P2P Lending | Mintos or PeerBerry?

PeerBerry and Mintos

In this investment guide we're going to review two top tier loan originator aggregators who provide peer-to-peer lending services. PeerBerry and Mintos, the two platforms have had a relationship with one another for a long time and are very similar businesses.

PeerBerry is far newer than Mintos and tries its best to be a profitable platform for investors. Mintos, on the other hand is a giant peer-to-peer lending marketplace and one of the largest to have ever existed. Mintos hosts more investors, loan originators and projects than any other peer-to-peer lending platform in Europe. Many investors consider PeerBerry to be only second to Mintos.

In terms of size, PeerBerry is only a fraction of Mintos. But, that does not stop us from comparing them because after all, they are two platforms open to retail investors like us. The question always persists, where is the best place for you to invest your capital? The details of the platform are secondary to your main priority, which is safely earning interest on your capital. The point of a healthy investment is to yield a healthy amount of capital over a long period of time. That being said, the first step is to determine if the platform, be it Mintos or PeerBerry will survive many years to come. The best way to determine the health of a company's future is by looking at it's past. So before we get into the do's and don'ts of these two platforms, let's take a look at a brief individual history of them.

A History of PeerBerry

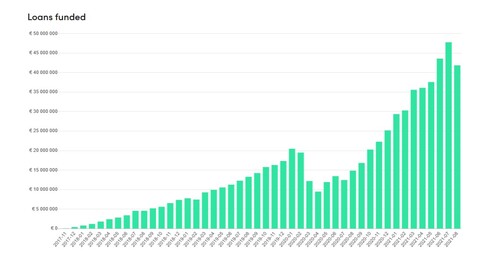

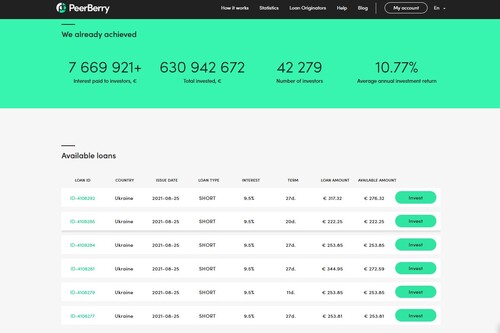

PeerBerry is a Latvian peer-to-peer lending platform that focuses on consumer loans. PeerBerry uses a loan originator aggregator model to manage their lender/ borrower ecosystem. PeerBerry is often dubbed as the fastest growing peer-to-peer lending platform, due to the large influx of investors they received shortly after launching. Investing on Peerberry requires a 10 EUR minimum and yearly rewards range from 9 - 12 percent. The peer-to-peer lending service was started in 2017 by Loan Originator Aventus Group. Aventus shortly after seeing Mintos' success firsthand decided they would build a competitor. Since it's creation, PeerBerry has been the fastest growing peer-to-peer lending service in history.

PeerBerry has an active investor base and in their marketplace they offer a wide variety of loans from a wide variety of countries. PeerBerry was founded by one of Europe's most successful lending groups, Aventus Group. Aventus initially offered loans on Mintos' platform, shortly after experiencing Mintos' success, Aventus created PeerBerry. Aventus is also PeerBerry's largest provider for loans in PeerBerry's marketplace.

PeerBerry offers a variety of extra features that other platforms do not. Most notably, their dual buyback guarantee protocol that ensures that investors on Peerberry are seldom at risk of losing capital. This feature of theirs provides investors with guarantees that if something were to go wrong, PeerBerry, would step in and assist them all the way until the funds are recovered. The first buyback guarantee ensures that after 15 days of late repayment that the loan originator who issued the loan buys the loan back from the investor. If the problem at hand is the loan originator themself runs out of money then all the loan originators step in to help that loan originator service their loans.

A History of Mintos

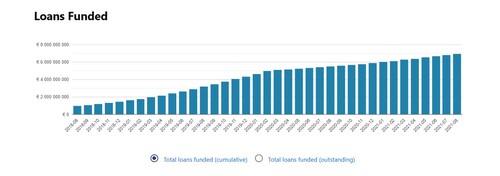

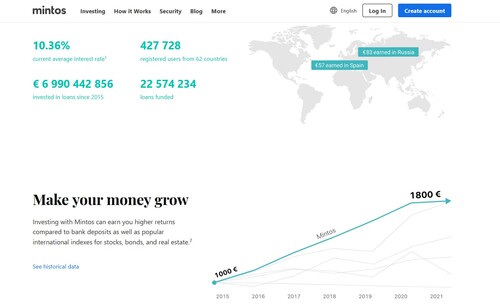

Mintos is one of the largest peer-to-peer lending platforms in the world. Mintos has funded over seven billion EUR in loans which is far more than any other platform in Europe can say. Mintos was founded in Riga, Latvia in 2015. Only in 2017, did Mintos experience explosive growth on their peer-to-peer lending platform. The peer-to-peer lending platform uses a loan originator aggregator model in order to manage their lending borrowing ecosystem.

Mintos are creative in their use of different instruments that make investing a pleasurable experience with them. To further expand, Mintos provides multiple auto-investing packages for their investors to utilize. Mintos has a very active secondary market and Mintos itself, offers just about every type of loan, so investors can feel that their portfolios are completely diversified.

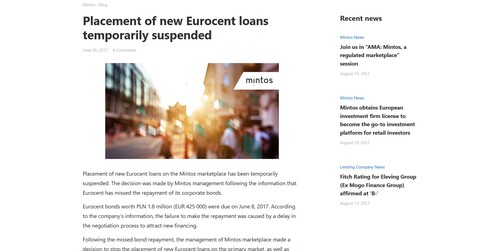

However, being the top peer-to-peer lending platform has it's drawbacks. For example, the surge Mintos encountered put them in a position where loans were filled up too quickly. Leaving a bad first experience for many in 2017 during Mintos' surge, and in order to mitigate such a problem from occurring again, Mintos was forced to add many loan originators. The process of adding more loan originators and having to expand to deal with more customers and capital was done quickly and poorly. When there is more quantity it becomes more difficult to retain quality. In such events, Mintos found that quite a number of added loan originators were faulty and had to be removed. By then, it was too late, Mintos has suffered greatly from defaulting borrowers. Mintos has a default rate of roughly 10 percent which can be troubling to some investors once they understand that it is likely that one tenth of their portfolio will most likely encounter problems.

A Comparison of Sustainability

Firstly and simply, our first task is to determine which platform will survive over the long term. If we were to optimize our auto-investing tool, which luckily both platforms provide, we would want our investments to autopilot and make ideal investing decisions based on our educated preferences.

A key factor here is that the platform will continue to be functioning in 10, 20 or even 30 years. If a platform stops operating even by the 20th year than it will have been an unsatisfactory platform to invest in. The best place to find out which platform is going to succeed and that is by looking at it's history, within the financial statements. The end of year balance, statement of cash flows and net revenue of a company will be one of the strongest signals that determine the future position of a company. If the platform has, by and large, been losing money then it would best to stay away. Both Mintos and PeerBerry have been highly profitable in their financial statements.

Both platforms provide their annual consolidated reports on their "about us" section in their respective homepages.

A Comparison of Default Rates

Both Mintos and PeerBerry have multiple layers of security on their platform. Both Mintos and Peerberry provide buyback guarantees, as well as loans with collateral in the case of a default. However, when you are Mintos, and you process a billion of EUR in loans on a yearly basis you're bound to make mistakes. PeerBerry, in it's 4+ years of operation is far away from processing even one billion. This is to provide context to the comparison of default rates.

As it stands, Mintos hosts 5 to 6 times the amount of loan originators than PeerBerry. Due to the quantity that Mintos operates in they are bound to mistakes. Unfortunately, Mintos averages a default rate of roughly 10 percent. PeerBerry averages a default rate of zero percent. This is a pretty substantial difference between the platforms. In other words, on PeerBerry you won't lose your principa,l and on Mintos you can expect to see 1/10th of your portfolio as either late or defaulted. Ten percent is not the highest default rate, but it's also not the lowest.

Mintos, having its ups and downs, is only to be expected, as the default rate does not cast a shadow on Mintos. But, it does shine brightly on PeerBerry, being able to provide smooth operations for years and protect investors is something only a very capable team can accomplish.

As investors we want to go with the investment that yields more money. As Warren Buffet likes to say, "rule number one of investing is don't lose money and the second rule is remember rule number one." The statement is both simple and powerful. As investors, we might be tempted to choose the riskier investment in the interest of yielding more but this also puts at risk of losing our capital. Choosing the sweet spot in between of risk and reward determines our success as investors.

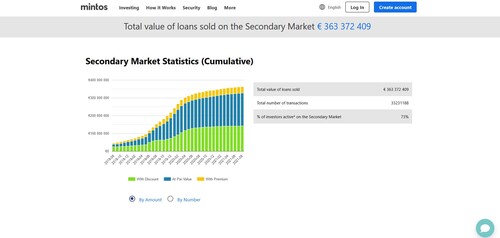

A Comparison of Marketplace

Mintos and PeerBerry both have excellent diversified primary marketplaces but Mintos' marketplace is a fair bit larger and more diversified. Not to mention, Mintos has a secondary market and PeerBerry does not. Secondary markets are very important features for peer-to-peer lending because it allows much needed, added liquidity for all investors. This feature, also provides a variation in potential investing strategies. Trading on the secondary market is a viable investment strategy: to be on the look out for loans that are being sold at a cheaper price on the secondary market. These loans will be sold off by investors who are looking to liquidate their loan contracts.

To illustrate this concept further, let's say you are familiar with Polish real estate, and you see on Mintos that there is a cheap commercial property in Krakow which you can purchase. You know already that the property will result in good loan conditions and many investors would be willing to pay a premium for it. You purchase the loan, wait for buyers accumulate, sell and repeat the process. Alternatively, you could wait on secondary market, check regularly for loans that are marked down and purchase loan you see the loan is sold for cheap. Many investors, need liquidity either because personal life, due to a business decision or better investment strategy elsewhere. In most cases, these investors sell cheap to sell fast. When we compare marketplaces we find that PeerBerry only operates at half capacity of Mintos. PeerBerry does not have secondary marketplace and therefore it also lacks the excitement of an investment strategy.

Mintos, being other than just and addition of a secondary marketplace, is also more diversified. With more conservative loan offerings and more volatile loan offerings. PeerBerry is more conservative in high yielding loans, and you will not find more than 13 percent on PeerBerry.

A Comparison of Risks and Rewards

Both platforms also have slightly different approaches to buy back guarantees. Mintos does not provide a basic buyback guarantee, where as Peerberry offers a more elaborate approach to protecting investors funds. PeerBerry provides within their service a dual buyback guarantee protocol. This means that when a loan defaults, then the loan originator has to purchase the loan back from the investor. This implies that if you ever encounter a problematic investment, then by the 15th day of late payment you will receive all your money back including interest. If the problem at hand is actually the loan originator who is unable to service your loan, then all the loan originators on PeerBerry will chip in to help the falling loan originator manage their borrowers.

Taken from PeerBerry's help center, "In case some loan originator will face financial troubles and will not be able to implement buyback guarantee, additional Group guarantee will ensure additional protection for your investments. The main PeerBerry partners Aventus Group and Gofingo Group has signed additional guarantee agreements with loan originators. This means that in case of insolvency of some company, other Aventus Group and Gofingo Group companies will cover all the liabilities of this company on purpose to protect investors investments, maintain transparency and good reputation of all the Group." Mintos' buyback guarantees are completely dependent on the loan originator issuing the guarantee. If the LO is unable to buyback the loan due to insufficient funds then all the principal will be lost.

Both the platforms offer similar base rewards. On both platforms you're looking to earn on the conservative side 8 - 10% of your portfolio. Some investments on PeerBerry hit the 13 percentile mark, whereas, on Mintos high risk investments can yield up to 20% percent. That being said, we don't advise investing into high risk loans on any platform. Perhaps holding a very small portion of your portfolio in high risk loans can be a strategy. We would again refer to Buffet's first rule: don't lose money.

PeerBerry does have loyalty bonuses for investors with exceptionally large holdings. PeerBerry would prove to be a more consistent yield, whereas Mintos has the possibility of coming short on one tenth of their loans. Mintos, being the size that it is, should have the resources to at the very least reduce that number. Althoug Mintos has a more diverse marketplace, as it currently stands, we would deem PeerBerry a better fit for conservative investors. Alternatively, Mintos would be a better platform for advanced peer-to-peer lending platforms and PeerBerry would be better for beginners. We have been brought to believe it is easier to make investing mistakes on Mintos and be punished for them. Whereas, PeerBerry protects investors from beginner mistakes.

After all, because these platforms are loan originator aggregators and not the loan originators themselves, it's not the platforms that one should worry about, it's the loan originators. This implies, that the due diligence on the investor is not only on the platform vetting the originator but also on the originator of the loan. If we take a loan from GoFingo on PeerBerry, or if we are taking a loan from Alexa Credit on Mintos, it's our responsibility to ensure that the originator is able to back up their end of the deal. We urge investors to take a look at the financial statements of the loan originators of the loans you are auto-investing into or manually selecting.

A Quick Overview

PeerBerry is only second place to Mintos for now. All things considered, PeerBerry appears to have a very promising trajectory. Despite Mintos being in the top position, there a lot of things they can learn from PeerBerry. It's always easier for small businesses to give a more personal touch to their clients.

In terms of facilities and resources, Mintos has a secondary market, Mintos has a much larger investor growth which means less cash drag and more diversification. There is so much diversification on Mintos, something that more experienced investors can take advantage of and ultimately use to yield more then they would on PeerBerry.

Company Origins and Presence

The two platforms are both based in Eastern Europe and come from similar beginnings. But they themselves also have a relationship with one another. Before PeerBerry became it's own platform it was a loan originator that offered it's loans on Mintos. After the initial loan originator named Aventus Group saw some success, they became interested in creating their own platform. Perhaps, they too thought it was a profitable model. They sought to create a platform that would be better than Mintos and they called it PeerBerry. For it was an investment that bore fruit.

The team in PeerBerry are also less communicative with the press. Mintos, on the other hand, creates a lot of online presence and virality. We are sure that many investors appreciate that they can message and speak to the CEO themselves and the CEO acknowledges, in fluent English, all of the misunderstandings and misgivings in his company's practice. In a nut shell, Mintos believes that they exist to provide credit for those who would rather not operate with banks. PeerBerry believes that PeerBerry and its investors should make money. Both are very noble goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Verdict

Both of these platforms are great platforms. To quickly address the default rate that has been a common criticism in this guide, it's not the worst in the world. It's also not because it's a super common occurrence on Mintos, rather, there have been a handful of bad actors that have basically taken advantage of Mintos' investors. Unfortunately, the legal process one undertakes to retrieve missing funds is a lengthy one and currently ongoing. Mintos' default rate, which is a contentious issue in this piece, is a common occurrence on many peer-to-peer lending platforms. A ten percent default rate is not as high as it gets on many platforms. There are only a handful of platforms like PeerBerry where the default rate is so low. Mintos suffers a bad reputation because of a few bad actors that had misleading financial statements like loan originator Capital Service.

Mintos is a great platform and it's position as the top peer-to-peer lending service in Europe is rightful. However, for your average investor, PeerBerry may be a safer alternative. Until the tides change and PeerBerry begins to experience defaulters, it will remain a more recommendable platform. We are not clear how long Mintos can promise a interest rate of 9% while having a 10% default rate, and we hope to see those numbers change in the near future. To be fair, if PeerBerry was struck with an unexpected amount of volume, then it too may suffer as Mintos has. Only time will tell which platform is more capable of holding the position of Europe's top peer-to-peer lending service.