P2P Lending | Investing With Only 10 EUR

The entire reason peer-to-peer lending has become a booming industry is because of how little it takes to begin investing on peer-to-peer platforms. Not only does it require little knowledge and experience, because the concept behind p2p is so straight forward, but it also requires a small amount of capital. It starts off at 10 EUR (11.50 USD). This is the minimum that you need to begin earning on peer-to-peer lending networks.

The concept is to provide financial solutions to those who need more help in achieving financial independence. Historically, only the wealthy had their "money working for them". Wealthy people are able to maintain their wealth by holding assets that generate capital, while taking out loans against their assets to keep themselves liquid. Peer-to-peer lending enables less wealthy persons the same strategies that the more wealthy use in order to better the quality of their lives.

PeerBerry

PeerBerry was founded in Riga, Latvia in 2017. They originally started off by offering consumer loans. Since then, PeerBerry has expanded into offering many different loan options, an origin story similar to that of Mintos. "PeerBerry" was actually once a loan originator on Mintos' marketplace. The loan originator Aventus Group offered loans on Mintos' marketplace. After noticing how profitable it was to own a peer-to-peer lending site, Aventus created Peerberry. Despite its similarities, PeerBerry serves to be a different platform to Mintos.

The minimum to invest in PeerBerry is only 10 EUR and the returns are the same of Mintos, 8 to 12 percent. But there is one key difference, as PeerBerry's system was designed to adapt for the future and has far more securities in place. The lender/ borrower ecosystem is something we often refer to in our reviews. It is the delicate management of finances going in and out, ensuring that the borrowers are paying back and the lenders receive enough money to reinvest their capital. This relationship ensures good profits, available loans and high liquidity.

PeerBery has perfected this model and provides an ecosystem that protects itself from malfeasance. This is described on PeerBerry's site as their dual buyback guarantee, which you can read up more about in our comparison of Mintos and PeerBerry.

Mintos

Mintos is one of the biggest peer-to-peer lending platforms in the entire world and certainly the biggest to come out of Europe. Minimum investments on Mintos start at 10 EUR. Mintos is classified as a loan originator aggregator, which means Mintos allows multiple loan originators to provide loan contracts on Mintos' marketplace. On this marketplace loan originators are divided by ranking from A - C. Loan originators with an A rank are considered low-risk, and as the number goes down, the risk increases, as well as returns. Yields range between a 8 to 12 percent in yearly returns on Mintos.

Mintos primarily issues loans for consumer loans, but since their establishment they have expanded to offer business loans, car loans, mortgage loans and invoice loans. Mintos has truly become a diversified marketplace, where investors can keep a diversified portfolio on its platform. Mintos was founded in 2015 in Riga, Latvia by Martins Sulte. Mintos is a highly profitable peer-to-peer lending platform and issues about a billion EUR in loans in each year, which is a staggering amount of capital for a private lending platform.

Mintos' platform offers a ton of great features like multiple auto-investing packages, and API integration so you can invest with your own bots. They have resources and manpower dedicated to fund recovery operations and strategies. The platform is super easy to navigate around and Mintos has a very active secondary market. Withdrawals and deposits are often instantaneous due to Mintos' active liquidity team. And lastly, the platform has a great resource center, support staff, and transparency with their investors.

Iuvo Group

Iuvo is a p2p lending and investment platform that also offers a high-yield savings plan. This format allows users to earn passive income two ways, maximizing the value of their money. Iuvo has attracted over 35,000 users who have invested over €350 million since the company's inception. That's an average portfolio of 1000 euro, but the minimum deposit on the platform is only 10 euro. Whether you're ready to drop a cool grand, or just want to get your feet wet with a 10-euro investment, Iuvo is one of the p2p investment platforms you should strongly consider.

Iuvo offers all the services one needs from an online p2p investment platform. There's an active primary market with over €350 million, as well as a secondary market on which users pay a small fee (1%) for the sale of notes. Iuvo posts loans in several currencies, including euro, Bulgarian lev, Polish złoty, Romanian leu, and Russian ruble (though they paused all activities in ruble during the Russian invasion of Ukraine). That being said, users need only deposit euro, which the platform automatically converts to the relevant currency and back.

The IuvoSave program is a savings plan into which users deposit funds and earn yields of 5 to 7%. The entire process is automated, meaning the user doesn't need to track any investments or construct any strategies. Simply deposit funds and watch them grow at a rate 15 to 20 times faster than they would in a standard savings account. Users can deposit and/or withdraw funds at any time, once the initial investment period has passed (6 months or 12 months, depending on which vehicle the user chooses).

Swaper

Swaper was created in 2018 by loan originator Wandoo Finance. Swaper serves to be an easy auto-investing solution for investors who aren't as interested in doing their due diligence. All the investing on Swaper is completely automatic, as investors do not have the option to manually select loans. The returns on Swaper range from 14 to 16 percent for yearly returns. Investors receive 14 percent for investments under 5000 EUR and 16 percent for investments above 5000 EUR. Minimum investments start at 10 EUR.

Swaper has a very easy to use website to navigate. The platform has no fees other than a two percent trading fee on their secondary market. Due to the ease of use and high liquidity of the platform, it has become a go-to platform for many investors. All of Swaper's loans are short term consumer loans that range from 50 to 1000 EUR, but never exceeds a 30 day pay back date. All loans are unsecured, but every loan is protected by a buyback guarantee promised by Swaper.

Swaper receives all of their loans from loan originator Wandoo Finance, which is also Swaper's parent company. Swaper has yet to lose any of its investors' capital and provides a significantly high return rate. We would be cautious over the fact that there is no manual investing on Swaper, but it otherwise appears to be a great platform.

RoboCash

RoboCash is a fully automated peer-to-peer lending platform with a variety of earning plans. Users deposit funds and set up their investment vehicle, after which the system takes care of the rest. There's actually no minimum deposit on the site, but you'll need at least 10 euro to open the portfolio. Over 20,000 users have registered with RoboCash, and they've invested an average of €4000 each. According to RoboCash's financial report for 2022, "statistics show that investors use small sums to get acquainted with the platform and gradually build up their balance." If you're the sort of investor who likes to test out a site using small sums, RoboCash is ready and waiting.

When you open a portfolio on RoboCash, you select from one of four investment vehicles, based on your economic goals. The first option is Payout, which withdraws all of your earnings the moment the loan is closed, and transfers the money to your bank account €50 at a time. The second option is Balance, which keeps your earnings in your RoboCash balance. Option three is to Reinvest Principle Amount, which separates your earnings from your original investment (principle), automatically reinvesting the latter. The final option is Reinvest Full Amount, which selects new loans and reinvests your entire balance, cyclically, ad infinitum. The value of reinvesting your entire balance stems from the compound interest you can earn over the long term.

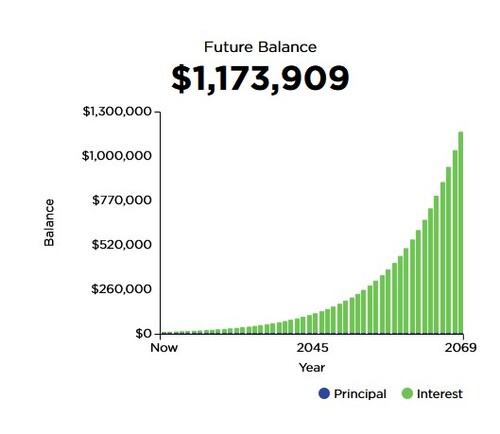

By continuing to reinvest your funds and allowing the full amount to grow at the fastest pace, you maximize the value of your capital. For example, if you invest €1000 in a high-yield account that earns 7% per annum, you will have €1070 by the end of the year. If you then withdraw the profit, you're back to €1000, which means by the end of the second year you'll have €1070, again. Simply stated, you'll earn €70 per year. But if you leave the funds alone after the first year, you'll have €1114.09 (a extra €4.09) by the end of the second year, and €1225.04 by the end of the third year. That's an extra €15.04, and the gap keeps increasing every passing year. In ten years the gap is €1700 versus approximately €1960.

Money is Printed Everyday

The entire reason we invest is because money is being printed everyday. "Why save money when they are printing money?", said by Robert Kiyosaki, author of Rich Dad Poor Dad. Robert discusses how the federal reserve in the US is constantly printing money, skewing the value of the currency. It is not enough to save money to achieve wealth, you need to invest. You need to acquire assets and you need to earn interest on your capital. The amount of capital itself does not matter. What matters is getting your money moving, working and growing. Saving your money in the bank so that it will grow by one percent at the end of each year is no strategy for becoming wealthy.

In order to see real gains you need a substantial amount of money invested over time, compounding year after year. Becoming wealthy is not a quick scheme, it's a lengthy process of discipline and dedication. For many years, allowing your money to work for you was the privilege of noblemen and politicians. Today it's the privilege of everyone.

The concept microfinance or crowdfunding are concepts designed for those in the middle to lower class. They are for people who need more financial tools to get them out of the paycheck-to-paycheck lifestyle they are living. The creation of peer-to-peer lending enables the people the tools they need to break through from financial oppression. And it starts at 10 EUR.

The Power of Value Investing

The greatest investors understand how real money is earned. The type of money that buys islands, or a professional sports team, or for market speculative investments. That money is earned through time, hundreds of years of holding valuable property. Old money that has already bought half of your local neighborhood and grows every month the rent checks come in. This money was primarily achieved by compounding value. The value of properties and assets that grow exponentially over time.

You see when it comes to finance and investing, time is your greatest friend. If your investments can continuously grow over time at a steady rate, then you are on your way to becoming very successful.

For illustration sake, if we take a textbook example of an investor with 10,000 euros and we predict every year he will receive a 10% increase in returns, then after 50 years that man be will be a millionaire. And we can take a look at that with this chart:

What we believe in and what many investors claim to believe in is called value investing. It's a term popularized by Warren Buffet and a book he often recommends, The Intelligent Investor by Benjamin Graham. In this book, Graham explains the best investments are the investments that you understand will not change for the foreseeable future due to it's popularity, necessity or tradition. For example, Warren Buffet has a large stake in Coca Cola and Wrigleys Gum. This is largely because Warren understands these industries and does not foresee either Coke or Wrigleys position changing in the coming future.

These two companies have also been two of the greatest contributions to Warrens incredibly large portfolio. Investors who know what they are doing are not as interested in the short-term earnings as they are with the long-term wealth growth. It's not about making 500 EUR in the next week, it's about making an additional 5,000 EUR every month for the rest of your life. So that when you retire, you do not have to ever worry about clocking back in again. Peer-to-peer lending allows us to begin amassing large portfolios by giving us a chance to start early and start small.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

Verdict

There are a lot of great platforms listed in this guide. All of them starting from a really small amount, but if we had to recommend one to start off with it, would be PeerBerry. They have the most intuitive site and most secure platform with a very promising projection.

All of the platforms herein are excellent, but PeerBerry has multiple security barriers, a highly sophisticated auto-investing tool, as well as, a diversified marketplace with both secured and unsecured loans. The returns on PeerBerry are very high considering their dedication to a secure platform.