A Good Start for Our P2P Investments in 2022-Q2

Please read P2PIncome's most recent investment-portfolio report for 2025.

Thus far, 2022 has been an interesting year. On the positive side, the infection rates and deaths due to Covid19 have decreased enough to allow many countries to return to normal. On the other hand, war in Easter Europe has led to a complicated set of sanctions and embargoes against Russia, which has responded with counter-embargoes of its own. There is currently a lot of confusion about the future of the oil market, in particular, and the Eastern-European economy in general. In addition, a looming supply-chain crisis threatens to wreak worldwide havoc. Some countries are already struggling to import necessities and restock shelves.

Peer-to-peer lending activities have been halted in most of Russia, Ukraine, and Belarus, but the rest of the market seems to be performing quite well. In this monthly report on our sample portfolio we find our investments continuing to progress. Our average monthly growth is around 0.8%, and our 12-month average IRR is an impressive 9.69%. EstateGuru is back in the game, and PeerBerry posted an excellent month. Reinvest24 didn't report much growth this month, but that's only normal considering the unusual returns we observed in May of 2021. We are currently very satisfied with all 3 sites.

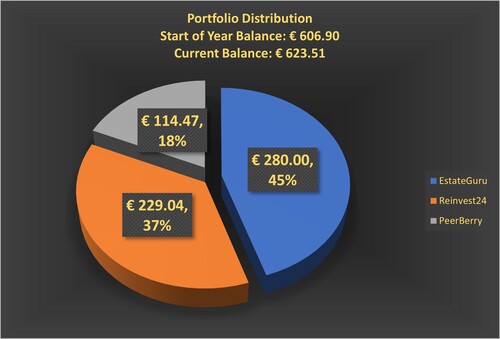

Overview of Our Current Portfolio

During the first month of Q2 our investments performed reasonably well. Reinvest24's numbers (0.14% gains) might seem worrisome, but upon reflection we understand that there has to be something to balance out the unusual 3.74% leap the account enjoyed in May of 2021. Averaging out the two still suggests an unrealistic average of 1.94%, meaning right now the highs outweigh the lows by a wide margin. Meanwhile, EstateGuru, which nearly gave us an ulcer in late 2021, has found its stride and its 12-month average of 8.12% is cause of optimism. PeerBerry is the star of the month, however, and its 1.18% performance boosted its averages to 0.81% monthly and it's IRR to 9.78%.

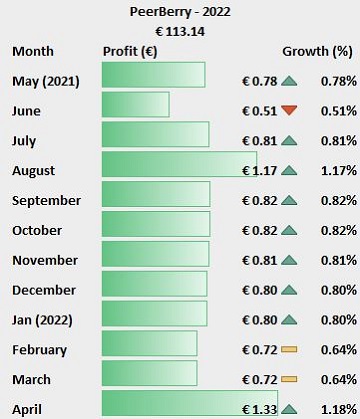

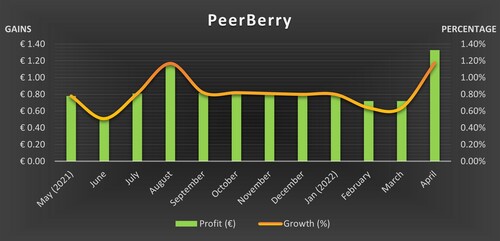

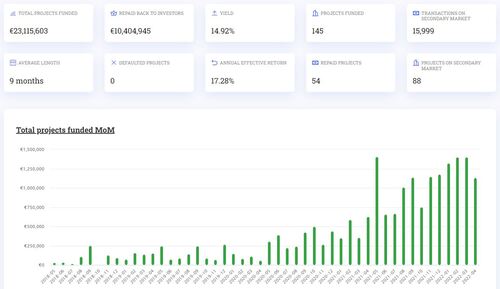

PeerBerry

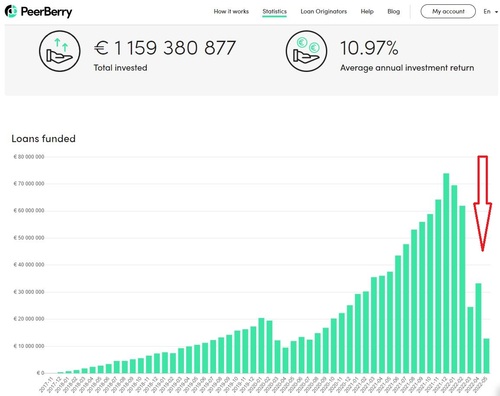

April 2022 brings PeerBerry to the forefront, as it posts impressive gains on P2PIncome's sample portfolio. We've always considered PeerBerry to be one of the best peer-to-peer lending platforms on the market, so we're happy to highlight them this month. In last month's report, we mentioned that PeerBerry was one of the first sites to shut down its activity in response to Russia's invasion of Ukraine, but that move hasn't affected our portfolio at all. A glance as PeerBerry's stats page, however, shows the platform's Loans Funded metrics have dropped precipitously, but we anticipate a return to normal growth by Q3.

PeerBerry - Our Account Figures - April 2022

March Balance: € 113.14

April Gains/Losses: € 1.33

April Balance: € 114.47

Monthly Increase: 1.18%

Total Profit to Date: € 13.14

We concluded the month of March with 113.14 euro in our account, and gained an impressive 1.33 euro over the course of April. This brought our new total to 114.47, for a net gain of 14.17 euro since our initial deposit of 100 euro in late 2020. The increase of 1.18% brought our average monthly-growth rate to 0.81%, and our 12-month average IRR to 9.78%. On their statistics page, PeerBerry reports an Average Annual Investment Return of 10.96%, and we'd like to reach those numbers. We're not far off, so we're curious to see whether we can reach them before the end of 2022.

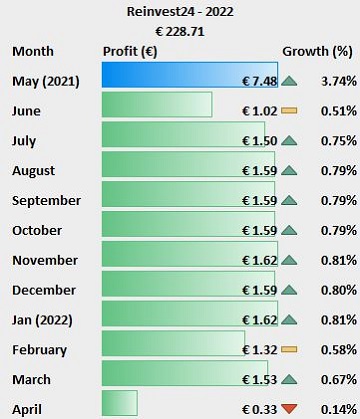

Reinvest24

If you make the mistake of looking at Reinvest24's numbers for April out of context, they look awful. No one would invest on a site that reports gains of 0.14%, nor should they. However, this isn't the whole story. Reinvest24 has reported consistent gains since May of 2021, when there was a huge boost (3.74%) due to some investments coming to term. There will always be months that offset such boosts, and April 2022 was that month. Averaging the two—May 2021's 3.74% and April 2022's 0.14%—we get 1.94%, which is still uncharacteristically high. That means we need to be prepared for at least one more correction in the coming months. Thereafter, we should expect a return to ~0.75% gains.

Reinvest24 - Our Account Figures - April 2022

March Balance: € 228.71

April Gains/Losses: € 0.33

April Balance: € 229.04

Monthly Increase: 0.14%

Portfolio Profit to Date: € 28.71

We concluded the month of March with 228.71 euro in our account, but gained a paltry 0.33 euro over the course of April. This brought our new total to 229.04, for a net gain of 29.04 euro since our initial deposit in late 2020. As mentioned, this month's performance should be viewed as a "correction" to the site's performance in May of 2021, so we are not terribly concerned. In fact, if we look at our total profits since opening the account (29.04 profit on a 200 euro deposit), we see a yield of 14.52%, which is quite close to the site's reported yield of 14.92%.

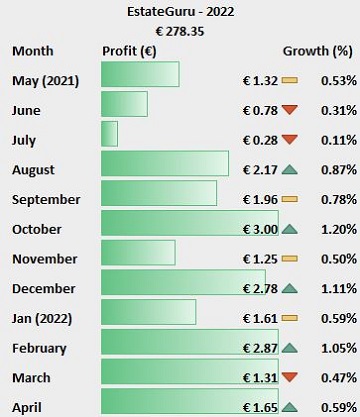

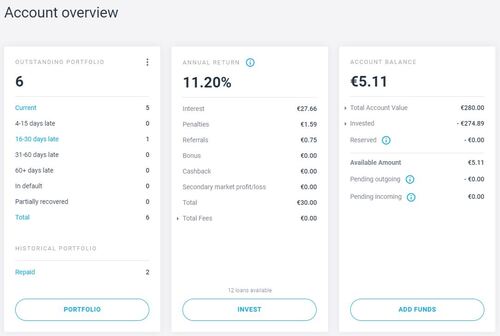

EstateGuru

Our experience with EstateGuru took a difficult turn last year, as we struggled with a borrower who seemed unable to make payments, and a lender who seems all too willing to reschedule the loan over and over. In the end it all worked out, and the loan was repaid in full. Since then, EstateGuru seems to have regained its footing, and P2PIncome's financial experts are cautiously optimistic about the platform.

EstateGuru - Our Account Figures - April 2022

March Balance: € 278.35

April Gains/Losses: € 1.65

April Balance: € 280.00

Monthly Increase: 0.59%

Portfolio Profit to Date: € 30.00

We concluded the month of March with 278.35 euro in our account, and gained another 1.65 euro over the course of April. This brought our new total to nice round 280, for a net gain of 30 euro since our initial deposit of 250 euro in late 2020. We currently have a balance of 5.11 euro we need to reinvest, and according to our profile we are enjoying an Annual Return of 11.20%. In addition, one of our borrowers is 16-30 days late with payment, so we might see an extra boost next month.

Comparing Platforms

As we enter Q2 of 2022, we find ourselves optimistic. EstateGuru is back on track, and we're currently enjoying a one-year monthly average of around 0.7% and an annual return of 11.20%. Similarly, our investments on Reinvest24, despite the slow month, report a monthly average of around 0.9% and an annual return of 11.20%. PeerBerry reports a monthly of around 0.8% and an annual just under 10%, meaning all 3 sites are doing well.

| Platform | Balance | Payout | Yield |

| PeerBerry | € 114.47 | € 1.33 | 1.18% |

| Reinvest24 | € 229.04 | € 0.33 | 0.14% |

| EstateGuru | € 280.00 | € 1.65 | 0.59% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

P2PIncome's financial experts are cautiously optimistic about all three sites. EstateGuru seems back on track, Reinvest24 suffered a mild correction, and PeerBerry performed very well. Our concerns about the market are not due to the performance of these sites; rather, we are concerned about how global issues might affect the entire market. PeerBerry's scope has been limited by having to shut down activities in a key area. Reinvest24 and EstateGuru deal in real-estate, and if borrowers cannot obtain supplies they will not be able to complete their projects and repay loans. Nevertheless, PeerBerry posted great earnings this month, and stands atop our list. It's a great site and we highly recommend it.