Prosper Reviewed | The First American P2P Lender

Prosper is the first P2P lender to come out of the US. It was founded in San Francisco in 2005. Since then, Prosper has funded over 17 billion USD on their platform, while offering a historic return of roughly 7.5 - 27 % IRR. They are direct competitors with the US's biggest P2P lender Lending Club. Currently, Prosper is only available to citizens in 28 states, the other 22 states can go through 3rd party exchanges to purchase notes on Prosper.

Types of Loans on Prosper

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Prosper Loan Characteristics

Loan duration3 - 5 Years

CurrencyUSD

Buybacks No

CollateralYes

Available inUSA

Returns rate6%

Default Rate3%

Recovery Rate7%

Fees1% Annual

BonusesNone

Prosper Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is Prosper?

Prosper is one of Americas largest peer-to-peer lending platforms. During their first few years they endured the recession of 2008 and had to subsequently shut down. Since then, they have been able to establish themselves as one of the biggest platforms for unsecured and consumer P2P loans. They were founded in California and have allocated a significant amount of resources into bringing awareness and exposure to alternative forms of finance.

Lender / Borrower Ecosystem

Prosper require a 25 USD minimum investment to join the platform. They offer both secured and unsecured loans, but most loans on their platform are unsecured. Prosper deals mainly with consumer loans and debt consolidation.

On Prosper, lenders do not directly fund borrowers. Instead, they buy "notes" from third party services. Users purchase these loan notes that are initially funded by WeBank, a partner company in Utah. These loans are given out to Prosper borrowers, and then lenders choose which loans they would like to fund. The entire system is similar to that of a loan originator P2P lender, but in this particular case, Prosper connects their borrowers to one loan originator and then relies on the lenders to fill up the already available loans.

Prosper offers a multitude of features on their platform to make the lending experience on their platform a pleasurable experience. Lenders can enjoy both a primary and secondary market, diversified returns, an auto investing feature and in-depth descriptions of the potential loans.

Users can open a variance of accounts on Prosper:

- Personal Account

- IRA

- 401K

| General | Data |

| Origin | San Francisco, USA |

| Founded | 2005 |

| Offices | San Francisco, USA |

| Loan Type | Consumer Lending |

| Sign Up Bonus | 25 $ |

| Fees | 2 - 5% |

| Interest Rates | 7 - 9% |

| Min Deposit | 25 $ |

| Investment Duration | 12 - 60 Months |

| Secured Lending | Yes |

| Currency | $ |

How to Borrow:

Prosper offers consumer loans on their platform for a total of 40,000 USD. In order to receive a loan from Prosper borrowers must submit an array of inforomatoin including but not limited to, FICO Score, Identification such as driving license or passport, bank account statement as well as any criminal history.

Registration and Withdrawal

Registering with Prosper is incredibly easy and quick.

Users need to have the following in order to participate in Prospers marketplace.

- US Phone Number

- US Zip Code

- US Social Security ID

Users will also need to fill out their necessary tax info in order to register on prosper. After which, standard KYC must be approved through sending legal documents.

Activation of accounts can take typically range anywhere from one week to a month, even a few months in the case of further verification needed.

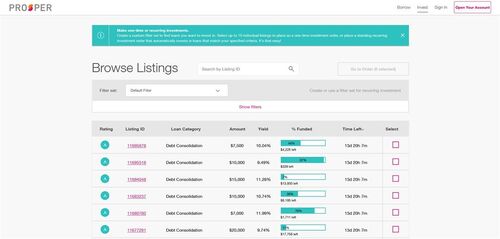

Marketplace

Prospect offers both a primary and secondary market. The upside of secondary markets is that users have an option to liquidate their portfolio. Subsequently, users can find more attractive deals from the secondary market from users looking for an exit.

On Prosper lenders can find a huge variety of different loans to fund.

Borrowers can opt for loans for:

- Debt Consolidation

- Business Loans

- Student Loans

- Mortgage Loans

- Real Estate Loans

- Auto Loans

- Medical Loans

- Special Occasion Loans

The rate of return on loans are based on the borrowers credit score which Prosper itself determines. The higher the risk the higher the return and the same is true for its inverse. Prosper deals mostly with unsecured loans and does not offer a buyback guarantee on most of the loans on its platform.

Borrowers may pay back their loans early at no penalty on Prosper which is different from other P2P platforms in the US.

Prosper, like many other P2P platforms have a simple mission statement, to provide financial well being to everybody. The idea behind prosper is that the way money, credit, lending and borrowing is changing. Companies that have defined the sharing economy, like: AirBnB, Amazon, and Uber, have paved the way for what Prosper calls the "access" economy. Instead of sharing the economy with whoever can participate, Prosper works to give access to the economy so that everyone may participate.

Passive income generating without restriction results in exponential growth. The compounding effect of investing is a force to be reckoned with. By providing everyone the access to multiply their profits over, let's say, a 10 year course, is incredibly powerful. It is the goal of most P2P platforms, though, but Prosper articulates it in a slightly more compelling way.

Investment Strategy

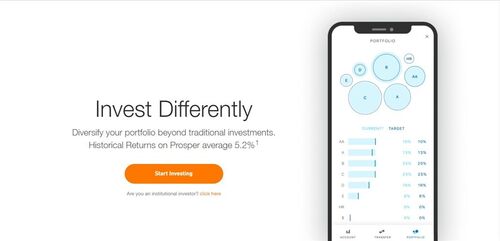

Prosper offers both manual and auto investing. Their auto investing feature is easy, understandable and brings about a decent return of roughly 7% p.a. Their manual investing strategy strongly relies on creating a diversified portfolio of loans from all levels of risk.

Prosper recommends investing in a 100 different loans, with $25 being put into each of them, to a grand total of $2500. This way, if one, two or three loans were to default it would not pose a big strain on a lenders portfolio, as the earnings from the other, healthy notes, would make up for the three that are defaulting.

The question of whether or not a diversified portfolio is a good thing is up for debate. Whilst its never good to put all your eggs in one basket, diversification is not necessarily the answer either. It would be more advisable to ensure that what ever is being invested into is approached with great caution and attention to detail or "due diligence". It would probably be best to only lend money to credible borrowers who have a good, proven credit record.

One of the more unique features of Prosper is that it very much advertises to borrowers. Many p2p platforms probably figure that people are looking for capital, so they emphasize their marketing and appeal to lenders. Whilst, not really paying as much attention to the borrowers. That isn't the case on Prosper, which aims to cater to both sides of the market. This results in having a lot of diversity and exposure for lenders. As well as, a platform that borrowers can feel comfortable using.

Risks Involved

- Default Risk - when a loan defaults there is no guarantee that lenders will see even their principal return.

- Inflation Risk - the risk of inflation where a users capital is locked up whilst slowly lowering its value due to economic despair.

- Management Risk - the fees associated on the platform and the general health of Prosper’s employees.

- Marketplace Risk - The risks associated with Prosper itself going bankrupt. In such a case, a legal team would take over liquidating Prosper and redistribute the remaining capital. In such an event lenders can expect to see a substantial reduction in their capital and returns.

- Callable Risk - Loans can be paid back early, meaning less or no return in interest.

- Diversification Risk - There is a necessity to diversify your investment on Prosper, the recommendation is more than 100 "notes", which means 2500 USD in total. This implicitly means there is a pretty high chance of loans defaulting.

- Liquidity Risk - Being able to cash out capital is a serious matter for investors. Prosper does have a secondary market but it does take some time, not to mention, if there are a hundred 25 USD loans it could be tedious selling them all. In general, an uncomfortable risk to deal with.

- Economy Risk - If there is an economic collapse borrowers are less likely to pay back their debt as they most likely won't have the means. Similar to the default risk but on a larger scale.

- Pricing Risk - The risk associated with Prosper's ability to properly identify who is a good borrower and who is a bad one.

Potential lenders on Prosper should acknowledge that the majority of loans are unsecured. Meaning, there is no collateral in the case of a loan defaulting. It would be rather difficult to see capital returned if a loan defaults in such circumstances. Most fund recoveries on defaulted unsecured loans are implemented through litigation and court hearings.

In a scenario of a fund recovery on an unsecured loan, Prosper would sell off the borrowers debts to a third party debt collector, after taking a fee. The debt collector will also take a fee and the remaining capital would be a fraction of what it used to be. Unlike many other p2p lending platforms, lenders can expect to lose all of their money in an investment that defaults in an unsecured loan.

Another piece of information worth mentioning is that Prosper doesn't conduct full investigations on all of their borrowers. In many cases credit scores are based off the borrowers "stated" income rather than proven income. Which is a pretty big red flag. Otherwise, and historically, this has been an issue that only affects a minority of lenders, as most borrowers fill in data that is reliable.

Customer Service

Prospers customer service is of good quality. They have email support and phone support both of which are fast, responsive and effective.

There is both an in-depth help center and FAQ section for any users who have pending inquiries. Their blog page is also frequently updated and consists of great data on how to approach P2P lending for both borrowers and lenders.

Transparency & Security

Prosper is both regulated by the FDIC and SEC though it is not yet accredited. Prosper is also not publicly traded but does disclose all necessary statistics to determine the companies success. Which it is, successful and very profitable and holds the spot as the U.S' second biggest P2P lending platform.

In the year 2008, Prosper under went litigation by the Superior Court of California. Briefly, Prosper was sued for losing the majority of investors capital. However, given the time period, the economic recession, and nature of credit during such times, it is rather reasonable to expect a large degree of defaulted loans.

In 2008, as a response of ongoing, uninterrupted fractional reserve banking the economy collapsed. In a recession, the first thing that generally defaults is credit. If someone runs out of money, he or she literally loses the ability to pay back debt. Prosper temporarily shut down and ever since their re-opening, in 2009, they have been profitable, successful and attractive.

Crisis Management

Prosper has already endured a recession in the past, even shortly after their beginnings of operations. If any P2P platform should have been prepared for a crisis, it was Prosper. As soon as Covid became an immediate threat to the economy, Prosper rolled out a few strategies to ensure that their ecosystem would be able to withstand the economic turmoil.

Users received different benefits, like larger loans to borrow, credit holidays on their existing loans as well as options for users to put the value of their house online and taken while putting the mortgage up as collateral. The loans are explained further under Prosper's HELOC (Home Equity Line On Credit) loan type, allows for users to receive loans that only require to be paid back 5, 10 or 20 years with the option to pay early at no extra fees. Effectively generating thousands of dollars for users to assist with the weakening economy.

Our Readers Have Asked:

Is it safe to invest with Prosper?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward as well as the chances of losing your investment.

How much money will I make with Prosper?

Prosper suggests that investors on their platform make anywhere from 7 - 9 percent in annually in returns.

What are the risks?

Investors on Prosper have experienced a 3 percent default rate. Investors can expect that 1/33 loans on Prosper will default. This is one of the lowest default rates in the industry but there are still platforms out there with even lower default rates.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Prosper is certainly one of the hardest working ones.

Where is Prosper located?

P.O. Box 396081, San Francisco, CA 94139-6081

Watch & (L)earn

Discover more about Prosper in this short but informative video.

Pros, Cons and the Verdict

Pros

- Auto- Investing Tools

- Established Platform

- Secondary Market

- Regulated

- Low Minimum Entry

- Low Fees

- Easy to Use

Cons

- Unsecured Loans

- No Buyback Guarantee

- High Default Rate

- One Loan Originator

Prosper is one of America's most attractive platforms. A stable IRR, optional secure loans, and unsecured for those who are not risk averse. An exciting marketplace with billions of dollars, and millions of lenders who believe in Prosper. It is rather strange that there is only one company, WebBank, that produces all of the loans on Prosper. It's also strange that the US does not call Loan Originators by their titles. Rather, they choose a plethora of other titles to explain what Loan Originators do.

The minimum investment being incredibly low is certainly a great factor, especially in comparison to many other US p2p sites that only offer accounts after a thousand dollars.

Prosper also has an auto invest feature, a huge selection of notes and a nice and easy to use platform. It's a little concerning that third party exchange platforms can purchase Prosper notes, as generally, it's better to have these ecosystems with minimal outside correlation risk. But only 28 states in the US have options to Prosper, so it is logical that Prosper, or other companies would make moves to make the P2P lender more accessible for those who are interested.