Fintown Reviewed | Our First Impressions

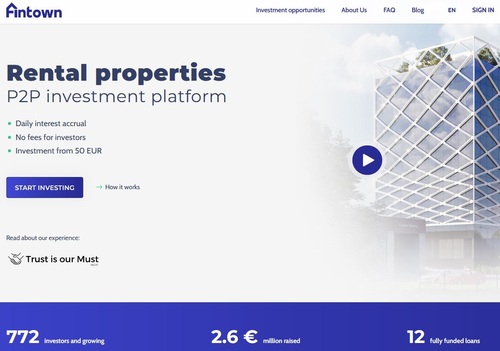

Fintown is a development-loan originator and peer-to-peer investment platform with a unique twist. The company utilizes the income it draws from Honest Apartments rental properties to sustain any mezzanine loans it originates, thereby ensuring the platform always has the money it needs to pay their investors. Fintown uses that income to update payments daily thereby maximizing investor revenue from interest. Fintown doesn't charge investors any commissions, earning all commissions off of borrowers instead. The minimum investment on Fintown is only €50, and the estimated annual returns exceed 12% per annum.

In this first look at Fintown, the financial experts at P2PIncome provide their initial impressions and overall opinion of the real-estate site. Should you add Fintown to your portfolio? Read this review before you decide.

Fintown Review: First Impressions

It's clear the designers of Fintown's website wanted an easy-to-use platform with very few bells and whistles. The simple yet elegant design of the site allows you to navigate without difficulty. Nevertheless, the site has all the pages one would expect: Investment Opportunities, About Us, FAQ, and Blog. The page is available in 9 languages, which is quite surprising, as most p2p investment sites offer only one or two. You can choose from Czech, German, French, Dutch, Italian, Latvian, Estonian, Greek, and Polish. The default language, however, is English.

On the About Us page you can learn about Fintown's founders: Maxim Vihorev and Vladislav Siganevich. Vihorev holds a Master of Law and Legal Science from Univerzita Karlova (Charles University, Prague), while Siganevich holds a degree in International Relations from the Prague University of Economics. Whether Fintown employs anyone else is unclear, but no other persons are mentioned on the site. As with the language list, the FAQ is surprisingly long, with 12 sections, including a glossary. The Blog section offers useful reports and investment tips, and further indicates the extent to which Fintown is committed to transparency.

Fintown's Marketplace

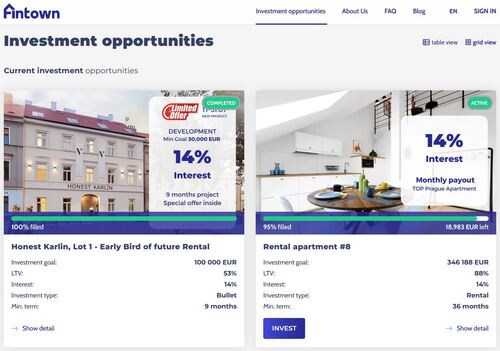

The most important, and most impressive, element of the Fintown website is their marketplace—labeled "investment opportunities." Fintown spared no effort to develop an attractive, streamlined real-estate marketplace. Looking to include real-estate in your p2p investment portfolio, this platform is worthy of your attention.

Each marketplace listing offers all of the details needed to make an informed decision: Investment Goal (in Euro), Investment Type, Loan-to-Value (LTV), Minimum Term, and the Interest Rate. All of that is available at a glace, and if you want even more data, just select "Show Detail." This will take you to a carefully curated page, with a complete prospectus of the project. Among the facts and figures included are the Max Term, Collateral Value, Location (the listing address), and Interest Payout (the frequency of payment).

The prospectus also includes a gallery of pictures and renditions, as well as an Executive Summary, a Project Summary, a Project Description, and on and on. It's an astounding amount of information, frankly stated, and much like the FAQ it suggests an eagerness to provide maximum transparency. Fintown even goes so far as to provide a chart of the property's performance history, as well as their Financial Analysis of the project. You can also download the Evaluation Report for the project. Very few other sites offer this level of detail.

Fintown's Features

Fintown makes its money on the lending side, so p2p investors need not worry about facing any fees or commissions for investing with the platform. The minimum investments on the site is only €50, making it a great site for investors with limited capital. The platform only accepts bank transfers, which is a plus and a minus. To be sure, bank transfers are very secure, but they can be time consuming, and many banks charge fees for transfers. Whether Fintown will eventually work with third-party funding processors, such as Wise or Revolut, remains to be seen.

Fintown invests 20% "skin in the game" in every project, and verifies every project via their legal team. Developers can contact Fintown directly to present their project and request funding. According to the site, borrowers can petition for more than one loan at a time. The direct funding for the loan actually comes from the rental income, rather than the borrower.

According to the site, "Vihorev.Investments.SE recieves fixed payments from Honest Apartments on a monthly basis that are enough to cover loan costs[.] This means that Vihorev always has enough money to pay the interest and repay the investment in Fintown."

"Our projects include rental apartments that generate consistent positive income starting from 2019, which is used to cover both Senior and Fintown loan costs. This information is disclosed in each open project, giving investors transparency on the project's revenue streams."

Fintown - Facts & Figures Financials

- Over 750 Investors

- Over €2.6 Million Raised

- 12 Loans Fully Funded

- 12% Average Achievable Interest

Verdict

Fintown is an impressive platform with a clever solution to the question of loan funding. By drawing from Vihorev's rental income, the platform ensures it has the funds necessary to cover loans while it waits on borrower payments. This structure could prove extremely effective, though it's too soon to tell. The website itself has a lot going for it, particularly in terms of transparency and detail. Investors have access to more than enough information.

Two improvements the site should consider are allowing third-party funding processing, and developing a mobile app. Most investors these days prefer to have ongoing access to their p2p portfolios. That being said, even as it stands, Fintown is worthy of consideration.