How Our Portfolio Performed In Q2 of 2022

Please read P2PIncome's most recent investment-portfolio report for 2025.

Adjusting to Quarterly Reports

P2PIncome first opened its sample portfolio in late 2020, in order to provide our readers some hands-on insight into the world of peer-to-peer investment. For the first year and half we provided monthly reports on the status of our investments. We updated our readers on the growth of the portfolio, discussed exciting loan opportunities as well as problematic occurrences, and made predictions and suggestions regarding the peer-to-peer lending market.

Having covered the first 18 months, however, we've decided it's time to reduce the frequency to quarterly reports and devote the rest of our attention to detailed reviews and compelling articles about the ever-changing world of p2p.

Quarterly Report: 2022-Q2

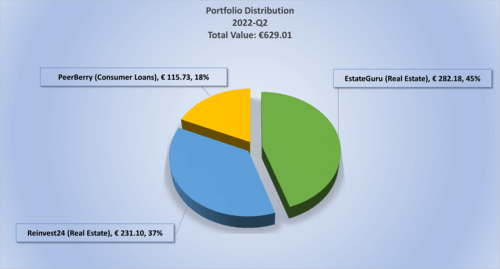

The P2PIncome portfolio is currently comprised of three sites: EstateGuru, Reinvest24, both of which are real-estate platforms, and PeerBerry, which specializes in consumer loans. This distribution strategy is based on the fact that real estate tends to draw greater revenues, but often ties up one's money for long periods, while consumer loans are riskier, but often quicker, thereby providing greater liquidity. As we continue to add platforms to the portfolio, we will diversify further by adding other types of loans to our portfolio.

Facts and Figures: 2022-Q2

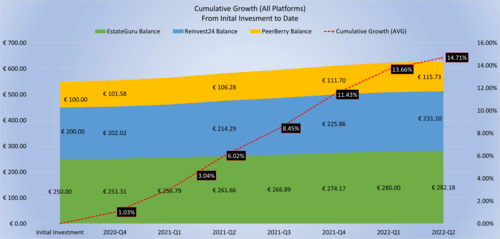

We entered Q2 with a portfolio balance of €623.51, from an initial investment of €550 in late 2020.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| Q1 | €280.00 | €229.04 | €114.47 |

| Q2 | €282.18 | €231.10 | €115.73 |

| Profit (€) | 2.18 | 2.06 | 1.26 |

| Growth (%) | 0.77 | 0.89 | 1.09 |

In late 2020, P2PIncome opened accounts at EstateGuru (250 euro), Reinvest24 (200 euro), and PeerBerry (100 euro). Over the course of the past 18 months (2020-Q3 to 2022-Q2) our portfolio has grown by 14.72% in aggregate. Much of the growth was fueled by the rental dividends and capital gains, in accordance with our general strategy. This, of course, is in addition to the expected rate of growth for the lending market. A growth of 14.71% in 18 months translates into an estimated annualized return of approximately 9.8%, which is really quite good.

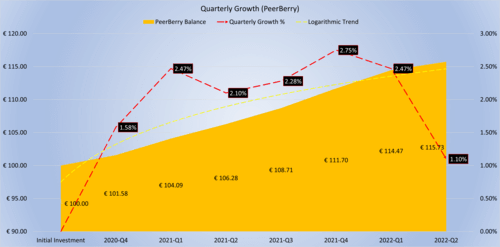

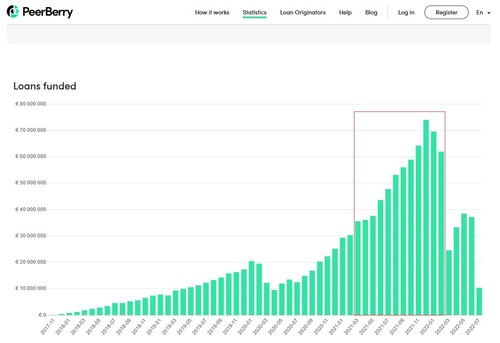

PeerBerry

PeerBerry is another site about which one can always feel confident. Boasting a "double" buy-back guarantee, meaning a 100% buy-back guarantee from the loan originator, as well as an Aventus/Gofingo Group guarantee in case the loan originator is unable to realize its obligation. All information related to these guarantees is available on the PeerBerry website. While interviewing PeerBerry CEO Arūnas Lekavičius, he explained that, "over more than 4 years of PeerBerry operation, the buyback guarantee has been 100% respected, and the group guarantee has never been needed to be applied."

Our experience with PeerBerry has been excellent. We invested 100 euro (the site minimum) in 2020-Q3, and in the 18 months since our initial investment that total has grown to 115.73 euro. That's a net annualized return of 10.5%, which is impressive for consumer lending. In addition, we were very impressed with PeerBerry's handling of the crisis in Ukraine. They immediately contacted their investors, reported on their plans, and followed up with regular reports. This attention to the concerns of their users is one of the features that makes PeerBerry a world-class site.

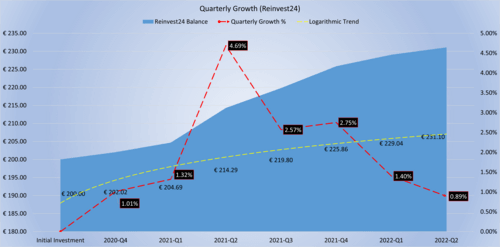

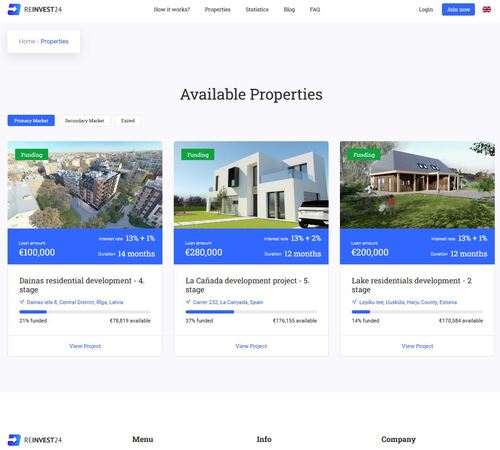

Reinvest24

We have only positive things to say about Reinvest24 as a platform, and that's been the case for quite a while. Reinvest24 consistently ranks at or near the top of our p2p platform review list, alongside PeerBerry and Mintos. Our initial investment of 200 euro has grown to 231.10 euro, a total growth of 15.55% in around 18 months. That's a net annualized return of 10.36%, which is excellent. Like EstateGuru, Reinvest24 is a real-estate crowdfunding platform on which lenders can earn money by collecting from interest, as well as rent. When a property is sold, investors enjoy the capital gains.

Every property listed on Reinvest24 has a detailed prospectus one can study, including photographs, building plans, and advertising strategies. A serious investor will find all the data required to make in informed decision. Unfortunately, in recent months the number of properties offered on Reinvest24's primary market has dwindled. At the beginning of 2022-Q3, there were only 3 new listings, and that is a source of concern. Has Reinvest24 lost too much business due to the war? Has their market been exhausted? To be sure, the market is slowing, but we remain optimistic regarding this top-tier platform.

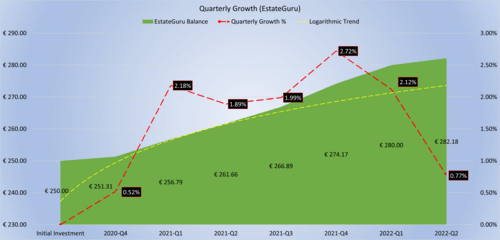

EstateGuru

We elected to place the majority of our funds into real-estate, because of the opportunity to earn rental dividends and capital gains, and we continue to believe that is a winning strategy. EstateGuru is a site with a lot of promise, and to a certain extent our optimism about the platform has paid off. We've gained 32 euro from our original 250-euro investment, for a cumulative growth of approximately 11%, and a net annualized return of 7.33%. That's a perfectly acceptable number, and were that the entire story we'd be thrilled.

Unfortunately, EstateGuru's approach to late-payments left us a bit flustered at times. We watched as one borrower re-upped the payment schedule several times, leaving us wonder when, if ever, the loan would be repaid. We considered dumping the notes on the secondary market, but decided to wait it out in order to see how EstateGuru handled such issues and report back to our readers. In the end it all worked out: The loan was repaid in full and the matter closed. We wonder, however, whether this approach is likely to succeed against larger sample sets. Still, as of today we've profited from our investments on EstateGuru, and that's what matters most.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Events that Influenced Financial Markets During Q2

Considering how tumultuous the past 18 months have been, we feel it's important to take a step back and review the events that have influenced the recent state of peer-to-peer lending and crowdfunding. After all, how many times in history does a global pandemic shut down the entire planet? And how many times is it immediately followed by a land war in Eastern Europe?

Covid19

The Covid19 pandemic wreaked havoc on much of the world, psychically, emotionally, and financially. As entire countries shut down, business owners were left wondering how they would survive for several without any revenue. To be sure, online retailers such as Amazon and Ebay thrived, due to the unprecedented need for home delivery. Similarly, GrubHub, Uber Eats, and DoorDash became household names. Wherever they were allowed to remain open, liquor stores benefited from the pandemic, as did most medical supply stores selling masks, testing kits, hand sanitizer, and protective gear.

Other small businesses, however, struggled to stay above water, and many failed. In their desperation to find working capital, small companies and private individuals turned to the peer-to-peer lending market, giving the industry a temporary boost. For example, PeerBerry, which focuses on consumer loans, saw a marked increase in loans funded in the period between March of 2021 and March 2022.

Russia Invades Ukraine

As though a pandemic weren't enough, Vladimir Putin instigated a war in Eurasia by invading Ukraine. That war rages on even now. Several months ago, we attempted to gauge the likely consequences of the Russo-Ukrainian War, but many twists and turns along the way have led to surprising results. The ruble has gotten stronger, despite an early downturn brought on by sanctions. In addition, a war that seemed likely to end in weeks continues, with no clear end in sight.

To their credit, several peer-to-peer platforms responded quickly to the conflict, either by freezing all activities in the area, or by ensuring reserves were in place to cover potential defaults. PeerBerry again led the charge, sending out a detailed email immediately, and following up with important updates on their blog. This seems to have increased consumer confidence, as evidenced by PeerBerry's continued growth, which outpaced its pre-Covid trends. On the other hand, EstateGuru and Reinvest24 currently list far fewer properties on their primary market than in past years. Entering into Q3, Reinvest24 lists only 3 properties on its marketplace.

Verdict

PeerBerry in not only a world-class site, but they are currently leading the way with regard to crisis management. Despite a large portion of their loans having been in Russia and Ukraine, they have managed to avoid any problems. In fact, as the beginning of 2022-Q3, their marketplace is quite full. Many of the listings are for amounts over 10,000 euro, though you only need to invest 100 euro on PeerBerry. We stand by all three platforms, but if you have to choose just one during 2022-Q3, go with PeerBerry.