P2Pincome | Understanding P2P Lending With Wise

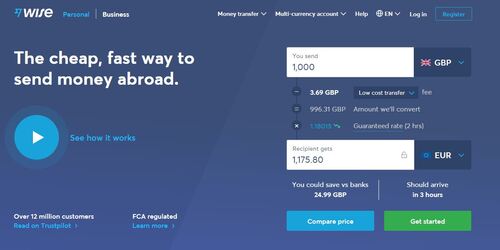

Who is Wise, Formerly Transferwise?

Wise is an Estonian Fintech company that was founded in 2010 under the name TransferWise. They quickly became a success because they allowed people to send money overseas at a fraction of what it would cost at the bank or Western Union. Wise also provides all of their customers a digital European bank account with an account number and IBAN. Wise was one of the first successful financial technologies that revolutionized the way individuals interact with their money.

Today, Wise is a full on payment system with PayPal and Stripe integrations for both businesses and individuals. Wise is good for everyone but it is specifically good for those who are living outside of Europe. The free European bank account provided by Wise will surely make it easier to invest in European investment ventures.

ReInvest24

Reinvest24 is a new age peer-to-peer lending platform. Instead of just simply selling loans to retail investors, Reinvest24 offers investors temporary real estate equity. What this implies is that Reinvest4 does not give investors a standard loan contract that is paid off after some time. Instead, the investors are actual owners of the property and are then subject to the same property rights any property owner has. They receive any money that comes from the property and they are also subject to the fluctuations in property value. Reinvest24 only offers loans for properties that are predetermined to make money. Reinvset24 has multiple partners in the localities that they operate in to establish profitable ventures for Reinvest24 and their retail investors. As a lender, when you hold a Reinvest24 share you'll always receive rental dividends and if the property value increases you will also receive capital gains. There is a 100 EUR minimum to invest in Reinvest24 and returns range anywhere between 14 and 15 percent in yearly interest.

Reinvest24, despite it's ingenuity and expansion, was only founded in 2019. Since their establishment they have shown themselves to be a very serious and dedicated peer-to-peer lending platform. In comparison to some of the bigger platforms like Mintos or EstateGuru, Reinvest24 is a very small platform. Due to the small size of the investors there is a fair bit of cash drag on their marketplace and few options to invest in. Reinvest24 has a secondary market which investors can use for liquidity purposes.

Out of a lot of the low risk platforms in the market today, Reinvest24 has one of the highest return rates. Let's further clarify the way investors earn capital on Reinvest24. There are two methods to earn on Reinvest24, rental dividends and capital gains. The rental dividends are fixed, if you purchase a loan share then every month you will receive payment in the form of rental dividends. In our experience we have found that the rental dividends will yield about 6 to 8 percent in yearly interest on your loan contract. The capital gains is not a fixed outcome. There is a strategy and game plan to sell all of the properties on Reinvest24. When the properties sell, their value increases, and therefore, so does the value of all the investors who are partial owners. The capital gains are generally spikes of anywhere from 3 to 7 percent. One of them we were able to document in monthly report 6.

Reinvest24's primary and secondary marketplace both have a one percent transaction fee. Both marketplaces are neat and clean. Unfortunately, there is no buyback guarantee. Reinvest24 has a direct investment structure with their borrowers and strategies for fund recoveries. The platform separates itself from other platforms in its unique approach to peer-to-peer lending.

October

October is a peer-to-peer lending platform that originated in France in 2013. Previously known as Lendix, the platform deals mostly with business loans for small to medium sized enterprises or SMEs. October is a Europe Union specific platform, it is designed for European Union businesses only. There is a 20 EUR minimum deposit requirement and yearly returns range between 3 and 7 percent.

October is a platform of quality with a highly competent team. October provides low interest rates for borrowers that are vetted and low risk. October has never let their investors down in any fund recovery. All investors on October have historically been safe from losing their funds. October offers only great value loans that are sure to yield the projected amount. October's security and legal teams use extensive credit and background checks to ensure that the borrowers on their platform are legit and trustworthy. Investors can also be subject to a degree of scrutiny by October. October, in particular, uses a direct investment strategy for their borrowers and lenders.

October has neither a buyback guarantee or a secondary market. October themselves say they are interested in investors who are committed and not ones who would be better off in a casino. October is licensed, highly regulated and compliant with many EU countries. All loans on October are secured by some form of collateral. The platform has strong ties to all of the governments in the countries they operate in and have ties with the Central European bank. Currently, half of Europe's economy is dependent on small butcheries, cafes, restaurants, small hi-tech companies and artifact merchants. October is simply providing a channel of credit into these preexisting markets.

PeerBerry

PeerBerry was created by a loan originator called Aventus Group. Aventus is a very large lending organization in Europe. PeerBerry is a loan originator aggregator, meaning they host multiple loan originators on their marketplace so they may offer their loans to retail investors. PeerBerry has a very clean, easy to use platform with many features that make PeerBerry an attractive investment proposition. There is a 10 EUR minimum to invest on PeerBerry and yearly returns range between 9 to 12 percent.

PeerBerry is a Latvian based platform founded in 2018. PeerBerry has an incredibly diverse marketplace but the majority of their loans personal and consumer loans. A slightly smaller percentage of their marketplace consists of business loans and real estate loans. One PeerBerry's special features is the way they have organized their buyback guarantee. The guarantee works in two ways, if a borrower defaults on their loan past 15 to 30 days, depending on the agreement, then, the loan originators buyback the loan back from the investors principal and interest included. In the case that it is the loan originator that is defaulting and unable to make his payments, then, every loan originator in the system would assist the falling loan originator. This is why it's referred to as a dual buyback protocol because lays out clear instruction as to what happens when the ecosystem requires delicate attention.

PeerBerry also has a different vision when it comes to peer-to-peer lending. PeerBerry does not believe that investors always make the best decisions. Because of this, PeerBerry limits the amount of money retail investors can invest with them. All loans on PeerBerry are already funded by PeerBerry's partners and hosted loan originators. PeerBerry offers a significant percentage of their portfolio to investors. The actual percentage is not publicly disclosed and probably varies between a quarter and a third of PeerBerry's portfolio. The upside is most of the dealings and problems are dealt with by PeerBerry on behalf of the investors. And the outcome, is a very healthy, stable peer-to-peer lending ecosystem.

Mintos

Mintos is a loan originator aggregator and one of the largest peer-to-peer lending platforms in the world and the largest in Europe. Mintos has two market places, a primary and a secondary both of which are very active and updating daily. Mintos has been processing over a billion EUR in loans on a yearly basis for several years. Mintos is widely known as a favorite for European investors. Investors on Mintos can expect a 10 EUR minimum and for yearly returns to range between 8 -to 12 percent.

Mintos launched in 2015 offering personal and consumer loans. Though the first few years were slow, Mintos started experiencing explosive growth as interest in peer-to-peer lending was climbing. Mintos expanded to offer almost every single type of loan available: auto loans, mortgage loans, development loans, rental loans more consumer loans. Mintos is a loan originator aggregator which means to issue more loans they more loan originators. Mintos was compelled to invite several more loan originators to their platform to manage their newly found popularity.

Mintos offers multiple auto-investing strategies that all investors have the option to sift through. Mintos also allows investors to create their own APIs in case they wish to use their own algorithms to invest in Mintos' marketplace. All loans on Mintos come with a buyback guarantee but not every loan is secured with collateral. The specifics of each loan change from loan to loan in such a diverse marketplace. Mintos utilizes their own ranking system to determine which loan originator should pay what interest rate. Then it's up to lenders to decide if they enjoy investing with that loan originator. If investors seem to appreciate a loan originator then Mintos imports more loans from that originator. Mintos has become a very big platform it lacks the personal touch all companies when they first start out. Mintos is still a great place for investors who are just starting out with peer-to-peer lending.

Why Use Wise Over Your Bank?

The simple truth of the matter is that it is probably cheaper to use Wise or Revolut than it is to use your own credit card. Credit card range anywhere between one to four percent in fees. Wise or Revolut will range in zero fees for European payments and minimal fees for international fees. In any case, it is most likely a more cost efficient option to fund your investment accounts with online banks that charge less fees than the majority of credit card companies.

We are motivated by two things, technology and money. And not necessarily in that order. The year 2000, and the remainder of the century, will forever be remembered as age of technology and innovation. Healthcare, infrastructure, public transport and education are all undergoing a massive upgrade and transformation. All of this is possible due to the ease and simplicity of disseminating data through online forums and social media applications. Fintech has become the manifestation of digital apps that are enabling us to secure and earn interest without the need of a bank or loan officer.

Verdict

The nice thing about this blog is that all the platforms listed have zero fees attached to them. This means, with Wise, you can move capital in and out of any of these platforms with barely noticeable fees. The beauty of smart applications is that they have the capacity and design to out scale our traditional forms of finance – banks. Online banks don't have any of the overheard or need of physical presence that traditional banks have.

Wise's phone application is easier to navigate than it is to deal with your local banker. All the platforms listed here have their pros and cons. For further details, please refer to each ones full review. In our recent experience, which you can read more about in our monthly blogs in our investment guide, we have found that Reinvest24 is a phenomenal investment platform.