Investing in Peer-To-Peer Lending, for Beginners | P2PIncome

- What Is Peer-to-Peer Lending?

- How Does Peer-to-Peer Lending Work?

- P2P Lending for Investors

- P2P Lending for Borrowers

- What to Expect When Starting Out

- Standard Risks with Peer-to-Peer Lending Platforms

- Pros and Cons of Different Types of P2P Lending?

- Best Sites for New P2P Investors

- Frequently Asked Questions

- Top 5 Experts Tips for New Investors

- Verdict

What Is Peer-To-Peer Lending?

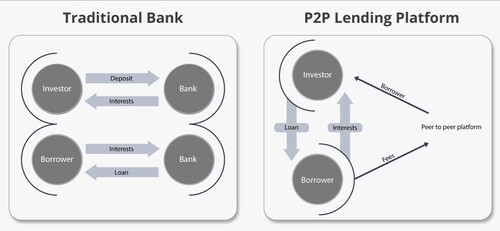

Newcomers to the world of peer-to-peer lending and investing might find the entire idea confusing. To equip you with the necessary tools, P2PIncome's financial experts have put together this detailed guide. To start, let's define the system: p2p lending is mechanism that allows private individuals to borrow and lend from one another via legal and secure online platforms, without the need for a bank. Some of these platforms conduct their own credit checks and issue the loans, thought most work with loan "originators." The platforms then allow investors to purchase "notes" (or shares) of those loans, and profit from the interest payments.

In the traditional model, the banks have a disproportionate amount of power and authority. Consider this: The bank is only able to lend money because you and other customers deposit money into accounts. The bank is effectively pooling people's money in order to profit from interest payments. However, the customers see little if any returns on their own money. Banks traditionally offer pawltry interest-rate returns to their customers, despite collecting large amounts of interest. The idea behind p2p is to cut the banks out of the equation and allow you, the actual lender, to profit from your own money.

Unlike banks, peer-to-peer platforms are accessible to all legally qualified investors. There is as much diversity in the p2p market as in the stock market or the real-estate market. You don't need to be wealthy to get started, and there are usually very few qualification requirements beyond legal age and residency. Much like Kickstarter or Indiegogo, peer-to-peer lending has opened up a world of financial opportunities to private individuals.

How Does Peer-to-Peer Lending Work?

There are four facets to the p2p structure: borrowers, loan originators, p2p platforms, investors (you). Borrower seek loans from loan originators. The loan originators conduct credit assessments, set interest rates, and issue loans to borrowers. Then the loan originators partner with p2p platforms, which post the loans on their marketplaces for you to purchase. The borrowers pay back the loans, plus interest, to the loan originators, which transfer the money to the platforms, which transfer your share to you. Some platforms originate their own loans, but the vast majority work with originators.

For example, the loan originator LuteCredit offers 100 loans totaling $100,000 on the Mintos marketplace. The means LuteCredit already conducted the credit assessments, determined the interest rates, and issued the money to the borrowers. Now that the loans appear on Mintos, you have the opportunity to purchase a share of the loan. Your money helps retroactively fund the loan, and in return for that funding you receive your share of the interest. Whereas a bank might offer you 1.2% returns on your "high-yield savings account," you can realistically earn 7 to 9% via the p2p market.

P2P Lending for Investors

First, it important to understand that the European and American p2p markets are drastically different. The European markets are far more accessible, in that they merely require legal standing and residence. In other words, anyone over the age of 18 with an EU bank account can register as an investor on a European p2p platform. The American system, on the other hand, requires investor accreditation, which involves proof of annual income exceeding $200,000 and/or assets exceeding $1,000,000. As such, very few people qualify for accreditation.

Regardless, investors should see far greater profits from p2p lending than anything they'll get from a bank. Also, because many of the platforms offer automated investment tool, one need not spend too much time perusing the marketplace and investigating options.

P2P Lending for Borrowers

Peer-to-peer lending is distinct from borrowing. Most p2p platforms do not lend money directly to users. Instead, they work with loan originators: companies prepared to accept loan applications, investigate the credit worthiness of the applicant, issue loans, and collect payment and fees. However, there are some platforms that provide reasonable loans at good rates. At each of these sites, it is possible to receive funding. The majority of the process of receiving funds occurs personally between the platforms. You fill in basic information on their contact page and a loan officer will contact you for further details.

If you're interested in loans for the following categories, you can look to these sites to request loans.

Business loans:

Consumer loans

- PeerBerry

- Swaper

Mortgage loans

All the platforms listed above are platforms that manage both the borrowing side of peer-to-peer lending as well as the investing side.

What to Expect When Starting Out

Now that you know how to start peer-to-peer (P2P) lending and investing, you'll need to register with one or more platforms. When doing so, you must be prepared to provide personal details, including bank-account numbers, passport numbers, email addresses, phone numbers, and other "know-your-customer" (KYC) details used during the verification process. This process is designed to protect you and the company with which you have chosen to invest. By verifying your identity, the company knows you are a real person with a valid account, and you know the company is only accessing and investing your money with your permission.

While the sign-up process takes about 5 minutes, the actual registration will take a few days, as the company process your request. To be clear, no reputable p2p platform will ever share your personal information. However, you should always read the platform's terms and conditions before sharing your data. If you are uncomfortable with those terms and conditions, you have every right to walk away. And it goes without saying that if you can't locate the terms and conditions, you should immediately seek out a different platform.

Signing up P2P Lending

So let's take a quick example with Europe's favorite platform: Mintos.

Step One: Go to Mintos

This is the Mintos' homepage, where you'll see a few options. If you have already read our review on Mintos, then continue to create account.

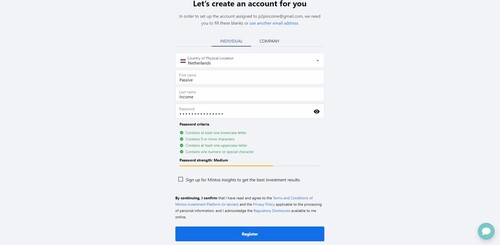

Step Two: Fill in Necessary Data

To get started on Mintos, you need to put in your name, location and password. Make sure that all of the information you're putting in this stage can be verified. This will be essential for the next step that everything is accurate.

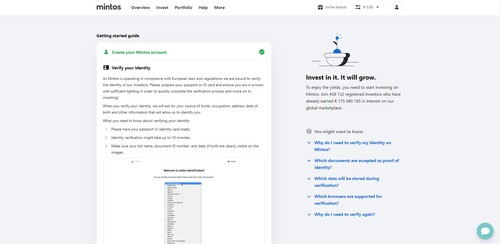

Step Three: Verify Documents

Mintos requests a fair number of documents to verify your identity. This is an industry standard among every single financial service. You can verify your identity with an ID card or a passport. This verification process generally takes about a week. Once that is over, and if all of your data is verified, you can invest on Mintos.

Standard Risks with Peer-to-Peer Lending Platforms

There are 9 general risks that can be found on peer-to-peer lending platforms. Not every platform suffers from every single risk. These are general things to look out for. Any platform that has more than 5 risks, in our opinion, should be avoided.

Pros and Cons of Different Types of P2P Lending?

It does not require a lot of money to invest in P2P lending, there is a lot of liquidity, the interest rates are high, and there are very little fees involved.

| Important P2P Details | Percentages |

| IRR for Low Risk Loans | 2 - 7 % |

| IRR for Medium Risk Loans | 5 - 10 % |

| IRR for High Risk Loans | 10 - 33 % |

| Average Fees Per Platform | 0 - 1 % |

| Average Investor Profit in Europe p.a. | 10 % |

Most platforms are of a newer generation of fintech platforms that do not have fees for their services. The sites are generally also very easy to use. The general interest rate is about 10 percent for the majority of platforms, meaning your investments will be comparable to the stock market.

Pros and Cons for Mortgage Lending

Pros

- Secured Loans

- Medium Yields

- Company Transparency

Cons

- Cash Drag

- Low liquidity

Lending on mortgage lending sites feels a bit safer because you know that there is actual property backing up your investment. This means that if anything goes wrong with the borrower, there is still a property to sell and retrieve your funds. On the downside, there is a lot of cash drag on real estate lending platforms, and once you're signed up for the loan, it can be difficult to get out of it without paying a penalty.

Pros and Cons for Consumer Lending

Pros

- High Yields

- High Liquidity

- No Cash Drag

- Secured Loans

Cons

- No Collateral

- High Risk

- Low Transparency

Lending on consumer lending platforms is a nice way to start because it starts at low minimums — as low as 1 EUR. There is little to zero cash drag because loans are filled up quickly. There is often less transparency because investors are not privy to all of the information of the borrowers.

Pros and Cons for Business Lending

Pros

- Medium Yields

- Secured Loans

- Transparent Proceedings

Cons

- Speculative Market

- Speculative Risk

Business loans can be a great way to start peer-to-peer lending. There are both low risk sites and high risk sites that you can invest with. The yields from business lending platforms are generally right in the safe spot of not being too high risk or low risk. Most loans are secured by the business requesting the loan. Investors are also privy to all of the information on the business, including the owners. The only downside is that businesses can be highly speculative and difficult to predict.

Best Sites for New P2P Investors

So which site would be best for you? There a few really good contenders for the first place. So, let's take a look at some of those platforms.

PeerBerry

PeerBerry is a great platform for beginner investors. The platform itself is super easy to use, registration is fairly quick and their support team is one of the finest in the industry. PeerBerry has been considered the fastest growing peer-to-peer lending platform due to it's constant increase of investors to their platform. PeerBerry is different than its competitors due to its high level of security. It's very difficult for investors to lose money on PeerBerry.

Buyback guarantees are a security on peer-to-peer lending that ensure investors that their principal is protected. PeerBerry recreated the buyback guarantee and turned into a multi-layered security protocol in PeerBerry's ecosystem. PeerBerry is headquartered in Latvia. They have been operating since 2018. The minimum entry to use PeerBerry is 10 EUR and yearly interest rates range from 9 to 12 percent.

Mintos

Mintos is a revolutionary platform, and in many ways, the father of modern peer-to-peer lending. There have been many peer-to-peer lending to grace the private sector, but none of them have been as effective and influential as Mintos. Mintos was a pioneer for many of the best features that we find in peer-to-peer lending, such as the buyback guarantee, secondary markets, and auto-investing tools were all perfected by Mintos.

Mintos works with dozens of loan originators around Europe. They primarily deal with consumer loans, but also have loans for mortgage and business lending. The numbers of investors on Mintos far exceeds the investors on any other platform. Mintos processes over a billion EUR in loans every year, which is a staggering number that hardly any P2P platform can compare to. Investing on Mintos requires a 10 EUR minimum deposit and yearly returns range from 8 to 12 percent. Mintos is a great platform for investors because they offer four auto-investing packages that will provide safe yet attractive interest rates.

October

October is more than a platform, it's also a European project that aims to provide more credit into the European economy. The majority of the loans are small to medium-sized loans, to small to medium-sized enterprises. The loan amounts range between 20,000 EUR and 500,000 EUR. All loans must be requested through a professional team from October. To get in touch with them, you'll have to go to October and register there.

October has close ties with European countries. During the 2020 COVID pandemic, October was able to roll out a lot of relief programs for their borrowers and investors because of the EU backing October possesses. There is a 20 EUR minimum deposit with October and lenders can expect a 3 to 7 percent yearly return. The majority of loans on October comprise of small restaurants, small artifact stores, and small start-ups.

ReInvest24

Reinvest24 is a new approach to real estate lending. They are a newer platform, founded in 2019 in Estonia. The platform offers mortgage loans in exchange for temporary equity. While this may sound complicated, it's actually very simple. All projects on Reinvest24 request funding to renovate property or to purchase property. In exchange for funding, investors receive temporary ownership of the property. With this ownership, they are able to benefit from the money made from holding ownership: like with rent payments, and the natural increase of property's value. To elaborate, whenever an apartment goes up in value, the owner benefits from that growth.

As an investor on Reinvest24, you also benefit from the natural growth of properties. That's why Reinvest24 is an impressive project, as it combines two forms of earnings in peer-to-peer lending and enables a safe and highly profitable way of earning in peer-to-peer lending. Reinvest24 has a 100 EUR requirement to invest, and yearly returns range from 14.6 to 16 percent. Though Reinvest24 is a new platform, they have a lot to say, which you can find out more about in our interview with their CEO, Tanel Orro.

Frequently Asked Questions

Is P2P lending legal?

First, it's important to clarify that P2PIncome does not provide legal advice or counsel. P2PIncome's financial experts write informative material about peer-to-peer lending, currencies and cryptocurrencies, investing, and other financial matters. For legal advice, you should consult with a licensed authority in your legal jurisdiction.

That being said, many peer-to-peer lending sites are indeed regulated and licensed within their region. For example, the US-based YieldStreet is regulated by the United States Securities and Exchange Commission. This means the US Government is ready to audit the company at the first hint of wrongdoing. LendingClub, another American institution, was audited just 3 years after starting business. The threat of severe penalties, de-licensing, and even arrest, keeps these companies in check.

Similarly, European peer-to-peer platforms Reinvest24, PeerBerry, and Iuvo are all regulated by EU-compliant banks in their respective countries. Reinvest24 and Iuvo have crowdfunding licenses from the Estonian government, while PeerBerry has one from the Lithuanian government. Estonia and Lithuania are members of the European Union (EU), and answerable to the EU's various financial laws and regulations. Many other platforms are also regulated and compliant.

Is P2P lending safe?

It's important to define the term "safe" very carefully. For one thing, every investment entails some degree of risk, and as a general rule the potential for profit is proportionate to the degree of risk. That is why high-risk loans (such as those given to borrowers with poor credit) involve higher interest rates. So, there is always the risk your investment will be lost (for example, if the borrower never repays the loan). There is also the risk that the investment won't yield enough profit to justify your time. However, the more you diversify your portfolio, and the longer you invest your fund, the less likely you are to lose money.

Another question regarding "safety" is whether a platform is trying to scam you out of your money. That is a real concern, and you should take great care only to invest on highly reliable platforms. Research and due diligence are the key to avoiding a scam. Look into the site's license. Read the site's terms-and-conditions and user-agreement to make sure the "fine print" doesn't contain something unreasonable. Read user responses on comment sites to gauge satisfaction. Be realistic: If it sounds too good to be true, it is. Investment is a long-term strategy based on math and statistics. Any site offering a get-rich-quick scheme is to be avoided at all costs.

Also, read our reviews. We can't guarantee any platform's reliability, but we do make every effort to investigate the sites we cover.

Can anyone invest in P2P?

There are certain legal restrictions regarding p2p investment that we feel deserve mention, not as legal experts, but based on the hundreds of pages of user agreements we've read on the many sites we cover:

- Every P2P platform we've ever covered requires investors to be legal adults. While the exact definition of "legal adult" varies from country to country, there is always some declaration of legality involved in opening a p2p account, and it is imperative to be forthright and honest with such declarations. Many user agreements expressly reserve the right to confiscate funds deposited fraudulently.

- P2P platforms require all investors be "real" entities. In many cases those entities can be businesses and/or proxies, but there is no platform (of which we are aware) that allows fake identities to invest. Several user agreements mention compliance with anti-money-laundering laws, and that includes barring fake identities and aliases.

- Many P2P are restricted to residents of particular regions. For example, Robocash and Swaper are only open to residents of EU and EEA countries. Similarly, YieldStreet is only open to US residents.

Our recommendation: We strongly recommend that you read the user agreement for any site on which you plan on depositing money. There are real-world ramifications you must know about before deciding which sites to patronize. Knowledge is power, and user agreements are free to read. If a site does not provide a user agreement, look elsewhere. All the reputable sites offer a copy, free of charge, and most sites let you download them for free, as well.

How much money do you need to start with?

The amount of money you need for starters is entirely personal. Perhaps you've only put away a few dollars/euro and you want to make that money work for you. Perhaps you're a wealthy individual who is looking to maximize yields. Perhaps you're one of the many millions of people somewhere in between. The one suggestion we believe applies to everyone is this: Never invest money you cannot afford to lose. While investing in P2P is most often going to succeed, there is a risk, and one must mitigate that risk by avoiding catastrophic consequences.

There are a few sites geared to small investments, with minimums as low as 10 euro. There's absolutely nothing wrong with starting off small and working your way up. It's certainly wiser than risking your hard-earned money on a whim.

Why has P2P investing become so popular?

Peer-to-peer lending and investment puts the power in the hands of the investor, rather than big banks. By allowing people to work together as a lender, p2p platforms use the power of large numbers to do what until now has been limited to institutions with massive capital. For example, even though one investor might not be able to lend you 50,000 euro, the combined capital of 500 investors can. And while none of those investors will profit the way a bank will, they will profit somewhat. Given the choice between investing 100 euro in the bank versus a reliable p2p platform, the latter wins out.

Is is easy to start investing in P2P?

The only difficult part of investing in P2P is doing the necessary research. The actual process is surprisingly easy. Once you're chosen a good platform for beginners, you'll just need to submit some paperwork, deposit some funds, and off you go. Many platforms have an auto-invest tool that does much of the work for you, while you sit back and enjoy passive income.

Top 5 Experts Tips for New Investors

Never risk money you can't afford to lose.

Investments are a way to make your money work for you, but they do entail some risk. You are not likely to lose money if you invest wisely over the long term, but you should never risk financial ruin when investing.

Diversify platforms and investment types.

You should spread your capital across numerous sites and investment types. Even if you only have 100 euro to invest, you should consider 3 platforms, and 3 investments on each platform. As you earn profits, diversify further. This reduces risk because even if one of the investments goes south, the others can protect your interests. The old adage about not putting "all your eggs in one basket" applies here.

Always read the user agreements

It may seem tedious to read a long user-agreement, but there's a lot to learn from them. First, the details provided in the agreement will often help you determine how professionally the platform is managed. These agreements often contain contact information, banking information, and other data you can research. The agreements will also help you determine whether the site is fair and honest. Do they commit to publishing financial reports? Do they clarify how your money will be handled? Do they have a buy-back policy? The answer to these are other questions should help you assess the veracity of the platform, and help you decide whether you're likely to be treated fairly.

Stay Informed

P2PIncome regularly updates its investment guide, with detailed analysis, reports, and other informative material. By keeping up with the latest news, you'll be better informed and better prepared to make the best decisions.

Focus on the Long-Term

Sound investing is based on long-term strategies, such as the power of compound interest. Don't but into get-rich-quick schemes, as they simply do not work. They are the modern form of "fool's gold," and any platform offering "miracle" profits is likely a scam. Understand that returns of 6% to 12% per year are realistic, with the upper-end entailing quite a bit of risk. To be sure, there are few sites that push past those numbers, and you can include them in a diversified portfolio if you don't mind the risk exposure, but in general you should look to the 6% to 12% mark.

Verdict

Peer-to-peer lending can be as interactive as you want it to be, and as passive as you would like it to be. There are many platforms that will give you the option to set up an auto-investing tool, and the site will do the rest for you. If that's your approach, we would recommend using conservative markers as opposed to high risk markers. Just make sure the loan is secured, and make sure the borrower is a decent one with history that shows they pay back.

We suggest that you choose a platform that is clearly legitimate. You should try to go for the well-known and trusted names like Mintos, PeerBerry, or October, and try to avoid sites that are not transparent. If a platform does not show its loan volume, profit earned, or the kinds of loans they have, it is most likely a Ponzi scheme. You must be wary of such sites — they really do exist. Out of all the platforms, we can advocate for PeerBerry. They have impressive systems in place to ensure that investors don't lose their capital, and as a first time investor, we believe that's the most important part — don't lose money.