4 P2P Lending Sites Fighting Climate Change and Saving the Planet

Few issues in human history have garnered as much worldwide attention as climate change. Annual conferences, nightly reports, scientific papers, and vast amounts of attention from politicians and celebrities have made climate change one of the most talked-about topics of the modern era. The peer-to-peer lending market is not apathetic toward such concerns, and in this article P2PIncome's experts introduce four platforms that place a special emphasis on green-friendly projects. From funding solar panels to planting trees, these are the most environmentally conscious p2p sites on the market.

PeerBerry

PeerBerry is a world-class peer-to-peer investment platform that ranks high on our list of the best p2p sites. PeerBerry works with dozens of loan originators to provide private investors with an active marketplace. On any given day, you'll find 50 to 100 investment opportunities, including long-term loans, real-estate loans, and personal loans. P2PIncome's investment portfolio includes investments on PeerBerry, and this far those investments have enjoyed an average annual return of 9%.

In addition to its financial activities, PeerBerry invests in the wellness of our planet. The company partners with Treenex, an environmental organization with "a vision to make the world a greener place." The funding for the trees comes directly from PeerBerry, and each tree is dedicated to one of their investors. In 2021, PeerBerry planted two forests in India, totaling over 5000 trees. According to their project report, the forest "will increase the greenery of the area and will create workplaces for local people, who will take care of planted trees."

PeerBerry also works with Lithuanian renewable-energy company, Litelektra. Investors can help fund Litelektra's activities, which include a one-megawatt solar plant and several wind farms, via the PeerBerry marketplace. Locate such loans by selecting the Start Investing button, and selecting Litelektra from the list of loan originators. Users who prefer the auto-invest system can set up their investment strategy to include Litelektra as a preferred loan originator.

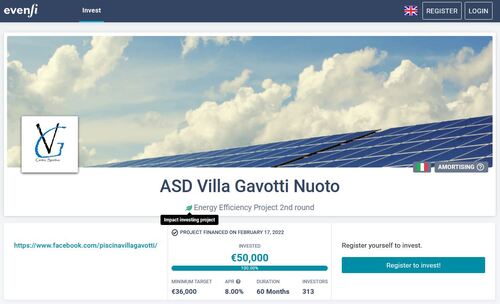

EvenFi

EvenFi is an Italian crowdfunding site with a passion for social and environmental projects. Unlike many p2p platforms, EvenFi originates its own loans, and those interested in funding a project can contact them directly to apply. Once a loan is approved, it is announced on the EvenFi marketplace, where users can help fund that project. Many of the projects aim at bettering the community, by helping local small-and-medium-sized enterprises (SMEs), funding film projects, promoting art exhibits and educational programs, and of course helping companies convert to greener options.

On the EvenFi marketplace, all Impact Investing projects are marked with a green-leaf icon, and while there are many types of socially-impactful investments, a large percentage are eco-friendly projects. For example, Soluzioni Eco Ambientali (SEA) is an environmental-hygiene company that has raised more than half-a-million euro on EvenFi. The company is involved in everything from cleaning streets and washing waste bins, to collecting and transporting industrial refuse. Similarly, the water-purification company AQuachiara, which provides the hotel/restaurant/catering market with "micro-biologically pure" water, lists projects on the EvenFi markeplace.

EvenFi is one of very few p2p platforms that originates its own loans. By selecting the For Companies tab, and entering your company's VAT ID, you can quickly and easily initiate the loan-application process. To qualify, a company must be able to demonstrate 3 to 5 years of business activity, with the last two years "in the black." Loans start at 35,000 euro, but EvenFi has funded several 6-figure loans. It is important to note that once a project is posted, it must raise a certain amount of capital within the time allotted, or the project is scrapped. Also, EvenFi only deals in growth projects and bridge loans, and does not fund cash flow or debt restructuring.

October

October is a well-established p2p platform founded in France back in 2014. The company is extremely selective, both in terms of borrowers and investors, and is high-respected for its thorough credit-worthiness checks. October only issues business loans, and while the interest rates and concomitant returns are lower than many of October's competitors, its due diligence means investors enjoy a level of security not found on most other p2p lending sites. The minimum investment on October is only 20 euro, so this is a great site for beginners to test the waters.

Over the years, October has implemented an impressive Responsible Lending Charter devoted to Sustainable and Socially Responsible Lending. The company is a signatory to the United Nations Principles of Responsible Investment (UN PRI), which emphasizes the importance of including "environmental, social, and governance (ESG) criteria into their investment decisions and practices." The UN PRI focuses on the most crucial effects of climate change, including water depletion, pollution, deforestation, and also addresses questions of work conditions, fair pay, and ethical governance.

One of the companies you'll find on the October marketplace is Olmix Group, which produces natural additives for nutrition products, algea that can server as a replacement for antibiotics, and safe animal-hygiene products. Another example of October's commitment to ESG is their zero-paper policy, which aims to reduce wood consumption by as much as 2000 kilograms per year. The company has also committed to eliminating the use of plastic disposables, preferring instead to purchase recycled and recyclable supplies and furniture.

Kiva

Founded in 2005, Kiva is a charitable crowdfunding platform designed to facilitate interest-free loans to help combat poverty, address social issues, and protect the environment. The company is based in San Francisco, California, and is registered in the United States as a 501(c)3 nonprofit. Kiva's commitment to social responsibility is exemplified by their motto: Make a Loan, Change a Life. To be sure, this isn't a site one which you can make any money as an investor, but if you're as passionate about making the world a better place, you know there's more to life than just turning a profit.

Kiva's model is quite similar to those of any standard p2p lending platform: a marketplace on which you can purchase shares of loans. The difference is the loans are interest free, which means the borrower is under far less financial pressure. Kiva does aim to recoup the entire loan, but also allows long grace periods, and works with borrowers struggling to repay. With rare exception, however, you will eventually get back all of your money. Loans on Kiva's marketplace are listed by category, including assistance for artisans (lists as Arts), directed help for Women, funding for Education, relief for Refugees, projects related to Covid-19, Agriculture, Eco-Friendly projects, and more.

Examples of projects includes a $100,000 loan to purchase solar home systems for a town in Madagascar, $15,000 to help fund a greenhouse in the United States, $3100 to help plant organic strawberries in Kyrgyzstan, and $5500 to purchase used clothes for resale in the Congo (DRC). Each loan offering on the marketplace includes the Story of the individual seeking the loan, a Business Description, an explanation about the purpose of the loan, and a list of Contributing Lenders and Contributing Lending Teams. Below that, you'll find the Loan Details, which include the Loan Length, the Repayment Schedule, and other important details.

A Quick Look at the Best P2P Platforms With Eco-Friendly Investments

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Market Type

Business Loans

Average Returns

3 - 7%

Minimum Investment

EUR 20

Signup Bonus

EUR 20

Registered users

43,000

Total funds invested

EUR 1 Billion

Default rate

3%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

October specializes in small risk business loans specifically to SME's in Europe. October has a great track record of fund recoveries, a solid mission and a very strong foundation. October's business and risk strategy is worth the time to read.

Market Type

Charitable Loans

Average Returns

0%

Minimum Investment

USD 50

Signup Bonus

USD 25

Registered users

40,000

Total funds invested

USD 1.68 Billion

Default rate

4%

Regulating entity

Self-Regulated/SEC Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Credit Card, Debit Card

Withdrawal methods

Bank Transfer, Credit Card, Debit Card

Kiva is a P2P lending platorm built to help low income families find a consistent cash flow to survive. Lenders take no interest on the credit they provide but have the ability to lend out the same capital to multiple borrowers.

Verdict

Each of the sites in this report has devoted itself to helping combat climate change and make the world greener. There is no "best" site in terms of the emphasis on helping save the planet, but as an investment advice site we do feel we have an obligation to recommend the site with the best balance of social consciousness and financial gain. To that end, we recommend PeerBerry. This is a platform with a world-class track record, and because they fund their own green activities, you can devote yourself to the business of making money while knowing they will continue to plant trees in your name.