These Peer-to-Peer Platforms are Great for Italian Investors

Italian citizens are ideally placed to participate in the ever-growing European peer-to-peer lending and crowdfunding market. Italy itself has no shortage of small businesses seeking bridge loans, and properties seeking development loans. In addition, investors in Italy aren't restricted to local venues. All of the top European p2p lending sites are open to Italian citizens with EU bank accounts. To help you find the best platforms for your financial goals, P2PIncome's financial experts have taken to reviewing the top crowdfunding platforms for investors in Italy.

PeerBerry

PeerBerry is one of the very best p2p sites on the European market. Based in Latvia, but open to any investor with an EU account, PeerBerry enjoys the backing of one of Europe's largest digital-lending entities: Aventus Group. PeerBerry's stellar team, led by CEO Arūnas Lekavičius, has put together a system that looks out for the best interests of the investor. They offer a 100% buy-back guarantee on all investments, such that users need not worry about loss of funds. According to Lekavičius, "the buyback guarantee has been 100% respected" since PeerBerry's inception.

PeerBerry doesn't originate loans. It aggregates them from several originators, including Smart Pożyczka, Pożyczka Plus, Credit Plus, Credit365, Gofingo, Lithome, and Aventus Development. The loan-types vary: On any given day, you might find a short-term personal loan in Poland with an interest rate of 12%, a secured, car-leasing loan in Kazakhstan with an interest rate of 13.5%, or a real-estate development loan in Lithuania with an interest rate of 11%. On average, investors enjoy average annual-investment returns of around 11.05%. PeerBerry boasts a zero-default record.

PeerBerry doesn't charge any fees, and the offer a 0.5%-interest bonus when you sign up. The minimum deposit is only 10 euro, but investors ready to invest large sums will enjoy the various benefits that come with the loyalty programs. At 10,000 euro, investors enter the Silver Club, where they receive an additional 0.5% in returns on all future investments. Similarly, those in the Gold Club (25,000 euro) receive an additional 0.75%, and those in the Platinum (40,000 euro) receive an additional 1%. Given that PeerBerry crossed the billion-euro funding mark in less than five years, its future looks very bright.

Reinvest24

Reinvest24 focuses on the vast European real-estate market, offering development and renovation loans for professional, buy-to-let, and guest-service properties throughout Europe. The company is based in Estonia, and keeps offices in Germany, Moldova, and Spain, in addition to its Estonian headquarters. According to their site, Reinvest24 "is constantly monitoring the market for projects." They conduct thorough background checks on the borrowers as well as financial assessments of the properties and projects. Investors enjoy not only the profits collected from interest, but also long-term rental dividends and eventual capital gains (at exit).

On the Reinvest24 marketplace, investors will find 4 types of real-estate investment opportunities: development projects, real-estate-backed loans, non-performing loans (NPLs), and rental projects. Each has its own conditions and standards. For example, a real-estate-backed loan is a loan to a 3rd party where the mortgaged property can be leveraged as collateral. A rental project, on the other hand, is purchased by Reinvest24, using a special-purpose vehicle (SPV), and rented out. The first type drawn profits from interest, the latter from rent.

Similarly, Reinvest24 will purchase NPL's via an SPV and initiate a rehabilitation project with excellent potential for capital gains upon exit. Often, these project take a couple of years to realize, but given the obligatory <60% LTV, investors are likely to enjoy large profits when the project comes to term. In the case of development projects, there are often several funding phases, and construction is left to companies with which Reinvest24 has well-established relationships. The bottom line is that Reinvest24 puts investors in a position to enjoy profits as high as 14.5%, which is well above the industry average.

Iuvo Group

Iuvo Group is an award-winning p2p platform with attractive annual returns, a generous loyalty program, and a flexible yet high-yield savings account program called IuvoSave. With over a dozen loan originators from which to draw, Iuvo always has opportunities for savvy investors, and their helpful staff is always available to guide you through the investment process. The minimum investment is only 10 euro, and investors enjoy an average annual profit of over 9%. Add to that the 5% you can earn via the savings program and you've got one of the best platforms for passive income.

Iuvo Group offers two services: investment and savings. Users can deposit money into their Iuvo investment account in order to purchase loan notes on the marketplace, and they can also deposit funds into a high-yield IuvoSave savings account. The minimum investment is only 10 euro, while the minimum savings amount is 100 euro. On the marketplace, you can invest in loans from several originators, including EasyCredit in Bulgaria, VivaCredit in Romania, and NordCard in Latvia. Transactions take place in euro, using Iuvo's currency exchange. The returns from investments range from 8% to 10%.

IuvoSave offers several savings plans, including a 3-month plan yielding 5%, a 6-month plan yielding 6%, and customized long-term plans. Savings can be deposited either in euro or lev (Bulgaria). Investors interested in Iuvo's loyalty program should be prepared to deposit a minimum of 10,000 euro, to quality for the Silver club, and 25,000 to qualify for the Gold club. Silver benefits include faster processing on deposits and withdrawals, reduced fees for sales on the secondary market, and a 1.5% bonus (up to 500 euro). Gold members receive the same bonus, pay no fees on the secondary market and priority access to new investments.

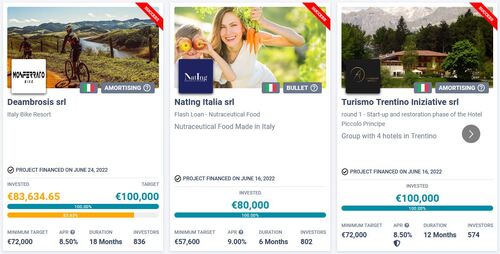

EvenFi

Obviously the main goal of investing is turning a profit, and EvenFi will help you do that. But in the process, you'll also help promote social progress and local business within the Italian market. That's because EvenFi's stated purpose is to help Small-and-Medium-Sized Enterprises (SMEs), as well as companies seeking to make the world a better place. Whether helping local artists and artisans, or promoting green-energy solutions, EvenFi seeks to make a difference within Italy, as well as Spain.

EvenFi originates its own loans, mostly within Italy, as opposed to aggregating them from other loan originators. They get to know the people behind the businesses so they can better understand the goals of the company. In some cases, they provide small-scale business loans intended to help a local artisan get started, but they're also able to provide loans in excess of a million euro if necessary. EvenFi has funded everything from investing in movies to bakeries, from local jewelry shops selling amulets and cameos to million-euro land-development projects.

If you're interested in investing within Italy itself, simply filter by Italy on the Country tab of the Invest page. You can also filter by Status, such as Raising (meaning currently active) or Coming Soon. In addition, you can choose the loan structure, such as Amortizing, Bullet, Dynamic, etc. Lastly, you can set the range for the Risk Level, APR, and Maturity (term) of the loans. Each listing takes you to a page with a detailed prospectus that provides all the information necessary to make an informed investment.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Business Loans

Average Returns

7.4%

Minimum Investment

EUR 20

Signup Bonus

No

Registered users

20,000

Total funds invested

EUR 36 Million

Default rate

Undisclosed

Regulating entity

Comisión Nacional del Mercado de Valores

Buyback guarantee

Secondary market

Payment methods

MangoPay

Withdrawal methods

MangoPay

In this detailed review, P2PIncome's financial experts assess EvenFi.com, an Italian crowdfunding platform that emphasizes social impact in addition to profits and gains.

Verdict

You're not actually obligated to choose a favorite platform on which to invest. To the contrary, diversification across sites is as important as it is across projects. That being said, some people feel a need for a "verdict," and if that's what you're looking for, our verdict is PeerBerry. The platform has a proven record of crisis management, having successfully survived both the Covid19 pandemic, and the effects of the Russo-Ukrainian War. They crossed the 1-billion-euro-funded mark with seeming ease, and they offer one of the most reliable buy-back guarantees on the market.