P2P Lending | Reinvest24 or Rendity?

Reinvest24 and Rendity

Reinvest24 and Rendity are two of the very best real-estate crowdfunding platforms on the market today. Both companies originate their own loans, meaning borrowers turn directly to them for funding. After conducting due diligence, to ensure the borrower and the prospective project are worthy of investment, the companies post the project to their website, where investors can fund the loan in exchange for interest payments, rental dividends, and capital gains. In this comparison piece, P2PIncome's financial experts will help you discover both sites, so you can determine which is the better platform for your p2p portfolio.

A History of Reinvest24

Reinvest24 was founded in Tallin, Estonia in 2018, and has grown into one of the top platforms on which to invest in real-estate. The premise is quite simple: A landowner interested in developing their property can petition Reinvest24 for a development loan, and Reinvest24's users can investment their capital to help fund the project. This allows the borrower to avoid the hassle associated with traditional banking and lending institutions, and it allows individuals to profit from a system originally reserved for banks. Investors can put up as little as €100 to purchase their share of the projects, and earn passive income proportionate to their share.

There are several excellent Estonian p2p platforms, of which Reinvest24 is one of the best. The platform focuses exclusively on real-estate projects, such as converting buildings into rental properties, and rehabilitating old homes for resale. Investors earn money from the interest payments, and often continue earning income from their share of the rent. In addition, when a property is sold off at a profit, the investor is entitled to their share of the capital gains. This triple crown of passive income makes Reinvest24 one of the most profitable crowdfunding sites around. That's why the financial experts at P2PIncome have included Reinvest24 in the Investment Portfolio.

A History of Rendity

Rendity is an Austrian platform, founded in Vienna in 2015 by Lukas Müller (the current Chief Executive Officer), Paul Brezina (the current Chief Financial Officer), and Tobias Leodolter (the current Chief Investment Officer). Rendity's business model is quite similar to Reinvest24's, with one major exception: The company only operates in Germany and Austria. To be sure, any investor with an EU bank account has the right to invest on the platform, but the properties are limited to those two countries. This approach has an obvious benefit, in that it allows the assessors to master the market area.

By focusing exclusively on the region they know best, the originators at Rendity are able to conduct extremely thorough due diligence. The process includes a 20-facet assessment of the borrower and the project, with 12 of the facets focusing on the borrower, and the other 8 on the property and development project. The selection process is rigorous, and only the very best borrowers make it past the first phase. They still have to prove the project itself has real potential. Borrower who successfully repay 5 projects earn the label of Premium Partner. Once a project is approved, Rendity lists it on their website's marketplace, where investors can purchase shares and earn passive income.

A Comparison of Sustainability

Both platforms have managed to establish large enough of a base that they shouldn't have to worry about user-retention. The bigger question, in terms of sustainability, is whether these platforms can continue originating projects during economic downturns. For example, during the Covid19 pandemic, development projects ground to a halt. Reinvest24 found itself wanting for projects, often listing just one, and on occasion zero new offerings. But because they operate in 5 countries, their access to new projects is far greater than Rendity's, which only operates in two.

Looking at the numbers, Rendity's entire scope amounts to 450,000 square kilometers, while Reinvest24's scope is over 1 million sq.km. In fact, Spain alone has more real-estate than Germany and Austria combined. In this sense, one should consider Reinvest24's sustainability superior to Rendity's.

On the other hand, Rendity takes far fewer risks, investing exclusively in top-ranked projects from meticulously assessed borrower-developers. Reinvest24 also carefully assesses each project, but not quite to the same resolution. This explains why Rendity's rate-of-return is just half of Reinvest24's. Investors with low risk tolerance, and those aiming to increase the security of portfolio should look to Rendity, while those looking for high returns should look to Reivnest24.

A Comparison of Default Rates

Neither Reinvest24 nor Rendity have suffered any defaults, due in no small part to their screening efforts, as well as their willingness to work with borrowers who find themselves stuck. On the other hand, neither platform offers a buyback guarantee, so investors are risking the entirety of their investment, minus whatever small percentage the platforms can recover via legal action. Most of the loans on Rendity are subordinated, meaning they receive lower prioritization than other loans funded by that institution. If the lending institution collapses, these subordinated debts are the last to be repaid (and only if sufficient funds remain). This is a good reason to favor Reinvest24 over Rendity.

A Comparison of Marketplaces

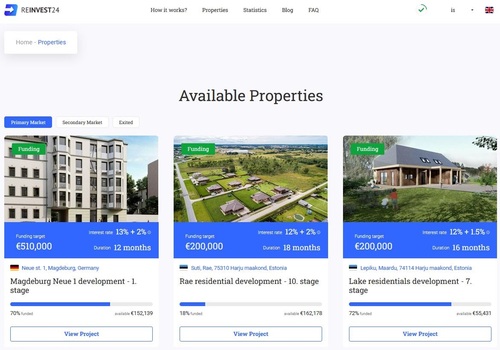

Both p2p lending sites have detailed marketplaces where investors can study the borrower's history, the viability of the project, and the likely profits from investing in that listing. Both sites offer photographs of the property, though Reinvest24 tends to upload far more images than Rendity.

As you browse the Reinvest24 marketplace, you'll notice each listing includes photos and renditions of the property and development project, as well as important details about the borrower and the loan. With a quick glance you can find the Interest Rate, the Duration, the Success Fee (which is how much you'll be charged when the project is complete and the loan has been repaid in full), and the minimum investment. You'll also find a map, a description of the area and of the project, and relevant documents. Reinvest24 wants to keep its investors informed, and the marketplace reflects that with its attention to detail.

The only flaw in the Reinvest24 model is that it doesn't have any specific investment vehicles. Users simply invest in projects and collect their profits. The listing does mention the potential profits from the investment, and the source of those profits (rental dividends, capital gains, or interest payments), but it's up to you to formulate your portfolio. Rendity, on the other hand, offers 4 categories of investments: Income, Growth, Bond, and Savings. This is a significant plus, as it allows investors to plan their portfolio with greater precision.

For example, if your goal is to earn a consistent income, the Income category allows you to invest in rental properties with fixed payments. You're collecting rental dividends, rather than interest payments, and the payment are transferred quarterly. On the other hand, if you're looking for larger profits, you can try your hand at some of the Growth listings. These are designed for maximum profit. The Bond program is the safest, but the least profitable, with many of the listing netting less than 5%. The savings program is especially attractive, as it promotes monthly investment in a long-term savings plan that offers between 6% and 7% returns. The average return from a standard savings account is usually below 0.5% for the same service.

Another important difference between the two sites is Reinvest24's secondary market, where investors can sell their notes to other investors. This option allows investors to walk away from what they believe to have been a bad investment. It also allows speculative investors to purchase small shares at reduced prices. In addition, it means an investor who finds themselves short on cash can sell their notes and increase liquidity. On Rendity, you have no choice but to see the project through.

A Comparison of Risks and Rewards

According to economic theory, there is a direct relationship between risk and reward. Riskier investments offer greater potential returns as a way of justifying the amount of risk taken on by the investors. In this regard we find a significant difference between Reinvest24 and Rendity. The former offers average returns of 14.5%, while the latter's returns are about half of that. To locate the cause we look to each platform's risk standards (among other things), where we find that Rendity is far more conservative than Reinvest24, both in terms of borrower selection and in project selection.

That's not to suggest Reinvest24 is cavalier with your money. They are a world-class operation, and they select their borrowers with great care. But their approach is just a touch more speculative than Rendity's, and that's reflected in the comparative rates. On the other hand, Rendity doesn't charge any fees, while Reinvest24 charges an exit fee once the project is complete. In other words, once the borrower has repaid the loan, Reinvest24 with transfer your share of the profits to your account, after deducting their Success Fee (usually 1%).

A Comparison of User Interfaces

Users should find both sites easy to navigate. Neither site suffers from graphic flaws or poor formatting, and both sites divide their information into intelligible sections. That being said, the Rendity site is superior in its attention to detail and overall structure. For example, the homepage has a collection of drop-down menus along the top of the page. Each menu is organized by topic, making it easy to land on the page you need. The Reinvest24 homepage only offers links, and it's not always clear where you'll land.

In addition, Rendity's page has a more vibrant color palette, more links to important features and investment vehicles, and a more detailed FAQ page. Where Rendity falters is language. The page is available in German, and much (but not all) is available in English. Reinvest24, on the other hand, is available in English, German, Estonian, Russian, and Spanish.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Real-Estate

Average Returns

6.4%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

32,000

Total funds invested

EUR 136 Million

Default rate

Undisclosed

Regulating entity

German Chambers of Industry and Commerce

Buyback guarantee

Secondary market

Payment methods

Bank Transfers

Withdrawal methods

Bank Transfers

Rendity is an Austrian fintech company that originates real-estate development loans and sells notes from those loans on its marketplace. In addition, Rendity offers 3 high-yield savings programs with varying degrees of risk. The average yield on Rendity is around 6.4%, which is also the rate of the medium-risk savings plan.

Verdict

A detailed analysis and comparison of Reinvest24 and Rendity leads to two important conclusions: First, both platforms elevate crowdfunding to an art-form. They both engage is rigorous due diligence to locate and fund profitable projects. Second, Reinvest24 is just slightly superior, if only because of its geographical scope. In fairness, this is a subjective preference. One could easily argue that Rendity's focus on the Austria and Germany allows the company to master a small region and originate the best possible loans. But diversification requires options, and by restricting itself to such a small region, Rendity also limits its investor's options.

Reinvest24, on the other hand, operates in several countries: Spain, Estonia, Moldova, Latvia, Germany, and Switzerland, while still managing to perform the necessary analysis and due diligence. The company also managed to pick off a few loans in Germany originated by EstateGuru, when the latter announced it would pause all operations in Germany. The scope of Reinvest24's operations mean that investors throughout Europe can find local investments, whereas Rendity relies heavily on its German and Austrian base (80%). This gives Reinvest24 a slight edge over Rendity, and it's why P2PIncome recommends Reinvest24 as the superior of two excellent options.