Our P2P Investments Survived Corona. Can They Survive a War?

Please read P2PIncome's most recent investment-portfolio report for 2025.

In our end-of-year report for 2021 we posited that the global economy was finally starting to recover from the effects of the Corona pandemic. SARS-CoV-2 had held the world hostage since March of 2020, but innovation and perseverance had won the day and most of the world was returning to a sense of normalcy. In our report for the month of January our only major concern was whether whether EstateGuru would manage to solve the long-standing problems associated with Bridge Loan #2260; we were otherwise optimistic. Little did we know war was on the horizon.

P2PIncome is not a political site and our financial experts are not here to comment on international affairs. However, one cannot ignore the direct effect global crises of any sort have on the economy. Whether a pandemic or a war, the economy abhors instability. That instability is further exacerbated by the waves of sanctions imposed against Putin's Russia. In our special report on the Russo-Ukrainian War, we outlined the actions taken by several governments, as well as the reactions of three major p2p platforms: PeerBerry, Iuvo, and Robocash.

Since then the situation has only worsened. The value of the ruble has fallen further, reaching a staggering 150 ruble to the US dollar (down from approximately 80 a month prior). Sanctions imposed by the international community are quickly devastating the Russian economy, with scores of major corporations, including McDonald's, Ralph Lauren, Siemens, UPS, and Shell cutting off all ties with Putin. The aforementioned leads to an obvious question: How has this affected our investment portfolio?

How Has Our Portfolio Fared?

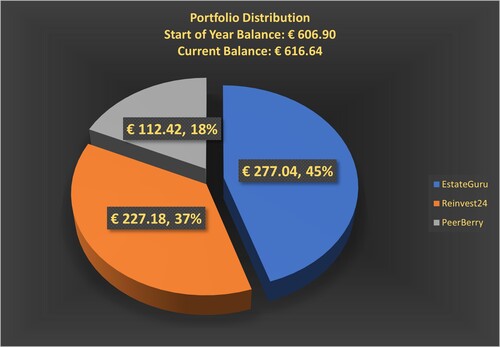

We started the year with new numbers, closing out the results of 2021 and starting fresh for 2022. Our portfolio distribution remained the same, though we have already initiated accounts at other platforms, which we will soon add to the portfolio. We continued to be satisfied with Reinvest24 and PeerBerry, but our frustration with EstateGuru had reached boiling point. What would be of Bridge Loan #2260?

After the invasion of Ukraine we faced another, more pressing concern: Would PeerBerry, which suspended all activities in Russia and Ukraine, be able to manage this crisis as effectively as it managed Covid?

Reinvest24

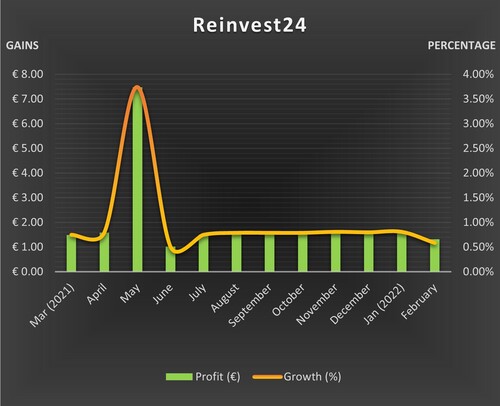

February wasn't our best month with Reinvest24 and that was the result of a minor flaw in the platform's format. The minimum amount one can invest on a Reinvest24 project is 100 euro, and that means our current balance of 25.86 euro is just sitting around collecting dust, rather than interest. This is an issue we can handle one of a few ways: withdraw the balance; sell current holdings and reinvest the total; deposit more money; invest on the secondary market. Ask yourselves which you would do and why, and then compare your decisions and reasoning with ours, which we will report on in next month's post.

Reinvest24 - Our Account Figures - Feb 2022

January Balance: € 225.86

February Gains/Losses: € 1.32

February Balance: € 227.18

Monthly Increase: 0.58%

Total Increase to Date: 11.45%

Our investments earned 1.32 euro during the month of February, which amounts to a 0.58% increase relative to our total balance (investments and liquidity). If we remove the balance from the equation, we find that we earned 0.66% in interest relative to our investments, which still isn't fantastic, but it's closer to the standard we've come to expect from Reinvest24. Regardless, our end-of-month balance for February 2022 stood at 227.18, which means that to date we've earned approximately 11.45% in interest, rental dividends, and penalties. We expect the numbers for March and April will be better.

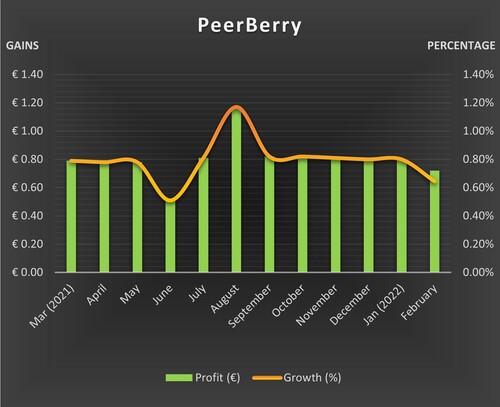

PeerBerry

As we entered the 2022 fiscal cycle we were very optimistic about PeerBerry, and though February's number's were less than stellar, we were very impressed with the platform's quick response to the Russo-Ukrainian crisis. All investors, P2PIncome included, received a detailed email outlining how PeerBerry would handle the matter. The email explained that all activities in the area were suspended effective immediately, and that actions were already underway to protect outstanding loans. PeerBerry's efforts to protect their clientele will not go unnoticed.

PeerBerry - Our Account Figures - Feb 2022

January Balance: € 111.70

February Gains/Losses: € 0.72

February Balance: € 112.42

Monthly Increase: 0.64%

Total Increase to Date: 10.47%

Unlike Reinvest24, users on PeerBerry can invest their balance with ease. We had a balance of 23 euro going into February, and those funds have been reinvested. We look forward to earning returns from them. In the meanwhile, our earnings from PeerBerry were slightly down compared to the preceding months, but not enough to elicit reaction. Given the alacrity with which PeerBerry handled the Russo-Ukrainian matter, we remain confident in the platform and have no doubt our profits will continue.

EstateGuru

In our previous two reports we expressed great displeasure with EstateGuru's handling of Bridge Loan #2260. Our concerns revolved around the platform's willingness to continuously extend the term of the loan while allowing the borrower to make interest-only payments. This strategy seemed exceedingly risky, but we are thrilled to report that the matter has been resolved. EstateGuru's gamble paid off, as the borrower managed to repay the loan in its entirety, meaning our funds were repaid. In the process, we earned money from the interest as well as the late-payment penalties. That's certainly an excellent result, but one wonders how many times such a gamble can succeed, and whether the problem is indicative of a strategic flaw.

EstateGuru - Our Account Figures - Feb 2022

January Balance: € 274.17

February Gains/Losses: € 2.87

February Balance: € 277.04

Monthly Increase: 1.05%

Total Increase to Date: 8.82%

Given the news about Bridge Loan #2260, it's no surprise our account at EstateGuru grew impressively in February. Unfortunately, the process by which those gains were achieved left much to be desired, and entailed a level of risk that we would argue doesn't justify the overall interest yields. After all, to date we have only enjoyed 8.82% in gains on the platform, and that's not much when compared with the 11.45% and 10.47% earned on Reinvest24 and PeerBerry, respectively. That being said, it was a good month for EstateGuru: we earned more (percentage wise) on their platform than on the other two. We've reinvested our balance, and it will be most interesting to observe the progress in March and April.

Comparing Platforms

EstateGuru managed to resolve the issue that had worried us for so long, and we earned money in the process. With a monthly return of 1.05% for February, EstateGuru has certainly started the year strong. Our other accounts, Reinvest24 and PeerBerry, slightly underperformed, and we hope to see an upturn in the coming months. Much to our surprise, none of the sites has been directly effected by the situation in Ukraine. To be sure, PeerBerry suspected activities in the area, but as of right now they haven't reported actual losses as a result.

| Platform | Balance | Payout | Yield |

| Reinvest24 | € 225.86 | € 1.32 | 0.58% |

| PeerBerry | € 111.70 | € 0.72 | 0.64% |

| EstateGuru | € 274.17 | € 2.87 | 1.05% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

Each of the sites in our portfolio is there for a reason, including EstateGuru. They all have excellent potential, and now that long-standing problems have been resolved at EstateGuru, we are more hopeful regarding their future. Whether the month of March yields more problems due to the war, or whether they manage to dodge the bullets, remains to be seen. In the interim, we continue to recommend Reinvest24 above the other two sites, despite the 100-euro minimum investment preventing us from investing our current balance, because the added value of the rental dividends is decisive.