Reinvest 24 Reviewed | P2P Real Estate Lending Done Professionally

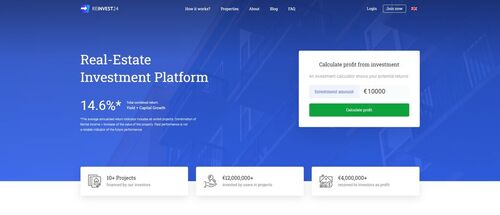

Reinvest24 is a comparatively newer real estate P2P lending platform. Minimum deposits start at 100 EUR and the site accommodates investors from around the world. Founded in 2018 by Tanel Orro & Kirill Tripolski, Reinvest24 seeks to open provide accessibility to all investors interested in the real estate market. Reinvest24 spins a new approach to P2P lending and allows their investors to directly purchase real estate equity and receive rental income until the loan duration ends.

Types of Loans on Reinvest24

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Reinvest24 Loan Characteristics

Loan duration1 - 36 Months

CurrencyEUR

Buybacks No

CollateralYes

Available inEU

Returns rate12 - 17%

Default Rate0%

Recovery Rate100%

Fees1%

BonusesNone

Reinvest24 Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Reinvest24?

Reinvest24 is the new kid on the block when it comes to P2P mortgage lending. They hope to expand in Eastern European markets and promote the idea of real estate backed equity investing. That means lenders instead of just being paid back their money, they are offered equity of the rental income of the property until they are paid back.

Lender/Borrower Ecosystem

Reinvest24 specializes in real estate equity loans. Reinvest24 loans are based on the idea that lenders temporarily purchase a stake in a rental company's apartment. To illustrate, rental company Tina VB OU, a company that works with Reinvest24, purchases an apartment, renovates the apartment and then leases it out for rent. The rental company secures a renter beforehand, and the lender receives rent as a return. The lender holds a percentage of ownership of the property and is paid back rent until the loan agreement ends.

All borrowers on Reinvest24 are professional property development and management companies. It's relatively safe to say that all borrowers have a good track record and a means of income to pay back the liabilities they possess.

Reinvest24 gives lenders the option to microfinance renovation contracts or purchases, and then receive monthly returns on the profit made from rental income.

Reinvest24 investments are based mainly in fast developing countries in Baltic and Eastern Europe. Discussed in further detail in our "Transparency & Security" section, a large part of what makes Reinvest24 such an outstanding platform, is their attention to detail and due diligence. The projects on Reinvest24 are hand picked for the purpose of providing a secure and guaranteed source of income. While that may be hard to believe, Reinvest24 has the numbers to back it up. All investors on their platform have been profitable as a result of Reinvest24 being able to choose profitable real estate listings. Furthermore, the company has also been profitable since its first year in operations for the same reasons. Their ability to choose their borrowers, to identify the levels of risk, to assess value in real estate have all been proven over their years of existence. It's safe to say Reinvest24 has started on the right foot.

Reinvest24's aspirations would imply they have not yet "succeeded". The purpose of the platform is to allow users to hold investments with them for 10 - 20 years. Reinvest24 truly incorporates the real estate market into the P2P sharing economy, in that real estate investments are always long term.

General Data

| General | Data |

| Origin | Estonia |

| Founded | 2017 |

| Offices | Estonia, Spain and Moldova |

| Loan Type | Mortgage & Equity Lending |

| Sign Up Bonus | €10 |

| Fees | 1% |

| Interest Rates | 14.6% |

| Min Deposit | €100 |

| Investment Duration | 4 - 120 Months |

| Secured Lending | Yes |

| Currency | EUR |

Registration & Withdrawal

It takes a few minutes to register. After verifying an address, number and standard KYC, users can deposit. There is a €100 minimum deposit after which, users can manually invest. The website itself is very user friendly, and Reinvest24 makes frequent successful updates to their level of transparency and website quality.

It is recommended to deposit in euro to avoid loss on currency exchange, as most of the platform operates with euro.

For free euro deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. Reinvest24 does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

Marketplace

The upside to real estate p2p lending companies is that there are always mortgages that can be sold and if the LTV is low enough then the principal is always secured. Such is the case on Reinvest24, for their business model it is more attractive to simply hold properties for years that can generate passive income rather than having to switch sources every few years. Since loans on Reinvest24 are 36 months, lenders can simply reinvest their capital into the project, retain "equity", receive dividends and simply enjoy letting their money make money. This is just one of the principles behind their dedication to due diligence. The company seeks to build long-haul customers who will stay because of a superior project, with proper attention to detail and sensible leadership.

The number of investors on Reinvest24 is a small 5,000 investors but they have received a historical IRR of roughly 14%, which is no trivial return. It does beg the question of scalability, if the platform were to receive the recognition it deserves would they be able to keep up with the demand? Rather, are there enough projects to reach their potential demand? Either way, Reinvest24 has proven that it has more than the ability to manage and sustain a lender/borrower ecosystem.

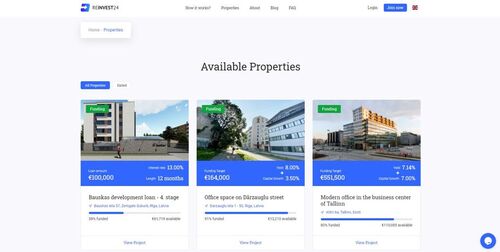

Reinvest24's marketplace is primarily in Eastern Europe. A lot of the projects are based in Tallinn, Estonia, where the company was founded and operates from. The marketplace is incredibly transparent, investors receive details on the property, it's value, amount purchased and projected returns associated with the property. Reinvest24's marketplace is fully funded. Projects are frequently attractive and sought after even outside of the P2P lending space.

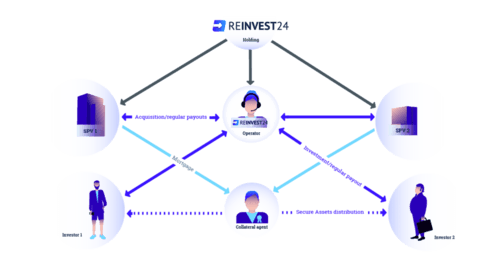

All listings are taken under a special purpose vehicle or SPV, which means a smaller subsidiary of Reinvest24 takes over the management of the funds. In the case of any issues or debt restructuring or fund recoveries, it's safer, cheaper, and smoother process for SPV's to manage. Lenders can expect a 1% fee on principal invested on Reinvest24 and a 10% annual fee on profits made with Reinvest24. Lastly, there is a fee if a property is sold, in which case Reinvest24 takes a 1 - 2% fee for administration which is typical in real estate markets. Lenders on Reinvest24 can experience a cash drag on the site as it's not common or easy for a new real estate listing to be accepted on Reinvest24.

Fortunately, Reinvest24 now offers a secondary market for their lenders.

Risks Involved

Investment Strategy

Reinvest24's marketplace is both for users who are interested in short term loans and long term loans.The company wishes to build customers aiming to generate passive income for the 10 to 20 years. The lending platforms offers loans that span from 4 - 36 months and it is possible to reinvest on their platform from amounts as small as one euro.

Unfortunately, there is no auto-investing tool but there is a secondary market. The secondary market is highly active, and serves as a solution for investors to cash out of their investment agreements.

Customer Service

Customer Service on Reinvest24 is a great experience. There are very fast responses on chat support, email support and phone support. All channels have quality support staff on standby with informative, efficient answers. In general, the user experience on Reinvest24 is among the best of the European platforms.

There is currently a blog page with great articles on investing and wealth growth. There is an extensive help center, chat support, phone support and an active social media team ready to answer any and all concerns. The support team is not only there for lenders but borrowers also benefit from this impressive quality of customer care. During the COVID-19 pandemic all borrowers who were suffering from economic despair were able to apply for a form of credit holiday, effectively, easing economic turmoil, avoiding insolvency and keeping a healthy ecosystem for lenders and borrowers alike.

Often, companies either focus heavily on borrowers, attracting too many projects with no funding. Or the company heavily focuses on lenders and borrowers who find themselves not cared for, that tend to take their business elsewhere. Managing an ecosystem where all players are satisfied is key to being successful. Reinvest24 does a great job of that.

Transparency & Security

One of the advantages of dealing purely with Real Estate is that there is always an asset securing your investment. It is difficult to imagine mortgage backed loans losing their investment and principal. Such events should not happen unless the company itself was illegitimate.

The company itself puts forth a lot of data on their loans. There is an abundance of information blogs, videos, CEO interviews which explain in-depth the inner workings of Reinvest24's business model. CEO Tannel Orro can be found explaining the P2P lending space, real estate markets in Baltic Europe, and the way Reinvest24 uses SPV's to orchestrate projects, payments and income distribution. The company has also released financial records to show that they have been in fact profitable from their first year of operations and are steadily growing.

Reinvest24 offers a very limited pool of loans to invest in however, they claim that their projects are guaranteed to be attractive and profitable. The general projects often come with a tenant ready to move in and purchase the rental agreement. In some cases, the properties after their renovation get sold, this would also mean your staked equity would also increase in value without any change to accrued interest. Whilst Reinvest24 is heavily focused on Tallinn, Estonia there are plans to branch out into neighboring capital cities like Vilnius, Lithuania and Riga, Latvia.

Our Readers Have Asked:

Is it safe to invest with Reinvest24?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take, the higher your reward, as well as the chances of losing your investment.

How much money will I make with Reinvest24?

Reinvest24 suggests that investors on their platform make anywhere from 11 - 15 percent in annually in returns.

What are the risks?

Investors on Reinvest24 have experienced a 3 percent default rate. Investors can expect that 1/33 loans on Reinvest24 will default. This is one of the lowest default rates in the industry but there are still platforms out there with even lower default rates.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Reinvest24 is certainly one of the hard working ones.

Where is Reinvest24 located?

Roosikrantsi 11. Tallinn, Harjumaa 10119, EE.

Watch & (L)earn

Discover more about Reinvest24 in this short but informative video.

Pros, Cons and the Verdict

Pros

- Manual Selection

- Very Transparent

- Low Fees

- High IRR

- Easy to Use

- Low Default Rate

- Unsecured Loans

Cons

- No BuyBack Guarantee

- Small Marketplace

- High Minimum Entry

Reinvest24 really does tick all the boxes. Real estate lending is always safe when there is a 1st rank mortgage behind it. Their areas of operations in the Baltic comprise of prime real estate in places where economic growth is prevalent. Their team is efficient, transparent and competent. The question remains, what happens when Reinvest24 scales and the demand far out weighs the supply? Does Reinvest24's risk assessment method work on a platform that services a large number of lenders? Or is reserved to the few who came first?

Until Reinvest24 is recognized for the talent that they possess it will remain an incredible platform. It is only when Reinvest24 is posed with the inevitable challenge of recognition that we will be able to see if they can rise above it.