Here are 5 P2P Lending Sites with Great User Interfaces

A pleasant user experience has become an integral part of how we judge online platforms. Peer-to-peer sites with mediocre user interfaces can feel cheap and unsatisfying, even if the investments themselves are solid. Conversely, users tend to respond very positively to sleek platforms with charts, graphs, and other features. P2PIncome's experts have scoured the internet in search of the platforms with the most attractive yet practical UIs, and in this blog we will cover the sites we liked the most. From downloadable status reports to easy-to-read charts and graphs, here are the peer-to-peer lending sites with the best user interfaces.

PeerBerry

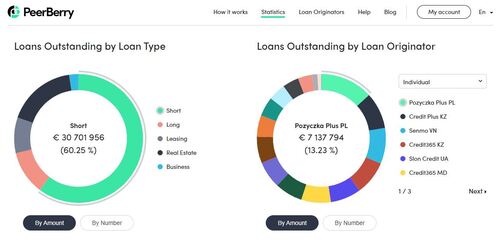

Whether you're talking about user interfaces, security and reliability, or the mobile app, PeerBerry is among the very best peer-to-peer platforms on the market today. The site aggregates consumer loans from several loan originators, including Aventus Group, Gofingo, Lithome, and SIBgroups, and all their subsidiaries. The minimum investment is only 10 euro, and every loan is backed by a 100% buyback guarantee. Loans terms range from 4 month to 120 months, with interest rates ranging from 9% to 12%, and an average annual investment return of 10.91%. PeerBerry is also the only major p2p platform to boast a 100% recovery rate.

PeerBerry's easy-to-understand user interface makes peer-to-peer investment easy, which is why it's one of the best sites for beginner investors. On the Overview page of the site's My Account section, users will find a clear overview of their current portfolio, including their current total balance, broken down by Available for investment, Invested funds, and Profit. Users can also view their Net Annualised Return expressed as a percentage. There is a Profit status graph that provides a view of when profits came in, with ranges of 1 Month, 6 Month, 1 Year, and 3 Years. Users can also view the investments, broken down by Investment statuses, Loan originators, Investments types, and Distribution by countries.

The Statement page allows you to view and download your Account Summary, using any range of dates from when you opened your account till the present. There are also preset ranges for your convenience: Today, This Week, and This Month. You can also filter the page by Deposit, Withdrawal, Principal repayment, Interest payment, Investment, and Referral fee. On the same page you'll find the Tax Statements tab, which allows you to produce a downloadable tax report to use when filing.

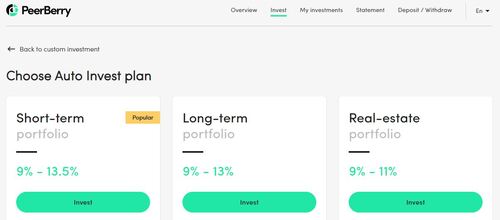

On the Invest page you'll find the PeerBerry marketplace, which is where you'll purchase notes. Here, too, you can filter by range of date, as well as by Available amount, Interest rate, Loan type (such as Short-term, Long-term, Real estate, Business), Country, and Loan Originator, which is important because PeerBerry lists thousands of loans. You can also save your settings, and locate them later using the My saved filters tab. If you don't want to spend so much time thinking about the investment process, simply activate the Auto-Invest tool. Choose from one of three preset investment strategies, or create your own based on your financial goals.

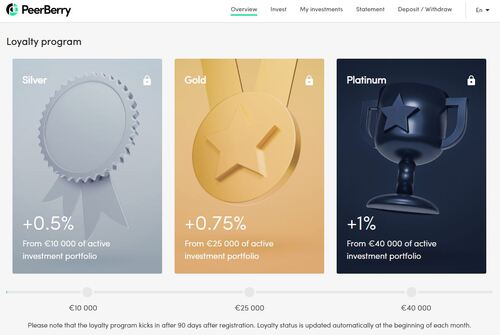

If you're an investor with several thousand euro at your disposal, consider PeerBerry's Loyalty Program, which offers interest-rate bonuses on accounts with balances over 10,000 euro. The Silver program offers an additional 0.5% for accounts up to 25,000 euro, the Gold offers 0.75% for accounts between 25,000 euro and 40,000 euro, and the Platinum offers 1% on account over 40,000 euro. To qualify, you simply need to maintain such a balance for 3 consecutive months, and the platform will automatically sign you up.

Reinvest24

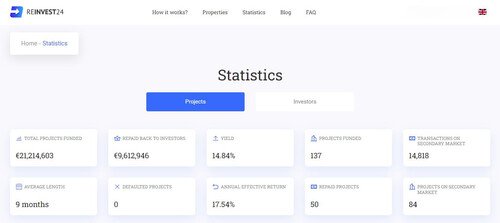

Reinvest24 is an industry leader in the real-estate crowdfunding market. The platform offers users the opportunity to invest in the construction, renovation, and rental of properties, thereby adding two sources of passive income in addition to interest gains: rental dividends and capital gains. Many of the projects continue to draw income even after the loan has been paid off, making them ideal long-term investments. The loan terms on Reinvest24 range from 4 months to 10 years, with interest rates ranging from 9% to 15%. ReInvest24 reports an impressive Average Annualised Return of 14.8%, stemming from the 3 income sources.

Reinvest24's user interface provides an impressive amount of information in a format that's easy to comprehend even if you're new to the world of peer-to-peer lending and investments. The homepage lists some basic stats and figures, as well as a glimpse into the marketplace. Select the How it works button to learn more about how the Reinvest24 ecosystem operates, and how you can make money using the platform. Similarly, you can go to the Statistics page to get a long list of detailed stats about the site, including Total Projects Funded, the annual Yield, the Average Length (or term) of a project, the Annual Effective Return, and more.

If you want to see your current account information, go to the tab with your username, which is near the top of the homepage, and select My Investments from the drop-down menu. This will take you to a page that lists your current Balance, your portfolio's Book Value, your Total earnings since opening an account, and all the properties in which you've invested. Each property listed has a link that takes you to the project page, where you can get more details. You'll also find the Buy and Sell buttons, which allow you to invest more money—or to move your notes on the Secondary Market.

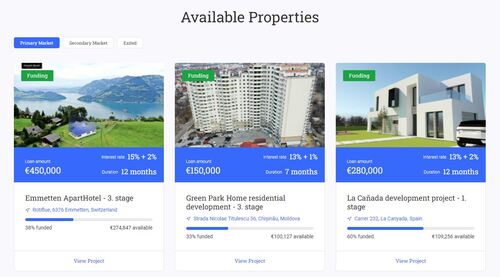

The Reinvest24 marketplace lists all of the Available Properties for investment on the Primary Market and Secondary Market, as well as Exited (meaning "completed") projects. Each project listed has its own report, where you can find all of the details required to make an informed decision. The report includes a gallery of 10 to 20 pictures, followed by an Object Overview, Investment Case, Financials, and Technical Overview. As you go through each section, you'll learn everything there is to know about the project, including the Annual interest, Collateral, Duration of the loan, and whether the property has passed the Reinvest24 risk assessment. You can also download the property Valuation and Building Plan.

If you're interested in learning more about peer-to-peer real-estate investment, take a look at the Reinvest24 blog page. The page contains dozens of informative posts on a variety of topics, from updates regarding Reinvest24's activities to reports on market trends and investment opportunities. You'll find updates on current projects, discussions on investment strategies, and fascinating articles such as Introducing Automated KYC Verification Process and 3 Types of Repayment Schedules and Which Is Best for You.

Iuvo Group

Iuvo Group was founded in Estonia in 2016, in order "to help" ("iuvo" in Latin) clients investment funds in a more effective and prosperous way. Early on, the platform earned praise from such industry leaders as Forbes Magazine, which awarded Iuvo 3rd place on the Forbes Best Start Up list for 2017, followed by 1st place on the Forbes Best Company in the Financial Category list for 2020. Iuvo focuses on consumer loans from reliable European loan originators. They offer a 100% buyback guarantee and returns as high as 15% annual. The site has an excellent auto-invest feature and a saving program called iuvoSAVE, where users can earn up to 5% to 6% short term, and up to 4% annually.

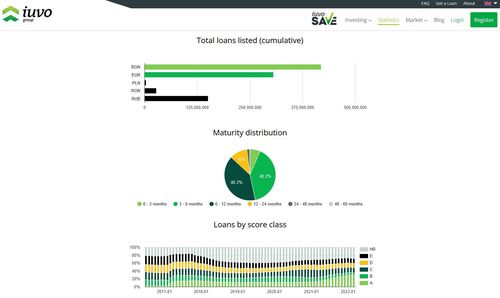

Iuvo Group's platform was carefully designed to keep you in the loop. The Account Statement page has no shortage of information for you to track and analyze, including your current Net profit, Payments received, and Investments made. Below the main data you'll find a long list of financials, including your Opening Balance, Late fees received, Interest received, Early interest repayment, Principle received, Secondary market sales, etc. It's important to understand that Iuvo lists loans in several currencies, including euro, the Bulgarian lev, the Romanian leu, and the Polish złoty. The platform has its own currency exchange, so you can move money between currencies before and after investing.

While the platform offers a lot of details about your account, the developers would do well to add more statistical graphs and charts. The way the information is presented is very high in resolution, and sometimes investors prefer a quick overview. That is perhaps the only minus we found on Iuvo Group's platform.

The Iuvo marketplace lists loans in a very simply format: First, you'll notice a small flag indicating the currency of that particularly loan. Next you'll find the Loan Type, which is usually Personal Loan with the occasional small-business loan. The Score Class indicates the creditworthiness of the borrower, decreasing from A to E, followed by the Guaranteed principle (typically 100%). The Loan amount refers to the total loan amount in euro, while the Balance is the amount in the original currency. Next you'll find the total number of payments, with the remaining number in parentheses, followed by the Installment type (monthly, weekly, daily), Status of the loan, and the amount Available for Investment.

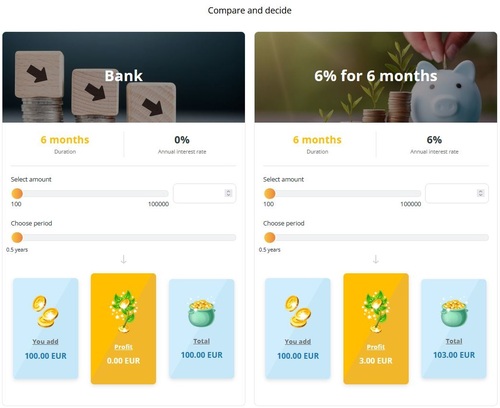

In addition to investing in consumer loans, Iuvo Group users can open a iuvoSAVE online-banking account, where they can earn 4% annually. You only need to deposit 100 euro to get the account started, and there is no maximum deposit limit. You can add to your account at any time, free of charge, and the fee for early withdrawals is only 1% of the amount withdrawn. The iuvoSAVE vehicle offers two short-term high-yield options: a 3-month 5% term, and a 6-month 6% term, as well as a long-term 4% option.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Verdict

P2PIncome's financial experts agree that all three of these platforms are excellent. Those who are interested in real-estate will obviously prefer Reinvest24, while those looking for an online savings program will naturally be drawn to Iuvo Group. That being said, PeerBerry remains our overall favorite, due to its stability and reliability, vast marketplace, and attractive rates. This is particularly true for high-end investors who can benefit from the bonus programs starting at 10,000 euro.