These Peer-to-Peer Lending Sites Let You Invest in Renovation Projects

"Buy land! They're not making it anymore."

—Mark Twain

Twain's famous quip about investing in real-estate is as clever as it is sound. Land is a finite resource, and those who own some are often positioned to enjoy long-term passive income from it. For many, the only major hurdles are the start-up capital needed to purchase and develop the land, or to renovate existing property. That's where the peer-to-peer lending sites below enter the picture. These sites allow land-owners to crowdfund the amounts needed to upgrade a property so it can start yielding profits. If you're interested in adding rental dividends and capital gains to your portfolio, try out these p2p sites that specialize in renovation loans.

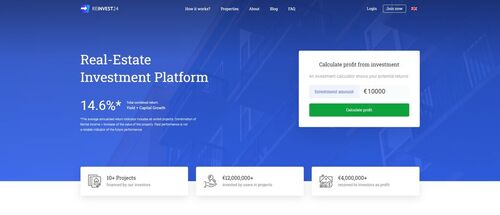

Reinvest24

Since its inception in 2018, Reinvest24 has provided investors with attractive yields on real-estate projects throughout Eastern Europe. The platform reports a Total Combined Return of over 14.5%, when combining interest payments on the original loan, rental income from active properties, and capital gains from exited projects. Reinvest24 is one of the sites included in P2PIncome's sample portfolio, and has performed consistently throughout. You can find more details in our end-of-year report for 2021, where we list Reinvest24 as one of the best peer-to-peer lending and investment platforms on the market today.

On the Reinvest24 marketplace you'll find properties at various stages of development, from newly-purchased land to fully-operational office buildings that require an upgrade. In each case, the listing will include a detailed prospectus that includes everything you need to know to make an informed decision. At the top of the page you'll find a gallery of high-resolution photographs or renditions of the plot. Below, you'll find the Object Overview, Investments Case, Financials, and Technical Overview. You'll also notice a profits calculator you can use to determine how much money you'll make on the investment.

In the Object Overview you'll find the annual interest, in addition to the anticipated return from rental dividends. The interest rates range from 9% to 15%, while the dividends are usually between 1% to 3%. The overview all lists the Payment Frequency (usually monthly), the Duration of the loan (from 3 months to 10 years), and the project's location. The Investment Case describes the acquisition process and estimated cost associated, such as the cost of licensing, the number of unites being developed, and the cost of the architectural firm. The Financials section provides current valuation, and the Technical Overview has all the downloadable documents associated with the project.

Reinvest24 also has an active secondary market, where you can trade in notes already purchased. The minimum investment on the secondary market is only 1 or 2 euro, and there are always dozens of properties available. If you're curious to know how well Reinvest24 is doing, go to their Statistics page, where you'll find everything from the Total Projects Funded and Repaid Back to Investors to the current average Yield and Average Length of the projects.

EvenFi

It's an obvious fact that investment and philanthropy are divergent practices, but Italian-based crowdfunder EvenFi is trying to bridge the two with its unique approach to socially-and-environmentally conscious investment. From helping a local winery to expand its online-marketing profile, to helping a sports complex in Genoa reduce its carbon footprint by funding solar panels, EvenFi it trying to make a positive impact on the world, all while ensuring its investors profit. They've even helped up-and-coming movie producers find funding for film productions.

On the EvenFi marketplace you'll find dozens of projects of varying sorts, but they all share one theme: They aim to help to community and the environment. For example, many of the projects help local SME's upgrade their facilities and their e-commerce infrastructure. From wineries to artists who hand-make porcelain cameos, from genetics-and-nutrition consultation services to scalable e-storage clouds for the public, every project on EvenFi has a clear purpose. Nevertheless, these are profitable investments. According to their Statistics page, EvenFi's Average Internal Rate of Return (net of risk) for 2020 was only 5.23%, but as projects came to fruition the IRR soared to 9.09% (2022 - Q1).

EvenFi's listings are very detailed, and as an investor you get the feeling you are being taken seriously. Each listing begins with the numbers: When the project opens/closes, the amount that has been invested thus far, the Minimum Target (expressed as sums and as percentages), the Target amount, the APR, the Duration, and the total number of investors to date. Thereafter, you'll find 3 tabs: Description, Earnings Calculator, and Project Updates. The Description page begins with the Investment Opportunity, and the Business Idea, which quickly summarize the project and how that business makes money. Next is the Market Opportunity, with a detailed explanation of how the project should further that company's goals.

If you're curious to know how much money you can make investing in a project, simply select the Earnings Calculator tab, and then enter the amount you wish to invest. The minimum investment is only 20 euro, and the maximum is stated on the right-hand side of the page, along with several other important figures. The calculator will provide estimated returns, as well as a sample payment schedule. EvenFi deals in several types of loans, including standard Amortising, Bullet, Dynamic, and even Venture Debt, so that calculator is quite useful.

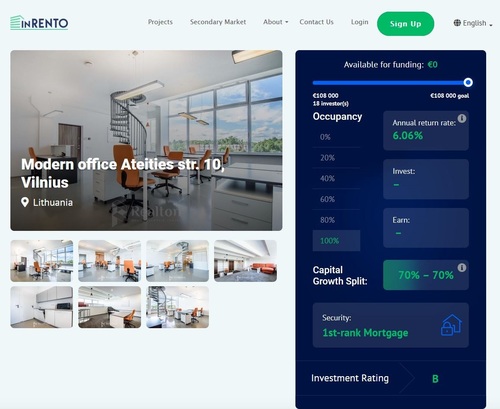

InRento

InRento was Europe's first buy-to-let peer-to-peer platform to receive official licensing. The site lists rental-income properties (i.e. "let") that are up for sale (i.e. "buy"). Investors purchase shares of the properties, and receive proportionate shares of the interest payments, rental payments, and capital gains. In addition, all of the properties listed on InRento have received First-Rank status, meaning the borrowers have passed the strictest creditworthiness assessments, and the properties themselves have been deemed market-worthy. Many of the rental agreements continue for years, making InRento an excellent source of reliable passive income.

InRento's goal is to provide low-risk investors with a mid-yield platform from which they can enjoy passive income for years to come. InRento's staff assess the properties for post-development marketability, to determine whether the properties will draw rental income. Since the properties are all First Rank, the interest rates on the marketplace are rarely above 7%, and the goal is the bolster total gains through long-term rental agreements. Investors looking to reduce their portfolio's overall exposure without damaging average yields are well-advised to invest on InRento.

Every property listed on the InRento marketplace includes a detailed overview, including the exact address of the property, and a gallery of high-resolution photographs. Next to the gallery you'll find the amount Available for Funding, which is the amount of money the borrower still needs, and the the current number of investors. Below that is the Goal amount, and the current Occupancy, which refers to the number of units currently occupied. Sometimes that number is zero, but you shouldn't see that as a bad thing. It only means the units have not yet been advertised, but InRento researches the market, and doesn't list properties likely to remain empty. You can look at exited properties to see the site's successful track record.

You'll also find the Capital-Growth Split, which is the amount of profit InRento's investors will take if and when the property is sold. A 70% - 70% split, for example, means that the borrower will receive 70% of the profit, and InRento will split the remaining 30% between itself and its investors (70-30). For example, if the profit on the sale is 100,000 euro, the borrower gets 70,000 euro, which leaves 30,000 euro for InRento and its investors. From the remaining 30,000 euro, the investors will split 21,000 (70% of 30,000) between them according to the number of shares each has purchased, and InRento will keep 9000 euro for itself (30% of 30,000) for operational costs and its own profits margin.

Housers

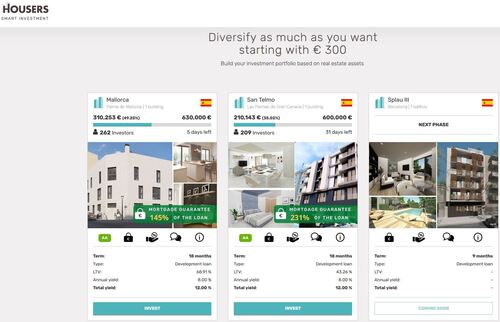

Housers was launched in Spain in 2016, and received licensing from La Comisión Nacional del Mercado de Valores (CNMV) in 2017. The platform lists properties in Spain, Portugal, and Italy, with most of the loans in the 6 figures, and many exceeding 500,000 euro. At any given time, you'll find dozens of properties in which to invest, including development loans, buy-to-let properties, and properties for sale. Often the properties are guaranteed for amounts far greater than the loan—such as a 230% mortgage guarantee—to help offset the default and restructuring rates. On average, investors enjoy returns of just over 8%, but investors should be forewarned: Housers is a high-risk platform.

Approximately 75% of the properties listed on the Housers marketplace are in Spain, while the rest are in Portugal and Italy. Most of the properties are locked, which means that ownership of the loan cannot be transferred during the life of the loans. As a result, you are making a long-term investment, in the hopes of long-term rental gains. In the case of Housers, those gains are extremely important, as Housers charges a 10% commission (performance fee) on any capital the investor earns.

Given that the platform's IRR is around 8.5%, and there are several fees along the way, you really need to rake in those rental dividends if you want to make money. Alternatively, you could try to master the market and gamble on huge capital returns, but that's a very high-risk proposition and there are better platforms than Housers on which to implement such a strategy. Nevertheless, Housers does have good listings, and they offer a sign-up bonus. They also have a very secondary market, which can be a great way to locate discounted notes. This is important, because Housers requires a minimum investment of 300 euro, and you can diversify quite a bit more on the secondary market than on the primary.

Every listing starts with the address of the location, the number of units, and a gallery of photos. That's followed by the current number of investors, the amount invested thus far, the goal amount, and the amount of time before the investment phase closes. The listing will indicate the mortgage guarantee is (in percentages), which is the inverse of the Loan-to-Value percentage (LTV). Below that, you'll find the Term of the loan (in months), the Type of loan, the LTV (), the Annual Yield, and the Total Yield. The LTV helps you determine risk, by comparing the actual value of the property with the loan value. For example, an LTV of 43% means the property is worth 231% of the loan amount, making the collateral far more valuable than the loan.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Market Type

Real Estate

Average Returns

14.41%

Minimum Investment

EUR 500

Signup Bonus

None

Registered users

16,000

Total funds invested

EUR 22 Million

Default rate

Undisclosed

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Paysera, Mangopay

Withdrawal methods

Paysera, Mangopay

In this detailed review, P2PIncome's financial experts assess the real-estate platform InRento. As a peer-to-peer platform focusing exclusively on first-rank mortgages being sold for long-term rental income, InRento offers an excellent low-risk investment option to add to your portfolio.

Market Type

Mortgage Loans

Average Returns

5 - 18%

Minimum Investment

EUR 50

Signup Bonus

1%

Registered users

135,000

Total funds invested

EUR 140 Million

Default rate

32%

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

Housers is one of Europe's largest real estate P2P lenders. They have become internationally recognized through their market choice. Housers marketplace consists of luxury properties from Italy, Spain and Portugal. Find out more in the review.

Verdict

There are two questions every investor should ask: "Should I invest in real-estate?" and "On which p2p lending site should I invest in real-estate?" The answer to the first question is "Yes! Real-estate is one of the very best long-term investments you can make." The answer to the second question depends a lot on your financial situation and your goals, but if you have to choose one site, P2PIncome's financial experts strongly recommend Reinvest24. The site is highly reliable, trustworthy, transparent, and profitable. They have world-class customer service, few fees, great listings, and a proven track record.