LendingClub Reviewed | Americas Largest P2P Lending Platform

Following a period of instability, LendingClub has decided to shut down its operations as a p2p platform. LendingClub will not be shutting down completely, but instead will continue its operations as a more traditional bank. This review encompasses what was around before the decision to close its doors. Thankfully, there are plenty of other great p2p platforms.

Lending Club is a US based P2P lender, founded on Facebook's platform on 2006. Shortly after, they raised enough capital and materialized in their own company. Lending Club primarily deals with long term loan contracts for borrowers who could not receive them otherwise.

Peer to Peer services emerged in order to challenge the fiscal centralization that eventually brought about the decline of traditional finance. Lending Club has taken the forefront in US P2P lending services. They are publicly traded and one of the P2P companies that are regulated. Lending Club is currently only available in the US.

Types of Loans on LendingClub

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

LendingClub Loan Characteristics

Loan duration3 - 5 Years

CurrencyUSD

Buybacks No

CollateralYes

Available inUSA

Returns rate6 - 36%

Default Rate10%

Recovery Rate71%

FeesNone

Bonuses1% Cash Back

LendingClub Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is LendingClub?

LendingClub was once the largest Peer-to-Peer lending platform in the world. In October of 2020, LendingClub announced that it would be closing down its P2P marketplace. The primary purpose of the platform was to provide unsecured, high interest consumer loans. LendingClub has in many ways defined the peer-to-peer lending space in the US.

Lender/Borrower Ecosystem

The minimum investment on LendingClub is 1000 USD, with a 1% yearly fee for using the platform. Payment distribution occurs daily. Borrowers can borrow up to 40,000 USD and are not required to put up any form of collateral. Interest rates are purely determined on credit score. In the case of a loan default borrowers can expect to be pursued by LendingClub and if efforts are unsuccessful then borrowers can expect to be litigated against.

Borrowers & Debt Consolidation

Lenders are generally funding consumer loans and even more specifically debt consolidation. Debt consolidation, is the act of paying off previous debts with new loans this could include those who have credit card bills, mortgage bills or any debt in general. The reason is because the longer a loan agreement is in debt the higher the interest rate becomes. Borrowers can take loans to pay off debt and get a new loan at more affordable interest rate. It is essentially moving a loan agreement elsewhere for a better price.

Types of Accounts

LendingClub offers a variety of account types lenders can open:

- Individual

- Joint

- Traditional IRA

- Roth IRA

- Simple IRA

- Roll over IRA trust

- Corporate and Custodial

There is a smartphone application as well as a website.

The minimum to open an IRA account is 5,500 USD. Simply put, IRA accounts are for individuals who wish to build their retirement funds. IRA's are subject to less tax than reported earnings or passive income.

| General | Data |

| Origin | San Francisco, USA |

| Founded | 2006 |

| Offices | San Francisco, USA |

| Loan Type | Consumer Lending |

| Sign Up Bonus | 25 $ |

| Fees | 5% |

| Interest Rates | 6 - 36% |

| Min Deposit | 1000 $ |

| Investment Duration | 12 - 60 Months |

| Secured Lending | Yes |

| Currency | $ |

How to Borrow?

In order to become a borrower on LendingClub users need to have a FICO credit score of at least 660. More than two-thirds of loan requests are denied by LendingClub. The remaining third is reviewed by LendingClub's risk management division.

Lenders & Investing

For lenders, the amount invested into their portfolios cannot exceed 10% of their individual net worth. Loans generally range from three to five years. The loan types on LendingClub vary across all markets where a heavy amount of capital/debt is involved. Including but not limited to: SME's, consumer loans, auto loans, medical loans, student loans. LendingClub is the most established, all encompassing P2P website to exist in the US and arguably the rest of the international market.

In order to be a lender on Lending Club there are requirements users must comply with for regulatory reasons.

- Stated Income Level

- From Approved States

- Stated Net Worth

- 1000 USD deposit for personal accounts

- 5,500 USD deposit for IRA accounts

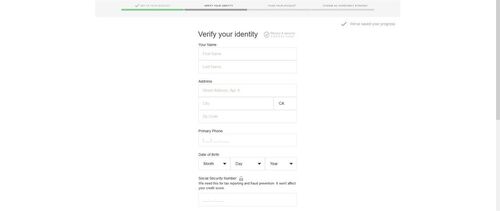

Registration & Withdrawal

Signing up on LendingClub is simple, easy and straight forward. Users need to fill in their name, email and subsequently, address and phone number. After which, users must undergo a common KYC procedure to have their account verified.

As mentioned previously, the minimum deposit is a 1000 USD. It generally takes 1 - 4 business days for the money to show up in your account and 1 - 4 business days for the money to come out upon request.

Marketplace

The marketplace is where lenders come to fund borrowers. Lenders see a table with loans, borrower reliability, credit score, amount requested and interest rate. Lenders can then pick and choose which loans based on LendingClub's criteria are deserving of their funds.

There is some concern regarding LendingClub's marketplace. First and foremost, borrowers on LendingClub are not required to put forth any form of collateral. In the case of a loan defaulting, LendingClub goes straight ahead with their legal team to retrieve missing funds. Which will be furthered discussed in 'Risk and Safety' below.

Their credit checks on borrowers have been criticized as insufficient. On the physical marketplace, lenders on LendingClub are not exposed to personal information of the borrower. The lack of data is discouraging and there is no shortage of customer reviews complaining that LendingClub does not practice proper due diligence on their borrowers.

The US P2P lending space is different from Europe's in many regards. This is one of those ways that it is different. Although users ought to retain their privacy where they can, in this given situation, it seems sub-optimal to not provide investors with important information on who the borrowers are.

Users on LendingClub can only see a borrower's job title, income and location. It is difficult to determine to what extent to which LendingClub will go to verify their users' identity. If money is being lent, names at the very least should be known.

Investment Strategy

The approach to investing on LendingClub is very straight forward. Users can either choose to invest with their automated service or invest manually.

There is a minimum deposit of a 1000 USD. LendingClub suggests investing small increments of 25 USD into 40 different loan requests. The emphasis being that lenders should diversify their capital on LendingClub. This way, if one of the loans, or a few of the loans default, then the remaining loans will make up for the amount lost. It is also recommended to spread out these small increments in loans with higher and lower risks/returns.

Customer Service

LendingClub offers a hotline and email support services at your typical 8 - 5, Monday through Friday.

Wait times are relatively typical, and the support itself is of acceptable quality. They typically take 1 - 2 business days to reply to inquiries and concerns.

LendingClub has an extensive help center. The data sheets are filled with educational materials for users to get up to date with LendingClub and P2P lending as a whole. There is financial literature and informative videos that explore P2P lending, risk aversion and the future of LendingClub. There are even segments on alternative finance finally being acknowledged as an innovative and booming industry.

LendingClub is by far the most documented P2P platform. Studies from various business schools have looked to LendingClub to determine whether or not P2P lending is an appropriate alternative to the traditional banking models that have been in place for so long.

Transparency & Security

Potential lenders on LendingClub's platform should be informed of the following risks LendingClub is exposed to.

- Default Risk - when a loan defaults there is no guarantee that lenders will see even their principal return.

- Inflation Risk - the risk of inflation where a users capital is locked up whilst slowly lowering its value due to economic despair.

- Management Risk - the fees associated on the platform and the general health of LendingClub's employees.

- Marketplace Risk - The risks associated with LendingClub itself going bankrupt. In such a case, a legal team would take over liquidating LendingClub and redistribute the remaining capital. In such an event lenders can expect to see a substantial reduction in their capital and returns.

- Callable Risk - Loans can be paid back early, meaning less or no return in interest.

- Diversification Risk - There is a necessity to diversify your investment on LendingClub, the recommendation is more than 100 "notes", which means 2500 USD in total. This implicitly means there is a pretty high chance of loans defaulting.

- Liquidity Risk - Being able to cash out capital is a serious matter for investors. LendingClub does have a secondary market but it does take some time, not to mention, if there are a hundred 25 USD loans it could be tedious selling them all. In general, an uncomfortable risk to deal with.

- Economy Risk - If there is an economic collapse borrowers are less likely to pay back their debt as they most likely won't have the means. Similar to the default risk but on a larger scale.

- Pricing Risk - The risk associated with LendingClub's ability to properly identify who is a good borrower and who is a bad one.

All risk factors exist in the majority of investment classes. Risk is always prevalent. LendingClub's attempts to inform their users can all be found in their help center where they address in great detail the risks associated on their platform.

The company is regulated by the respective financial authorities in the US. It is one of the very few P2P lending companies publicly listed on the stock exchange. Unfortunately, there are a few problems that portray LendingClub as a lesser P2P platform.

Generally speaking, if a company is on the stock exchange it means it's done quite a few things correctly. The problem is, LendingClub says outright it is not there to protect capital. Every investor is responsible for where his money goes and how much he receives in returns.

No buyback guarantee and no strategy for fund recoveries makes LendingClub difficult to determine as safe. Borrowers are not required to put forth any form of collateral, which is absurd. LendingClub always resorts to legal battles with borrowers meaning that lenders are always at risk of their principal, forget interest entirely.

Litigation means, legal fees, and a lot of time before a court decision is made, and all of this cost comes out of the pockets of the lenders. In finality, making the entire experience of investing in P2P lending both unpleasant and unprofitable.

Extra security appears to be a more European approach to P2P lending, however, it really should be a prerequisite for all P2P lending companies.

Crisis Management

LendingClub has been on the forefront to help their lenders from COVID- 19. Not just their lenders on their platform but the entire state of California.

The first few steps they took was increase spending on their help center to assist users who were struggling due to the pandemic. All borrowers received a 15 grace period from LendingClub and upon request, LendingClub offered to assist borrowers with debt payment restructure.

LendingClub also partnered up with a few other companies who were experts in responsible financing. So that users now have more resources to utilize when strategizing their own plans for coming out of the pandemic as unscathed as possible.

LendingClub was partly responsible for Congress passing the Covid - 19 stimulus package. The P2P lender went further to donate hundreds of masks to hospitals around California and pass more legislation in the state of California to help small business owners with their debt management.

In regards to LendingClubs borrower-lender ecosystem, not much changed. Their numbers have remained more or less stable through the course of Covid.

All in all, LendingClub is the McDonalds of P2P finance. Even through hard times, they remain stable and profitable. Despite all of their problems, they are still a great platform.

Our Readers Have Asked:

Is it safe to invest with LendingClub ?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take, the higher your reward, as well as the chances of losing your investment.

How much money will I make with LendingClub?

LendingClub proclaims that investors on their site make anywhere between 6 - 36 percent in yearly returns.

What are the risks?

Investors on LendingClub can experience a 10 percent default rate on their loan contracts. Which means about a tenth of your overall loan portfolio will go in default. LendingClub has traditionally opted to pursue defaulted loans with litigation which means if you lose money with LendingClub you can expect it be gone for good.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones.

Where is LendingClub located?

370 Convention Way, Redwood City, CA 94063, United States

Watch & (L)earn

Discover more about LendingClub in this short but informative video.

Pros, Cons and the Verdict

Pros

- Established Platform

- Regulated

- Big Marketplace

- Secondary Market

Cons

- High Minimum Investment

- High Fees

- High Default Rate

- Unsecured Loans

LendingClub is a well established platform for P2P lending. It is the oldest platform, regulated, publicly traded with a track record of profitability. Users are by and large satisfied with their experience with LendingClub.

It is unfortunate the level of risk one undertakes when choosing LendingClub. It would be nice to see implementation of some form of guarantee or at the very least a well outlined strategy for fund recoveries. Allowing investors to simply give all of their capital with no collateral is a recipe for disaster.

The minimum deposit is also unreasonably high and nothing on their platform indicates that any loan will pay out above 15% IRR.

LendingClub could be a great part of a diversified portfolio but otherwise we could not recommend LendingClub as a sole platform to utilize.