EstateGuru Reviewed | The Experts of P2P Real Estate Lending

EstateGuru.co is one of the most well-known P2P platforms operating out of Europe. Rather than dealing with a variance of loan options, EstateGuru only deals with real estate and property related projects. EstateGuru.co was founded in 2014, in Tallinn, Estonia. It currently operates in Estonia, Finland, Germany Latvia, Lithuania, Portugal and Spain. The lending platform has processed more than 151 million EURO in loans to more than 55,549 investors from 109 different countries around the globe. EstateGuru is famously known for being the only P2P platform to have a one hundred percent success rate at fund recovery, protecting principal and partial returns.

Since it's founding EstateGuru has never lost any of it's investors capital, making it a very enticing P2P lending company to register with.

Types of Loans on EstateGuru

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

EstateGuru Loan Characteristics

Loan duration6 - 60 Months

CurrencyEUR

Buybacks No

CollateralYes

Available inEU

Returns rate8 - 13%

Default Rate6%

Recovery Rate40%

Fees2% (secondary market)

BonusesNone

EstateGuru Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is EstateGuru?

EstateGuru is a very impressive real estate based peer-to-peer lender. This is the idea behind P2P real estate, REIT investments and really anything that requires a relationship between credit and property. Loans are offered with property as collateral so that in the case of a loan default there is always the property that can be sold off. In such a case, investors funds are protected. The reality is, many P2P real estate companies still fail at this, losing investors principal and the physical property.

EstateGuru on the other hand does not lose either principal or property. EstateGuru has always been able to provide their users attractive returns on their investments and in the case of a default, investors receive all of their funds and usually partial interest.

EstateGuru are truly experts at P2P real estate lending.

Lender/ Borrower Ecosystem

The minimum deposit is 50 EUR and properties funded are located in Eastern Europe. EstateGuru unlike other crowdfunding platforms does not offer a buyback guarantee. All loans are secured with a first or second rank mortgage on the property on behalf of the lenders. The platform also reports a long history of successful fund recoveries on projects that have defaulted.

EstateGuru offers competitive interest rates for their lenders, varying from 9% to 12%. Users that deposit over 75,000 EUR receive a bonus depending on the project originator. Estate Guru's vision is, "We believe that great projects deserve to be backed and that this backing should be fair, transparent and mutually beneficial to the investor and the borrower."

The borrowers on EstateGuru consist of property and real estate developers. They come to EstateGuru for a specialized market which focuses on and understand their needs. Borrowers enjoy a low interest rate on their loans because of their high security.

Since it's founding EstateGuru has never lost any of it's investors capital, making it a very enticing P2P lending company to register with.

General Data

| General | Data |

| Origin | Tallinn, Estonia |

| Founded | 2014 |

| Offices | Tallinn, Estonia |

| Loan Type | Mortgage Lending |

| Sign Up Bonus | 0 € |

| Fees | 0% |

| Interest Rates | 10.00% |

| Min Deposit | 50 € |

| Investment Duration | 4 - 60 Months |

| Secured Lending | Yes |

| Currency | € |

How to Borrow?

EstateGuru offers mortgage loans directly on their platform. Investors need to fill out basic information regarding the type of loan they would like, how much funding, the amount of collateral. After which, the amount of interest and LTV is indicated.

Registration & Withdrawal

Getting started on EstateGuru is very straightforward. Users can sign up with their basic details and have an account in just a few minutes. The website does require KYC before depositing. After the verification process is completed users can deposit funds.

The minimum amount to deposit is 50 EUR.

It is generally recommended to deposit in EUR as most of the loans operate with EUR.

For free EUR deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account and to withdraw it will generally take 1-3 business days for the funds to appear back in the user's account. EstateGuru does not charge any fees for deposits and withdrawals however depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

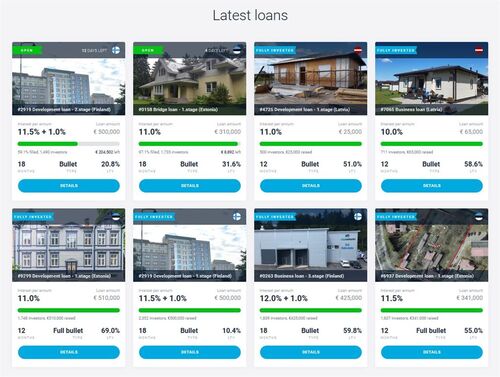

Marketplace

EstateGuru has two marketplaces. The primary one deals only with real estate related loans and the loan periods generally range from 6 - 60 months. The secondary market serves as an opt-out tool for lenders in any case they need their funds prior to the contracted agreement of the loan. The secondary market charges a 2% fee, which is considerably high.

EstateGuru does extensive due diligence on those taking a loan at their marketplace. They reject almost 90% of potential borrowers.

The world of finance is vast and it is often difficult for investors to venture into markets they have no understanding of. Using EstateGuru does not necessitate an in-depth understanding of real estate.

That being said, before getting started on EstateGuru users should learn Loan to Value rations or LTV. LTV, simply put, is the ratio between the money borrowed and the value of the project post construction.

EstateGuru offers an LTV calculator on their website so users can always double check what the value of a given project is as well as it's projected value.

Risks Involved

EstateGuru only provides the ability to lend to direct structured loans. In other words, it means in the case of a borrower defaulting on payments then EstateGuru will step and take over the relationship between the borrower and the lender.

So far EstateGuru has been profitable and no investors have ever lost funds on their investment. EstateGuru releases their yearly reports so any lender may verify on EstateGurus' FAQ.

In the unlikely event of EstateGuru going bankrupt it is important to note the investors’ funds are kept safe and protected in a separate bank account. All contracts between the lender and the borrowing company remain intact. However, a legal team would take over for EstateGuru to implement the redistribution of the companies remaining capital. After funds have been redirected the platform would then eventually close or become something new.

Investment Strategy

EstateGuru has the option to auto invest after depositing 250 EUR into the platform. When loans are offered on the market they are very quickly filled out. Even users who have opted for emails and notifications will find that the available projects are quickly snatched up. Although there are new projects being uploaded frequently, users can expect to experience a bit of a cash drag on their portfolio.

All investments on EstateGuru are direct structure investments, meaning that lenders can only purchase claims against borrowers as opposed to an indirect structure, where lenders purchase the rights of a loan provided by the loan originator.

To further clarify, if a borrower defaults on EstateGuru, it initially becomes a problem between the borrower and the lender. Despite this structure in place, EstateGuru has always stepped in and implemented strategies to recover missing funds for their lenders. As per the legal binding between EstateGuru and the lender, this is not a guarantee.

It is most likely the case that EstateGuru has always been able to implement successful fund recovery strategies because all assets are backed by the value of the property. Meaning that in the case of a borrower defaulting, EstateGuru still has the property to sell off and reimburse lenders for their investments.

Premium Club

In order to be a part of EstateGuru's premium status users have to have at least 100,000 EUR accumulatively invested into projects on the platform.

The perks of being a part of the club include:

- Pre-notifications of upcoming loans

- Possibility to mark your interest prior to publishing the loans

- Bonus offers from larger investments

- Free Trustly deposits

- Invitations to EstateGuru’s events

- Personal EstateGuru contact

Customer Service

After a thorough investigation of EstateGuru's customer service, p2pincome.com can confirm that their customer service is one among the very best on the market. EstateGuru's support team works hard to understand and remedy any problems their unsatisfied users report. To that end, they have a chat-bot, email, and the phone numbers of each of their offices available on their site. They make every effort to respond to emails within 1-2 business days.

Transparency & Security

As mentioned earlier, EstateGuru provides in-depth details regarding the credibility and ratings of their borrowers. EstateGuru's transparency is emphasized most in its website's user experience. Lenders are exposed to all of the most important details of their borrowers and their real estate projects. All of these details are frequently updated, making lenders feel secure and aware of their investments and returns.

In addition, every quarter EstateGuru releases statistics and a report of their most problematic loans. On their website users can see all of EstateGuru's employees, which can all then be further verified on LinkedIn. It is easily acknowledged that EstateGuru's management comprises of some of the most experienced, seasoned real estate and financial experts.

EstateGuru is vocal and proud that the company has never lost any of it's investor's principal. All funds have been financially secured and backed since the beginning of their operations.

The worst scenario to have occurred on their platform involved a project named, Koru põik. In this instance, fund recovery took 15 months to finalize and lenders only received a 4.46% return. To your average investor this may seem like too long and too little, but in comparison to other P2P companies this is a serious indicator of a superior business model in the altfi/defi space.

The team behind EstateGuru regularly post their webinars, studies and animated videos on their YouTube page. They also release an article on their blog every two or so weeks. Their appearance outside of their company is, less to be desired especially when compared to their competitors. But, they certainly makeup for it with their exceptional user experience.

Lemonway Payment Solution

In efforts to increase transparency and credibility to EstateGuru users, the company has implemented the Lemonway Payment solution. Marek Partel CEO stated in a press release,

“We are expanding to several new European countries in 2020. To be fully compliant with the regulatory requirements in all of the operating countries, and to offer our investors the best possible service, we will start using a licensed payment service provider for storing funds differently from the current set-up." This would move lender funds away from the company in order to move it into the custody of Lemonway, a trusted merchant service.

The payment merchant is fully EU and EEA compliant and regulated. This would increase the transaction speed on EstateGuru's platform as well as ensure lenders their capital and liquidity.

Crisis Management

EstateGuru was not heavily impacted by the pandemic. Like PeerBerry, their approach was to reduce the number of new projects and the loan amounts. They were slightly affected in the beginning, but after the peak of pandemic hysteria the market stabilized.

Our Readers Have Asked:

Is it safe to invest with EstateGuru?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward as well as the chances of losing your investment.

How much money will I make with EstateGuru?

EstateGuru proclaims that investors on their site make anywhere between 8 - 13 percent in yearly returns. EstateGuru features both auto investing and manual investing in order to maximize profits.

What are the risks?

EstateGuru is one of the few platforms that have never lost their investors capital. Historically speaking, the worst situation you will have on EstateGuru are late loans.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. EstateGuru is certainly one of those companies that is honest, hard working and profitable.

Where is EstateGuru located?

Pääsukese 2, 10145, Tallinn, Estonia

Watch & (L)earn

Discover more about EstateGuru in this short but informative video.

Pros, Cons and the Verdict

Pros

- Auto-Investing Tools

- Established Platform

- Regulated

- Secondary Market

- Low Default Rate

- Easy to Use

- Secondary Market

- Manual Selection

- Secured Loans

Cons

- No BuyBack Guarantee

- 2% Fee on Secondary Market

EstateGuru is certainly one of the more elite platforms when it comes to P2P lending. Their focus solely on real estate allows them to put in measures to ensure the safety of their investor's funds. EstateGuru is without a doubt in the top 5 P2P lending platforms and company performance indicates that it will be for a very long time. It is incredible that the platform has always been able to give their investor's back their principal and accrued interest even in the event of a loan defaulting and a company going bankrupt.