The Philosophy and Origins of Peer-to-Peer Finance

In this piece we wanted to go over why we believed in Peer-to-Peer finance as a whole. This guide will cover some of P2P history as a mechanism and where it's at now. We are going to focus on a few key elements that enabled peer-to peer-lending, expand on the necessity of credit markets and delve in to the fundamentals of modern financial technologies.

Origins of Peer-to-Peer

Peer-to-Peer networks hearken back to the first days of Internet. In order to make file sharing and data transferring more accessible to the public, scientists and technologists found a way to distribute Internet services and networks in a decentralized manner. You might even remember such systems like Napster or Limewire who were pioneers in developing peer-to-peer networks.

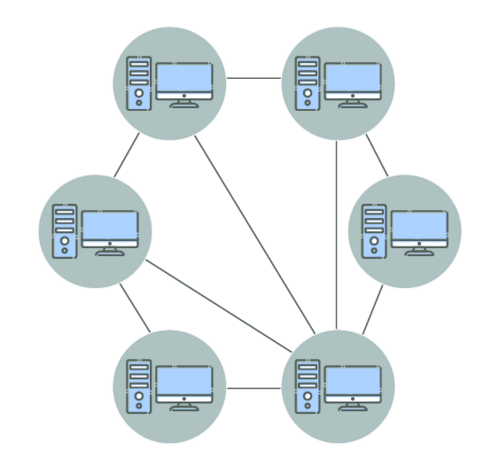

Defining a Peer-to-Peer Network

A peer-to-peer network consists of multiple nodes. These nodes are the Internet routers. They send, store and receive bits of data on the network. A network that consists of one centralized node would be responsible for the same distribution and management of data among all other nodes.

At the time a peer-to-peer network of data management was significantly faster than a centralized one. It was the difference that once allowed your web download to finish in one hour rather than one day.

P2P Network

Together, all nodes on a peer-to-peer network evenly distribute the amount of data they need to send and share. Spreading the burden of saving and sending data among everyone in the system. This revolution made the Internet easier to use and allowed it to become the hot-spot that it is today.

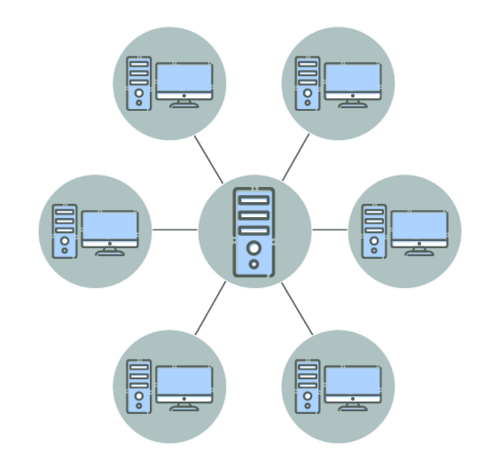

Centralized Network

A centralized network requires all computers that are requesting data from the Internet to request it through the centralized router. The centralized router is solely responsible for sending, storing and receiving data. The problem with the centralized network is that the bits of data are sent through a single channel. To save data, it requires time to copy it. Old centralized networks experience a large degree of Internet traffic because of this slow and tedious process.

Our Internet networks and systems today are more complex and incorporate a degree of centralized and decentralized networks.

What is Credit?

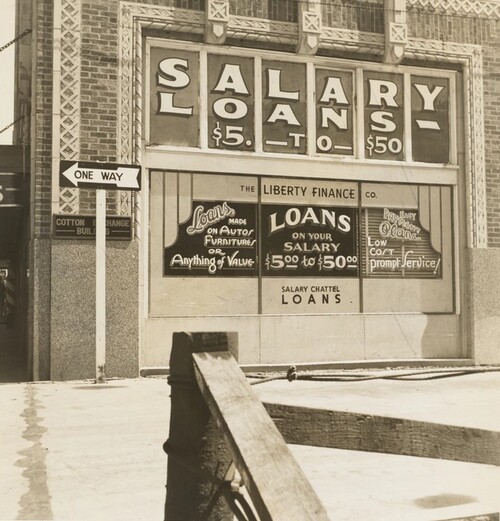

The biblical saying,"Neither a borrower nor a lender be" is outdated and inapplicable. In modern society, credit underlies every transaction. Credit cards, business loans, mortgages and car payment installments can only exist because we utilize this idea of credit.

You might be asking yourself where does all this credit come from? It comes from you, the consumer. Banks issue credit based on the amount of cash they have stored in their reserves. Based on their projected earnings they are able to print money and justify doing so with this concept of projected future revenues. This is an oversimplified explanation to illustrate that the money you deposit in your bank is the means the bank uses to issue credit.

That's not the only avenue banks use to generate cash, they also invest. In businesses, stocks, commodities and so forth, the investment banking industry is robust and complex.

Although a line of credit and a loan note are two separate things they operated under the same logic. In order for a bank to issue a loan for a substantial amount a certain amount of collateral would have to be offered up in the case borrower is unable to pay back their debt. In order for a credit line to be issued the borrower who is in needs to have some form of proof that they are indeed able to pay back their issued credit.

The concept of credit is in many ways borrowing money from ones future self with the assistance of bank services, which depending where you are, comes at a relatively high cost.

Peer-to-Peer finance is about removing the bank, the banks overhead, potential for corruption and so forth, and replacing it with decentralized intermediaries. Third parties whose sole purpose is to connect the borrower and the lender. With no alternative goals of using the money for some unknown agenda or even printing out credit without enough cash to justify it.

To summarize, Peer-to-Peer finance is about giving the individual the tools for everyday banking without having an institution like the bank which comes with bureaucracy and overhead expenses.

P2P and Micro Finance: A Symbiotic Relationship

The essence of P2P and microfinance is hundreds or thousands of small payments to fund a project that requires funding. Kickstarter is a popular example of a P2P funding site however in exchange for business, investors received physical products. Peer to Peer lending is similar to that except the investors get their money back and a bit of interest but no product.

You might be wondering how much interest? Well, lenders can find over the vast multitude of P2P lending sites a return of anywhere from 6 to 30 percent. The selling feature here being accessibility. Micro payments allow individuals who otherwise could not invest or produce a second stream of income the ability to produce one.

For some borrowers getting the bank to give them a loan or a private loan is not possible. Some borrowers, in what are considered high risk countries could never get their hands on enough capital to pursue their ambitions. P2P lending gives exposure to those who only need a little to go a long way.

Peer-to-Peer finance starts at 10 USD. It's affordable, at the lowest minimum deposit users can see a return on it. A way for anyone to manage a second stream of income in a simple, transparent and secure way. P2P finance is investing made easy.

Microfinance has only been achievable due to technological innovation. Due to the use of smart phones, applications and the innovations in programming we have been able to begin democratizing finance. There are now companies that can provide those in financial need the tools to get out of perpetual poverty. Microfinance dissolves the barriers surrounding investing, no longer does it require thousands of dollars to see valuable and positive fluctuations in ones portfolio. And this is really the essence, the definition and the mission of Peer-to-Peer Finance.

The Age of FinTech

We are currently in the nascent stages of the "Age of Fintech". FinTechs or financial technologies, have not only become a European favorite, but they have become incredibly popular around the world. Alternative and decentralized finance are all the talk in the private sector. Fintech encompasses financial technologies and software that have enabled an increase in efficiency, transacting, recording and projecting profit and losses. Modern financial technologies have changed the nature and behavior of consumption and business.

Fintech comes in many forms. Such as accounting softwares like Xero of Zoho. Online banking applications like Revolut, N26 and TransferWise. Blockchain technology such as Bitcoin and Ethereum. All variations of financial technology have drastically changed the landscape, forcing both investors and everyday consumers to reassess their financial allocation and decision making.

Other more abstract forms of financial technology have enabled people to monetize their assets that would have otherwise remained as frozen capital. Such as, a spare room in an apartment or an empty house can now turn into an income as an online hotel on AirBnB. Any car can be turned into a taxi on Uber, or a grill in your backyard can be sold on Amazon. Today, to find an investment of capital one does not need to find an investor, but may microfinance from thousands of people the amount of money he or she needs to start a venture, like on Kickstarter.

We refer to this revolution as the "sharing economy" but it is the product of disruptive financial technology and even more explicity, it's this notion of Peer-to-Peer finance. And as it was to be expected, the disruption of the sharing economy has been profound.

There is an inter-connectivity within our world which we have never experienced before. Sector by sector, the old markets of the past are being taken over by a newly adopting and changing decentralized economy. The outcome of this economic transition is a recognition and subsequent rejection of the overarching, over imposing tendencies of institutions and governments and proposals. The solution is, and always has been, to allow true laws of free market capitalism to exist.

The Future of Decentralization

Blockchain technology provides an easy solution by providing decentralized governing systems. For example, Bitcoin, is run by miners around the world, it is unprofitable to control all of the supply of Bitcoin because of a fancy concept called Byzantine Fault Tolerance. It is only owned by those who use it, and those who use it can only hold up to a certain amount. A single party or actor is unable to control the value and outcome of Bitcoin.

When we think about decentralized government we really should be asking ourselves, with about cost? "There are no solutions, only trade offs.", economist Thomas Sowell often says. What is the price that a system pays for having a decentralized government model? The answer is inefficiency. Blockchains are slow, time consuming and indecisive. Centralization produces quick decision making. Centralized banks don't argue over who to give loans and centralized governments don't hesitate to pass any policy they desire to pass.

However, Bitcoin is decentralized and therefore, slow. It considers everyone when making a decision. Bitcoin can only process roughly 300 transactions per minute, Visa processes 1700 transactions a second. Using Bitcoin is out of the question, it is old software.

Even so, Bitcoin is just another manifestation of the worlds shift towards a less centralized economy. There is great debate as to which direction we as collective societies should assume when questioned with the applicability of crypto-currencies. The outcome will most likely be an economy which supports multiple currencies, some of which will be fiat and some of which will be digital.

Fiat or Crypto?

When considering alternative forms of finance as opposed to traditional forms we reach the contemporary debate, fiat or crypto? Fiat refers to government tender, cash. Crypto refers to coins like Bitcoin and Ethereum. The everyday consumer probably knows a little bit about fiat and even less about crypto. It's not exactly a conversation starter and most people probably don't have the time nor interest to really understand the way money, fiat or crypto works.

There are however, the best options to consider when investing in either fiat or crypto peer-to-peer investment vehicles. We have taken our top three from both the crypto, decentralized world of finance and the top three from our fiat, centralized world of finance.

For more information regarding decentralized P2P lenders we advise checking out our Guide on Alternative Crypto Lending.

Considering Peer-to-Peer Finance?

Ultimately the investor needs to choose the investment vehicle most comfortable and most known to them. If one cannot decide whether or not to choose bonds, stocks, homes or p2p lending we advise choosing what it is you know best. If you're still at the learning curve, then learn more. Investing is all about making wise, careful and fiscally responsible decisions.

Crypto Companies

YearnFinance

YearnFinance is an incredibly popular crypto-currency. They provide interest on crypto-assets like Ethereum and other ERC-20 Tokens. They are one of DeFi's most prized possessions and there are high hopes for Yearn.Finance since they have been the fastest growing crypto-currency to date.

YearnFinance uses a complex algorithm to ensure their investors they are always receiving the highest possible return on investment. It is totally hands off and currently advertises one of the highest returns in the DeFi space.

Yearn.finance accomplishes this by hosting several crypto-currencies to use as lending capital and a few crypto-currencies to use as collateral. The usage of two chains that serve different purposes, as well as, a successful algorithm has brought Yearn.Finance to the forefront of crypto as one of highest valuated cryptos.

CoinLoan

CoinLoan is a popular Estonian P2P lender. It is a private company that offers a lender/borrower ecosystem that utilizes crypto assets.

They also offer a CLT token which is representative of their ecosystem. CoinLoan is one of the biggest DeFi peer-to-peer lenders and have only continued to grow since the beginning of their operations in 2017. CoinLoan requires a 100 EUR minimum deposit to receive a roughly 6 - 10% IRR.

CoinLoan's business model is rather simple, investors deposit their capital into a pool of their preferred crypto. CoinLoan offers dozens of different currencies. The platform selects the lenders who put up loan amounts in the form of Ethereum or Bitcoin, which they then receive regular repayments from. In the case of a defaulted loan, CoinLoan simply takes the borrowers crypto collateral and pays back the lender. The sole risk of this platform exists from the high volatility and price fluctuations that is associated with crypto-currencies as a whole.

Binance

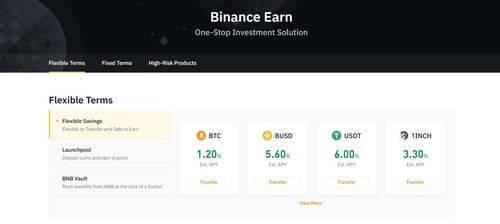

Binance is a crypto-currency exchange platform. They also offers a vast multitude of services one of them being peer-to-peer finance. Binance despite not solely being a lender they are very prolific in the industry in all of their services.

Binance is one of the largest crypto-companies. While they specialise as an exchange platform they have branched out and have become an all encompassing crypto-platform. They offer the BNB token, which can be also be used in their peer-to-peer services. There is no minimum entry to deposit with Binance Earn, there is also no set yearly return, as it constantly varies. Due to the speculative nature of investing with crypto-currencies it is often difficult to determine what kind of yield an investor will receive.

The option of stable coins that can be seen in the image below such as BUSD or USDT is fixed. Investors can expect 5 or 6 percent on the stable coins offered on Binance Earn.

A lot of Binance's lending capital goes directly to the derivative market on Binance that allows traders to buy and sell options. Binance cooperates with other major blockchain networks to deliver an affordable, profitable and efficient blockchain for everyone. Binance Earn also provides different benefits that come with using the platform Binance. Earning with Binance will give you the opportunity to take part in cheap token sales, airdrops and other features the platform hosts.

Fiat Companies

PeerBerry

PeerBerry is Europe's second biggest P2P lending platform. Their service can be understood from the perspective of their group company, Aventus Group, who service the loans and then allows lenders to participate in their loan portfolio.

PeerBerry is the fastest growing fiat company today. They have an incredibly attractive marketplace where loans are constantly being updated, processed and produced. PeerBerry is classified as a loan originator aggregator. This means that PeerBerry hosts a marketplace whereby many other lending organizations participate and offer their loans. The lenders or investors come and select which loans they prefer the most. When a loan originator is successful on PeerBerry, then the entity may add more loans to the marketplace.

PeerBerry loans start as little as 10 EUR. The minimum to invest is 10 EUR and the projected return on PeerBerry has traditionally been 9 - 13 percent annually. PeerBerry loans, by and large, come with both a buyback guarantee as well as mortgage in the case of a defaulted loan.

EstateGuru

EstateGuru is a European favorite, they offer an attractive return, the most secured system and a very easy to use interface. Their only downside is that they only offer real estate. EstateGuru is better as a part of an overall diversified portfolio rather than the ultimate peer-to-peer lending platform.

EstateGuru is a very popular real estate backed P2P lender. Users can expect a high return on EstateGuru and all investments are backed by physical property. EstateGuru also has an awesome fund recovery percentage: 100 percent.

EstateGuru starts at 50 EUR minimum deposits, the projected return on EstateGuru is 8 - 12 percent yearly return. In order to use to the auto investing function, users must invest more than 250 EUR. EstateGuru is well known for the fact that they have never lost their investors capital. EstateGuru offers no buyback guarantees because of the mortgages that backs every loan contract. As per our experience we have found that EstateGuru suffers from late payments and subsequent cash drag.

Mintos

Mintos is a loan originator aggregator, they invite multiple loan originators to their marketplace and borrowers determine, based on choices and reviews, which loan originator is the best and most profitable. While Mintos is highly profitable, they have endured some hiccups over the last few years, but overall they are still holding the top position.

Mintos is the favored P2P lending company in Europe and arguably in the international world. Mintos has in almost every way redefined modern peer-to-peer lending. Especially given the size of their platform they report a low default rate and many platforms around the world have been influenced by Mintos' easy-investing platform.

Mintos is a loan originator aggregator that hosts many different loan originators in Europe. In Europe, Mintos has the largest volume of loans, lenders and loan originators. The minimum entry is 10 EUR and users can expect to earn 8 - 12 percent yearly with Mintos. Mintos is a great platform for both beginners and advanced peer-to-peer investors. Mintos by far offers the most diversified portfolio marketplace one could ask for.

Verdict

Both approaches to investing come with their strengths and weaknesses. One can either choose physical collateral like that of a car or a house, or one could prefer to use crypto-assets as collateral. Both fiat currencies and crypto-currencies are subject to price change. In some cases it could be drastic, in others less. It's very much determined on which currency. The same applies to crypto-currencies, as there are those which are stable and others that are highly volatile.

Loans defaulting on crypto seem to have a much easier, more logical solution. The collateral submitted is simply taken. Where as with fiat, in traditional methods of fund recovery, it can get very messy. P2P Lending companies that operate with crypto and fiat endure problems of vastly different natures and so investors can expect to see vastly different results when comparing the two markets.