Use These Digital Wallets to Fund Your P2P Lending Activities

Peer-to-peer lending and investment platforms are an excellent way to get a quick loan, or to earn passive income from the interest on loan notes. To use a p2p platform, however, you need some way to move money back and forth, and not everyone is comfortable giving their banking information to a bunch of strangers on the internet. Furthermore, some banks charge outrageous fees, especially when you want to exchange currencies or transfer money overseas. Many banks won't work with cryptocurrencies, and some banking transactions only go through during bank hours.

Digital wallets were designed to address all of the above. They provide a 24/7 online financial mechanism that meets your needs at the click of a button, and with very few fees. P2PIncome's financial experts have taken a look at the best digital wallets online, and in this article we recommend three sites you can use to fund your p2p activities: Wise, Revolut, and N26.

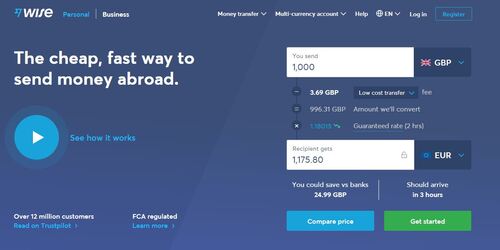

Wise

Wise was founded in 2011 by Taavet Hinrikus and Kristo Käärmann, under the name TransferWise. They were both from Estonia, but lived and worked in the UK. With property and bank accounts in Estonia and the UK, they found themselves paying huge fees to convert their money from pound to euro and back. The decided to start a new venture, "with the vision of making international money transfers cheap, fair, and simple." Since then, Wise has grown into a major online financial platform offering multi-currency, personal and business accounts, debit cards, currency exchanges and transfers, remote bill payment, and a savings program. In 2021, Wise went public on the London Stock Exchange, with an IPO valuation of 11 billion dollars.

Wise is a fully functional online-banking platform offering all the services a regular bank offers. The company is fully regulated, and complies with all the relevant laws and regulations of the countries in which it operates. You must register your account based on your country of primary residence, which will determine the scope of your account activities. For example, users living in the European Economic Area (EEA) are bound by EU laws, those in the US by American law.

For example, because the sale of alcohol is regulated, you will not be able to receive proceeds from such sales on Wise. You will, however, be able to engage in most day-to-day activities, including converting funds to and from dozens of currencies. In addition to spending money, you can use the Wise Jars to save your money in various currencies and convert between them as you see fit. The service is open 24/7, and all transactions (other than transfers to a brick-and-mortar bank) occur within a few minutes.

Revolut

British-based Revolut is a sophisticated fintech company offering online banking services in the United States, the UK, the EEA, and Japan. The platform lists a complete array of personal and business financial services, including savings accounts, debit cards, currency exchange, crytocurrencies, stock trading, and even travel insurance. Several peer-to-peer sites accept Revolut, and via the mobile app you can even withdraw cash from an ATM. The platform is licensed as a Challenger Bank by the European Central Bank, with the legal right to accept deposits and make various (non-investment) financial transactions.

Revolut markets itself as "One app, all things money." Users with personal accounts can go to the Everyday Needs list to pay bills, receive payments, order a debit card, and even study their spending habits via the Budgeting and Analytics page. You can automate your monthly payments using Pockets, and organize your Subscriptions to avoid confusion. In the Travel section you'll also be able to convert money to and from 30+ currencies, including the US dollar, the British pound, the euro, and the yen. You can also visit the Invest section to move cryptocurrencies like Bitcoin and Etherium. Choose from four plans: Standard (free), Plus ($4 a month), Premium ($9 a month), and Metal ($15 a month).

The Business account offers some important options, including a multi-currency account, payment gateways, QR code payment, and payroll. There are four business plans: Free, Grow, Scale, and Enterprise. The free account is rather bare, offering only the basic services, while the Grow plan offers a touch more for around $30 a month. The Scale plan, which is around $120 is far more practical for most business people. It offers two Visa/debit cards, up to 50 free international payments, local spending in just about every currency, and over $50,000 in foreign exchanges in the interbank rate. Users have the option to upgrade or downgrade their account at any time.

N26

/>

/>Founded in Germany in 2013 as fintech company, N26 received a banking license in 2016 from the Bundesanstalt für Finanzdienstleistungsaufsicht (the German Federal Financial Supervisory Authority). The platform is available in over 20 countries throughout Europe, and in certain countries users can apply for a Maestro Card (a debit card from MasterCard). The platform was available in the United States until early 2022, when they shut down all American operations to focus on the European market. They also shut down operations in the UK in response to Brexit. Despite these closures, the platform was awarded the 2021 World's Best Bank prize by industry leading Forbes Magazine.

For those in the EEA interested in an excellent online banking option, N26 is definitely worth a look. The platform is so popular there's actually a waiting list to join. Private users can choose from four plans: the Standard account is free and offers a debit card, free wireless and mobile payments in any currency worldwide, and Statistics to help you track your financial habits. For around $6 a month, users can enjoy the added benefits included in the Smart plan. The plan offers an additional card, Spaces in which to categorize your funds, and Round-Ups on every purchase, with the difference going into one of your Spaces. The Smart plan also includes a Phone Support Hotline.

For $12 a month, the You program offers unlimited free withdrawals, various travel-insurance options, discounts on certain luxury brands. If you're interested in the full N26 experience, you'll only have to pay around $20 a month. This premium package, called Metal, includes an actual metal card, a dedicated Metal hotline, car-rental insurance, and limited insurance for your cellphone.

Digital Wallets and P2P

Most major p2p sites work with the digital wallets covered herein, but P2PIncome would like to recommend 3 sites that are particularly good: Reinvest24, PeerBerry, and Iuvo. Reinvest24 allows users to invest in various types of real-estate development loans, thereby collecting not only the interest on the loan (12% to 17%) but also rental dividends from the properties. PeerBerry is among the very best p2p consumer-loan platforms, with average returns of 9% to 12% on loans ranging from 4 months to 120 months. Both of these sites are in our sample investment portfolio, and are covered in our annual report.

Another site we strongly recommend is Iuvo-Group, which offers returns of 10% to 12% on p2p investments of up to 60 months. The site also offers a digital savings account, IuvoUp, with which you can earn 4% annually and execute your long-term-savings plans.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Final Verdict

If you're looking for our top recommendation, look not further than Reinvest24. The additional passive income that comes from rental dividends simply can't be matched. We've been investing with them since late 2019, and so far, we are impressed.