Kiva Reviewed | P2P Lenders Bringing Poverty to its Knees

Kiva is a non-profit organization founded in 2005, San Francisco by Premal Shah and Jessica Jackley. Their vision was to create a tool that would effectively fight and defeat poverty through charitable loans. Lenders give out money while expecting to only get back what they put in, without any profit. They have issued over 1.4 billion USD in loans to low income societies and households. Kiva loans are serviced by over 1.7 million lenders in the world, all who are inspired by Kivas noble mission. From it's start of operations Kiva has been profitable, competent and inspiring at helping those who need an extra push to become financially independent.

Types of Loans on Kiva

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Kiva Loan Characteristics

Loan duration1 Month - 36 Months

CurrencyUSD

Buybacks No

Collateral No

Available inInternational

Returns rate0%

Default Rate4%

Recovery Rate58%

FeesNone

BonusesNone

Kiva Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Kiva?

Kiva is a micro finance, no-interest P2P lending platform. Individuals from societies lowest classes from all over the world are able to receive funding for their small businesses from Kivas micro payments. Individuals all over the world can benefit from Kivas no interest loans. The minimum deposit is 25 USD. Users can expect zero interest on any investments on Kiva. They have a 4% default rate which is considerably low. The project itself is really more of a donation to those who really need it with businesses that can be profitable in low income societies.

Many users find Kiva to be a fulfilling experience. Giving funds to real people, to start real businesses, to make real change. Kivas aim in the P2P lending space is to eradicate poverty. Kiva tries to issue as many micro payments to small entrepreneurs as possible so they may have the capital to start an enterprise that will become a stable source of income.Kiva is the ultimate platform for the altruistic. Kiva is a platform that gives everyone the chance to impact real people.

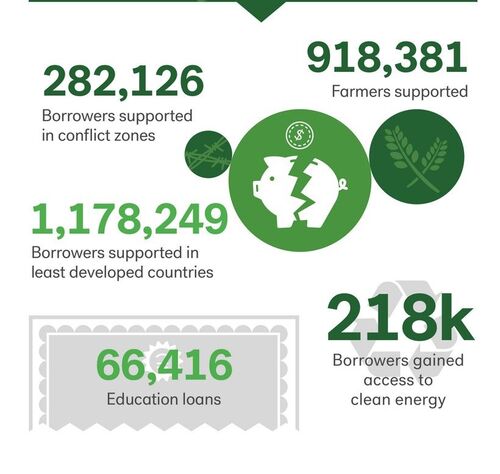

Lender / Borrower Ecosystem

The borrowers on Kiva are citizens of third world countries who are unable to receive a loan from the bank. Kiva is non-profit company and its lenders should not expect to see a return on their investment. They can however, expect some of the loans to default, as they have a default rate of about 4%. As of the end of 2021, Kiva has lent over 1.6 billion USD to over 3.9 million borrowers.

| General | Data |

| Origin | San Francisco, USA |

| Founded | 2005 |

| Offices | San Francisco, USA |

| Loan Type | Charity Lending |

| Sign Up Bonus | 25 $ |

| Fees | 0% |

| Interest Rates | 0% |

| Min Deposit | 25 $ |

| Investment Duration | 12 - 60 Months |

| Secured Lending | Yes |

| Currency | $ |

How to Borrow?

Kiva offers interest free loans only to borrowers in the United States. The loan documentation process takes up to an hour, afterwhich, Kiva's team will call you and take down further details and explain whether or not the loan would be a good fit.

Registration & Withdrawal

Registering on Kiva is easy and straightforward. KYC procedure and protocol and pretty standard on Kiva, although, it is less strict than some other P2P companies. Considering it is a charity that is accessible to many, Kiva probably thought security was less of an issue. It should probably be upgraded to match contemporary standards.

Withdrawing on Kiva is also easy and straight forward. There are no fees on Kiva for lenders. Borrowers however, may be subject to interest rates by the loan originators on Kivas platform.

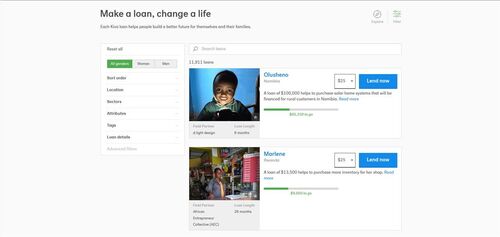

Marketplace

On their marketplace one can quickly see there is no shortage of loans on Kiva. The lenders do not directly fund the borrowers. There is an intermediary, MAXIMA, also known as a loan originator. MAXIMA services loans to borrowers, and advertises the loan on Kiva and users fund MAXINA loans that are offered. The way which MAXIMA then recovers your funds is not necessarily clarified, however, the system itself does finance individuals who need the capital by means of P2P lending.

Loans are available to laborers in many industries, some examples:

- General store owners

- Vegetable markets

- Farms

- Jewelry

- College degrees

- Auto-repair

- Sustainable energy

- Mental Health

- Groceries for families

- Renovations

There are many other professionals in need of capital and Kiva finds a way to service those needs. As mentioned earlier, once these loans are paid back, users can either withdraw the money or continue to service other loans. Kiva itself, generates income off donations from the lenders on their platform. Users have the option to tip once their loan is completed. Other foundations who believe in Kivas cause also donate and award capital to the platform.

Risks Involved

- Default Risk - when a loan defaults there is no guarantee that lenders will see even their principal return.

- Inflation Risk - the risk of inflation where a users capital is locked up whilst slowly lowering its value due to economic despair.

- Management Risk - the fees associated on the platform and the general health of Kiva’s employees.

- Marketplace Risk - The risks associated with Kiva itself going bankrupt. In such a case, a legal team would take over liquidating Kiva and redistribute the remaining capital. In such an event lenders can expect to see a substantial reduction in their capital and returns.

- Economy Risk - If there is an economic collapse borrowers are less likely to pay back their debt as they most likely won't have the means. Similar to the default risk but on a larger scale.

- Pricing Risk - The risk associated with Kiva’s ability to properly identify who is a good borrower and who is a bad one.

Lenders on Kiva are not particularly concerned with risks of losing their investments. The capital that goes to borrowers is for people who are suffering under the conditions of poverty. If it's not paid back it probably just went to someone who is trying to feed their hungry family.

Investment Strategy

There are no real investment strategies on Kiva. It is also difficult to do one's due diligence. One should probably think of Kiva more of a donation and should not expect to be paid back in full. Kiva does have a very high repayment rate so it is most likely very safe to use but it is philanthropy and not an investment that will garner any interest or earnings.

Once loans are finished and paid back, users, can then simply re-invest that 25 USD to the next person with a dream and a plan. The point here being that one 25 USD loan can be more valuable on Kiva. If a user reinvests 25 USD four times onto Kiva it would be the same as lending 100 USD. On Kiva, a small amount of money can impact a lot of people.

There are two forms of loans, the first one is through local "Field Partners" which function in the same ways as loan originators. The second way, is through "direct loans', where users can directly send funds to the borrowers bank account. This option is only available to citizens in the US and internationally recognized entities.

Customer Service

Kiva offers a support phone line as well as emails. The response times are a little too long. It is also a shame that there is no live chat. That being said, if they are focusing the majority of their resources onto providing the best service for borrowers who need it, then that would be justified.

Users can expect customer service emails after two business days.

Transparency & Security

Kiva is incredibly transparent. Their objective is very clear and they use a rather unconventional method to make that a reality. Kiva uses "Field Partners", which are really local organizations who find and vet borrowers. They provide them credit and then users on Kivas platform can decide who they think should be funded.

Though transparent, there is some concern regarding this model. Kiva partners up with loan originators and other organizations to loan out to individuals who need it. These loans are given up front to the borrowers. Then Kiva, advertises that listing on their website, the money that goes to "raise" the funds does not actually go to their borrowers. It goes to the loan originator servicing that loan.

The credit that comes from the users is used in any way the loan originator wishes to use the funds. There is no difference made to the user, as the user still receives his principal. The businesses that need capital get the capital. Kiva itself works off donations which have made them highly profitable. The only problem here is there is a small degree of secrecy regarding what these loan originators do with the funds they receive from users. It is difficult to determine as they themselves are third party organizations and are not required to divulge their movement with the public.

It's highly likely that the loans that are being filled up are going to future loans on Kiva. That would be a very healthy way to keep Kivas ecosystem going, however, there is nothing to corroborate that claim and nothing to suggest that Kiva is unjustly directing and redirecting funds. Simply, there is a point in the history of transactions on Kiva that is not open for all users to see.

Crisis Management

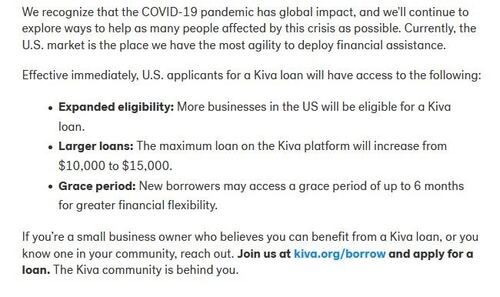

During the COVID crisis, Kiva did everything within their means to ensure economic health and stability where ever they could. When the pandemic hit, Kiva opened up eligibility to US citizens. Helping the US economic market with interest fee loans. They enabled borrowers to request for bigger amounts of capital, from 10,000 USD to 15,000 USD. On top of these awesome offerings, Kiva gave borrowers up to 6 months of credit holidays. Meaning, for 6 months borrowers would not have to pay back their investments. Rather, they had 6 months to breath until things would normalize.

The fact that Kiva was able to do this and did it, is a sign of a healthy company, with real cash reserves in the bank and actions that match their words.

Actions like this prove that Kiva is a company focused on its desire to economically help those who just need a little push to get going. If philanthropy or altruism is something you, as a user, wish you could have done more of, this is a great place to start.

It really is worth reiterating that companies that can withstand economic turmoil and even implement strategies to reduce its impact are companies with real value. Value that can be preserved and perpetuated.

Our Readers Have Asked:

Is it safe to invest with Kiva?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward as well as the chances of losing your investment.

In this case with Kiva, your investment is going to a charitable agenda, if you are not paid back by someone who needs your money to eat then it probably shouldn't phase you. If it does, we would advise finding a different platform for charity.

How much money will I make with Kiva?

None. You can only be paid back your principal.

What are the risks?

Investors on Kiva can experience a 4 percent default rate on their loan contracts. Which is very low. Kiva makes money off donations and grants from large organizations.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Kiva's agenda is to simply cure poverty and keep limited income fed and sheltered.

Watch & (L)earn

Discover more about Kiva in this short but informative video.

Pros, Cons and the Verdict

Pros

- Manual Selection

- Easy to Use

- Established Platform

- Low Default Rate

- No Fees

- Charity

Cons

- No Interest Earned

- Not Very Transparent

While we are a little disappointed with Kivas approach to security, anyone can use Kiva to deposit funds and loan to borrowers. Generally some KYC helps feel users secure that they are not just letting anyone on to their platform.

This is, after all, a money transferring company which can be subject to some serious fraudulent activity. Usually, you don't want "who knows what" to go "who knows where". Which is the case when companies fail to do KYC on their users.

That being said, their mission is noble and their performance effective. Their use of loan originators to handle their loans are still significantly helping people in low economic circles to grow out of them. Not only that, they have also shown that they want to, and have the ability to service the greater public and even assist the greater public with their economic problems and failures. Kiva has been well-recognized by a number of institutions around the world and has serviced over 1.5 billion dollars to people who were living in objective poverty.

Kiva is not for investors. Kiva is for people who wish to help other people. Kiva is an accessible way for everyone to take part in making the world a slightly richer place, 25 USD at a time.