Introducing Maclear | A New P2P Lending Platform

In April of 2023, Maclear AG, "a crowd-lending platform aimed at the Swiss and European markets," successfully passed a full audit conducted by financial consultation firm Grant Thornton. According to a press release from Maclear, the company had spent the previous two years researching the market, applying for and receiving Swiss licensure, and developing "a practical, user-friendly P2P application" that provides "fully transparent investing instruments that comply with Swiss regulations." To ensure ongoing compliance, Maclear joined PolyReg, a self-regulatory organization (SRO) operating under supervision for the Swiss Financial Market Supervisory Authority (FINMA), and in accordance with FINMA's Anti-Money Laundering (AML) policies.

Maclear Reviewed: First Impressions

The company's stated goal is to create an environment "where all our investors can access proven and diversified international investment opportunities." They seem to understand that Switzerland enjoys an excellent reputation as a country that protects investors, and have emphasized that fact throughout their platform. They correctly assert that investors feel more comfortable putting their money in the hands of a company that faces "robust regulation." To that end, they promise Maclear will function as a "transparent, trustworthy, and sophisticated" peer-to-peer lending and crowdfunding platform.

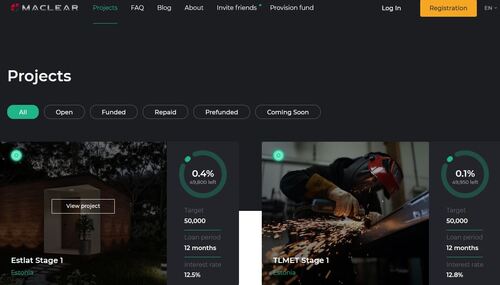

Considering Maclear launched at the beginning of May 2023, it should come as no surprise that there are only 2 listings on their marketplace (as of this writing). As such, it's not yet possible to provide a detailed overview and assessment of the platform. In terms of first impressions, however, Maclear does quite well. The website is beautifully designed, and provides plenty of details about the burgeoning platform. The homepage promises a "[s]afe investments and passive income" with returns of "up to 14%." The first two projects list interest rates of 12.5% and 12.8%, but we suspect the 14% estimate includes various reward programs.

Maclear's Features

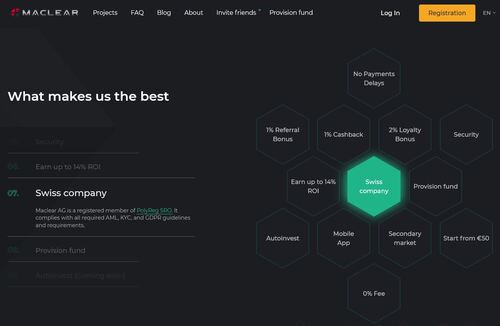

Maclear's platform promises an ambitious list of features, though many are currently labeled "coming soon." According to the website, the platform will offer a secondary market, an auto-invest tool, and a mobile app. And they offer 3 reward programs:

- A 1% cashback program on all investments made during the first 90 days

- A 1% referral bonus for both members, on all investments made by the referred party during the first 90 days

- A 0.5%-to-2% loyalty program, based on the balance of the user

Maclear plans to maintain a Provision Fund using 2% of the funds invested into each project and all commissions from the secondary market. The provision fund will protect investors against late payments, with indemnities kicking in just 3 days after date of payment and continuing for 60 days, or until the borrower makes payment. After 60 days, the matter goes to "enforcement of collaterals."

Maclear Financials

According to the website, Maclear will not charge any deposit fees, and the minimum deposit will be set at €50. That's a long road from the €75,000 one needs in order to qualify for the Alpha Plus program and earn an additional 2% on investments. This suggests Maclear is casting a wide net in terms of potential users. As of this writing, however, a €75,000 would suffice to purchase all the projects on the site and still have plenty left over. It's also worth mentioning that Maclear will charge a 0.5% withdrawal fee, with the minimum withdrawal set at €50. Monies will move between investors and Maclear exclusively via bank accounts, and the account holder's name must match that of the investor.

Final Thoughts

With so many p2p lending firms popping up, each new platform needs to find a way to stand out. It would seem Maclear hopes to stand out by attracting high-end customers while leaving enough room for small-time investors. In addition, it's one of the only p2p lending firms looking to promote real-estate and business loans. Unlike Reinvest24, which focuses exclusively on real-estate, or HeavyFinance, which focuses exclusively on agri-business, Maclear seems willing to work with several types of loans. This approach could very well attract investors hoping to diversify their portfolios, especially those who can afford to invest several thousands per project.