Rendity Reviewed | Prime Real-Estate for P2P Investors

Rendity is a real-estate fintech platform located in Austria and serving the European Economic Region. The majority of borrowers are from "German speaking countries," and the platform has a "strong focus on urban areas in Germany and Austria." According to the website, "Rendity is a commercial investment adviser registered in Austria and an authorized financial investment broker in Germany regulated by the Chamber of Industry and Commerce (IHK)." Rendity reports over 30,000 registered users ("customers"), who have invested a combined €130 million and enjoyed an average return of approximately 6.3% per annum.

Types of Loans on Rendity

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Rendity Loan Characteristics

Loan duration30 months (avg.)

CurrencyEUR

Buybacks No

CollateralYes

Available inAustria, Germany

Returns rate6.4%

Default RateUndisclosed

Recovery RateUndisclosed

FeesNone

BonusesEUR 10

Rendity Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Rendity.com Pros & Cons for Investors

Pros

- Regulated Platform

- Extensive Due Diligence

- Institutional Investors

- No Fees

- Detailed Marketplace

- Fixed-Income Bonds

- High-Yield Savings Plan

- Highly Informative Website

Cons

- Bank Transfers Only

- Small Marketplace

- Some German-only Pages

- Subordinated Debts

- No Secondary Market

Investing with Rendity

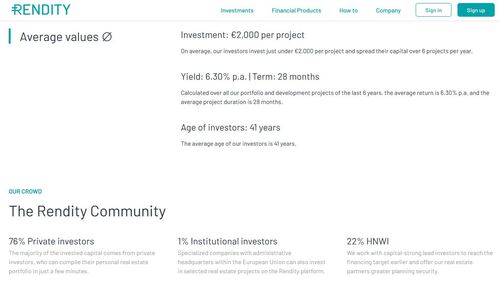

Investing with Rendity means enjoying a stable 6% to 6.5% per annum in profits from real-estate development loans in Germany and Austria. The platform is fully regulated by the Bank of Austria, and all investor transactions take place via their EU bank account. The minimum investment is only €100, but the average is closer to €2000 per project. The average project duration is just over 2 years, but investors pay zero fees throughout that period.

You can also use Rendity to invest in fixed-income bonds and high-yield savings plans. Both options utilize the company's real-estate portfolios to draw attractive rates. Rendity conducts one of the most thorough borrower assessments you'll ever find on the European crowdfunding market, thereby providing greater security than most p2p lending platforms.

Types of Investments

Rendity is a real-estate development and rental platform offering 4 types of investments: Income, Growth, Bond, and Savings Plan.

Income

Property rental is one of the best forms of passive income, assuming the property is correctly managed and maintained. Rendity offers investors the opportunity "to generate stable rental income" by purchasing shares of the rental agreement. The renter makes regular rental payments, the profits from which are shared by the p2p investors, after deducting maintenance fees, taxes, and other expenses. Since rental payments are usually fixed, the income is relatively stable. In essence, you become a property owner and rental agency. Rendity pays out the returns from Income investments quarterly.

Rendity understands that a rental property is "only as good as its management." To ensure the property is correctly maintained, and that the rental agreements are properly managed, Rendity works with professional property managers with a proven record of success. Furthermore, all properties are subject to interest deposits amounting to 6 months worth of interest. These funds are held in escrow, and may only be used "to compensate for unpaid interest [and] missing capital repayments."

Growth

Rendity's portfolio includes short-term projects designed to turn quick profits. There are two such types: New Construction projects with designs that maximize utility of space and energy, and implement "modern construction techniques," and General Renovation projects that aim to increase the value of a property quickly, so the property can draw greater income. Rendity pays out the returns from Income investments annually.

Bond

According to Rendity, the introduction of real-estate bonds represents "a new chapter in digital real estate financing." These fixed-income bonds differ from Rendity's other investment vehicles, as they allow investors to "invest in established real estate companies" rather than properties, and to enjoy annual distributions based on "predefined maturity." This is quite similar to investing in a publicly-traded company via the stock market, except the maturation of the bond is defined.

Savings Plan

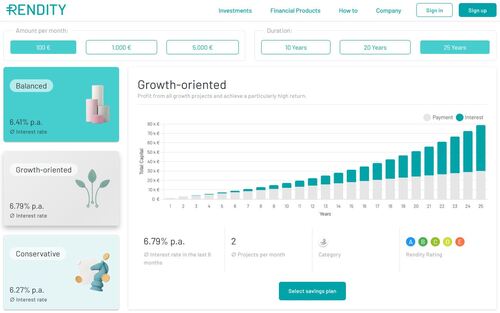

Rendity offers a high-yield savings program “tailored to your needs.” Investors can select one of 3 savings plans: Conservative, Balanced, and Growth Oriented. The Conservative plan aims to earn 6.27% per annum, by only investing in listings with a rating of A or B. According to the site’s calculations, if you were to deposit €100 per month, you’d have approximately €7000 after 5 years: €6000 in savings, and an additional €1029 in interest. After 15 years, you’ve saved €18,000 and earned €11,916 in interest, and after 25 years you’ve saved €30,000 and earned €42,629 interest.

The Balanced plan aims to earn 6.41% per annum, by investing in any project rated A through E. While the added 0.15% might not seem like much, the effects of cumulative interest mean that over time you will earn more money: €6000 savings plus €1089 in 5 years, €18,000 plus €12,281 after 15 years, and €30,000 plus €44,235 after 25 years. Since the platform's reported rate of return is also 6.4%, it's fair to say the Balanced plan essentially the same as investing funds directly (which are not mutually exclusive).

Finally, the Growth Oriented program takes the most aggressive approach, investing in only 2 projects of any rating per month. This means more money is devoted to each listing, but because the portfolio isn’t as diversified, there’s greater risk involved. The increased risk helps account for the 6.79% rate of growth, which yields €1161 in interest over the first 5 years, €13,300 over 15 years, and €48,810 over the 25 years. The deposit totals remain the same (€6000, €18,000, and €30,000 respectively).

One might argue that a difference of €4000 over the course of 25 years isn’t significant enough to bother, but that’s simply not the thinking of an investor. Declining an opportunity to earn more requires real justification. For example, if you really can't afford the added risk, you have a good reason to go for the Conservative approach, rather than the High Yield approach. Otherwise, declining an additional half of a percent for no reason is like turning down a better paying job for no reason.

Auto-Investment Tool

There are several excellent p2p platforms with auto-invest options, which allow you to set your investment parameters and trust the algorithm to do the rest of the work for you. Rendity doesn't have an auto-invest tool, per se, but the Savings Plan isn't far off. You decide how much you want to invest per month, what interest rate you'd like to earn, and allow the platform to make all the investment decisions.

Borrower Data Verification

Rendity's vetting process is among the most comprehensive in the business. Would-be borrowers must satisfy a long list of metrics to qualify for a loan. Rendity assesses everything from the borrower's corporate structure and management team, to the valuation of the project and its estimated returns. Rendity inspects the properties, the borrower's financial reports, and even run background checks on employees.

Rates and Returns

According to their Facts & Figures page, Rendity's average yield is around 6.3% per annum. There are projects with interest rates as low as 5% and as high as 8%. On the Investments page you can filter by percentage rates, and at any given time you'll find between 20 to 40 listings below 6%, another 20 to 40 over 7%, and the vast majority (100 or more) between 6% and 7%. The duration of the loans ranges from 12 to 48 months, with the reported average at 28 months. There are loans for "as little" as €250,000 (far more than the average on Reinvest24), and as much as €2 million. This might explain why the average per-project investment is around €2000.

Who is Rendity?

Rendity is a Austrian fintech platform that aims "to democratize the real estate market," by originating development loans and then facilitating crowdfunding for those loans. The company was founded by Lukas Müller, who currently serves as the CEO, Paul Brezina, who currently serves as the CFO, and Tobias Leodolter, who currently serves as the CIO.

Lender/Borrower Ecosystem

Rendity is a two-pronged operation. One prong is loan origination, with Rendity serving as the originator for real-estate development projects and rental projects. The other prong is crowdfunding, which Rendity facilitates via its online platform. Real-estate developers in search of funding (as well as owners looking to rent out their properties) can petition Rendity directly via the website. To contact Rendity, select How To on the homepage, then select Get a Funding (sic.), and fill out the online questionnaire. For some reason, this section of the website is only available in German.

Having received a request for funding, Rendity will contact the petitioner for an initial consultation. Assuming Rendity chooses to proceed, they will conduct a thorough due-diligence audit of the petitioner, based on 20 criteria: 8 to assess the entity borrowing the money, and 12 to assess the project or property.

First, Rendity checks the "core competencies" of the team managing the project, including "technical, legal, economic, and financial." The management team must demonstrate academic and professional qualifications, experience, licensing, and a successful record of collaboration with other relevant entities. Next, Rendity investigates the number of successful projects completed by the borrower, resulting "total floor space," equity capital, total investment volume, and similar facts and figures.

Potential borrowers must present Rendity a clear "sales structure" that delineates the intended function of the developed project. As the final phase of the borrower audit, Rendity conducts a credit check and reviews the borrower's register extract and annual financial reports (including those of any parent/sister companies).

Having completed an audit of the developer/borrower, Rendity conducts an audit of the project. This phase is concrete, as it is based on metrics such as the price at which the land was purchased, the estimated construction costs, project calculations, the milestone plan, and similar financial considerations. Simply stated, Rendity looks for reliable borrowers with potentially profitable projects.

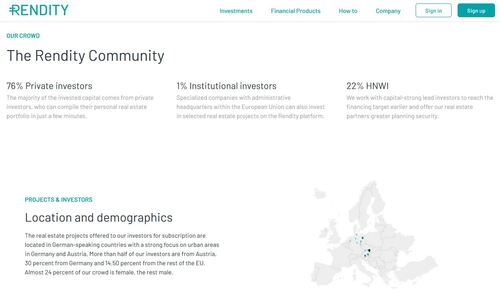

Once a project is approved, Rendity offers 22% of the total investment value to High Net-Worth Individuals (HNWIs), in order "to reach the financing target earlier," and to offer "greater planning security." The other 77% is open to standard investors, including 1% for institutional investors. According to Rendity's statistics page, over 50% of its investors are from Austria, 30% are from Germany, and approximately 14.5% are from other parts of the EU. It's not clear where the other 5.5% are located.

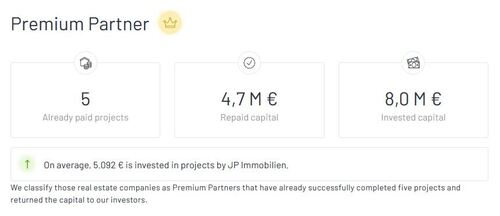

Premium Partners

Once a borrower has successfully completed 5 projects, having returned all capital to investors, Rendity labels the borrower a Premium Partner. On any subsequent projects from that partner, the status appears on the listing. The label includes the total number of completed projects, the total amount of capital that has been repaid, the total Invested Capital, and the average investment with that entity.

General Data

| General | Data |

| Origin | Austria |

| Founded | 2015 |

| Offices | Tegetthoffstraße 7, 1010 Vienna, Austria |

| Loan Type | Real-Estate |

| Sign Up Bonus | €10 |

| Fees | None |

| Interest Rates | 7% |

| Min Deposit | €100 |

| Investment Duration | 30 Months (average) |

| Secured Lending | No |

| Currency | EUR |

Registration & Withdrawal

Rendity's registration process is much like other peer-to-peer lending and investment sites. Users begin by going to the homepage and selecting the Sign Up button, on the top-right corner. This will take you to the sign-up page, where you must fill in the online form. If you're a private investor, choose Individual. If you represent a company, select Company, but keep in mind that only 1% of the Rendity marketplace is open to institutional investors.

Fill in your name and email, generate a password, and agree to the terms and conditions to continue to the next page. There, you'll be asked for your Account Details, which include your salutation, birthday, nationality, place of birth, address (including zip code, city, and country), and your phone number. You must also affirm you are not a Politically Exposed Person (meaning someone who has held or currently holds public office, as well as the immediate family and close associates of such a person). You must also affirm you are "not taxable in the US," and that the data you've entered is accurate.

The system will ask you to verify your email account, and then you'll need to enter your bank details and fund your Wallet. You'll receive a small sign-up bonus (€10), and can immediately begin investing. The minimum investment is €100, but you can invest as much as you'd like, and the average is actually €2000.

Languages

The Rendity site and its chat options are only available in English and German, which makes sense considering nearly 80% of the platform's users are from Austria and Germany. Still, one hopes to see other languages, if the site seeks to attract investors from other parts of the European Economic Area.

Marketplace

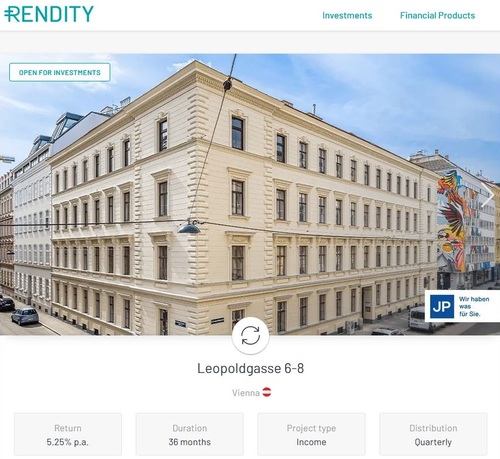

Rendity has an world-class marketplace, not only in terms of investment opportunities, but also overall design and attention to detail. The colorful listings are easy to browse, and the high-definition photographs add an element of style to the look and feel of the site. Each listing includes an exhaustive report on the investment. The listing begins with basics, such as the address of the project, the investment's estimated Return, the Duration of the loan, the Project Type, and the Distribution (meaning the payout structure).

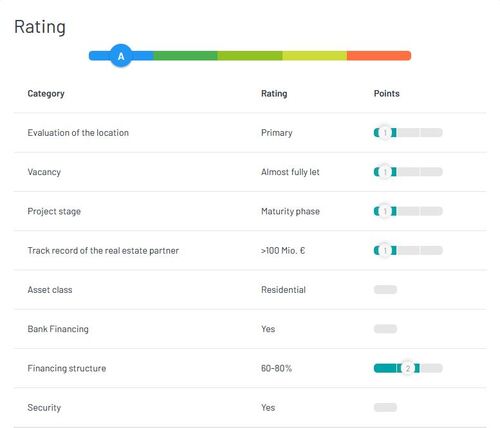

Along the side of the page you'll find a more slightly more detailed summary of the listing, including the Rating (A through E), the Financial Instrument (i.e. the type of investment), the Issuer (meaning the institution actually issuing the funds), and the Intermediary, which is most often Rendity itself. You'll also find the Invest Now button, which will take you to the loan contract.

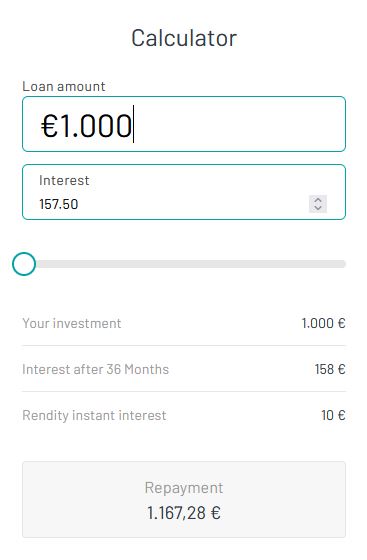

If you're curious to know how much money you can earn from your investment, try the Rendity Calculator, found on the bottom-right of the page. Enter the amount of money you plan to invest, and the tool will report back the amount of interest you'll have earned by the time the loan ends. In addition, you'll find out how much Instant Interest you'll earn. This is rare feature, in which Rendity pays investors a portion of the interest upfront, as an incentive to invest.

The next section of the listing is the Project Presentation, which describes the property in its current state, and the goals of the project. The Project Presentation is followed by the Deal Highlights, which detail the standing of the borrower, the current and projected income streams, any methods used to secure the investor capital, and the anticipated returns from the investment. Next is the Investment Case, which provides details about the property, its value, square meterage, the distribution format, and other relevant information.

The Financials section and the Finance Structure section allow you to look over the facts and figures of the project, including the Equity of the property, any Bank Loans included in the project finances, and the amount of money the project seeks via crowdfunding. You can download various documents related to the project, including an Exposé (a.k.a. prospectus), the Vermögensanlagen-Informationsblatt (investment datasheet), and an Information Datasheet. However, many of these documents are in German.

Rendity has even taken the time to include a map of the area, and an extremely detailed description of the area. At the very end of the listing, you'll find the Rating of the investment, based on parameters such as an Evaluation of the Location, Vacancy (in cases of rental projects), the Track Record of the Real-Estate Partner, and so on.

The final section of each listing describes the borrower's Team, and provides links to borrower's pages and projects. It's important to understand that such attention to detail, combined with Rendity's sophisticated due diligence process servers the investor well. You know your money and time are taken seriously when a company puts out this much effort.

Risks Involved

Transparency & Security

Rendity scores high marks on every metric of transparency and security. The company has one of the most restrictive set of demands you'll find in p2p lending. Very few potential borrowers can withstand such scrutiny, and those that can are usually worth your investment. The detailed marketplace, complete with photographs, downloadable materials, maps, and descriptions, allows you to enter into each investment well-informed. Since most projects enjoy various funding sources in addition to crowdfunding, the investment is far less likely to fail.

Our Readers Have Asked:

Is it safe to invest with Rendity?

Rendity is a top-tier lending and crowdfunding platform that takes every precaution possible to protect your investment capital. Rendity is a fully licensed and regulated entity, and its webpage security is verfied by Cloudflare. That being said, all investments entail risk, and one should never invest capital one cannot afford to lose.

Which credit bureau does Rendity use?

Credit bureaus are an integral part of the American loan market, but they are not used in Europe. Instead, lending companies and banks assess credit-worthiness based on their own metrics, including monthly income, income-to-debt ratio, collateral, financial reputation, criminal record, and other factors.

What minimum credit score needed to get a loan from Rendity?

Because Europeans don't use credit bureaus, they don't use credit "scores" in the sense you might be thinking. Instead, they use their own rubric, which can't really be compared to the numeric system used in the US.

How do I become an investor on Rendity?

To invest on Rendity you must register for an account, complete the KYC process, and deposit funds. Once you're been greenlighted, study the marketplace, and try to select projects that suit your financial goals.

How much money will I make?

Rendity reports an average annual return of 6.3%, and you can use the sites calculator to estimate your potential earnings.

Why do I need to submit ID verification?

With all the scams on the internet, it's important that a company confirms they're working with an actual person, and have that person's permission to move their money around. Just imagine if someone pretending to be you invests your money.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Rendity Located?

Rendity's headquareters are located at Tegetthoffstraße 7, 1010 Vienna, Austria.

Verdict

There are several reasons your peer-to-peer investment portfolio should include Rendity. Real-estate tends to grow in value, if for no other reason than it's a limited commodity. In addition, the nature of rental income makes it an excellent passive income source. Other than maintenance and management, rental properties place few demands on the owner. Real-estate development allows investors to enjoy added value. A flat piece of land can only yield so much, but a 50-story building on that land can earn millions. Rendity is world-class platform for real-estate crowdfunding, offering serious investment opportunities.