EvoEstate Reviewed | World's First REIT Loan Originator Aggregator

Note to the Reader: In early 2022, EvoEstate CEO Audrius Višniauskas announced the company would merge with InRento, Europe’s first licensed buy-to-let crowdfunding platform: “I feel that the merger of EvoEstate and InRento will contribute greatly to improving the way people invest in Real Estate.”

The same investors who invested into EstateGuru, the top real estate P2P platform are the same people who invested in EvoEstate. The loan originators who work with EvoEstate are also players with considerably good reputations. EvoEstate, as the name suggests, only deals with real estate borrowers and investors.

Types of Loans on EvoEstate

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

EvoEstate Loan Characteristics

Loan duration6 - 120 Months

CurrencyEUR

Buybacks Yes

CollateralYes

Available inEurope

Returns rate14.41%

Default Rate0%

Recovery RateUndisclosed

FeesNone

BonusesNone

EvoEstate Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Who is EvoEstate?

EvoEstate is a peer-to-peer loan originator aggregator founded in 2019 in Tallinn, Estonia by Gustas Germanavicius. They invite dozens of loan originators to their platform and allow users to choose from a diversified marketplace. The minimum to invest on EvoEstate is a 100 EUR and the projected yearly return is 10 percent. The reality of the projected return is that it is more complicated than a 10 percent average. There are several loan originators on EvoEstate and all of them project their own yearly returns for investors.

The investors behind EvoEstate are the same ones behind not only EstateGuru but Investly as well, another successful Peer-to-Peer lending platform. All the loan originators that manage and host lending services on EvoEstate are of European origins.

Lender/Borrower Ecosystem

Their business models works by hosting several loan originators who manage and finance real estate debt. Investors can then go EvoEstate in order to choose among a wide array of different real estate investments.

Because of the nature of EvoEstate's business model they are able to service a variety of loans that could not possibly be found from a single loan originator. This means that EvoEstate can provide not only every type of real estate loan you're comfortable with but is also the platform that has the widest range of options for investors. Though this may be a strength it does also have a weakness, as this type of model can only add to existing models.

One way of understanding this is as EvoEstate does produce it's own ecosystem, it builds on top of others. All the loan originators, such as Reinvest24 who we have also reviewed, benefits from the added user base that EvoEstate brings.

General Data

| General | Data |

| Origin | Tallinn, Estonia |

| Founded | 2019 |

| Offices | Tallinn, Estonia |

| Loan Type | Mortgage Lending |

| Sign Up Bonus | 0 € |

| Fees | 0% |

| Interest Rates | 10.00% |

| Min Deposit | 50 € |

| Investment Duration | 12 - 72 Months |

| Secured Lending | Yes |

| Currency | € |

How to Borrow?

EvoEstate is a loan originator aggregator. It is not possible to receive loans from EvoEstate. However, borrowers may visit their website to find out more about their local partners.If those local partners exist within the borrowers proximity then they may contact them there.

Registration & Withdrawal

It takes a few minutes to register. After verifying an address, number and standard KYC, users can deposit. There is a 100 EUR minimum deposit after which, users can manually invest. The website itself is very user friendly, and EvoEstate makes frequent successful updates to their level of transparency and website quality. It is recommended to deposit in EUR to avoid loss on currency exchange, as most of the platform operates with EUR.

For free EUR deposits we recommend the following online banks:

It generally takes 1-3 business days for funds to appear in the account. EvoEstate does not charge any fees for deposits and withdrawals, however, depending on the transaction fees of a given bank, users may be charged by their bank for exchanging and handling fees.

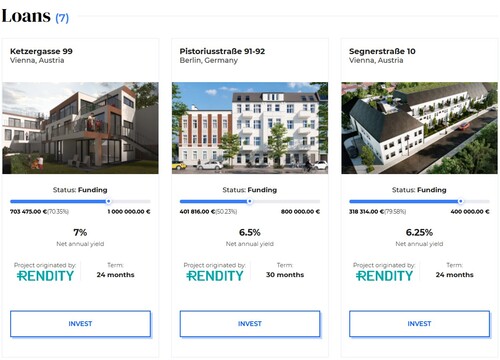

Marketplace

Due to the expansive marketplace, EvoEstate is able to offer a diverse range of real estate lending loans. Investors can choose to lend money:

- REIT( Real Estate Equity Loans)

- Real estate loans are loans that provide the equity of the property as collateral. Holding this equity does not only guarantee you interest with your repayment but as well as partial earnings from the rental/ business income. The duration of these loans usually range from 6 months to as long as conditionally agreed upon. Real Estate equity is attractive because if the property during the process is sold with a profit and you're a holder of the percentage then your investment size increases accordingly to the sale. The risk is here is if the property is sold at a market down price then again, your investment is adjusted accordingly.

- Development Loans

- A development loan is related to a large residential development project. The loan cycles range from generally 6 - 18 months. Issuing development loans are a common practice of any large condominium construction project.

- Renovation Loans

- For any form of renovation, personal loans for house renovations or business loans for business renovations. These are generally short term loans as well.

- Real Estate Business Loans

- Real estate related business loans just means that the loan will be going up to a business who is putting up their property as collateral.

- Private Investment Funds

- On EvoEstate you can opt to invest in Private Investment Funds that deal solely with Real Estate. It is the same as simply putting money into an account and watching it grow, investors are not in control of these funds.

- Fixed Interest Loans

- Fixed interest loans are loans whose interest is fixed and so the borrower can accurately predict the payout schedule and costs.

With EvoEstate you really get to choose what it is you want in an investment and in a borrower. One of the most impressive things about EvoEstate is their use of a secondary market and how that works on a bigger scheme.

Many of the platforms that operate with EvoEstate do not offer a secondary market such as Reinvest24. However, EvoEstate still allows them to sell these loans on their secondary market. Meaning, many investors who enjoy servicing loans on Reinvest24 or BrickStarter can use EvoEstate for the same listings but with an upgraded layer of liquidity. In addition, EvoEstate allows their investors to use their secondary market at zero fees and investors can decide if they want to sell their loans at a marked down price or a premium.

Fees or loan listings are determined per platform, but EvoEstate charges no additional fees. EvoEstate makes money off the loan originators not the borrowers or investors.

EvoEstate also has a well developed auto-investing tool where investors can choose among several parameters to fit their investment needs.

Investment Strategy

What is more critical in respect to the investment strategy on EvoEstate is that now platforms that did not provide an auto-invest or a secondary market do not need to create one.

Like Reinvest24 that has neither a secondary market or an auto-invest feature becomes a far more valuable product because of the added features EvoEstate provides for free. The ease of use, the diversified options, a functioning auto-invest and secondary market for extra liquidity make EvoEstate a necessity in P2P lending space.

But as always, every strength comes with a weakness. The problem with investing on EvoEstate is how dependent the platform is on loan originators. Not to mention, real estate loans are not like consumer loans or small business loans, these projects can range in the dozens of millions. There will undoubtedly be cash drag on how many loans are issued and the time it takes to actually finish funding the loan.

EvoEstate can only be a successful Peer-to-Peer lending platform if all the other platforms it hosts are able to grow, scale, be profitable and secure. Though EvoEstate is a great platform, it is not up to EvoEstate if they will succeed or not.

Investing in real estate is generally the safest way to invest capital. Property has, at least, anecdotally been an investor's first choice of asset due to its ability to retain and generate capital.

Always do your due diligence on the loan originator before investing in any project and if you're using an auto-invest tool, ensure that the Loan to Value(LTV) ratio is not too low and a percentage you are comfortable with.

Risks Involved

- Inflation Risk - The risk of inflation where a users capital is locked up while slowly lowering its value due to economic despair.

- Management Risk - The fees associated on the platform and the general health of EvoEstate 's employees.

- Marketplace Risk - The risks associated with EvoEstate itself going bankrupt. In such a case, a legal team would take over liquidating EvoEstate and redistribute the remaining capital. In such an event lenders can expect to see a substantial reduction in their capital and returns.

- Economy Risk - If there is an economic collapse borrowers are less likely to pay back their debt as they most likely won't have the means. Similar to the default risk but on a larger scale.

- Pricing Risk - The risk associated with EvoEstate ability to properly identify who is a good borrower and who is a bad one.

- Diversification Risk - There is a necessity to diversify your investment on EvoEstate, this means there is a high chance of loans defaulting.

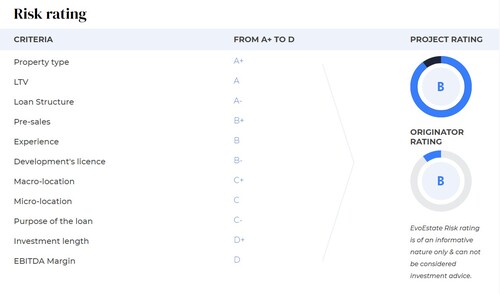

As mentioned above, one of the main risks on EvoEstate is that they are not a platform that issues out loans, they are totally dependent on those who are in the business. EvoEstate operates as an aggregator, and they have decided it would be best to rank their loans originators so their investors have a better idea of who they are investing with. Users can use these rankings to determine what kind of risk level they would like to engage with.

There have been a few instances in the past, where aggregators inaccurately rate loan originators on their platform and as a result lose their investors millions of Euros of their capital. When a platform gives a rating it is not always guaranteed that the rating is correct, and investors should always take the extra to make sure the loan originator and the project are in good standing.

EvoEstate could also potentially affect, on a larger scale, which peer-to-peer lending platforms are more successful. It is generally preferred when peer-to-peer lending platforms are not subject to external forces.

If malicious actors were to attack EvoEstate's network and manipulate the market, than not only one loan originator could be effected but dozens. Generally speaking, the more actors in a financial deal the more possibilities for failure.

The same is true for PeerBerry or Mintos, which are also loan originator aggregators.

What is telling and should not be forgotten is that the founders of EvoEstate clarify each loan on their platform that they are personally invested in. The majority of loans on their platform are invested in personally by them with an amount of 1000 EUR per project, and the smaller minority with slightly less funds. They claim this is because their philosophy requires all mutual funds and investment vehicles ought to have "skin in the game". The people who are leading the investment experience and the retail investors participating have to be to some degree equally liable.

This concept of skin in the game ensures a layer of trust, the investors know that if the loans are successful, then it's a win-win situation and if they are not, it's a lose-lose.

Transparency & Security

Given the age of EvoEstate, they are a very transparent company. They work with credible loan originators that boast impressive track records. It is to be hoped that as the platform grows this practive will continue and result in greater transparency.

Crisis Management

EvoEstate operates with many platforms that already have fully functioning ecosystems of their own. In terms of the Corona virus pandemic, EvoEstate does not have any power to mitigate economic damage or assist the defaulting loans on their marketplace. They are more of a middle man than a intermediary platform.

Not to mention, they are quite late to the game, as their company is still in a growth mode and does not have the wherewithal to be able to mitigate real damage induced by the corona pandemic. Perhaps in the future EvoEstate can partner up with the loan originators on their marketplace to assist with struggling borrowers.

That being said, their first objective has been improving the flow and functionality of their secondary market. Their second objective is ensuring their auto-investing feature is well tailored to the several real estate peer-to-peer lending platforms.

Our Readers Have Asked:

Is it safe to invest with EvoEstate?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward as well as the chances of losing your investment.

How much money will I make with EvoEstate?

Evoestate proclaims that investors on their site make anywhere between 6 - 20 percent in yearly returns. Evoestate is not a platform for beginners and should be considered for investors who are very familiar with property.

What are the risks?

Evoestate default rate ranges between 26 - 28 percent, historically speaking, investors can at the very least expect a third or more of their loans to be very late or completely defaulted. EvoEstate hosts multiple great websites but also a few bad apples, such as Housers. This weight brings down EvoEstates default rate but does not change the fact that there are incredible projects available on EstateGuru.

Why do I need to submit ID verification?

Know-Your-Customer or KYC protocols are a standard and necessity to protect your investment account from bad actors and hackers.

Is P2P lending a ponzi scheme?

Some Peer-to-Peer lending platforms are dishonest and shady. The industry is still in nascent stage and while there are definitely some illegitimate companies, there also many honest, hard working and profitable ones. Evoestate is certainly one of those companies that is honest, hard working profitable but with a risky business model.

Where is EvoEstate located?

Narva maantee 5, 10117 Tallinn, Estonia

Watch & (L)earn

Discover more about EvoEstate in this short but informative video.

Pros, Cons and the Verdict

Pros

- Loan Originator Aggregator

- Secured Loans

- Auto-Investing Tools

- Secondary Market

- Diversified Marketplace

- Reputable Loan Originators

- No Fees

Cons

- New Platform

- Dependent on Loan Originators

- High Minimum Deposit

EvoEstate is what the peer-to-peer real estate lending market needed. A real estate p2p lending aggregator was definitely lacking in the industry and the fact that it's here is pretty exciting. It's too early to tell whether or not the platform will be successful, but it's already drawing up on great actors such as Housers and Reinvest24.

The layers which EvoEstate builds upon, the already existing models, provides a massive upgrade. Many platforms are discriminated against for their lack of secondary markets and subpar auto-investing tools. EvoEstate fixes a very very real and prevalent problem for many Peer-to-Peer lending platforms. On that final note, we have very high hopes for EvoEstate's business and development.