Europe's Top P2P Lenders

P2P Lending in Europe

There are a great deal of good European Peer-to-Peer lenders. Some of the most impressive we have seen include PeerBerry, October and EstateGuru. Each company has successfully repaid interest and in the worst case scenarios, gave back principal. All have a relatively low interest rates, but because of their default rates being so low and successful, and fund recoveries being so high, they have earned the top position.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Business Loans

Average Returns

3 - 7%

Minimum Investment

EUR 20

Signup Bonus

EUR 20

Registered users

43,000

Total funds invested

EUR 1 Billion

Default rate

3%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

October specializes in small risk business loans specifically to SME's in Europe. October has a great track record of fund recoveries, a solid mission and a very strong foundation. October's business and risk strategy is worth the time to read.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

PeerBerry

There are a few main reasons as to why PeerBerry comes to the list. PeerBerry has it all. Auto-investing, easy to use platform, reasonably high returns in comparison to their minimal risk. All loans have buyback guarantees and all buyback guarantees are further secured by group guarantees. PeerBerry's multilayered approach to risk management is one of the reasons for its rapidly growing adoption.

The main entity that supports PeerBerry is Aventus group, a highly profitable loan company with decades of experience in the field. Moreover, their business model is highly sustainable and scalable. They offer relatively high risk investments in countries that are struggling to obtain capital. And yet, all loans on PeerBerry are serviced.

Projects from high risk countries like Ukraine, Moldova and parts of Russia can be funded through PeerBerry without having to risk lender principal. Over time, if PeerBerry continues to prove itself, then these states and projects will not have to be listed as high risk and the company can simply scale from that point onward.

It's well known PeerBerry is Europe's number two P2P lender, but it very much contends for first place. The only downside is that PeerBerry is relatively young and has yet to stand the test of time.

October

October is so much more than just a Peer-to-Peer lender. They have been and continue to build into the very foundations of Europe itself. October serves small to medium sized enterprises or SME's in Europe, SME's comprise the majority of the economy and October enables lenders from across the globe to invest. European markets have historically been very attractive and now they are more accessible at a more affordable rate.

For a business it is a more attractive offer to take debt over equity. By allowing business owners to retain their equity they are in effect becoming more financially stable and able to pay off their debts. Moreover, business owners have a means to pay back their debts as opposed to consumer loans, mortgage loans or auto-loans. There is more assurance on the side of the lender when lending to an entity that generates income. Whilst less rewarding, it is also less risky to lend money to a business than to invest in one. When a business dissolves, the debts are always paid first and equity is paid last.October catches a lot of attention for their ability to seek out good projects, very high repayment rate and 100% success in fund recoveries.

October only offers a 4 - 8% IRR. This is pretty low for market standards but they have proven that they deliver. Many other P2P platforms are prone to have defaulted loans and lost funds. October dedicates an enormous amount of resources to transparency, due diligence, and investor education. October not only wishes to allow everyone to make passive income, but to also understand what is the mechanism behind it.

Despite October being a project solely for Europe, October, allows lenders from all over the world to take part in their lender/ borrower ecosystem. The only downside to all of this, is that October doesn't allow an auto-investing tool.

EstateGuru

EstateGuru is the most profitable of the three. It promises an 8 - 12% IRR, has never lots its investors principal and remains uncontested as Europe's best Peer-to-Peer real estate lending platform.

Its only downside is that it's solely for real estate. Which for investors, is not a downside. For borrowers, it simply means it's less accessibility. Real estate is also a different in a different ball park altogether. There is always a way out for real estate if worse comes to worst, and that's because all loans are backed by a mortgage. So, if the borrower defaults, the property, land, and equipment can all be sold. And, at the very least, if the loan-to-value ratio or LTV is low enough, the principal is returned. Nothing is gained, but some time is lost.

EstateGuru primarily offers loans in the Baltic region of Europe. All loans are real estate based but users can invest in a few different types:

- Hotels

- Apartments

- Condominiums

- Houses

- Malls

- Offices

EstateGuru has an incredible interface with an easy to use auto investing tool. The only downside to EstateGuru is that their auto-investing tool requires a minimum of a 250 EUR deposit. Though, this is hardly a downside seeing as if one hopes to achieve a considerable return, one would have to deposit, at the very least, 250 EUR on EstateGuru.

Defining P2P Lending

Peer-to-Peer lending is a marketplace where individuals from all walks of society come together to borrow and lend money from one another. The attractive aspect being that Peer-to-Peer can offer attractive interest rates for the lenders whilst still being cheaper and more accessible for everyday people. Moreover, since the 2008 financial regulations have only become more difficult to comply with, getting a loan from the bank is not as easy as it used to be. P2P lending takes the chance on the people society would not consider. And it's successful. Most platforms report a very low default rate and many investors and borrowers have processed billions of dollars worldwide.

The world today can finally support peer to peer systems. Being globally connected online to giant markets on incredibly designed financial applications is an economic game changer. The micro financial aspect of P2P lending is also another feature that will prove to enlarge the middle class by providing all bread winners more value on their income.

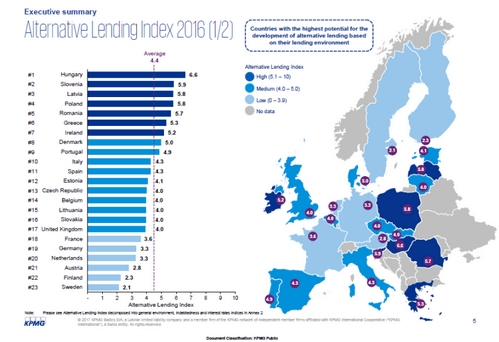

P2P Lending in Europe

Peer-to-Peer lending first began in the U.K. before it expanded to Europe and subsequently, the world. The European P2P market has become in many ways one of the most secure ways to invest in P2P lending. European models have undertaken the goal of being as safe as possible for investors to lend money. Peer to Peer lending is in many ways unconventional. It poses great risks to banks, to the extent that many banks have opened branches and organizations to facilitate loans on peer to peer markets. It helps the economy. And it truly democratizes financial power within society.

In Europe P2P lending platforms have focused on ensuring that capital is not at risk and that borrowers pay back their loans. There is a great emphasis on ensuring that the ecosystem itself is trustworthy. That being said, investors sometimes wait years before seeing their funds recovered without real solutions in sight.

P2P lending in the US takes a different approach when loans default.

First, the top US platforms are extremely selective in terms of borrowers and investors. Their credit requirements make it difficult for high-risk borrowers to get loans. The second-tier US platforms, on the other hand, usually rely on litigation as a form of fund recovery. They do recover funds but at high costs for investors and the ecosystem is permanently damaged in the aftermath. If everyone's solution is litigation, the market will effectively get smaller with every default.

European P2P platforms like negotiation. They try to find the best way to resume the lending-borrowing relationship. Sometimes it takes time but it also has a high success rate. After which, borrowers get slightly worse scores but they can still remain on the platform and can still contribute to the ecosystem. And lenders, although they may wait a bit longer, see their principal returned and regularly, through partial accrued interest.

Ultimately, it isn't a good thing to want to maintain unreliable borrowers on a platform. But, if it is inevitable, it is better to know that there is a sustainable solution that provides a better outcome than what already exists. Litigation should only be used as a last resort in these circumstances. The U.S is still learning that with their platforms.

European P2P lenders support buyback guarantees.

Investors can feel assured that if their loans aren't being serviced, the p2p lending site, or one of their loan originators, will step in and cover the cost. In the long run, this is subject to controversy. It doesn't fix the problem of missing capital. What it does is, is push the debt onto the main company and at some point, if enough loans default, the company will default.

When choosing to fund a P2P lending site it is important to recognize if the site deals with loan originators, has a buyback guarantee, and that the financial health of the P2P site indicates its ability to hold your funds without possibly losing it.

P2P lending in Europe v. U.S.A

The USA and Europe are subject to very different financial regulations.

Peer-to-Peer financial services in the US are regulated by the SEC. Due to the nature of the P2P lenders in the US, investors are subject to strict guidelines. Depending on the platform, as restrictions vary, investors can't invest more than 10% of their net worth and must be accredited investors to invest in P2P lending.

Europe has less restrictive regulations regarding who can lend money. Individuals are not required to be investors, or are not limited by their net worth. In Europe, anyone can participate. Europe is even more open in the respect that they allow international individuals to lend money on their platforms. US P2P lenders only accept US citizens on their platforms.

Both Europe and the US take a different approach to P2P lending. Whether this is the result of culture or regulation, Europe is ultimately a more attractive location to lend on for P2P lending.

Who are they for?

These three companies are accessible to anybody who can access a European bank account. Unlike LendingClub, IBAN and so many others. These top three platforms can be used from any country. No lender is discriminated against. Borrowing, on the other hand, is a lot different and is subject to the users' location.

What does Peer-to-Peer lending mean for Europe?

Noticeable mentions include:

Not all noticeable mentions are accessible to users outside of Europe.

Europe has no shortage of impressive Peer-to-Peer lending companies. It's simply the case that many European platforms are attractive, profitable and safe to use.

It was difficult to nominate the top three platforms. However, PeerBerry, EstateGuru and October have never lost anyone's capital despite being years in operation. When it comes to investing, the most important aspect is accumulative gains. And in this context, these three companies will be able to potentially provide the most gains over a long time period.

Their track records also make them attractive to other users who also wish to participate in an ecosystem that can be trusted. Not to mention their business models are all unique and service a different type of loan in society. Their platforms are all encompassing and easy to navigate. It is the case that through the expansion of P2P markets and platforms, that new players on the block will prove to be contenders. Yet, it can be safely said that these three companies have shown their commitment, competency, and ability, when it comes to managing credit relationships and good business practices.

Considering European P2P platforms, one should be wary that if any P2P company fails in any of the following three categories, they ought to be criticized and their place rescinded.

- A form of principal guarantee

- A reliable fund recovery strategy

- Rigorous KYC and Transparent Practices

A guarantee of any form would suffice. But investors need a first level of fund security in order to participate in this market that is at it's foremost, unconventional.

A reliable recovery strategy is vital because it is inevitable that loans will default. A loan company should have tried and true ways of mitigating damage and obtaining missing funds.

Rigorous KYC and transparency is paramount for any financial entity or institution. Users need to know where money is going, to who it's going to, and how has the company managed themselves in the past. A track record is the only piece of evidence that determines an investment vehicle.

Verdict

Investing in P2P lending in European markets compared to the rest of the world is a safer bet. Loans come secured and all sorts of risk mitigation strategies are in place in case of a defaulted loan. The USA has yet to catch up with Europe's approach to risk management. Though, originating in the United Kingdom, Eastern Europe, specifically Estonia and Slovenia, have become the new faces of fintech.

Many start ups which develop new financial technologies and applications are based in Eastern Europe. And their approach leaves little room for improvement. As the world moves forward into the age of the sharing economy, with democratization and decentralization, Peer-to-Peer lending is finding its permanent place with applications on our smart devices.

Out of our top European lenders we believe that PeerBerry is the ideal choice to invest with.