Esketit Reviewed | Artificial Intelligence Meets P2P Lending

Esketit is a peer-to-peer lending platform based in Ireland. It is a subsidiary of CreamFinance, a loan-origination firm based in Latvia. CreamFinance offers personal loans ranging from as little as 100 euro to as much as 10,000 euro. The loan durations range from 30 days to 5 years. What makes CreamFinance special is its proprietary borrower-assessment algorithm, which allows the company to provide so-called "one-click" technology. According to the site, this technology helps them "recognize the right borrowers instantly." Esketit is an extension of this loan process: it serves as a p2p-investment platform for the loans originated by its parent company.

The owners take on 5% of each loan, also known as having "skin in the game." CreamFinance issues approximately 150-million euro in loans per year, with an application-approval rate of 30%, and a consecutive-loan-approval rate of 88%. While it's not clear precisely what percentage of loans granted by CreamFinance make their way to Esketit, it's fair to assume it's a large portion. In addition to CreamFinance, Esketit also works with other loan originators, including Money for Finance, a lending company based in Amman, Jordan. Unlike the parent company, however, the loan durations are usually between one and three months.

Types of Loans on Esketit

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Esketit Loan Characteristics

Loan duration1 to 3 months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEU, MX, JO

Returns rate12.5%

Default RateUndisclosed

Recovery RateUndisclosed

FeesNone

BonusesNone

Esketit Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Esketit.com Pros & Cons for Investors

Pros

- Institutional Backing

- Proprietary Algorithm

- Low Minimum-Deposit

- No Fees

- Accepts Cryptocurrencies

Cons

- Very Few Loan Originators

- Limited Statistics

Investing with Esketit

As an investor on Esketit, you'll be able to purchase loan notes from personal loans originated by Esketit's parent company, CreamFinance, as well as other loan originators. Simply put, you'll contribute your money to a personal loan, and therefore own part of the loan. How much you contribute is entirely up to you, with the minimum being a mere €10. You will receive proportional returns, essentially making you a lender within a larger loan framework.

Each loan is listed on the Market, and you can select the loans based on your financial goals, with all the relevant filters available. The reported average return (net) is around 12%, which is impressive. That being said, it's a relatively young company, so it's difficult to know how much weight to give that stat. The average loan term is only one month, which also helps explain the returns. It also means you'll enjoy greater liquidity, as your money will never be tied up for very long.

Types of Investments

Esketit lists consumer loans ranging from as little as €10 per month, up to several thousand. All of the loans have undergone a rigorous risk assessment, using the latest artificial-intelligence algorithms. How much you invest, and how much risk you take on, is entirely up to you. The minimum investment is only €10, so even if you're just testing the waters, this is an inviting platform. On the other hand, there is a loyalty program for those ready to invest €25,000 or more. Keep in mind that most of the investments are very short-term, so in many cases you're in and out within a month.

Auto-Invest Tool

Esketit offers a sophisticated auto-invest tool that can do all of the heavy lifting for you. Users decide what types of loans the tool should look for, based on various filters: duration, interest rate, risk level, etc. Once you've selected your settings, the tool with automatically invest your funds. Whenever a loan comes to term, the computer will reinvest the capital and interest you've earned into a new loan, and so the process continues ad infinitum. It's literally "passive" income. You can change the settings at any time, to reflect changes in your strategy.

If you're not interested in making decisions regarding investment strategy, consider Esketit's three ready-made options: Diversified, Jordan, and CreamFinance. The Diversified strategy will invest your funds evenly across all loan originators, with an average interest rate of approximately 12%. The Jordan strategy will invest exclusively on loans from Money for Finance - Jordan, with an average interest rate of around 14%. The CreamFinance strategy will invest across all loans originated by CreamFinance, in Spain and in the Czech Republic, with an interest rate of around 11%.

Borrower Data Verification

As Esketit is not a loan provider, they don't have a verification process for assessing borrowers. Instead, they list loan originated by their parent company, CreamFinance, as well as other subsidiaries of the parent company. In terms of their process, CreamFinance relies on proprietary artificial-intelligence algorithms designed to identify qualified users instantly. The formulation of the algorithms is secret.

Esketit Rates and Returns

Esketit reports an average annual net return of 12.5%, from an average interest rate of 13.35%. That suggests they haven't faced many defaults at all, which is consistent with CreamFinance's report of an 88% second-loan approval rate. It also worth mentioning that the highest rates and the largest investment sums come from their Jordanian loan originator, Money for Finance - Jordan, which charges 14%.

Who is Esketit?

Esketit is a subsidiary of Latvian fintech consumer-finance provider Cream Finance LLC. The parent company has offices in Austria, the Czech Republic, Spain, Latvia, Mexico, and Poland. Whereas Eskatit is a peer-to-peer lending platform, CreamFinance is a loan originator. The company uses machine-learning algorithms to determine the credit-worthiness of a potential borrower, and issues loans to those approved by the algorithm. Then they post the loans on Eskitet, while keeping 5% skin in the game.

Lender/Borrower Ecosystem

Esketit loans originate in several countries: Spain, the Czech Republic, Poland, Mexico, Jordan, and Latvia. Users, on the other hand, only need to be 18 years or older, and have either a valid EU bank account or a cryptocurrency stablecoins account. The loans are generated by CreamFinance, as well as its subsidiaries, and listed on Esketit. Most of the loans are short-term and high-yield, and investors can invest either manually or using the auto-invest tool. Esketit also offers an excellent mobile app, for those on the go.

General Data

| General | Data |

| Origin | Ireland |

| Founded | 2020 |

| Offices | 77 Lower Camden Street Dublin 2 D02 XE80, Ireland |

| Loan Type | Consumer Loans |

| Sign Up Bonus | 1% for 90 days |

| Fees | No |

| Interest Rates | 12% |

| Min Deposit | €10 |

| Investment Duration | 1 month - 5 years |

| Secured Lending | Yes |

| Currency | EUR |

Registration & Withdrawal

To register for an account on Esketit, you must be 18 years or older, and you must have either an EU account or a stablecoin cryptocurrency account. Assuming you qualify, simply go to the Esketit registration page and fill out the online form. They will ask you for your email and phone number, and then you will need to generate a password. After you've agreed to the Terms of Use, you will continue to the Know Your Customer (KYC) phase.

You will need to prove you're over 18, provide proof of EU account or stablecoin account, and you will be asked to provide other paper (including a picture ID). Within a short period, you will receive a confirmation email, at which point you can deposit funds and begin investing on the platform. New users will also receive a 1% bonus on all investments, for the first 90 days.

Marketplace

The Esketit marketplace provides investors a list of all the loans currently available on the site. The listing begins with the flag of the Country in which the loan is offered, followed by an Loan ID number. Next, the listing names the Originator, the Issue Date of the loan, and the Amount and Balance of the loan. The Amount is the total being lent, while the Balance is how much remains to payback. Next come the Interest Rate, Term (meaning, duration of the loan), and the amount Available for investment. Finally, My Investments indicates how much you've invested in this particularly loan, followed by the Invest button, in case you want to invest or add to your current investment.

Risks Involved

Transparency & Security

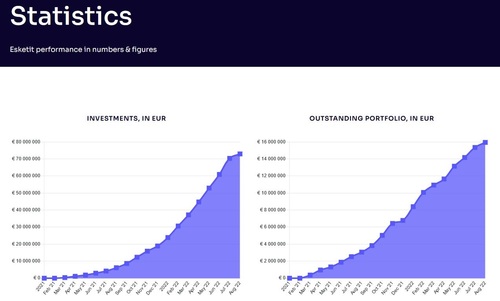

Esketit excels in terms of transparency, regularly posting financial reports and other summaries on its blog. The summaries are available to everyone online, while registered users can access audited versions of these reports via the site. The blog page also has interviews with staff members, as well as informative articles on various aspects of peer-to-peer lending. Esketit has a statistics page, but it could use more detail. That's not to suggest they're hiding anything, but the stats page is just not particularly informative. Esketit also places a premium on security, using advanced encryption throughout the site, and offering 2-step authentication for account access.

Our Readers Have Asked:

Is it safe to invest with Esketit?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, Esketit is a safe platform. They take great care to avoid security breaches by using a secured site, and their commitment to transparency provides users with a feeling of confidence. The CEO is a former executive at Mintos, one of the very best p2p platforms in the world, which shows the level for which this company is aiming.

What minimum credit score needed to get a loan from Esketit?

CreamFinance does not reveal its credit-worthiness metrics, and there is no way to determine what they are. What we do know, is that they approve only 35% of first-loan applications, but around 85% of second applications. That means they are extremely selective, and that they are happy with the borrowers they do approve.

Which credit bureau does Esketit use?

Credit bureaus are commonplace in the United States, but are not used in Europe. Instead, lending companies and banks assess credit-worthiness based on their own metrics, including monthly income, income-to-debt ratio, collateral, etc. Esketit's parent company, CreamFinance, uses a unique, and secret, artificial intelligence system to determine whether someone qualifies for a loan.

How to become an investor at Esketit?

To invest on Esketit, you must have open an account, complete the KYC process, deposit funds, and begin investing. The registration process could take several days, but once you've opened your account, it's smooth sailing.

How much money will I make with Esketit?

When trying to predict your profits, think long term. The point of investment is to allow compound interest to do its job, and that requires time. Look for consistent growth of around 7% to 12%, as your investments generate passive income that has the potential to grow exponentially for decades. For example, if you invest €1000 at around 9% for 20 years, you will have €5000, and you'll have done nothing but watched as the money grew.

What are the risks with Esketit?

There are always risks when investing money, and the anticipated returns are linked directly to that risk. In the case of Esketit, which focuses on personal loans, the main risk is wasting your time on an investment that yields nothing. You're not like to lose the money you invested, because the loan originator backs that with a buyback obligation. But if you invest money and get nothing back but the money you put it, you've wasted an opportunity - hence the term "opportunity cost." Sometimes there's the risk of the loan originator going bust, but in the case of Esketit, the founders own the loan originators. They also provide a group guarantee, so that the group steps in to deal with any buyback obligations in case the originator goes under.

Why do I need to submit ID verification on Esketit?

There are thousands of scams across the internet, and both the p2p platform and the user benefit from a meticulous Know your Client (KYC) process. This way, the platform knows it's dealing with a real person, and knows the funds deposited are valid. You, in turn, know that you are the one in charge of your user profile, and are consenting to any investments made. Imagine what a disaster it would be if someone pretended to be you and deposited your money into an investment scheme. Similarly, imagine if a company received €10,000 in investment funds, just to discover the money isn't real. KYC prevents all those types of fraud, and more.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Esketit Located?

Esketit is headquartered at 77 Lower Camden Street, Dublin 2 D02 XE80, Ireland.

Verdict

Esketit had a lot going for it: CreamFinance has been very successful in the lending market, and the synergy between the two companies is promising. Furthermore, having instutional backing means Esketit is better positioned to activate buybacks, if and when necessary. Esketit's commitment to transparency, and their low minimum investment requirements make them an attractive platform for investors just trying out the market. The young CEO brings an impressive resume, and the team seems focused on growth. This is certainly a platform that deserves a shot.