Understanding Which P2P Lending Sites Offer the Best Interest Yields

"Money makes money. And the money that money makes, makes money."

—Benjamin Franklin

The point of investing in peer-to-peer lending platforms is to earn passive income. Simply put, we want a source of income that requires minimal effort, if any. Unlike a steady job, one can have several full-time sources of passive income, with certain types continuing to earn money in perpetuity. The lending market is an excellent example of a passive-income source, because the lender only needs to provide the loan and collect the interest. In the case of peer-to-peer lending, where all the heavy lifting is done by the platform and its loan originators, the passivity is maximized, which makes the interest yields even more attractive.

That being said, lenders do take on some risk: If the borrower fails to pay back the loan, the investment loses money. If the borrower pays back the principle but not the interest, the entire enterprise has been a waste of time because we can't make a profit merely getting back what we put in. We need the interest in addition to the principle, and that means we need to know how to calculate interest and how to interpret the rates and yields the various p2p platforms report.

To that end, P2PIncome's financial experts have put together this guide to understanding interest rates and calculating interest yields. In addition, we've provided a list of the best p2p platforms based on interest yields, as well as overall quality.

Interest: Simple, Compound, and Continuous

Simple Interest

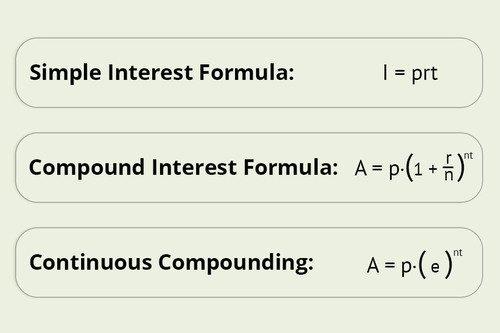

Let's start with a practical example. We decide to invest 1000 euro at 12% interest for a term of one year. The easiest way to calculate the anticipated interest is to use the equation for simple interest: "p" times "r" times "t," where the p stands for principle (1000 euro in our example), the r stand for interest rate (12%, or 0.12), and the t stands for time period (1 year). The product of that equation would be 1120 euro, and that would be how you calculate the Annual Percentage Rate (APR) you often hear about in advertisements for loans, cars, and mortgages. The result seems to makes sense, but it has one major flaw: Banks don't use APR for anything other than advertising.

The APR banks advertise doesn't tell you the entire story. Also known as the nominal rate, APR is a simple but inaccurate figure, and if you use it to calculate the actual interest you're going to pay or earn (known as the effective interest rate), you'll end up with an inaccurate result. In fact, the longer the term of the loan or investment, the more inaccurate the result will be, with things like 20-year mortgages easily being off by tens of thousands of euro.

Compound Interest

Rather than calculating the simple interest, financial institutions apply compound interest, which grows exponentially rather than linearly. To calculate compound interest they divide the interest rate into periods (usually 365 days) and aggregate (compound) that amount back onto the principle using an exponential-growth formula. In other words, the add a small fraction of the interest back onto the total each period , whether it's months, weeks, or days.

The more frequent the time period (t) the higher the rate-of-growth (nt, where n is the number of times the total is compounded). The higher that is, the higher the effective interest rate. When banks say "APR," they're referring to interest that has been compounded annually, but they never actually do that. Usually they compound the interest daily, sometimes monthly. Whereas the APR in our example is 12%, the effective rate when compounded monthly is 12.683%, and it climbs to 12.747% if compounded daily. That's obviously a very good thing when you're the investor, because it means you make more money from your money.

Continuous Interest

In 1683, mathematician Jacob Bernoulli was working on the question of compound interest, trying to determine its highest possible rate-of-growth. Obviously, days could be divided into hours, from there into minutes, and into seconds, and so on. But was there a point beyond which you could not divide? In mathematical terms, did the process "converge?" Bernoulli discovered that it did indeed converge when taking the limit (as n approaches infinity) of the nth power of 1 + 1/n. In other words, if you divide the interest rate by a number of periods (n), add that to the principle, and then take the nth power of that result, you'll get to the fastest and smoothest possible climb in total interest. It was a powerful realization that Albert Einstein considered one of the most important mathematical concepts ever recorded.

In practical terms, the number that results from that formula, which we now refer to as "e," is approximately equal to 2.72, though it's an irrational constant, like pi, so it actually goes on forever. Banks use e to calculate continuous interest, which means the interest is compounded on an ongoing basis, moment by moment, rather than daily or monthly. In our example, the effective rate for continuously compounded interest would be right around 12.75%. That might not seem like much of a difference, even from the original 12%, but when you start looking at long-term investments it's adds up to a lot of money. Were we to invest 1000 euro at 12% for 15 years, the APR would yield us 5473.57 euro for the course of the investment. Compounded continuously, on the other hand, the total leaps to 6049.65 euro, and there's no way to downplay that difference.

Amortization

Thus far we've spoken about interest rates in general, but when it comes to loans there is one more variable to consider: the payment plan. We want to collect steady payments, and frankly it's easier for the borrower to budget steady payments. Only the most reputable businesses and some extremely wealthy individuals can hope to get a so-called bullet loan, meaning a loan with a single end-of-term payment of the entire principle. Those are usually one-year loans, and even then you have to pay the interest regularly. The average borrower must agree to a structured payment plan.

To create a such a payment the banks divides up the expected total into fixed payments using a process known as amortization. When banks amortize loans, they divide the payments is such a way that the borrower pays back some of the principle and some of the interest each month, while the payment itself remains the same. In most cases, the earlier payments are staggered in favor of the interest and the later in favor of the principle. For example, if you're paying back a loan and your monthly payment is 100 euro, the very first payment might credit 30 euro toward the principle and the other 70 toward the interest. After a few years the split will be even, and toward the end of the loan you'll be paying mostly principle and a negligible amount of interest.

Amortization ensures the interest isn't neglected, but it also means the principle decreases over time. As it decreases, the amount on which the interest applies also decreases, and that results in a reduced annual percentage yield (APY). Using our original example, and assuming daily compound interest, the result of a one-year investment should be 1127.47 euro. But when we lend 1000 euro for one year, the result will only be around 1070 euro, because the borrower will be paying down the principle and the interest will only be applied to the remaining amount.

When interpreting interest rates you must always distinguish between APR and APY. Whenever you see the term APR, keep in mind that it means simple interest, whereas the APY refers to compound interest. Whenever you're buying a loan on a p2p site, try to find out the rate at which the interest is compounded, and look for the amortization schedule to make sure it's reasonable. Amortization schedules are usually included in loan agreements, and if you're investing in long-term notes you should determine whether schedule is principle-heavy. If it is, you might be placing your money at far too much risk to justify the potential returns.

P2P Platforms and Interest Rates

Usually when people start shopping for p2p platforms they have two questions in mind: How much do I stand to lose? How much do I stand to gain? The first question is usually satisfied by the buy-back guarantee, which prevents the investor from losing the principle. Platforms that offer buy-back guarantees react quickly to potential defaults, and before there's a chance for the investor's money to be swallowed up, the initial investment is returned. However, our goal isn't to avoid losing money, it's to make more money. To determine how much money you're going to make, look at the reported interest rate, and then start checking for the details. Ask the following questions:

- What is the effective interest rate?

- What is the amortization plan?

- Do the interest yields on the financial reports match the advertised averages?

Recommended Platforms

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

P2PIncome's financial experts have selected 3 sites we believe are excellent in terms of interest rates and yields: PeerBerry, Iuvo Group, and RoboCash. The top spot goes to PeerBeery despite having slightly lower rates than RoboCash due to PeerBerry's track record. PeerBerry has a 100% success rate when it comes to fund recovery, and while interest gains are the path to passive income, loss prevention is always top priority. Iuvo Group takes a conservative approach, so the advertised rates are a touch lower than some other sites. On the other hand, they are consistent, well-funded, and highly reliable. RoboCash advertises slightly higher rates than Iuvo and PeerBerry, but they don't offer long-term loans, which means the compounded interest never really enjoys an opportunity to grow very much.

Conclusion

The most important take-away from this article is that compound interest makes more and more money over the long term. While each of the sites listed offers great rates, only PeerBerry offers loans of up to 10 years, making it our top choice for anyone focusing on long-term interest yields. PeerBerry also offers plenty of short-term loans, so you can diversify and adjust as need be. Furthermore, PeerBerry's reported interest rates average 10.5%, which is a very attractive effective rate by today's standards.

If you must choose just one site based on interest rates, we recommend PeerBerry. Readers interested in reviewing our experience with PeerBerry are invited to look over our Annual Report, which outlines how our 100-euro investment on their platform performed over the course of 2021.