Swaper Reviewed | Auto-Investing in Unsecured Consumer Loans

Swaper is a Estonian based peer-to-peer lending platform that was founded in 2016 by Marina Tjulinova. They deal solely with short term unsecured consumer loans that range from 50 - 1500 EUR. Their borrowers are primarily from Spain and Poland and the platform has won several awards for being a state of the art, financial tech company.

Types of Loans on Swaper

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Swaper Loan Characteristics

Loan duration30 Days

CurrencyEUR

Buybacks Yes

Collateral No

Available inEUR

Returns rate14 - 16%

Default RateUndisclosed

Recovery RateUndisclosed

FeesNone

Bonuses2% Loyalty Bonus

Swaper Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Swaper?

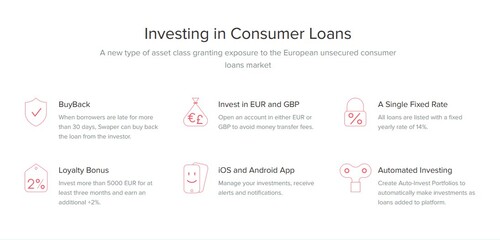

Swaper began being profitable in May 2019 after having been operations since October 2016. The minimum deposit is €10 and users can expect to receive a 16% yearly return on their investments. All projects on Swaper are unsecured and come with a buy back guarantee. Swaper has funded over €220 million in loans since their operations, from only one loan originator and parent company, Wandoo Finance.

Lender/ Borrower Ecosystem

Swaper is a peer-to-peer lending market that operates with one loan originator, Wandoo Finance. Marina Tjulinova is also the legal owner of Swaper. However, Swaper's platform and model is configured to be able to include additional loan originators. This would eventually turn Swaper into a loan originator aggregator like Mintos and PeerBerry.

Only those in the EEA, the European Economic Area, can invest in Swaper. Lenders on Swaper can expect a 14% yearly return. If the investment exceeds €5000 then they receive a bonus of 2%, making a total of 16% in yearly interest.

Borrowers on Swaper are there generally for unsecured consumer loans. Swaper issues a buyback guarantee for all loans. Swaper is unique to the Peer-to-Peer lending space as it charges no fees to invest on their platform. All services, including: selling loans on the secondary market, deposits, withdrawals, loan purchases, all of it comes at no additional cost. Swaper's ecosystem is heavily reliant on Wandoo Finance's ability to service loans. Swaper takes their cut from Wandoo Finance to be on their platform. Wandoo Finance covers the fees that would otherwise be there for the investors. The investors on Swaper are not encouraged to do their due diligence, rather to let the platform generate the revenue for them.

In comparison to the rest of the industry it is clear Swaper dedicates more of its resources to display and user interface. Rather than allowing investors to do their own due diligence.

General Data

| General | Data |

| Origin | Tallinn, Estonia |

| Founded | 2016 |

| Offices | Tallinn, Estonia |

| Loan Type | Consumer Lending |

| Sign Up Bonus | €10 |

| Fees | 0% |

| Interest Rates | 14% |

| Min Deposit | €10 |

| Investment Duration | 30 Days |

| Secured Lending | Yes |

| Currency | EUR |

Registration & Withdrawal

It takes a few minutes to register. After verifying an address, number and standard KYC, users can deposit. There is a €10 minimum deposit, after which, users can manually or automatically invest.

The website itself is very user friendly, and Swaper makes frequent successful updates to their level of transparency and website quality. It is recommended to deposit in euro to avoid loss on currency exchange, as the platform operates with euro only.

For free euro deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. Swaper does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

Marketplace

Swapers marketplace is only comprised of unsecured consumer loans that are issued from WF. There is no real option to diversify loan contracts. Investors are basically giving their capital to Wandoo Finance, which then issues out new loans to borrowers to finance their repayment.

Swaper offers manual investing, auto-investing and a secondary market. Their primary market has both manual investing and an auto-investing tool. After lenders fill out their auto-invest tool they can sell their loans in the secondary market for a marked up or marked down price. Many P2P lending investors enjoy having the secondary market as a feature in case their is an imperative necessity to cash out.

Investment Strategy

Swaper only offers their auto-invest tool for their advertised return of 14%. The tool is very simple to use and allows investors to choose the parameters for which types of loans they would like to invest in. Users can decide the duration, location, and currency, to automatically reinvest and decide whether to allow for early and late repayment.

Lenders can configure their auto-investing tool to invest in a minimum of €10 or a maximum of €10,000. For the duration investors can set their auto investing tool to operate from three months to 36 months. At any point the auto investing tool can be stopped. The auto investing tool predicts the amount of projected interest rate and total projected return.

There is no real investment strategy. If a user invests more than €5000 then they are eligible for a 2% bonus on their yearly return.

Risks Involved

Wandoo Finance is in a tough position considering they cover all of the fees on the platform as well serve as a buy back guarantor for any loan that defaults. This is a huge burden on a company, and in the event that Wandoo Finance can't service the loans, then the buy back guarantee is useless and their is no collateral to sell for fund recoveries. Certainly one of the more frightening risks a platform could have. Generally speaking, it is better to opt for loans that are secured. And if choosing to use loan originators, choose loan originators with an additional group or state guarantee.

If either aren't an option, look to see the history of the platforms fund recovery track record. It is easy to find the recovery rate of a given platform. As an investors we need to find the information regarding how much funds are recovered in the event of a defaulted loan. Those with high rates of successful recoveries are the best platforms to invest with.

Since 2016, all financial statements released by Swaper have indicated that their platform is indeed profitable.

Transparency & Security

Once a week Swaper issues blogs for their investors to track Swaper's performance as a platform. Swaper, being an extension of Wandoo Finance, has its setbacks. For starters, lenders are not privy to the actions, identity, or proven credit rating of the borrowers. Wandoo Finance manages everything related to choosing the loans, checking their credit rating, and then supplying them to Swaper. This symbiosis, while attractive for being able to divide two sides of the business, can also function as a double edged sword for investors. If Swaper fails, it is problematic for Wandoo Finance. If Wandoo Finance fails, Swaper fails with it.

Wandoo Finance does not disclose any of it's dealings with Swaper's investors, making it difficult to assess real risk factors. Unlike, PeerBerry, which has an identical model, Aventus Group their Wandoo Finance equivalent has posted their yearly financial statements for several years running, all showing that Aventus themselves are highly profitable.

Lenders do not have the ability to manually select their loans. Lenders should be skeptical of a 14% promised return, unsecured consumer loans, an opaque loan originator, and only an option to auto-invest. It all sounds too good to be true.

Crisis Management

The 2020 Corona Virus pandemic really put P2P lending platforms to the test. The ones who were forced to shutdown because of the pandemic were simply less equipped and resourceful to run a quality peer-to-peer lending platform. Others, like Swaper proved not only that they were great platforms but their approach to risk mitigation was a successful one.

A look at their statistics would further reinforce that they functioned well even during difficult times.

Our Readers Have Asked:

Is it safe to invest with Swaper?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward as well as the chances of losing your investment.

How much money will I make with Swaper?

Swaper proclaims that investors on their site make anywhere between 14-16 percent in yearly returns. Swaper features both auto investing and manual investing in order to maximize profits.

What are the risks?

Swaper is one of the few platforms that have never lost their investors capital. Historically speaking, the worst situation you will have on Swaper are late loans.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Swaper is certainly one of those companies that is honest, hard working and profitable.

Where is Swaper located?

Viru väljak 2, 10111, Tallinn, Estonia

Watch & (L)earn

Discover more about Swaper in this short but informative video.

Pros, Cons and the Verdict

Pros

- Auto-Investing

- Manual Investing

- Fixed Yearly Return

- Buyback Guarantee

- Low Minimum Entry

- High Returns

- Secondary Market

- No Fees

Cons

- One Loan Originator

- Lack of Transparency

To conclude, Swaper is certainly a top functioning Peer-to-Peer lending platform. They report a low default rate, and a high return. They are backed by a well established, financial institution that at least on paper, promises to have Swaper and its investors' best interest in mind.

Their platform provides a nice experience regarding navigation, auto-investing, and receiving profits. It's worrying that Swaper only works with one loan originator despite having a service that accommodates multiple loan originators.