These European P2P-Lending Platforms Have the Best Mobile Apps

Most peer-to-peer investors work outside of the lending industry. These aren't professional investors with the time to sit in an office analyzing the market. These are baristas, attorneys, line cooks, school teachers, and doctors. They don't necessarily carry their laptop with them everywhere they go, and like most people, they utilize their mobile device for most online activities. So it comes as no surprise that the p2p platforms have developed mobile apps that allow users to make portfolio decisions "on the go."

P2PIncome's tech experts have taken the time to look over the mobile apps available in the European p2p market, and we report back on the 4 platforms with the best apps: Mintos, Swaper, and PeerBerry. Which app has the best user interface? Which app has the most features? What if you need an app in a language other than English? Our team has put together a detailed analysis with answers to those questions and more.

PeerBerry

In 2017, Aventus Group, a loan originator based in Lithuania, decided to start its own P2P platform, called PeerBerry. The platform enjoyed immediate success, and continued to thrive even throughout the Covid pandemic. CEO Arūnas Lekavičius proudly announced that the challenges they faced during the pandemic "helped us to show and to prove who we are [...] Our investors see us as one of the most reliable and transparent alternative investment platforms in Europe." Having paid out EUR 11.5 million in interest to its 50,000 active investors, PeerBerry has established itself as a force to be reckoned with.

In March of 2021, PeerBerry posted an announcement on its website inviting users to try out their new mobile app. According to the announcement, "Seeking to offer our investors a more convenient way to invest and to track personal investment statistics, we have developed a mobile application that offers full functionality of PeerBerry services." Unlike some apps, which provide only a glimpse of one's portfolio, push notifications, and a few features, the PeerBerry app was designed such that "investors will be able to perform all the same functions that they can perform in the desktop version."

Aesthetics and User Interface

The PeerBerry app is very reminiscent of the website in terms of its color scheme. The mint-green Start Investing button appears in the first frame of the Overview page, just as it does at the top of the site. The result is an immediate sense of familiarity. The rest of the Overview page includes your Net Annusalised Return, some suggested reading materials, such as Protection of Investments and Greener Planet, your Profit Status, which you can view in several formats, and finally a graph reporting the status of your current investments.

The app supports English, German, and Spanish, and PeerBerry reports other languages are on the way. They also plan to add a Dark Mode.

Features and Security

Using the PeerBerry app, you'll be able to do everything you would on the website. The Start Investing button takes you to the Investments page, where you can peruse loans currently for sale, as well as your current loans and even loans that have already finished. You can also filter the list to isolate precisely the kinds of loans you wish to purchase.

The app allows you to deposit and withdraw money on the Money page, which also lists your current payment details.

Other features include...

- Push Notifications - You can activate or deactivate Daily Profit, Weekly Profit, Monthly Profit, Transactions, and New and Announcement

- Auto-Invest - You can adjust your auto-invest settings and activate the tool directly from the app

- Details - A comprehensive description of the loan, including the total Amount, Interest Rate, Remaining Principle, and Remaining Loan Term

In terms of security, PeerBerry has taken a few important measures not found on the other apps in this review. For example, rather than having to log in each time, there app requires you log in once using your user name and password, and then enter the app using either a four-digit PIN or biometric options such as fingerprint and facial recognition. This avoids the hassle of entering a long alpha-numeric password each time. On the other hand, you can elect to log out each time you leave the app. The app also locks you out the moment you switch out of the app, and any time you're inactive for more than 30 seconds.

Mintos

Mintos is among the very best peer-to-peer platforms on the market, particularly for small portfolio investors. Established in 2015, the Latvian company started out quite poorly, suffering two years of zero growth; but in 2018 the young platform enjoyed an astonishing surge that propelled it to the top of the P2P market. Mintos has a large stable of loan originators covering several markets: mortgages, business loans, personal loans, and invoice financing. The platform is available in over 90 countries and various currencies, and its sophisticated auto-invest tool helps investors generate passive income at the touch of a button.

Recognizing the need "to provide investors with faster and easier access to their accounts," Mintos invited approximately 4000 of its investors to participate in a series of mind-hive discussions, brainstorming sessions, and subsequent beta tests of its mobile app. "We were pleasantly surprised at how active Mintos investors were in their willingness to participate in testing the app and providing extensive feedback," said Marcis Gogis, Head of Product for Mintos. Mintos co-founder Martins Sulte remarked that, "[i]n the future, we believe our mobile application might be the primary access for using our services."

The app was launched in early 2020, and has since been updated around once a month to include features like Investment Strategies, Push Notification, and even an educational section titled "How Mintos Works." In terms of compatibility, Senior Product Owner Petris Studens explains that "[Mintos has] the same function set for iOS and Android, and we try to make the deployments and deliver new app versions in the same time, for both apps."

Aesthetics and User Interface

According to Studens, Mintos developers "spent quite a lot of time, and by meaning 'a lot' I mean really really a lot of time" on the design concept for the app. Studens believes "a product needs to solve user's real problems while offering an extraordinary, smoother experience." The result was a sleek, modern user interface that feels very intuitive, even on first use.

The backgrounds can be set to a bright Light Mode that gets a bit tiring to the eyes after extended use, as well as a far more pleasant Dark Mode. The graphics are clear and easy to understand, though we would say the app makes excessive use of toroid charts. However, the charts are color coded and easy enough to interpret, particularly in Dark Mode, and the same can be said for graphics in general.

In terms of languages, the app currently supports English, German, Spanish, Dutch, Russian, Polish, Czech, and of course Latvian.

Features and Security

To their credit, the Mintos development team not only invested a lot of thought into which features an investor needs from a mobile app, they also listened to their users and incorporated user input into the design. There are dozens of informative features you can scroll through, starting with a portfolio overview and continuing to more detailed pages. The overview tells you how much money you have on the platform, and then breaks it down by Available, Invested, and Pending Payments. You can also see your returns (i.e. profit), under My Returns.

Other features include...

- Avg Remaining Term - a list of your investments by the amount of time remaining on the loan

- Avg. Interest Rate - a list of the interest rates you're earning, by Amount (per loan) or by Count (meaning, the number of investments earning a particular rate)

- Lending Companies - a list of the loan originators from which your investments stem

- Countries - a list of the countries from which your investments originate

- Withdraw Money - withdraw from the app directly to your bank account

The one glaring oversight in terms of features is that you can't actually invest via the app, though Mintos has promised it will eventually update the app to facilitate investment.

In terms of security, the Mintos app offers several login options, including an email/password login, a four-digit PIN, and biometric options such as fingerprint and facial recognition. The app automatically locks you out the moment you switch to a different app, so you'll have to reenter your PIN to go back in.

Swaper

Swaper was founded in 2016 to serve as the peer-to-peer platform for Latvia-based Wandoo Finance Group. Ownership of Swaper has since changed hands, but Wandoo still serves as Swaper's exclusive loan originator. The current owner and Head of Operations, Marina Tjulinova has been described as "the guru of all financial and legal matters." Swaper's initial performance was unimpressive, to say the least, and near the end of 2020, they brought in a new CEO, Indrek Puolokaine, "to grow the platform by listing more loan originators." Though Swaper has yet to add more originators, its overall performance has improved somewhat.

Swaper's mobile app has actually been around since the company was founded, and the platform takes pride in having been "the first P2P Marketplace" with a mobile app. The app has undergone numerous updates since it's launch, and the current iteration offers most of the functionality of the web page. There is no cost to download the app, and there are version for both iOS and Android. Using the app, investors can track their investments, create auto-invest portfolios, view push notifications, and more.

Aesthetics and User Interface

Swaper's designers elected to go with a theme that invokes the brand's cherry-red logo. While the branding is understandable, the bright red-and-white theme is rather stark. Admittedly one doesn't usually use the app for more than a few minutes at a time, but a slightly toned-down color scale really is in order. The app's Dark Mode, on the other hand, goes to the other extreme: It's simply too dark, and the absence of any coloration makes it slightly difficult to read.

In terms of languages, the app currently supports English.

Features and Security

The Swaper app offers most of the features available on the website, and should suffice for most people's day-to-day needs. The Overview page provides a lot of information at a glance: Account Balance, Interest to Date (i.e. the amount of money you've profited), Return XIRR (the Internal Rate of Return), and other financial stats. You can also access your Auto-Invest Portfolio where you can view and adjust your settings, and active or deactivate the auto-invest tool. There is even an Easy setting for novice investors. On the Investments page you'll find a listing of your Bought Loans, Interest Received, and other information related to your investment history.

Other features include...

- Profile - a list of tabs to access Personal Information, App Settings, FAQ, and Notification Settings

- Withdrawal - allows users to transfer money from their Swaper account to their linked bank account

- Push Notifications - notifications regarding current investments

The one oversight that must be corrected is the absence of charts and graphs. Not everyone responds well to listed information, and the lack of graphs gives the app a somewhat pedestrian feel, despite it having all the necessary features and functionalities.

In terms of security, the Swaper app requires a use-name and password, and allows for PIN and biometric entry once logged on.

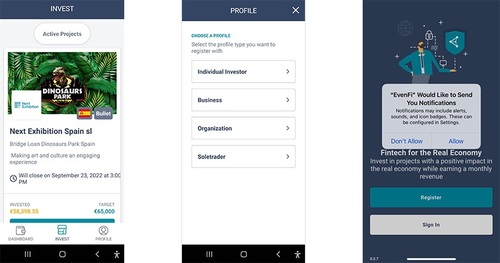

EvenFi

EvenFi is an Italian company founded in 2018. The founders considered it their mission "to create a new financial future: simpler, free and decentralised." To that end, the company originates its crowdfunding opportunities, for which businesses can apply via the site. Once a project has been approved, it's posted on the EvenFi marketplace, where investors can purchase shares, starting at 20 euro. The maximum investment is different for each project, with a 50,000-euro project usually being capped at 3000 euro. Each project also has a Minimum Target that must be met by a certain deadline or the project is cancelled.

Aesthetics and User Interface

The EvenFi app is available for iOS and Android. The user interface has a dark blue background, similar to the company's logo, while the main body of the app is white, and various shades of blue. The result is an easy-to-read interface. The marketplace also utilizes an orange shade to indicate invested amounts, and but the contrast isn't harsh at all. The app doesn't have a Dark Mode available, but likely doesn't need one, given the successful color scheme. The simple font is also easy to read, and overall, the app looks good.

The app supports English, Italian, and Spanish. However, on occasion, when changing between languages, portions of the app retain the previous language settings, which creates a confusing interface.

Features and Security

The app is divided into Dashboard, Invest, and Profile. The Dashboard opens the My Account page, where you can view your current Account Balance, including how much is currently Invested, how much is Available for withdrawal, and how much is Pending. You can also Withdraw or Deposit, and you can view your Recent Activities, and in the My Investments section you can view any projects in which you are currently invested.

The Invest section takes you to the EvenFi marketplace, where you can view all the projects, including those that have already closed. Each project listing includes all of the information necessary to make an informed investment: the name of the company, the location of the project (in the form of a flag), the type of loan (bullet, amortising, bridge, or other), when the project closes, the amount sought, the APR and Duration of the loan, and how many EvenFi Investors have entered the project. If you open the project listing, you'll find additional details, including the Minimum Target, Investment Min/Max, etc. You'll also be able to use the investment calculator to Simulate an investment.

The Profile section indicates the name and email of the user, and offers a link to the platform's Terms and Conditions. It also allows the user to change the language setting, and indicates the current App Version.

The EvenFi app was designed as a stand-alone. Unlike some mobile apps, it offers all of the functionality of the website, which means you really can conduct all of your investment activities "on-the-go."

Other features include...

- Push Notifications - the iOS version offers various push notifications regarding your account, and any new investments available. It's not clear whether or when the same will be offered for the Android version.

In terms of security, EvenFi's app is automatically set up for two-step authentication. That means you'll have to enter a password, and then enter a special code sent to your email account. The code times out after only 90 seconds, so you need to act fast. This is an excellent security measure, but it's a touch annoying. The other option is to use the biometric option: fingerprint and facial recognition. While that's only a one-step authentication, it's highly secure.

One security features we'd like to see added is an auto-shut-down due to inactivity. It's not reasonable that the app remains open when the phone is open, leaving your entire account vulnerable to manipulation.

Best Aesthetics

If we're to judge an app exclusively on its appearance, the Mintos app takes top honors. The carefully crafted design looks more like a professional PowerPoint presentation than than an app. The charts and graphs are very easy to read, and the various colors add some pop to the overall look.

Best for Functionality

A good-looking app is one thing, but it's the functionality of the app that really matters, and PeerBerry is certainly best in that regard. PeerBerry's app is on par with the desktop version site in terms of options and features. For example, you can make an actual investment using the PeerBerry app, unlike on the Mintos app. You can view various charts and graphs, unlike on the Swaper app. Lastly, it is the most familiar in terms of its overall appearance, so there's no learning curve. You feel right at home the moment you enter the app. While the EvenFi app also allows you to invest, it has some technical design flaws that place it below PeerBerry in terms of functionality.

Most Secure

All four of these apps are secure, both in terms of entry and in terms of data. The PeerBerry app has the added feature of locking the app due to inactivity, which is a nice plus.

Our Recommended European P2P Investment Platforms with Great Mobile Apps

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Verdict

Mobile apps add a level of convenience that many investors need, given today's fast-paced way of life. Each of the aforementioned apps allows you access at the touch of a button, but the PeerBerry app edges out the competition due to its superior functionality. To be sure, you'll need to open a PeerBerry account, but you were planning to do that anyway, weren't you?