PeerBerry Reviewed | Europe's Fastest Growing P2P Website

PeerBerry is a relatively young P2P lending company that began in 2017 and has successfully found it's place in the market. PeerBerry is based in Lithuania, and is backed by one of Europes most prolific lending companies, Aventus Group. Aventus, at first, was a loan originator (LO) on Mintos. Shortly after, they decided to build their own product that then became PeerBerry. Since then, PeerBerry has been sold to two private investors. Aventus still has very deep ties within PeerBerry and is ultimately responsible for their success.

PeerBerry's mission statement, is a noble one, "We strongly believe that passive income guarantees a stable economy and better lifestyle hence our mission is to bring passive income to everyone."

There are two features that PeerBerry possesses that distinguish them from the rest of the market. Firstly, all loans on PeerBerry come with a buy back guarantee and secondly, the "group guarantee".

Types of Loans on PeerBerry

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

PeerBerry Loan Characteristics

Loan duration1 Day - 75 Months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEurope

Returns rate9 - 12%

Default Rate7%

Recovery Rate100%

FeesNone

Bonuses0.5%

PeerBerry Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is PeerBerry?

PeerBerry is loan originator aggregator specializing in short term loans for high liquidity. PeerBerry has a great reputation for not losing investor funds and being an incredibly comfortable user experience. PeerBerry is legally based in Zagreb, Croatia, and maintains an office in Vilnius, Lithianua where it was founded. PeerBerry has borrowers throughout Northern and Eastern Europe, while its lenders are from all over the world.

Lender/Borrower Ecosystem

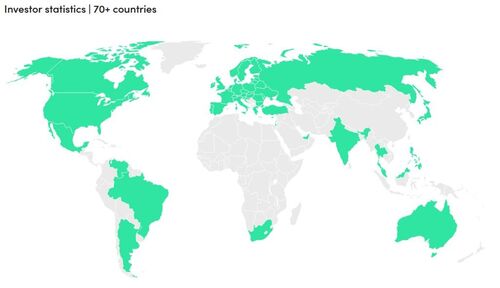

PeerBerry has loaned €281 million with over 23,000 investors from over 70 different countries. User's can expect an average of 9.5% IRR on their loans. PeerBerry stands behind it's slightly lower interest return by claiming that it is the price of stability.

PeerBerry is primarily active in Eastern European countries, including countries like Ukraine, Moldova, Kazakhstan and Russia. This has garnered some criticism due to these eastern nations generally being considered high risk investments. With PeerBerry, P2P lending exists for the purpose of providing people with a limited income, to generate a secondary passive income.

The borrowers on PeerBerrys platform consist of low-to-middle class workers who are in need of car loans, consumer loans, business loans and credit loans. PeerBerry does not acquire any of the loans on the platform, instead, the loan originators on their platform vet and service the loans on PeerBerry. The Lenders on PeerBerry come from all over the world and all walks of life.

That being said, PeerBerry having multiple countries that are higher risk could potentially be a great asset for lenders to diversify their portfolio. As well, to give borrowers in these high risk states the chance to acquire funds and grow their own industries. This is ultimately a good business model that can scale and continuously generate future income by helping fund economies that genuinely need it and could not otherwise obtain it.

Nevertheless, the level of risk begs the question of security and to what extent will PeerBerry go to protect their lenders capital?

All loan originators on PeerBerry come with a buy back guarantee. As we have learnt from past failures on the side of P2P companies, a guarantee is only as credible as the company that guarantees it. Which means all investors ought to do their due diligence only and invest after the fact.

The loans guarantees generally come in three categories:

Consumer Loans

Consumer loans are generally given out to borrowers to finance some form of personal expenditure such as auto loans, credit card bills and student loans.

Real Estate Loans

Real estate loans, or otherwise known as mortgages, are funds put in a legal document in order to purchase a piece of property.

Secured Car Loans

A secure car loan is a loan where the lender is given some form of security, or collateral. In the case that the borrower fails to repay the lender, the lender would take the vehicle or whatever was determined as collateral.

The loan duration ranges from 1 day to 75 months. Many of the loans are short term from 30 - 90 days in comparison to other companies that require loans for a minimum of a few years. PeerBerry uses a combination of wide range of diversity and multiple layers of security to ensure their ecosystem remains stable. This is all incredibly attractive to investors who are new to the P2P lending space.

General Data

| General | Data |

| Origin | Lithuania |

| Founded | 2017 |

| Offices | Croatia, Lithuania |

| Loan Type | Consumer Lending |

| Sign Up Bonus | +0.5% interest |

| Fees | 0% |

| Interest Rates | 10.5% |

| Min Deposit | €10 |

| Investment Duration | 4 - 120 Months |

| Secured Lending | Yes |

| Currency | EUR |

How to Borrow?

PeerBerry is a loan originator aggregator. It is not possible to receive loans from PeerBerry. However, borrowers may visit their website to find out more about their local partners. If those local partners exist within the borrowers proximity then they may contact them there.

Registration & Withdrawal

Registering on PeerBerry is a very simple affair. It takes a few minutes to register. After verifying an address, number and standard KYC, users can deposit. There is a €10 minimum deposit after which, user's can manually invest or auto invest. The website itself is very user friendly, and PeerBerry, makes frequent successful updates to their level of transparency and website quality.

It is generally recommended to deposit in euro to avoid loss on currency exchange, as most of the platform operates with EUR.

For free euro deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. PeerBerry does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, user's may be charged by their bank for exchanging and handling fees.

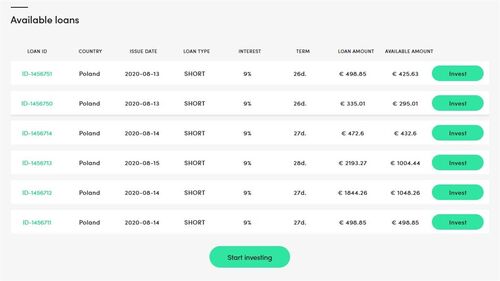

Marketplace

PeerBerry only offers a primary market for users to purchase loans. The borrowers on PeerBerry are all found and offered from the loan originators who vetted them. Other P2P lending marketplaces offer a secondary market, where if users need to cash out early they can sell their loan agreement for higher or lower prices. PeerBerry has expressed their intention to add a secondary market to their platform, though no timeline has been disclosed.

PeerBerry's marketplace offers extra guarantees for their users so they do not have to feel anxious if a loan might default or not. PeerBerry as a marketplace gives users a guarantee on their principal.

Although secondary markets are great for cashing out early they are more relevant to long term loans of 3 - 5 years. PeerBerry's loans are majority short term, a couple of days, a few weeks, it is rare to see a loan on PeerBerry which spans even one year. PeerBerry is a high liquid platform for short term borrowers and lenders.

Risks Involved

User's should not make the mistake of blindly trusting the platform's group guarantee and always do their own proper due diligence on potential projects.

Users should research all that they can on a given loan originator. The LO's historical and current revenue, level of debt, as well as quality of employees. All factors go into determining the worth of a company.

To reiterate, buyback guarantees, as well as group guarantees, do not imply that the company itself is risk free. Only that the company Aventus and Gofingo will step in to do what they can for those companies who can longer stand for themselves.

To date, PeerBerry has enabled access to four established Loan Originators.

Aventus Group - 66% of Market Share

GoFingo - 25% of Market Share

LitHome - 8% of Market Share

SIBgroup - 1% of Market Share

PeerBerry's buyback guarantees are heavily reliant on Aventus and GoFingo, as they guarantee the loans on PeerBerry. Historically speaking, Aventus group was formed in 2017 by Aventus Holdings Limited (AHL) and Aventus Retail Property Fund. It has been profitable since it's first year of operations. Platforms supported and funded by Aventus could very much be considered a low risk investment.

Another facet that reinforces Aventus' as a low risk investment is that investing in PeerBerry is exclusive. It is not possible to borrow funds from Aventus through other P2P lending platforms. In this respect, users can understand that PeerBerry is an exclusive branch of Aventus and their loan partners. Outside factors have minimal impact on the health of PeerBerrys ecosystem.

PeerBerry is currently unregulated, however, they have indicated plans in their February 2020 announcement with pursuing an Investment Broker License.

Added Risk Management

To mitigate the potential damage of a loan originator defaulting, PeerBerry has implemented "group guarantees". This is an agreement that Loan Originators need to agree upon entering PeerBerry's marketplace. The group guarantee in essence means that if one Loan Originator is failing to manage their lenders and borrowers, then Aventus Group and partner company, GoFingo Group will step in and cover all liabilities of the failing company.

This may be regarded as pushing the problem back as opposed to getting rid of it. If too many companies default and Aventus is to cover them, then surely Aventus itself would default. It is in nobodies interest for Aventus to reach this stage. Ultimately, this feature does provide more protection for investor's on the short term. For the platform, it is more concerning on the long term ramifications.

Customer Service

PeerBerry is a popular site that often receives rave reviews from its users. They're devoted to their customers, sending informative emails and reports on a regular basis. They offer a live chat, and usually respond to customer emails with 24 hours.

Transparency & Security

PeerBerry's model regarding transparency is mainly focused on their website data and blog posts. Their blog posts are not as frequent as their main competitor, Mintos, and the management team appears less publicly presented than their main competitors.

Otherwise, they have made some moves to become more transparent to their users and investors.

It's incredibly important to note that PeerBerry has less than 10 employees, which is tiny in comparison to their biggest competitor, Mintos. With the growth of the company, it is most likely that transparency will see a correlation. PeerBerry has been clear that their attention is focused on becoming more transparent, secure, and committed to an overall better user experience.

Loyalty Program

As of August 2019, PeerBerry included their loyalty program for lenders that have a noticeable amount of capital invested in the platform. The reward is calculated based the following account values:

- Silver: From €10,000 of active investment portfolio (+0,5% for future investments)

- Gold:From €25,000 of active investment portfolio (+0,75% for future investments)

- Platinum: €From 40,000 of active investment portfolio (+1% for future investments)

Crisis Management

During the COVID pandemic a set of legislation was introduced in two eastern European states which PeerBerry operates in, Kazakhstan and Poland. The legislation can be referred to as "credit holidays". This concerned PeerBerry, which led them to a conservative approach to issuing new loans to high risk borrower's and bringing LO's aboard. The outcome was interest rates and loan amounts decreased by a noticeable percentage. Since then, the number quickly stabilized and is on a healthy road to recovery. This can be considered a great sign and decision, on the part of management.

Furthermore, PeerBerry has still been profitable during the pandemic and investors have, in fact, received their payments in a reasonable/unaffected time frame. Aventus CEO goes in-depth in a Youtube interview regarding their approach to ensuring their lenders that their invested money is guaranteed, and the track record of COVID 19 is proof of their ability to handle financial crises.

Our Readers Have Asked:

Is it safe to invest with PeerBerry?

No investment is ever "safe". There is an inverse relationship between risk and reward, as the more risk you take the higher your reward as well as the chances of losing your investment.

How much money will I make with PeerBerry?

PeerBerry suggests that investors on their platform make anywhere from 9 - 12 percent in annually in returns.

What are the risks?

Investors on PeerBerry have never lost any of their principal. PeerBerry is one of the safest and most profitable Peer-to-Peer lending platforms in that respect.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. PeerBerry is certainly one of the hardest working ones.

Where is PeerBerry located?

Business Centre SKY OFFICE, 20th floor of the Tower B, Roberta Frangeša Mihanovića 9, Zagreb, Croatia

Business Centre ELEVEN, Kareiviu str. 11B, LT-09109 Vilnius, Lithuania

Watch & (L)earn

Discover more about PeerBerry in this short but informative video.

Pros, Cons and the Verdict

Pros

- Auto-Investing Tools

- Established Platform

- Regulated

- Secondary Market

- Very Transparent

- Low Fees

- High IRR

- Easy to Use

- Low Minimum Entry

- Manual Selection

- Multi-layered Guarantee

Cons

- Relatively Young Platform

PeerBerry has been deemed as Europe's fasting growing P2P website. Although Mintos dominates the European market, PeerBerry is a serious contender. Their website and user experience is almost at an identical level. PeerBerry can provide comparable interest rates, increased guarantee of principal, as well as even more portfolio diversification in respect to high-risk Eastern European countries.

While it may be concerning that PeerBerry operates as an extension of Aventus, it is not worth worrying about. Aventus has been historically profitable and dependable. Aventus is committed to retaining a "financial pillow" for its loan originators and lenders so that they won't have to feel at risk on PeerBerry's platform. For international investors, PeerBerry lives up to it's name as Europe's second best P2P lending platform.