German Investors Should Consider These P2P Platforms

Citizens of Germany enjoy all the benefits that come with a European Union (EU) passport. They can travel freely within Europe, open an EU bank account, and utilize any financial services available within the European Economic Area (EEA). It stands to reason, therefore, that German citizens keen to invest their money should look into EU-based p2p lending platforms. Which crowdfunding and p2p platforms are best suited to the German Investor? In this article, P2PIncome's financial experts address that question and provide their recommendations for the best p2p crowdfunding and lending platforms for German investors.

PeerBerry

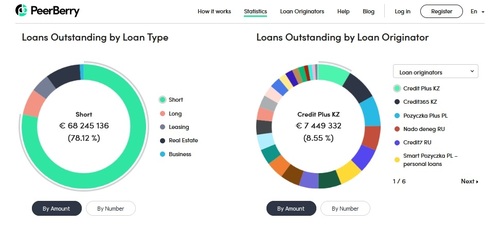

Founded in 2017, PeerBerry is a Latvian p2p platform with institutional backing from Aventus Group, one of the largest digital-loan providers in Europe. On PeerBerry users with EU bank accounts can purchase notes from personal loans, business loans, car loans, payday loans, bridge loans and so on. PeerBerry's 10-euro minimum deposit makes it accessible to all investors, and because the lending is secured, investors can feel confident in their investments. PeerBerry also has a generous loyalty program for those able to invest 10,000 euro or more.

PeerBerry has a well-earned reputation as one of Europe's top-tier p2p platforms. In their first 5 years of operation, they managed to draw over a billion euro in investments, despite such challenges as the Covid19 epidemic and the Russo-Ukrainian War. As an aggregator, PeerBerry lists loans from dozens of loan originators throughout the European Union and the great EEA. Loan terms range from 1 day to several years, with interest rates ranging from 9% to 13%.

To invest on PeerBerry, users must prove they have an EU bank account, which means German citizens need not worry about access. All investments are in euro, meaning you will not need to worry about exchange rates. On average, users enjoy average annual-investment returns of around 11%, which is above average for the peer-to-peer lending industry. Users interested in keeping up with the latest news will enjoy PeerBerry's blog, which posts articles on a regular basis.

Reinvest24

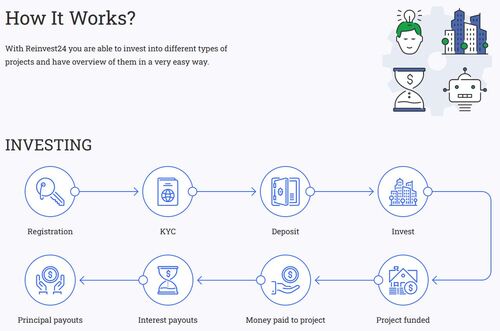

Reinvest24 is an Estonian real-estate crowdfunding platform open to users with EU accounts. They have offices in Estonia, Spain, Moldova, and Germany. The company lists real-estate projects at various phases of development, including completed rental properties from which users can draw passive income in perpetuity. Reinvest24 has a minimum investment of 100 euro, up from its original 10-euro minimum. Still, the site offers excellent returns, and its robust secondary market allows users to move notes with ease.

Reinvest24 focuses on the European real-estate market, offering loans for development projects, mortgages, and service-based properties. Many of the loans are asset backed, while others are secured by favorable Loan-to-Value (LTV) ratios. Reinvest24's team meticulously inspects every borrower's credit history, and performs a unique project-risk assessment. On their marketplace, Reinvest provides detailed overviews of each project, including a gallery of pictures, descriptions of the property and the surrounding area, and other data necessary to make an informed decision.

Reinvest24 users must have an EU bank account, but they can utilize payment providers such as Wise, Revolut, or Paysera to make transfers. All transactions on the platform are in Euro. Reinvest24 reports average user-profits of approximately 14.5%, including rental dividends. That's an excellent ROI by any standard. There is a 1% Success Fee on profits from exited projects, and a 2-euro transaction fee when making withdrawals, but the site is otherwise free of added or hidden expenses.

Rendity

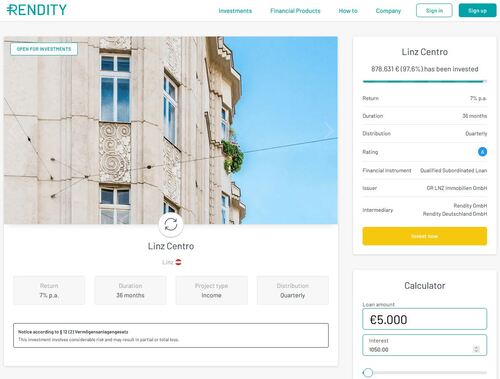

Rendity is a loan originator and crowdfunding platform based in Austria. The platform only deals in real-estate located within Germany and Austria, and conducts one of the most detailed borrower assessments you'll find in the world of peer-to-peer lending. The selection process limits the platforms scope to top-tier projects only, making it a safe bet for conservative investors. On the other hand, Rendity's conservative approach means their returns are lower than many other sites, with the average annual return hovering around 6.5%.

Rendity is a sophisticated platform on which investors can select from 4 investment vehicles, each aimed at a particular types of growth. Investors interested in a safe option can choose Rendity Bonds, which are fixed-income vehicles with a "predefined maturity" that Rendity distributes annually. These bonds fund well-established companies involved in real-estate development. On the other hand, investors looking for regular income can invest in Rendity Income listings, which are rental notes that pay out quarterly.

The third option is the Growth vehicles, which fund new buildings and general renovations. These are the most aggressive options on Rendity, and they're also also paid out annually. The fourth option is the Savings vehicle, which allows investors to deposit money each month into a high-growth savings program that draws its growth from real-estate investments. There are three versions of the savings plan, based on the desired rate of growth: Conservative (~6.25%), Balanced (~6.4%), and Growth-Oriented (~6.8%).

Iuvo Group

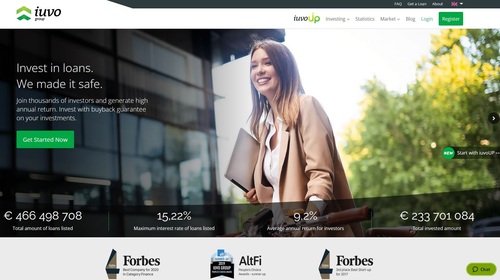

Named Forbes Magazine's Best Company in the finance category for 2020, Iuvo is an investment and online-savings platform with broad range and availability. Iuvo works with dozens of loan originators throughout the EEA, including EasyCredit in Bulgaria, VivaCredit in Romania, Ibancar in Spain, and SN Finance in Macedonia. The minimum investment on Iuvo is only 10 euro, and the site charges very few fees. In addition, it offers a high-yield savings account called IuvoSave.

On Iuvo investors will finds scores of personal loans, each of which carries a principle guarantee of 100%. Most of the loans are below 1000 euro, and most are relatively short term (under one year). Investors should take note: Many of the listings have poor credit assessments (D - E), and delays of 3 to 15 days are rather common. It's also worth noting that while the loans are listed in euro, the site works with several currencies, including the Bulgarian lev, the Russian ruble, the Polish złoty, and the Romanian leu. Iuvo also offers an active secondary market.

In addition to crowdfunding, Iuvo offers an excellent savings program, called IuvoSave (formerly IuvoUp), where users can enjoy fixed-rates of return as high as 6%. The savings programs facilitates liquidity, and users may withdraw funds at any time. The process is fully automated; users need only deposit funds and set the terms. For example, a 3-month savings track will yield 5%, while a 6-month will yield 6%. Users can continue to reinvest their savings ad infinitum, and there is no maximum limit on amounts. Early withdrawals greater than 10,000 euro do entail a 1% fee, but otherwise there are no fees.

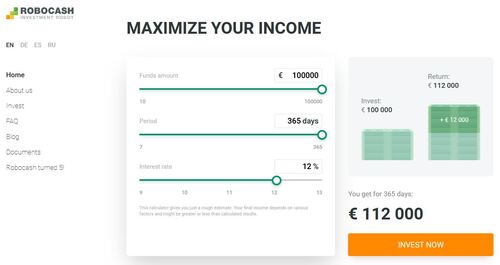

RoboCash

Located in Croatia, but operating throughout the EEA, Robocash is a fully automated peer-to-peer lending platform that lists consumer loans from its own loan originators: RC Riga-Kazakhstan, RC Riga-Sri Lanka, RC Riga-Singapore, UnaPay (Philippines), and Prestamer (Spain). Despite not originating loans from within Germany, over 25% of Robocash's investor base is from there. All loans on the site are listed in euro, they all come with a 30-day 100%-buyback guarantee, and the site offers generous bonuses for investors committing 5000 euro or more.

Robocash was founded by Sergey Sedov, who earned a PhD in economics from the Russian Academy of Science. He launched Robocash in 2017, as a subsidiary of Singapore-based Robocash Group. The platform differs from most other peer-to-peer lending sites in that its primary market is only open to automated investment. The site markets this as an advantage, arguing that it saves investors time and effort, and there's some validity to that. On the other hand, the inability ever to review a loan before selecting it can be unnerving.

Nevertheless, Robocash is a successful site with an average user portfolio of 3500 euro, and an average annual return of around 11.5%. In addition, investors who commit 5000 euro or more enjoy added percentage points. At the Bronze level (5000 euro) investors receive in additional 0.3%, while at the Platinum level (50,000 euro), users receive an additional 1.3%. You don't need to sign up for the loyalty program, by the way. Your account automatically qualifies when you reach the required amount.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Real-Estate

Average Returns

6.4%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

32,000

Total funds invested

EUR 136 Million

Default rate

Undisclosed

Regulating entity

German Chambers of Industry and Commerce

Buyback guarantee

Secondary market

Payment methods

Bank Transfers

Withdrawal methods

Bank Transfers

Rendity is an Austrian fintech company that originates real-estate development loans and sells notes from those loans on its marketplace. In addition, Rendity offers 3 high-yield savings programs with varying degrees of risk. The average yield on Rendity is around 6.4%, which is also the rate of the medium-risk savings plan.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

Verdict

There are hundreds of peer-to-peer lending platforms operating around the world, and it would take years for potential investors to investigate all of them. P2PIncome has taken the time to highlight the top platforms on the market today. For those within the EEA, as is the case for German investors, the platforms mentioned here are the best of the best. Of those, PeerBerry stands above the rest. Led by Arūnas Lekavičius, this is a platform with over a billion euro in investments, proven success during global crises, and a business model that continues to deliver.