A Guide to Alternative-Crypto Lending

Defining Cryptocurrency and P2P Lending

Cryptocurrencies (or distributed ledger technologies) are essentially digital tokens that are built upon blockchain networks. For something to be built on a blockchain it has to use an encryption protocol that utilizes complex accounting equations and hash power to create an immutable, transparent financial ledger.

Cryptocurrencies could potentially solve a lot of problems we see today in our financial markets. Some experts claim the king of crypto, Bitcoin, is worthless, while others, call it the new gold.

Stablecoins & Crypto Lenders

Stablecoins are a byproduct of blockchain protocols and current economic practices. It serves to take the best of the two existing models: crypto finance and traditional finance. Stablecoins use a blockchain that comes with transparency, encrypted security, and traditional models that consider stability of purchasing power pegging value of one currency to an external reference. Or, more explicitly, using collateral to determine the value of a given Stablecoin. This invention came about because of Bitcoin's frequent price fluctuation.

Bitcoin itself experiences short bubbles every four or so years, making it difficult for consumers to want to put their money in, because tomorrow it might be less valuable. Stablecoins are directly responsible for crypto lending to be a viable alternative to traditional banking. It allows a true decentralization and a true free market within our economy for consumers to use.

Other benefits include:

Pros

- Anonymity

- No Banks Required

- No Regulation

- Favorable Fees

- Transparency

- Diversification

- No Discrimination

Addressing Lack of Regulation and Anonymity

The lack of regulation and anonymity could be worrisome for some and an advantage for others. The rest of the pros are without a doubt a plus in a lender/ borrower ecosystem.

Whether someone is a proponent of regulation is based on their individual economic philosophy, as some believe government intervention is necessary, while others believe that it ultimately harms the economy. Anonymity may prove to be unattractive to lenders who wish to know who they are lending their funds too. The counterargument here is that all borrowers are required to put collateral of equal value to the loan they are taking.

Why The Pros Are Favorable

Banks require overhead fees, resulting in high administration fees and unfavorable exchange rates. They are also prone to bad actors and managers. Having a code in place that can't be breached would prove to be favorable for those concerned over human errors. Transparency is key in determining the success of a company. Diversification is a hallmark of any good portfolio. No discrimination is obviously a plus, as nobody should be judged on a lending platform by their location or ethnicity, rather, on their economic ability.

Cons

- High Default Rate

- Crypto Related Volatility

- DDos Attacks

Why The Cons are Worrisome

The cons, although small in quantity, are scary in quality. The high default rate on DeFi is very high and it's easy to understand why. Even though there is collateral, the collateral normally comes in the form of Bitcoin or Ethereum. These two cryptocurrencies are incredibly volatile.

To give an example, a borrower requests a loan for 10,000 P2PIncome stable coins which are equal in value to 10,000 USD. As collateral, the borrower submits 10,000 USD worth of Bitcoin, but in the coming week, Bitcoin falls to 8000 USD. The collateral is now less in value than the loan requested, the borrower is now incentivized to default on his loan, give the collateral and keep the loan.

This is incredibly worrisome, and different platforms approach this problem with their own methods which you can find more information on further below.

DDos Attacks prove to be a problem for all websites, but for cryptocurrency platforms they risk the entire platform. Hackers have found ways to manipulate code in blockchains. They use DDos or a Distributed Denial of Service attacks to shut down a network. This is done by spamming users to a specific website at a given moment which forces the network itself to crash. Then hackers manipulate the code or mine user emails and passwords to milk networks for all of their funds. The most famous case of this was the online exchange Mt.Gox in 2014, that suffered a theft of 744,408 Bitcoins. It is unlikely that Bitcoin holders will ever see their funds returned.

All networks are prone to such hacks and malicious activity. Which is also incredibly concerning.

Coin Loan

Coin Loan was founded in 2016 in Estonia, it is currently regulated by three entities and provides transactions in fiat, crypto and alternative currencies. They are currently the number one crypto lender in the market, having raised 250 million USD in their ICO, and they have been able to efficiently dominate the DeFi space.

One of their unique traits, is that they have within their blockchain, strategies to ensure price volatility of crypto assets is protected by giving users the ability to reverse their collateral. In other words, to swap the asset of equal value to another asset of equal value to fight against volatility.

BlockFi

BlockFi was founded in 2017, in New York. BlockFi is licensed and regulated by the New York Department of Financial Services. They are among the top crypto lenders, as they began issuing fiat loans in exchange for Bitcoin collateral. Over time, they moved to incorporate other crypto assets, as well as a bank card so users could spend their crypto earnings.

BlockFi offers an attractive 8,6% historic IRR. It encourages crypto rich holders not to sell their crypto, but if necessary, take a loan out on it to keep yourself afloat without having to get rid of your precious bitcoin.

Nexo

Nexo was founded in 2018. They launched their Token sale from Cayman Island. However, they operate from Estonia. They are currently one of the biggest platforms to date and offer one of the highest interest rates in the space. Nexo has a minimum deposit of 1000 EUR worth of crypto in order to utilize their website. Nexo is more for the crypto savvy, while many platforms offer consumer loans, Nexo offers a wide array of loan options from crypto pioneers and creators.

Nexo offers a high return rate of 10% on their investments. Nexo is both licensed and regulated by financial EU institutions and have processed over 3 billion euros worth of loans.

MyConstant

MyConstant was founded in 2019, launched in California, USA. MyConstant has created for itself an easy to use, easy to make money platform. Their Lender/ Borrower ecosystem aggregates loan originators and allows them to offer loans on MyConstants platforn. Due to this model, all loans on their platform can come with a buyback guarantee. In order for loans to be listed on MyConstant, they have to be secured loans. This is the best multilayered approach to secure an investor's funds.

Sitting funds on MyConstant rise at 4% a year just by being in MyConstant. If a lender chooses to fund a loan they could see an attractive return of 11% a year. On the other hand, MyConstant does not produce any of its prior history or track record. Their advertised return and risk cannot be verified.

LendaBit

LendaBit is another P2P lender that takes a huge share of the market. However, unlike the rest of the crypto lenders, they only offer fiat, regular government printed money in-exchange for assets in crypto. In order to mitigate the potential less of crypto assets, due to their volatile behaviour, LendaBit seeks improve all other aspects of their platform. Rather than address the problem, borrowers can expect reasonable interest rates and lenders can expect high returns.

LendaBit is a great easy to use platform, they offer a reasonable return and maintain the standard of securing collateral. LendaBit might be a great fit for those who wish to have even more anonymity. LendaBit does not immediately require users to submit verification which may be considered a huge benefit for some, or a red flag for others.

YouHodler

YouHolder was founded in 2018, in Switzerland. The purpose behind Youhodler was to encourage individuals not to sell their crypto but rather, to lend it. So they could hold on to their valuable assets, while retaining a profit from loaning their crypto.

YouHodler is slightly different from the rest of the crypto lenders in so far as it offers a number of crypto assets to put up as collateral. Whilst most only accept Bitcoin or Ethereum, YouHodler, allows the top 12 crypto currencies determined by market cap to be offered up as collateral.

Nuri

Nuri, formerly "BitWala," was founded in Germany in 2015, and has been popular ever since. The platform offers alternative digital-banking services to customers within the European Economic Area (EEA). Services include a euro-based bank account insured for up to 100,000 euro, a VISA debit/ATM card, and a German IBAN.

Nuri customers enjoy annual returns of around 4.5%, and have access to various banking services:

- Euro-based bank account

- German IBAN

- Free deposits (euro/cryptocurrencies)

- Free SEPA

- Free VISA debit/ATM card

They also offer alternative banking tools for their crypto related transactions:

- No Withdrawal/Deposit Fees

- Secure Crypto Wallet

- Annual Tax Report

- 1% Trading Fees on Cryptos

Binance

Binance was founded in 2017 and is headquartered in Malta. Binance is first and foremost an online crypto exchange. Binance has been the superior crypto exchange for a long time, and they currently serve the largest of market of traders and have branched out into many other avenues in the crypto space. One of them being Peer-to-Peer lending.

While Binance is not the best P2P lender, it is arguably the most successful crypto company ever made. That being said, Binance's infrastructure for lending has been built, and while it is not as comfortable as others, it's open to the worlds largest and richest traders.

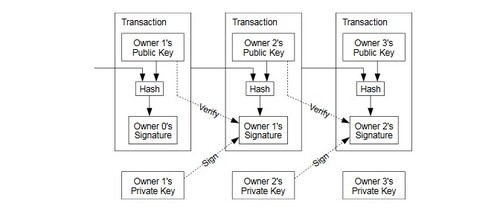

We will not be expanding into the specifics of blocks, hashes, forks, fault tolerance or common criticisms. This is simply to provide background to the operating and governing systems of crypto lenders.For further clarification we will delve into a few of the technicalities of cryptographic models that exist on blockchain technology. The two most popular protocols being Proof of Stake and Proof of Work. PoS is a protocol that requires crypto token holders to stake their tokens to keep the ecosystem going. The other, Proof of Work, requires raw hash power from GPUS (graphics processing unit, or the graphics card in your electronic device) to keep the ecosystem going. Each protocol possess their own weaknesses and strengths when implemented. Proof of Work is a more secure system but requires more physical energy/electricity to sustain the consensus model. Proof of Stake is energy efficient but is more subject to holes in its security.

Tokens & Hash Power

PoW is the protocol used for Bitcoin, the first cryptocurrency ever created by Satoshi Nakomoto (pseudonym). PoS is the protocol used for Ethereum, founded by child prodigy Vitalik Butterin. Ethereum is the largest network that comprises the vast majority of decentralized P2P lenders, in the space it's referred to as DeFi for decentralized finance.

P2P lending not only integrates itself with blockchain easily but benefits from it greatly. The blockchain is not its own product, it is a tool a product can use. It's purpose is to create transparency and security, two features all P2P lending platforms require. Secondly, crypto lending can assist operations, automating them through smart contracts. Smart contracts are digitally coded contracts that trigger automatically based on certain conditions which are determined by both lenders and borrowers. Borrowers and lenders can be responsible for their own agreements and customize them to the extent that code will allow.

This is what the underlying consensus protocol looks like on the Blockchain. All tokens must move through verification processes by all token holders or miners in order for the block chain to continue processing.

In a PoS system the overarching ecosystem is governed through voting procedures to make changes to the ecosystem. All users who stake their digital tokens are representative in this governing model. It is a simple democratic process, as majority rules. Generally a 51% or a 60% vote is required to make any specific or overarching changes to the ecosystem.

In a PoW system, the overarching system is governed by the miners who control the hash power. Due to complex coding equations like byzantine fault tolerance, miners are discouraged to control the entire network, and the profitability for a miner is maximized when he owns roughly a third of the mining pool and receives less rewards when he owns half. This is one of the preconditions that allows Bitcoin to be a truly decentralized platform.

For those more literate in cryptography and cryptocurrencies, we remind you that these oversimplifications are present to allude to a greater, more relevant point to the every day consumer: Decentralized Finance.

True Decentralization

Crypto Lenders have two objective goals, firstly, to completely decentralize finance. This goal goes hand in hand with the second objective, to allow capital to be earned equally. Bitcoin was a response to the malpractice of banks and the government. The concept of government issued tender is increasingly being rejected by modern society as outdated and untenable.

To decentralize finance would imply that banks no longer have a monopoly on lending and borrowing markets. It would further imply that in order for a currency to have value it would have an intrinsic form of value or be represented by something real.

To earn capital equally implies that people should no longer be barred by forms of discrimination, which do exist. It also makes the case that if Bitcoin were to be highly valuable then there would not just be one winner, there would be millions of winners. Anyone who holds Bitcoin would be rewarded for Bitcoins success.

Similar to other cryptocurrencies which issue large token sales and ICO's, they are collectively suggesting that a victory for them can be a victory for the masses who choose to support them. The transparency of the networks also guarantees token holders that they could not be cheated by the token issuers. Assuming the network is credible and honest, however, suggestions that cryptocurrencies are a scam are not the fault of the blockchain, they are the fault of bad actors.

Private lending companies in alternative finance, although doing a great service, are ultimately in it for themselves. The majority of the profits go to the ones who take a commission off all the transactions they bring together. But with crypto lending, it is the participants of the network and only in part, the owners, who own the means of production of the enterprise.

A Trust-less Ecosystem

The greatest strength behind decentralized networks or Peer-to-Peer networks is their governing model. Typical P2P platforms are at risk of the platforms themselves being governed by unsatisfactory managers. A great example of a manager acting in bad faith could be Lending Club. In 2016, Renaud Laplanche almost drove the entire company into the ground by misrepresenting the company on it's financial statements. Lenders need to be wary that the site that is being used to lend money, ought to be as secure and trustworthy as the borrower who is receiving the money. Due diligence must be done on every aspect of the company because events such as what happened with Lending Club, are hard to predict, even with a careful eye.

Blockchain technology, on the other hand, answers this conflict. For starters, Blockchain technology ensures that the financial entries in the company are accurate. If an incorrect transaction occurs on the blockchain the network itself stops operating. No financial authority in a given entity could manipulate or misrepresent financial data without having the majority of tokens or majority hash power. Secondly, the governing model being decentralized would ensure a large degree of transparency between the companies activities and token holders.

On crypto lending platforms, the platforms issue certain tokens which are used as a loan and the borrowers offer up Bitcoin or Ethereum as collateral for their loans. In the case of loans defaulting the lenders simply take the collateral offered up by the borrowers. All loans are secured by an equal value of collateral, and due to the efficiency of smart contracts in the blockchain, borrowers can easily pay their lenders and lenders can receive their payments on time.

Conclusion

By and large, Crypto lenders offer a smaller rate of return than their solely fiat counter parts. One could argue that crypto collateral is more secure than say, a car or a house, but the volatility of crypto assets is still a hurdle to overcome. Some websites claim that they have implemented instruments in order to mitigate the loss of capital from volatility. What happens, ultimately, is the company takes the temporary loss. The entire crypto sphere becomes an attractive investment if crypto itself sees adoption in the general public. While much ground has been covered to introduce crypto into our daily lives, it has a long way to go before it becomes part of our everyday financial transactions.