The Best Sites For Small Portfolio Investors

There are many reasons someone might start out investing small. You might have just gotten out of college, suffering through a rough divorce or even just want to test the waters of something you don't quite understand. So you want to start investing small?

P2P lending started for the sake of helping those with limited income create a second stream of income. Through the use of crowd funding and financial technologies, with only 10 Euros you too can let your money work for itself. P2P lending can be a healthy portion of any diversified portfolio, but there are platforms whose sole purpose is to help investors create diversified portfolios. Let's take a look at three which specialize in small investments.

The websites that offer the most attractive returns for a 10 EUR minimum deposit platforms are the following:

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Business Loans

Average Returns

8 - 9%

Minimum Investment

EUR 500

Signup Bonus

EUR 20

Registered users

10,000

Total funds invested

EUR 80 Million

Default rate

0%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Debitum Network is an innovative fintech platform that wishes to bridge fiat and crypto into one platform. Debitum Network is a loan originator aggregator with an 8 percent average for investors. Read our analysis on Debitums strengths and weaknesses as a peer-to-peer lending platform.

PeerBerry

PeerBerry is a loan originator aggregator that specializes in consumer loans. PeerBerry is the product of a well-established loan originator, Aventus Group, and the minimum entry deposit starts at 10 EUR. Aventus Group first started issuing loans on Mintos but quickly decided they would build their own P2P lending platform. Aventus Group issues the majority of loans on PeerBerry, but PeerBerry hosts several loan originators and continually invites more as time passes. PeerBerry was founded in 2017 in Riga, Latvia.

PeerBerry also specializes in a variety of consumer finance, auto finance and mortgage finance loans. The platform also has a well established auto investing tool and a very easy to navigate platform.

PeerBerry provides investors two forms of guarantee so investors can feel safe investing in their marketplace. The forms are Buyback Guarantees and Group Guarantees. Buyback Guarantees ensure the investor that if the loan defaults within 30 days the loan originator buys the loan back from them and pays back accrued interest. But sometimes, the loan originator themselves default. Group Guarantees enforce all loan originators on PeerBerry's market place to give a helping hand to the failing loan originator. Whether it be financial, or bearing the burden of the loan servicing which is keeping the lending/borrowing ecosystem in tact.

Mintos

Mintos is Europe's number one platform, they specialize in consumer loans and investments start at only 10 EUR. Mintos is a loan originator aggregator which means they host multiple loan originators on their marketplace. On this marketplace, lenders may select loans from the numerous loan originators and choose which loans they would like to fill. The loan originator acts as an intermediary between the borrower and Mintos. Mintos acts as the intermediary between the investor and the loan originator.

Mintos issues loans for consumer finance, business finance, auto finance, mortgage finance and development finance. Their market is all encompassing. Mintos was founded in Riga, Latvia in 2015 but claimed Europe's top P2P lending position only in 2019. Mintos has been a highly profitable P2P lending platform. And while they have had their few hiccups regarding fund recoveries, they remain Europe's number one favored platform. Their auto-investing tool, easy to use website and emphasis on investor education and knowledge is unmatched.

Debitum Network

Debitum is a Latvian p2p platform that markets Asset Backed Securities (ABS's) from several loan originators throughout Europe. These ABS's comprise anywhere from 5 to 50 assets, with interest rates ranging from 9% to 12% and penalty fees ranging from 10% to 18%. As with most ABS's, Debitum's vehicles tend to be long term, with an average duration of 12 months. Debitum reports a 0% default rate, and boasts an XIRR of over 11%, making it a solid addition to any p2p portfolio.

Debitum works with several European loan originators, including Sandbox Funding, Evergreen Capital, and Triple Dragon. The company has over 10,000 users, and is fully regulated by the Latvian Government, via the Bank of Latvia (an EU compliant central bank) and the Financial and Capital Market Commission (FCMC) of Latvia. While the company has investors worldwide, approximately 25% of the company's investors are Latvian, another 25% are German, and around 10% are French. Debitum doesn't charge any deposit fees or processing fees, and the minimum deposit is only 10 euro.

Micro - Finance and Starting Small

The reason we invest is to let our money work for itself. Whether it's 10 euro or a 1000, letting it sit and accumulate interest is what everyone wants. The difference between everyone and investors, is that investors wants more than the 1 - 2% sitting in a bank. But in order to see real gains in legacy markets, investors are required to have a rather large sum of capital. This barrier of entry discriminates against billions of people around the world who make less than a hundred dollars a month.

Micro finance, crowd funding, peer-to-peer finance are all synonyms of the same idea, providing limited income individuals the ability to gain profit on their small amount of capital. 10 percent profit of 10$ is still a gain of 10 percent. The creation of peer-to-peer lending enables not only individuals but limited income communities the financial instruments to build financial stability and independence.

Furthermore, what's compelling about behind micro-finance is that everyone can start small. The requirements to invest are not high or difficult because the power of micro finance lies in the people and their numbers. 1000 people lending out 10 euros is all the same to one person lending 10,000 to the borrower. The difference now being made is that everyone has the option to take part in this ecosystem.

The Power of Compounding Interest

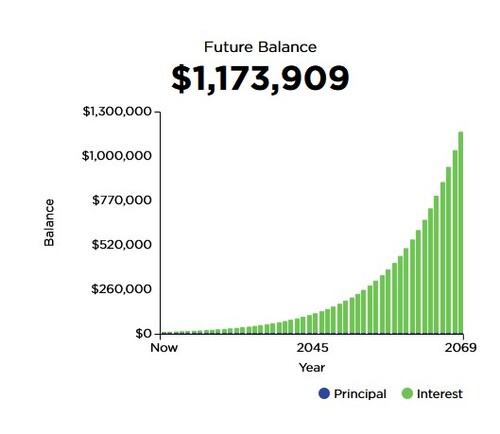

Compounding interest is the process by which investments grow exponentially, and they all do. The greatest investors are not those who made incredible trades on the stock market or those who luckily purchased a company that became highly profitable. The greatest investors are those who above all else, invested in time.

If we take a textbook example of an investor with 10,000 euros and we predict every year he will receive a 10% increase in returns, then after 50 years that man be will be a millionaire. And we can take a look at that with this chart:

Investors who are worth their salt are not as interested with short term wealth growth as they are with long term wealth growth. Making money through investing is not about 500 EUR the next day or by the next week but rather 50,000 EUR every year for the next ten years. All of this is to simply show you that with a sum of 10,000 EUR or USD will allow you to retire a millionaire.

Peer-to-Peer lending easily provides investors with the option to constantly reinvest their capital. Platforms like Mintos have shown that a marketplace can be successful and profitable for a long period with the right guidance and risk management. The security provided when investing in peer-to-peer platforms makes them not only a viable option when it comes to investing, but increasingly, an attractive or even preferred option.

Verdict

There is no "one size fits all", investing strategy. Investors ought to do their due diligence and determine with their own ability which investment instrument they would like to use. Some strategies fit other investors differently. Peer-to-Peer lending might fit your investing strategy but deciding which platform to go with is another factor that requires time and research to be determined.

For those hindered by large barriers of entry, you may find comfort in knowing there are platforms specifically catered to your needs. The platforms mentioned in this piece are designed with that idea in mind.

You may be discouraged to even start investing because of lack of funds. After all, a 10 percent profit of 10 euros is just a one euro profit. It's not much. But everyone starts somewhere, and PeerBerry isn't a bad place to get it going.