Our P2P Lending Portfolio Yielded 9.8% in 2022

Please read P2PIncome's most recent investment-portfolio report for 2026.

In this end-of-year report for 2022, P2PIncome's financial experts summarize the performance of our investment portfolio. We discuss how each of the platforms in the portfolio contributed to overall growth, and determine which platform was "Best in Class" for the year.

By way of introduction, we opened this investment portfolio in late 2020, investing €550 across three platforms: EstateGuru (€250), Reinvest24 (€200), and PeerBerry (€100). This portfolio-diversification strategy was based on the fact that real-estate investments such as those offered on EstateGuru and Reinvest24, tend to yield greater profits; while consumer loans such as those offered on PeerBerry provide liquidity, as well as the potential for excellent yields relative to risks. The results speak for themselves.

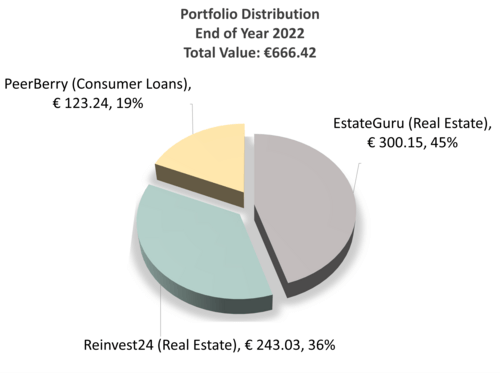

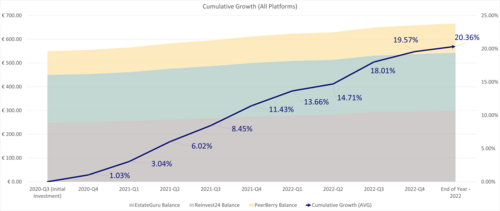

Our annualized return for the year was slightly over 9.8%, which is excellent by any standards, let alone for a year as tumultuous as 2022. By end of year, the portfolio has reached €666.42, which amounts to a total growth of over 20% since our initial deposit of €550. Out of the 17 investments in our portfolio this year, only one went into default—a bridge loan on EstateGuru—but the platform's management continues to work behind the scenes to collect payment. All the other investments performed as expected, bolstering our confidence in the diversification model.

Annual Report: 2022 in Review

We selected each of the 3 platforms on the P2PIncome investment portfolio based on specific strengths, beginning with PeerBerry, due to it's excellent consumer-loan marketplace. We have confidence in the platform's 5-year average returns of 10.5% on loans originated from a long list of top-tier originators throughout Europe, Asia, and Africa. The investments range from 4 months to 5 years, meaning you have a wide range of options in terms of liquidity, and because the minimum investment is only €10, you can spread your capital across numerous listings.

We selected Reinvest24 because its real-estate listings offer profits from rental dividends and capital gains in addition to those garnered from interest payments. This means you'll make more money per euro invested, including long-term passive gains. The detailed marketplace provides all of the information you could possibly need to make the right decisions.

EstateGuru, is also a real-estate site, but differs from Reinvest24. EstateGuru is a larger and riskier site than Reinvest24. According to Reinvest24's statistics page, no project on the platform has ever entered default. EstateGuru, on the other hand, has currently has around 300 project in default (as of this writing). To be fair, EstateGuru lists over 5000 projects, meaning the default rate is consistent with the 5% to 7% worldwide average. But the point remains that investing on EstateGuru entails greater risk than investing on Reinvest24.

Facts and Figures

By the end of 2021, our investment portfolio stood at €606.90, from an initial investment of €550, 15 months prior. By the end of 2022, it had reached an impressive €666.42—an adjusted, annualized return of 9.8% across 3 platforms. EstateGuru had the largest real-money increase, €27.59, while the largest growth percentage went to PeerBerry, which grew by 11.93%. We invested in over 20 listings throughout the year, of which only two entered late-payment, with one eventually entering default. Considering the overall default rate for peer-to-peer lending is around 5%, these results are very promising.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| 2021 - EoY | €272.56 | €224.24 | €110.10 |

| 2022 - EoY | €300.15 | €243.03 | €123.24 |

| Profit (€) | €27.59 | €18.79 | €13.14 |

| Growth (%) | 10.12% | 8.38% | 11.93% |

The goal of investing in p2p lending is to make your money work for you. Unlike a job, where you work for the money, passive income is a way to sit back and watch as money turns into more money. That's obviously an oversimplification, but it's important to strip this idea down to its most basic concept: money plus interest plus time equals more money. In our example, we took €550, and 27 months later, we had approximately €666.50. In terms of labor, we did very little to earn that money. We simply selected promising loans on 3 peer-to-peer lending platforms. It's the sort of the thing you can do over your morning coffee. With today's mobile p2p lending apps, you can even do it on the go.

The reason that's so important is that you can only work so many hours per day. Even if you're paid a very good salary, your earning-from-labor potential is limited by your humanity. For how many years can you realistically expect to work 60-hour weeks? On the other hand, you can invest in dozens and even hundreds of listings. This means that even while you're asleep, your investments are working.

After all, that's the way compound interest works: It earns money continuously until someone pulls the plug. Add to that the rental dividends you collect every month, and the potential capital gains if the project is sold, and now you're money is working for you. The best part is that you don't need to manage the rental property, and you don't need to be a real-estate agent. Someone else is taking care of that. All you need to do is risk some capital, and long-term you will earn between 7% and 12%, per year. To be sure, a 20% increase of a small sum remains a small sum, but what if you invested €10,000? That's an easy €2000 euro, and that's not a trivial amount of money for most people.

PeerBerry

We included PeerBerry in our portfolio because the platform has a large and dynamic marketplace. On any given day, you'll find a list of approximately 1000 consumer loans from loan originators in Europe, Asia and Africa. Many of the loans are originated by PeerBerry's former parent company company, Aventus and its various subsidiaries. The loan amounts range from as little as €10 to €25,000, the duration of the loans ranges from 14 days to over a year, and the interest rates are usually around 10%.

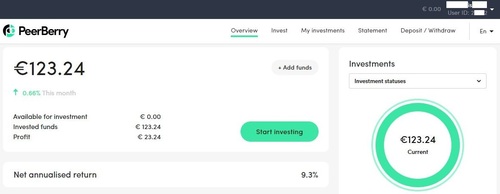

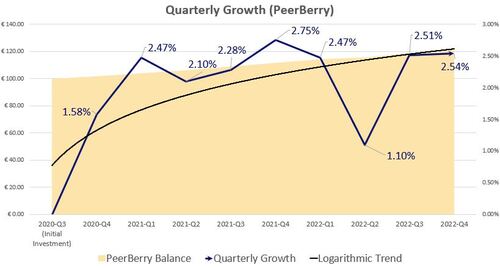

We ended 2021 with a balance of €110.10 on PeerBerry, having enjoyed a total growth of 10.1% over the first 15 months of activity. By the end of 2022, the account balance had grown to 123.24—an annual growth of €13.14, or 11.93%. The account overview reports a Net Annualised Return of 9.3%, but that's because some of these investments are still active. We would have to wait for all the investments to mature, and then cash them out, to see the "true" yield. Instead, we elect to reinvest all of our gains, to get a better sense of the long-term behavior of the site. In that sense, this portfolio is more educational than financial albeit we take all the investments seriously.

Reinvest24

Reinvest24 is one of the most attractive platforms for peer-to-peer real-estate investment. Like all p2p real-estate sites, Reinvest24 offers interest payments, rental dividends, and capital gains payments (upon sale of properties). Unlike many other sites, Reinvest24 does not work with loan originators and does not use third-party assessors to valuate properties. Instead, the assessment and valuation processes are performed in-house. According to the site's blogger, Anders Olson, the platform's metrics include location, price, options, existing contracts (such as rental agreements), financing, visual appeal, limitations, market, and potential rental yield.

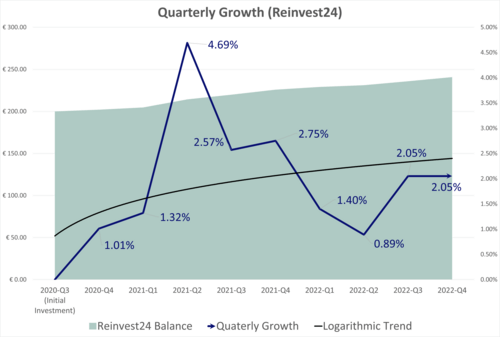

By the end of 2021, our portfolio on Reinvest24 was valued at €224.24, having yielded a total growth of 12.12% over the first 15 months. Between 2021 and 2022, the portfolio balance grew to 243.03, which amounts to an annual growth of 8.38% (€18.79). When we divide the first period's activity by quarter (12.12% growth over 5 periods), we see an annualized return of approximately 9.7%. For 2022, the rate-of-growth decreased by 1.4%, which is tolerable.

EstateGuru

EstateGuru is a large real-estate investment platform on which p2p investors can purchase notes from a long list of properties. The platform also offers an active secondary market. However, unlike Reinvest24, there is no buyback guarantee. EstateGuru justifies this by working with property-backed loans, and engaging in rigid due diligence. The reject the vast majority of submissions, and even the 10% that they do consider undergo careful inspection. That being said, one finds that over 5% of the listed properties are in default. That's within the average, but it still indicates greater risk than one faces on Reinvest24.

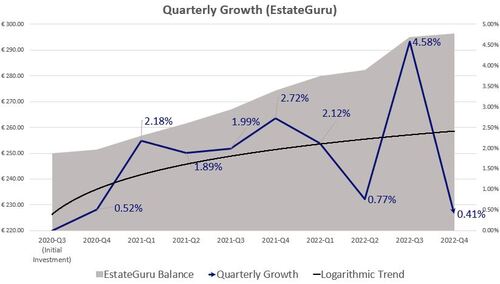

When we closed out 2021, our portfolio on EstaetGuru had reached €272.56, from an initial investment of €250 just 15 months prior. The €22.56 of profit amounted to an increase of approximately 9% in 5 quarters, or 7.22% per annum. That's not a stupendous year, but it's within the 7% baseline we set when we opened the portfolio. This past year, however, EstateGuru posted better results. The total value of the portfolio grew from €272.56 to €300.15. That €27.59 of profit amounts to an annual increase of 10.12%. That's an growth increase of nearly 3 percentage points, and suggests EstateGuru has far greater potential than we saw in 2021.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Events that Influenced Financial Markets During Q4

There can be no doubt that 2022 was one of the most extraordinary years in human history. The developed world fought off a global pandemic, a nuclear power went to war against its neighbor, and experimental digital currencies plummeted in value, calling into question the viability of cryptocurrency.

As the threat from Covid19 dwindled, governments slowly lifted constraints on day-to-day life and economic activity began to rehabilitate broken economies worldwide. Russia's invasion of Ukraine introduced new economic challenges, as Putin's regime cut off supplies to natural gas. The price of heating and electricity skyrocketed, leading to fears that many people wouldn't be able to survive the winter. But the weather throughout the winter months was mostly mild, so while expenses did increase, they weren't unbearable for most--and eventually the prices returned to pre-invasion levels.

The collapse of Bitcoin and other cryptocurrencies hit speculative investors hard, with many people losing millions in net worth. Hackers managed to exploit weaknesses in the crypto-market, stealing a combined $4 billion in one year. Whether the crypto experiment has failed entirely--or whether investors can revamp it remains to be seen. But for now, it looks like a sinking ship. The current $1 trillion crypto valuation is a mere shadow of its glory days. While there remain many diehard crypto loyalists, others are looking for investment opportunities outside of crypto.

On the other hand, the Russian ruble managed to regain some of its value after nearly collapsing. This came as a frustrating surprise to investors, who might have enjoyed buying a few thousand euro worth of rubles with the latter lost nearly 80% of its value. Western governments and investors alike assumed that Russia's invasion of Ukraine, and the ostensibly "crippling" sanctions that followed, would bring Putin's banks to their knees. Putin, however, would not be ruled. Russia found countries willing to work around the sanctions .In addition, long-time Putin loyalist and Central Bank governor Elvira Nabiullina engaged in what NPR called "Financial Alchemy" to save the ruble. She succeeded, and in the process secured for herself a permenant seat at Putin's table.

Verdict

Sometimes the best thing an investor can do is run the numbers. After all, in the world of finance and statistical modeling, past performance is considered the best indicator of future potential. As such, we recommend investors take a good look at PeerBerry. The platform performed well above expectations, bringing us 11.93% growth in one year. That's not to say the other sites aren't good. These are all excellent platforms for peer-to-peer lending, and you should certainly consider a p2p real-estate site when developing your portfolio. But for 2022, our by-the-numbers winner is PeerBerry.