How Our Portfolio Performed In Q1 of 2023

Please read P2PIncome's most recent investment-portfolio report for 2025.

With the first quarter of 2023 in the books, P2PIncome's financial experts return for another installment of the ongoing Portfolio Report series. This report assesses the performance of the portfolio as a whole, and of each platform individually, during the first months of 2023. Which site enjoyed the highest rate of return? Which site earned the most money in actual euro? Which platform does P2PIncome recommend above all others? The report answers these questions and concludes with an overview of recent geo-political and financial events that affected the peer-to-peer lending industry during the relevant period.

Quarterly Report: 2023-Q1

The P2PIncome investment portfolio consists of three peer-to-peer lending platforms, carefully selected for their profitability, consistency, and reliability. In addition, the structure of the portfolio seeks to satisfy the rules of diversification found in Modern Portfolio Theory, as first laid out by the Nobel-Prize winning, American economist, Harry Markowitz. To that end, two of the three platforms are real-estate crowdfunding platforms (EstateGuru and Reinvest24), where the investments are secured via tangible collateral, and the returns are bolstered by rental dividends and capital gains. The third platform, PeerBerry, lists short-term personal loans, facilitating quick gains and liquidity.

Fact and Figures

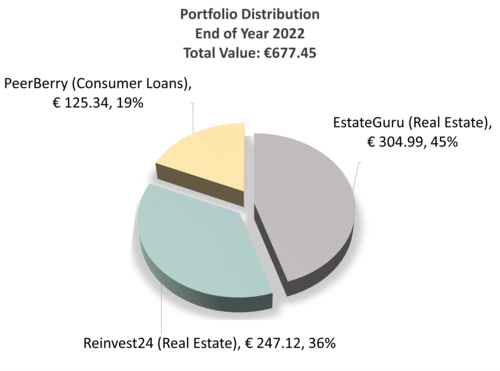

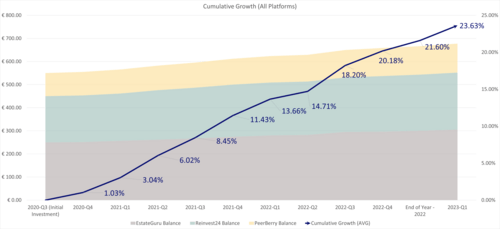

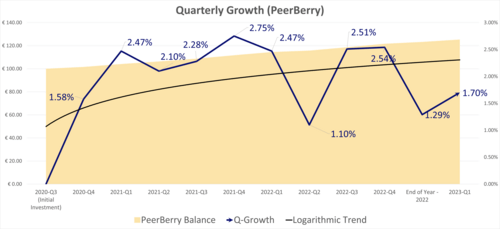

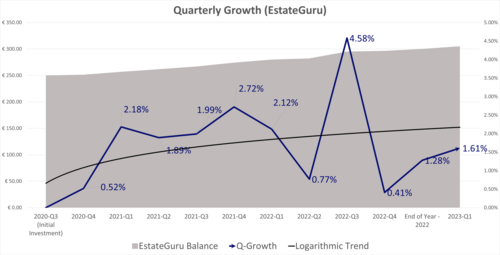

We opened the P2PIncome investment portfolio in late 2020, committing €550.00 across three sites: EstateGuru (€250.00), Reinvest24 (€200.00), and PeerBerry (€100.00). By the end of 2021, the total balance was up to €606.90, with EstateGuru at €272.56, Reinvest24 at €224.24, and PeerBerry at €110.10. This amounted to an increase of €56.90 in 15 months, which averages out to 8.27% (annual growth). The following year the portfolio grew from €606.90 to €666.42—an increase of 9.8% annual growth.

Whether the portfolio can sustain ~9% growth for another year remains to be seen, but if the first quarter of 2023 is any indicator, we have some cause for optimism. During the first quarter, the portfolio increased by €11.03, which would amount to an annualized rate of growth of only 6.62%, but we have several investments that should come to term during that period.

| Platforms | EstateGuru | Reinvest24 | PeerBerry |

| 2022 - EoY | €300.15 | €243.03 | €123.24 |

| 2023 - Q1 | €304.99 | €247.12 | €125.34 |

| Profit (€) | €4.84 | €4.09 | €2.10 |

| Growth (%) | 1.61% | 1.68% | 1.70% |

The portfolio's total cumulative growth across all platforms has reached 23.63% in aggregate, as funds from completed projects are reinvested, to maximize returns. Cumulative growth is one of the most important concepts in investment: The longer you let your money collect interest, the faster is grows. This long-term approach requires patience and resolve. Your portfolio will likely endure some ups and downs, and even occasional losses, but if you're patient, you will make money.

\

\The passive nature of these gains can't be overstated. Imagine two scenarios: In the first, you put €5000.00 in an envelope and place the envelope in your safe. In the second, you deposit the same amount across three platforms, and spend about 15 minutes per week reviewing and updating your investments. After 30 months, you go to the safe and check on your money. It's still there, in the envelope, precisely as before. Then you look at your investments and discover your balance is up to €6200.00. You earned €1200 in 30 months, doing little to nothing.

But I might have lost it all!

There can be no disputing the risks involved in investing money. The collapse of cryptocurrency is a great example of just how quickly millions of euro can turn to dust. On the other hand, a carefully diversified portfolio is far more stable than cryptocurrency would ever have been. It suffers only slight exposure, and the long-term trends are positive, and have been for over 100 years.

Reinvest24

Reinvest24, like EstateGuru, is a real-estate platform that originates its own loans and sells notes from those loans on its website. Reinvest24 has been around since 2017, making it quite a bit younger than EstateGuru, but during that time it has established itself as a serious platform. Reinvest24 has over 20,000 investors, and has successfully funded over 200 projects in 6 countries. To be sure, this numbers don't approach EstateGuru's, but Reinvest24 can boast one statistic EstateGuru cannot: a 0% default rate. While EstateGuru struggles with a shocking 40% default rate in Germany, its Estonian competitor remains steadfast. In fact, Reinvest24 has already taken over some of EstateGuru's problematic projects.

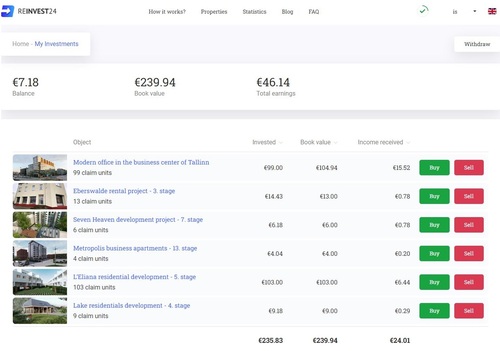

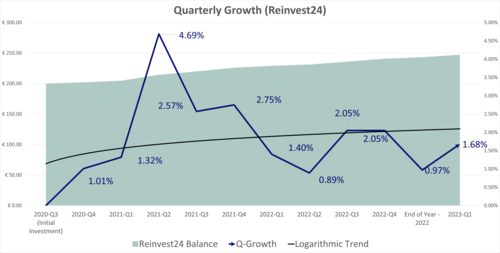

We entered 2023 with a balance of €243.03, and by the end of Q1 it was up to €247.12, including a cash balance of €7.18, which we've since invested on the secondary market. An increase of €4.09 on a balance of €243.03 represents a growth of 1.68%, which would annualize to 6.72%—far below the expected returns from Reinvest24. On the other hand, several of our investments should come to term during that period, and we anticipate a total yield closer to 8%.

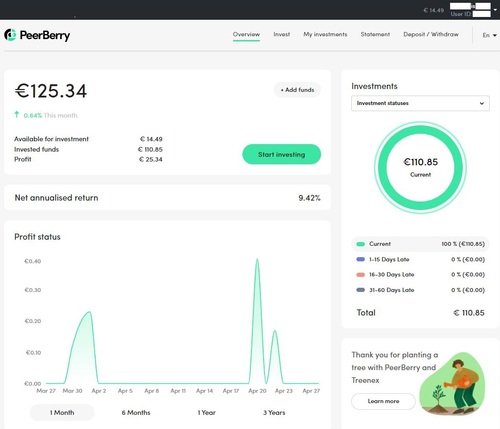

PeerBerry

PeerBerry is a giant in the peer-to-peer lending business, with over €1.5 billion in total investments by its 70,000 investors. This Lithuanian company, headed by the charismatic Arūnas Lekavičius, deals is personal loans of all sizes and purposes. Unlike the other sites on the portfolio, PeerBerry works with numerous loan originators, and doesn't not originate any loans of its own. The process for the borrower, therefore, does not involve PeerBerry, rather one of its two dozen originators in Lithuania, Poland, Ukraine, Kazakhstan, Moldova, Romania, the Czech Republic, Spain, Vietnam, the Philippines, and Kenya.

Our PeerBerry portfolio grew modestly in the first quarter of 2023, from €123.24 to €125.34 (1.7%). The account has around €15, which we will soon reinvest in short-term loans, to protect liquidity. PeerBerry often posts loans with very short durations (5 to 7 days). Obviously, short-term loans require more time and attention from the investor, as the money must continually be reinvested. The good news is that PeerBerry has an excellent mobile app, so users can maintain their accounts "on-the-go."

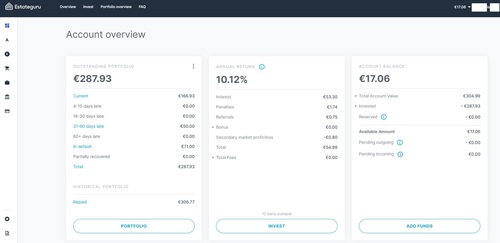

EstateGuru

EstateGuru is one of the market's best real-estate crowdfunding platforms in Europe. The company originates its own development loans, bridge loans, and business loans. The loans are available to "legal entities incorporated in the EU," and range from €20,000 to €5,000,000, depending on the LTV of the collateral. As of 2023-Q1, EstateGuru boasts over 5000 projects funded in 8 countries, with an average return of 10.69% per annum. The platform have over 150,000 investors, who have earned over €63 million since the company was founded in 2013.

At the start of the year, our portfolio balance on EstateGuru was just over €300, and has since increased by another €5. The account currently has cash balance of €17.06, which we had intended to reinvest till we discovered a serious problem:

Over the course of the past 6 months, more than 75% of the loans originated there have entered late-payment and/or default. EstateGuru sent out an email, which was later reproduced as an "open letter" on the EstateGuru website. The letter expressed great concern over the situation in Germany, even going so far as to suggest foul play, and to announce a complete cessation of activity in the country. Co-founder Kaspar Kaljuvee was sent to the German offices to investigate the situation, with the hope of reducing the default rate to 15% or below.

With so many listings in default, including €71 of our portfolio, we need to reassess the situation before making any rash decisions.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Events that Influenced Financial Markets During 2023 Q1

Simply stated, the world is extremely unstable right now, and the economy does not enjoy instability. Few people expected the war in Ukraine to rage on for this long. No one expected one of the largest banks in California to collapse. No one expected violent riots in France. And certainly, no one knows what to expect when it comes to cryptocurrency. On the other hand, everyone expected the gas crisis to devastate the European economy, and that didn't occur due to unseasonal temperatures. It would seem people aren't particularly skilled at predicting the future. That being said, let us attempt to affect some order vis-à-vis the p2p market.

The War in Ukraine

It's no longer clear what possible outcome in Ukraine could possibly satisfy all parties involved. Putin seems unwilling to consider withdrawal, despite severe losses from what he estimated would be a Blitzkrieg-like conquest of Ukraine. What now? Does Putin intend to exhaust Ukraine's resources with a protracted war of attrition? Perhaps he calculates the US and other allies cannot indefinitely aid Ukraine? P2PIncome isn't an international policy platform, but this specific war has direct implications for p2p markets. The longer the war, the more refugees flee, placing greater and greater pressure on the economies of neighboring countries.

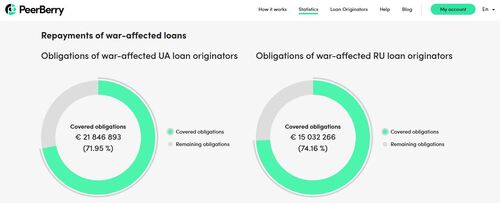

For example, Moldova is paying a heavy price due to the sudden influx of refugees, as loss of revenue. After all, nearly 2% of the Moldovan GDP comes from exports to Russia, now blocked by ground fighting and international sanctions. As companies in Moldova struggle to stay afloat, more and more p2p loans are going into default. Simply stated, many Moldovans can't repay their debts. PeerBerry, among others, is dealing with more defaulted loans than ever before. They've even added a set of War-Affected Loans statistics to their site.

Collapsing Crypto...and Banks

There have always been crypto skeptics, as is to be expected with any financial innovation. So, while the collapse of the cryptocurrency market, caught many off guard, there were also plenty of savvy investors who enjoyed an "I told you so" moment. The collapse of a major bank with a valuation in the tens of billions, however, is rarely predicted. The collapse of Silicon Valley Bank in early March of this year sent shockwaves through the banking industry. Memories of the 2008 banking crisis bubbled to the surface, as investors scurried to salvage exposed funds. Some financial experts predicted an industry-wide catastrophe.

Though the worst predictions have not materialized, First Republic Bank collapsed on the 1st of May, increasing speculations and concerns. Is this yet another ominous warning? Only time will tell. JP Morgan took immediate action to mitigate the crisis, paying out $10.6 Billion to the FDIC for control of First Republic's assets. That a solution to the immediate problem, but it's not at all clear how many more times we can expect companies like HSBC (which bought out SVB's UK notes) and JP Morgan can bail out the bank-and-lending industry.

Verdict

The first quarter of 2023 is behind us, and while some of the world's troubles have calmed—Covid19 is mostly a thing of the past—others persist. The war in Ukraine rages on, and it's no longer clear what can be done to put an end to the conflict. Two major US banks have collapsed in less than 2 months, and EstateGuru, which until recently was one of the strongest p2p lending platforms in the world, is facing crippling default rates in Germany. Thus far, however, our portfolio holds strong, though we have real concerns about the €71.00 in default on EstateGuru. We also have some concerns regarding PeerBerry, as they are still struggling to handle all the problems caused by the war.

For that reason, and in recognition of their attempts to take on defaulted projects from EstateGuru, we currently recommend Reinvest24 as the strongest platform for the coming quarter. That's not to suggest you can't invest on the other platforms, rather to point out that Reinvest24 currently enjoys the highest recommendation from P2PIncome.