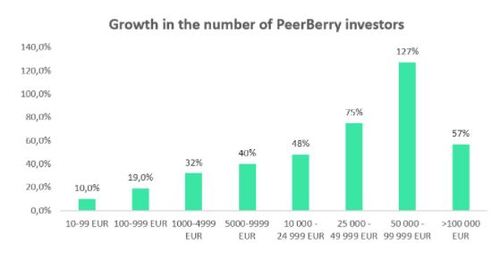

PeerBerry spent 2021 increasing its market share and overall position. With rates consistently over 9% and a short-term loan format that allows users to enjoy quick gains and then "take the money and run," PeerBerry achieved impressive growth, reporting EUR 566.2 million in loans funded for Fiscal 2021—an increase of 185% from the previous year. Add a field of 50,000 investors and growing, and you can understand why PeerBerry is now recognized as one of the very best P2P platforms available in Europe.

A History of Swaper

Swaper entered the peer-to-peer market in 2016 as a subsidiary of Wandoo Finance Group, based in Latvia. The platform posted only modest gains during its first few years, and in 2019 it was sold to Marina Tjulinova, who currently serves as Head of Operations. According to the site, "Marina is the guru of all financial and legal matters." Swaper is now based in Estonia.

In late 2020 Swaper announced the appointment of a new CEO, Indrek Puolokainen, who was charged with "taking on the main tasks to grow the platform by listing more loan originators." According to Puolokainen, "Swaper aims to be one of the favourite P2P marketplaces in Europe and charm investors with ease of use and great returns. [...] Swaper makes investing easy and great returns with a fair BuyBack (sic.) policy are the cherries on top."

Unlike many P2P sites, which aggregate loans from various originators, Swaper works exclusively with its former parent company. In the past, that led to investors complaining about idle funds due to insufficient loans. Nevertheless, by the end of 2021 Swaper had reported over EUR 200 million in invested funds on its site.

A Comparison of Sustainability

When searching for the best investment platforms users often look for sustainability. After all, there's no point investing in a site where the borrowers are going to default on a regular basis. Even with the buyback guarantee protecting your initial capital, there's the issue of opportunity cost—meaning the time and effort spent on the investment and the returns you could have earned somewhere else. Opportunity cost is the very reason people diversify their investments. They want some of their money to generate passive income. If all of their money is languishing in a savings account earning 0.3% APR, they're literally missing out on an opportunity.

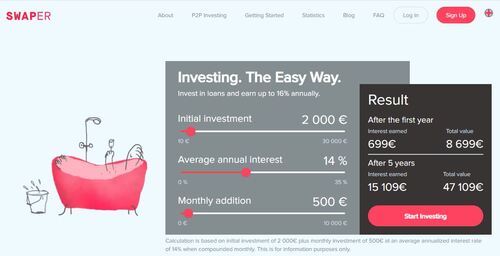

Swaper seeks to provide its investors with that opportunity. They offer very attractive rates of return—perhaps too attractive. Standard investors are assured returns of 12% to 14%, while premium investors (EUR 5000 or more) receive a two-point bonus, for total returns of 16 percent. Reports from the field suggest those aren't empty promises, though one wonders how long they can sustain such numbers. The company's lack of transparency is a problem in that regard. Without detailed reports, it's hard to figure out what is happening behind the scenes.

PeerBerry, on the other hand, has proven itself to be the top platform on the market when it comes to protecting your investments. The platform's buyback guarantee is triggered well in advance of a loan defaulting, which protects your invested capital. In addition, the company's transparency allows investors to feel confident their money is valued. The platform posts a synopsis of its annual report on its site, and one can download a PDF of the complete report for free. The downside to that level of security is that PeerBerry's returns are lower: 9% to 12%. For investors with deep pockets, the difference of approximately 5% might be enough to draw them to Swaper, but thus far PeerBerry has attracted far more total investors: a 9.8 to 1 active-investor ratio.

A Comparison of Default Rates

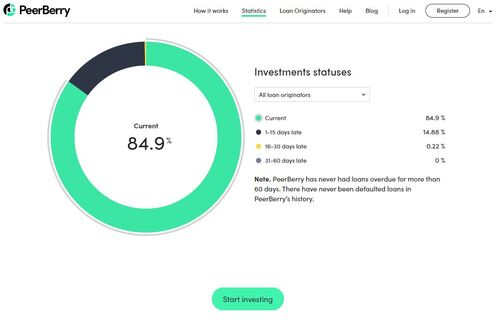

Perhaps the most staggering statistic in PeerBerry's favor is its handling of overdue loans. According to the site, "PeerBerry has never had loans overdue for more than 60 days." This is due in part to successful screening prior to issuance, and in part to a customer relations mechanism that seeks equitable solutions. PeerBerry further clarifies: "There have never been defaulted loans in PeerBerry's history." This impressive stat makes PeerBerry an attractive option for conservative investors favoring stability over volatility, even at the cost of a few interest-rate points.

PeerBerry - Default Rates

Swaper - Default Rates

Unfortunately, Swaper doesn't divulge their default rates, which is a concern. One is advised to assume they face the industry average of 6 percent.

Conclusion

If you're not risk-averse, and don't mind a bit more exposure, you'll likely be drawn to Swaper's impressive returns. That's especially true for those with several thousand Euros to invest, where the difference of 4 or 5 points can amount to significant sums. Those who prefer to make informed decisions and enter into stable investments will prefer PeerBerry's proven track record.

A Comparison of Marketplace

There are striking differences between the two site's ecosystems. Swaper's loans are all originated by Wandoo Financial, and assurances by Swaper's new CEO notwithstanding, that doesn't seem likely to change. This absence of scope significantly diminishes Swaper's lending profile. Having only one loan originator means fewer loans, and that means investors must race to swipe up loans the moment they appear. Obviously, that's very difficult to do manually, so investors are encouraged to deploy their funds via the auto-invest tool. It's basically a hi-tech race to grab up available notes.

Swaper's most important distinguishing feature is its secondary market. Many investors enjoy being able to move their money around, buying and selling notes as they see fit. PeerBeery offers no such option, so if buying and selling notes is in your investment strategy, you'll likely prefer Swaper.

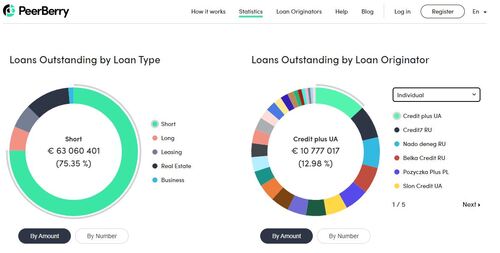

PeerBerry, on the other hand, works with numerous originators, via its parent company, Aventus. Among the more prominent originators listed on the site are Pożyczka Plus (Poland), Credit Plus (Ukraine), Belka Credit (Russia), and Lithome (Lithuania). On the PeerBerry site one can find links to their various originators, including a company report and downloadable financial reports (PDF).

PeerBerry's marketplace is available for inspection on the homepage of their website. Simply scroll down to the middle of the homepage and you'll find a list of the current Available Loans. The loans are listed by Country, Issue Date, Loan Type, Interest, Term, Loan Amount (total loan), and Available Amount (currently unfunded amount). All you need to do is select Invest, and decide on an amount.

With Swaper, you have no such option. You simply deploy your funds and let the auto-invest tool handle the rest.

Conclusion

The PeerBerry marketplace is far more investor-friendly and inviting. There's something rather disconcerting about not being able to select your own investments. To be sure, that's how auto-invest works, but we choose whether to use it. On the other hand, if you want a secondary market, Swaper has one while PeerBerry does not.

A Comparison of User Interfaces

Both Swaper and PeerBerry have rather straightforward user interfaces that anyone with basic internet skills will find easy to use. The respective homepages have what one would expect: relevant information on how to invest on the platform, as well as prompts to "start investing." Both sites have easy sign-up processes, and their general KYC procedures are similar. To Swaper's credit, their site is sleeker, more attractive, and more interactive that PeerBerry's, and that holds true for the mobile app as well. Judging purely on aesthetics I have to give the nod to Swaper.

A Comparison of Risks and Rewards

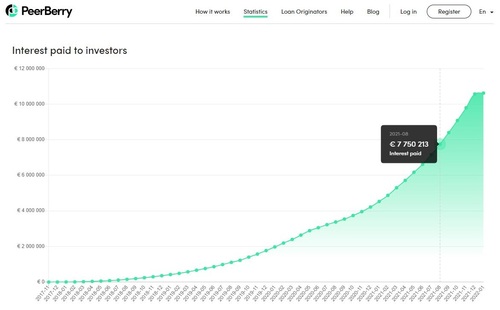

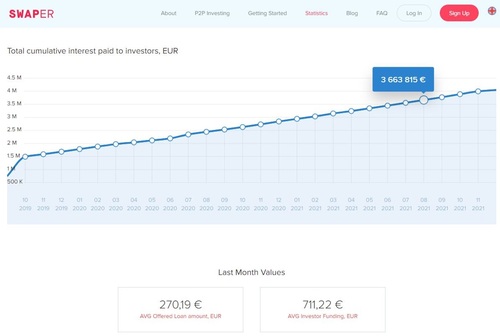

A careful look at the interest paid to investors between 2019 and 2021 shows two very different scales. While PeerBerry paid out nearly EUR 10 million over those two years, Swaper paid out a little over EUR 3.5 million. Furthermore, the rate-of-growth of sums paid differed greatly, with Swaper showing near-linear growth while PeerBerry's was exponential. Added to that is the fact that PeerBerry has 10 times the number of investors and we begin to see a difference of scale that makes this comparison somewhat academic. It's not quite apples to oranges, but it is individual apples to bushels of apples.

As evidenced from the chart above, PeerBerry's investors enjoyed exponential growth in total returns during one of the most economically challenging periods in recent history. Indeed, during the height of the pandemic, 2019-Q2 through 2021-Q3, PeerBerry's numbers skyrocketed. To say they "survived" would be an understatement. They thrived during an economic downturn that ravaged the market, and that success drew more investors, creating cyclical upward momentum that carries the promise of long-term stability.

By contradistinction, Swaper's growth during the same period (2019-Q2 through 2021-Q3) was linear. They certainly weren't beaten down by the pandemic and concomitant recession. They managed to sustain their platform, which is more than many other companies were able to do, but the absence of growth suggests crisis management was focused on aversion, rather than strategic positioning.

Conclusion

PeerBerry's success during the Covid19 crisis proves their crisis management model is up to the task. Savvy investors look for such indicators, and in this case all the signs point to PeerBerry.

Company Origins and Presence

Both companies were originated in Eastern Europe, which is quickly turning into the EU's lending hub (Estonia in particular). Both started out as subsidiaries, though Swaper has since become an independent entity. Both companies have investor presence throughout the EEA, though PeerBerry is a much larger platform. PeerBerry reported a 127% increase in investors within the EUR 50,000 to 100,000 category, and a 57% increase in the 100,000+ category. While Swaper doesn't post such stats, it's hard to imagine their numbers competing with the above.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Verdict

The goal of a side-by-side comparison is to provide the reader more of a "hands on" approach to studying the market. In some cases the verdict is merely a formality, but in this case there is a clear winner: PeerBerry. On just about every front, PeerBerry outclasses Swaper. Whether one seeks transparency, sustainability, or scope, PeerBerry is the obvious choice.

Are there reasons to choose Swaper?

Yes. If you're inclined to greater risk with the promise of higher returns, consider Swaper. If you're interested in moving notes around on the secondary market, consider Swaper.

But if your goal is to invest "wisely," meaning to place large sums into an investment portfolio where they will garner steady returns for years to come, PeerBerry is not only the better choice compared to Swaper, it's one of the very best peer-to-peer platforms on the market.