InRento Reviewed | Europe's First Licensed Buy-to-Let Platform

InRento is Europe's first buy-to-let platform to receive a crowdfunding license. Investors can purchase shares of real-estate properties, collect rental dividends and enjoy long-term capital growth. All projects are carefully assessed by the team, and only first-rank mortgages receive approval. The loans have interest rates around 6% to 7.5%, as these are considered low-risk investments. Rental dividends are distributed monthly, making the platform an excellent source of passive income. The minimum investment is 500 euro, which is a bit high, but understandable given the low-risk and high-value of the properties. InRento also offers a secondary market with transaction fees of 2%.

In this detailed review, P2PIncome's financial experts assess the InRento platform and marketplace, and provide a recommendation.

Types of Loans on InRento

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

InRento Loan Characteristics

Loan duration6 to 120 months

CurrencyEUR

Buybacks No

CollateralYes

Available inEU

Returns rate14.41%

Default RateUndisclosed

Recovery RateUndisclosed

FeesNone

BonusesNone

InRento Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

InRento.com Pros & Cons for Investors

Pros

- Licensed

- First-Rank Mortgages

- Institutional Investors

- Monthly Rental Dividends

- Expert Assistance

- Time-Share

Cons

- 500-euro minimum

- Fewer than 100 properties

Investing with InRento

InRento was designed to facilitate low-risk, mid-yield investment in the real-estate buy-to-let (i.e. rental property) market. Unlike in the US, where rental complexes are a common site, many rental properties in Europe are privately owned. InRento seeks to help owners looking to upgrade and rent out their properties. The properties are all first rank, meaning the owner has excellent creditworthiness and the property has been inspected and found highly marketable.

For these reasons, the platform's interest rates are relatively low, but the rental dividends boost the investors' total profits. Because the site only lists top-rated properties, you won't find as many properties as you would on ReInvest24 or EstateGuru. On the other hand, if you're looking to add a low-risk option to your portfolio, this is the site to choose.

Types of Investments

InRento focuses exclusively on first-rate buy-to-let properties, meaning the owners have purchased the properties (i.e. "buy") to rent out (i.e. "to let"), so they can collect ongoing rental income. Many of the properties have long-term contracts (as much as 10 years), and investors, who are now actually property owners, enjoy ongoing dividends throughout the duration of the contract. If the property is sold off, the investor-owners receive a proportionate share of the capital-growth split (i.e. profits). For example, investors in a modern-office complex in Lithuania earned 20.32% returns when the property was sold.

Because InRento focuses on such a specific market, the number of listings on the platform is relatively low, and investors are encouraged to invest larger sums (500-euro minimum) than on other peer-to-peer lending platforms. As an added perk, investors sometimes have the opportunity to vacation at the properties in which they've invested, an options known as time share.

Investment Customization Tool

InRento does not have an auto-invest tool, but there are plans in the works to create one. In early 2022, InRento merged with EvoEstate, and users from the latter platform can still use the EvoEstate auto-invest tool with their new InRento accounts, but it's not clear whether or when the option will be globalized.

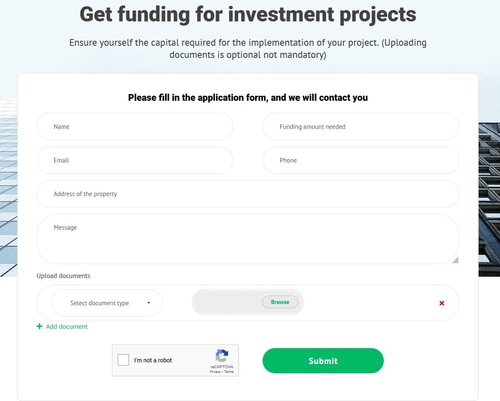

Borrower Data Verification

InRento conducts rigorous due-diligence, approving only the most attractive investment opportunities. According to InRento's terms & conditions, anyone seeking to fund a project must first open an account with the platform, confirm their identity, legal status, and age, and provide all the information required to satisfy the EU's anti-money-laundering regulations and anti-terrorism procedures. Next, the potential borrower must satisfy the platform's Project Owner Reliability Assessment Procedure, in addition to any other requests made by InRento. Those who fail to satisfy these inspections will not be allowed to submit projects for crowdfunding.

Furthermore, InRento meticulously inspects the properties submitted for investment, as well as the borrower's credit history. Borrowers are asked to provide paperwork related to the project, such as proof of ownership, as well as paperwork related to their credit status, such as other outstanding loans. InRento only approves loans for top-rated borrowers and projects, ensuring low-risk investments for its users.

InRento Rates and Returns

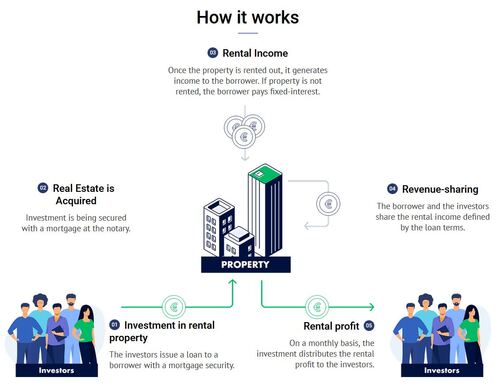

InRento advertises returns of 8%, which is the combined return from interest collected on the loan, rental dividends from the rent paid to the property, and the capital gains resulting from the sale of a property. To understand how all this works, we need to look at how InRento arranges loan agreements:

Loan Structure

After InRento's staff complete the KYC and due-diligence processes, the borrower enters into a complex agreement with InRento. The actual loan agreement is a mortgage-secured loan with a combination of fixed and variable interest rates. Assuming the property remains empty, the borrower must pay the fixed interest rate for an agreed-upon duration. Thereafter, the interest rate increases, to offset the lack of rental income the investors should be receiving, with the marginal interest rate increasing by 2.5 to 4 times the original rate. To be sure, no borrower wants to face that, so the arrangement helps motivate them to fill up the property.

Rental Dividends

As the property fills up and begins collecting rent, investors receive a portion of the rental income commensurate with their share of the project. InRento aims for an 80/20 split with the project owner, where 80% of the rental income goes to the platform and its investors (10% to InRento and 70% to the investors), while the borrower keeps the other 20%.

For example, if as property has 25 units, each collecting 2000 euro per month (a total of 50,000 euro per month), InRento will receive 40,000 euro, and the borrower will keep the other 10,000. Of the 40,000 collected by InRento, the platform keeps 5000, while you (the lender) keep the other 35,000. Assuming the original listing was 200,000 euro, and you invested 1000 euro (0.2%), you should receive a 0.2% dividend payment (70 euro) every month. That means you'll recoup your principle in 14 months just from the rental dividends.

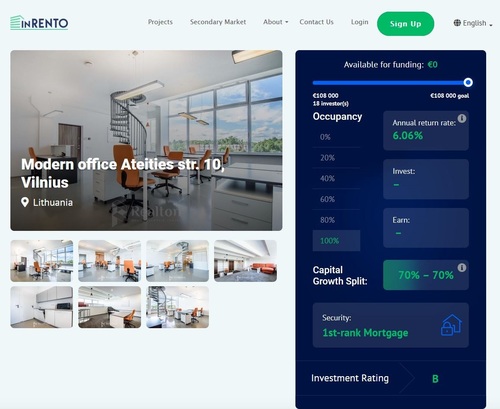

Capital Gains

When a property is sold for profit, investors receive a proportionate share of the capital gains. For example, in February of 2022, InRento announced the profitable sale of an office building in Lithuania. The building, which had been funded by InRento investors at a total of 108,00 euro, was sold for 130,000—a capital gain of 22,000 euro, or 14.29%. The 22,000-euro profit was split 70/10/20 between investors, InRento, and the borrower respectively. That means an investor who put in 1080 euro would receive 1540 euro. Prior to the sale, however, the property had already yielded 6.06% returns in rental dividends, for an impressive total return of 20.32%.

Who is InRento?

InRento was founded in 2020, by Gustas Germanavičius and Audrius Višniauskas, who had founded EvoEstate just two years prior. On the site, Germanavičius explains that as they worked to build EvoEstate, they discovered "a lack of lower-risk real estate crowdfunding opportunities." Based on their personal belief that "buy-to-let crowdfunding or rental properties offer a great risk-reward ratio," they founded InRento, "to provide people carefully sourced buy-to-let investment opportunities across Europe." In early 2022, Višniauskas posted an announcement explaining that announced that EvoEstate would merge with InRento, with an estimated timeline of 24 months to complete the merger.

Lender/Borrower Ecosystem

InRento started out in Lithuania, and has since expended to Spain. Their emphasis on low-risk buy-to-let properties makes InRento something of a niche platform, yet they were able to draw well-over 10,000 investors in their first 2 years, funding nearly 15 million euro in projects in just those two countries. According to InRento's statistics, there are usually around 65 investors per project, with the average project running around 225,000 euro. That means the average investment is approximately 3500 euro.

General Data

| General | Data |

| Origin | Lithuania |

| Founded | 2020 |

| Offices | A. Vivulskio g. 7, LT-03220 Vilnius, Lithuania |

| Loan Type | Real-Estate |

| Sign Up Bonus | No |

| Fees | No |

| Interest Rates | 6% - 7.25% |

| Internal Rate of Return (IRR) | 8% |

| Min Deposit | € 500 |

| Investment Duration | 12 to 120 months |

| Secured Lending | Yes |

| Currency | Euro (€) |

Registration & Withdrawal

The registration process on InRento isn't very complicated. Simply go to the homepage and select the Sign Up button. This will take you to the registration page, where you will fill out an online form that includes Email, Mobile Number, Name, Surname, Password (for you to create), Repeat Password, and a dropdown menu labeled Where do you pay your taxes?, which lists all of the relevant countries. After filling in the information you'll need to consent to the data-usage agreement, the Terms & Conditions, and prove you're not a robot.

InRento will use your phone number to validate your identity, and then you will begin the Know Your Customer (KYC) process. You'll need to provide proof of legality (18 or older), of residency, and open an account with Paysera or MangoPay, which you will use for all deposits and withdrawals. Once everything has been approved, you can deposit money and start investing.

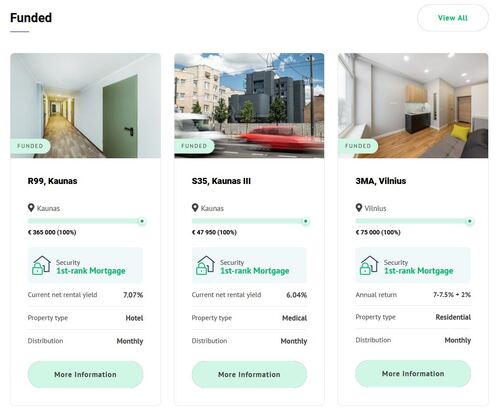

Marketplace

The InRento marketplace lists a few dozen properties at a time, providing a detailed assessment of each project. The prospectus includes pictures of the site, the amount of money needed, the amount currently Available for funding, and investment details such as the Annual return rate, the current Occupancy, the Capital Growth Split, the Security ranking of the mortgage, and the project's Investment Rating.

Below the main section you'll find a Description with details about the project, including its location, the interest rates, the proposed rental prices for the units in the property, the anticipated returns for investors, and term of the loan (anywhere from 12 to 120 months). There is even a short list of bullet points in the description titled Reasons to invest in the project. Alongside the Description page is the Project Updates page, where investors can track the progress of the project.

Risks Involved

In truth, investing with InRento generates very little risk. The borrowers have proven creditworthiness of the highest standard, the projects have been carefully inspected, and the contracts tend to favor the investors. To be sure, things can happen that delay a project or prevent the project from succeeding, but because the loans are backed up by actual real-estate, their is tangible collateral for InRento to collect.

Transparency & Security

As a regulated and licensed platform, InRento must comply with EU regulations regarding transparency and cybersecurity, including the General Data Protection Regulation (EU GDPR). Personal data must be carefully protected, and the site must have security features in place, such as encryption coding, SSL certification, offsite servers, and so on. InRento posts quarterly and annual reports to their blog page, with data such as the number of properties currently active, the average investment per user, and the total rental-dividend distribution.

Crisis Management

InRento was established just as the Covid-19 pandemic was preparing to ravage the market. If InRento's management of that crisis is any indication of their abilities, the platform should do extremely well. Through aggressive fundraising and by establishing relationships with institutional investors, InRento was able to maintain its facilities, grow its clientele, and protect its assets.

Our Readers Have Asked:

Is it safe to invest with InRento?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, InRento is a relatively low-risk platform for two reasons. First, whenever a loan is backed by collateral, in this case real-estate, there is greater security as the property can be seized in lieu of payment. Second, the InRento team assesses the property and the borrower to determine creditworthiness. Only the very best candidates are approved.

What minimum credit score needed to get a loan from InRento?

In Europe, credit ratings are listed on an A-through-D scoring system, rather than the American numeric system. All listings on InRento have an A rating, as the goal of the site is low-risk buy-to-let investment.

Which credit bureau does InRento use?

Credit bureaus are an integral part of the American financial system, which is why many people are surprised to learn they aren't used in Europe. That's not to say there are no credit-assessment agencies or protocols in Europe. Rather, the process by which credit and borrower worthiness are assessed in Europe is based more on bank history, with a lot of weight given to the borrower's monthly income and current debt.

How to become an investor at InRento?

All you need to do to invest on InRento is sign up, open an account, deposit funds, and start investing.

How much money will I make?

InRento reports an IRR of 8%, which means that over the long term you should expect to make approximately 8% profit per year. To be sure, there will be ups and down; the growth will not be linear, but as you zoom out over many months and years, that rate should prove itself reliable.

What are the risks?

InRento was designed to be a low-risk venture, and compared to other platforms users face minimal exposure. Nevertheless, there are always risks involved, and InRento lists them in their Risk Disclaimer. The list includes things like market changes that devalue the project, natural disasters that destroy the property, changes to the political climate (particularly war) and to the laws of that country, and of course the possibility of the borrower defaulting. Nevertheless, since these loans are collateralized with real-estate, there are always actionable collections opportunities.

Why do I need to submit ID verification?

The goal of the "know your customer" (KYC) process is to prevent fraud. Peer-to-peer lending platforms request personal information so they can be sure they are dealing with a real person, and that they have that person's permission to proceed with a loan or investment. Platforms can't risk lending tens of thousands of euro to a fake profile, and you certainly don't want someone borrowing or investing money in your name without your permission. By requesting photo ID, bank details, credit histories, and other relevant information, everyone can feel certain the process is legitimate.

Furthermore, InRento is a regulated entity that must adhere to the laws of its jurisdiction. The EU has banking regulations, income-tax regulations, embargoes on certain countries, and other laws related to the financial market. All of the above are mitigated by careful KYC processes.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is InRento Located?

InRento's physical address is A. Vivulskio g. 7, LT-03220 Vilnius, Lithuania

Verdict

Buy-to-let purchases provide an excellent form of passive income, and the collateralized loan is safer than most p2p options. InRento does an excellent job of investigating the properties it lists, and the borrowers listing them. The site is run by a highly experienced team with a successful p2p history, and the low-risk nature of the investments makes InRento a good site to add to any portfolio.