P2PIncome | Understanding P2P Investment Structures

Direct and Indirect Investment Structured Loans on P2P Lending

In this guide today we would like to cover investment structures. Two type of investment structures underlie the majority of peer-to-peer platforms. You may have noticed there are several types of platforms. Some platforms work with loan originators, some work as loan originators and others simply connect borrowers and lenders together.

These three models are the most prevalent:

- Work with Loan Originators

- Work as Loan Originators

- Facilitate Borrowers and Lenders

Investment Structures

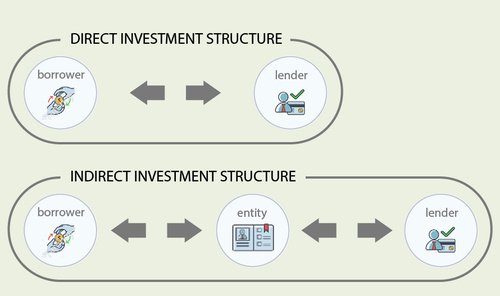

While you may have been aware of these different business models, you may not be aware of the investment structure that is agreed upon which differs based on platform. The two types of investment structures are indirect investment structures and direct investment structures.

- A direct investment structure simply means you're purchasing loan rights against the borrower. Only those that operate as facilitators between borrowers and lenders issued direct investment structures. This also means there are no buyback guarantees.

- An indirect investment structure simply means you're purchasing loan rights against the lending service, and this can only be done with platforms that work with loan originators.

These two pieces of information are important because when all hell breaks loose and your money is lost, the investment structure determines who is going to pay you back. This becomes increasingly more complicated when we consider buyback guarantees and collateral. In this blog we will do our best to explain where it matters, the pros and cons of both structures and what actually happens when something goes wrong.

The two types of investments came about because of the emergence of P2P platforms working with loan originators. Prior to loan originators there was no need for a distinction as everything was understood as lenders have direct buying rights against their borrowers. Loan originators entering the scene meant the possibility of changing the rules.

Because the ecosystem of platforms that work with LO's consists of generally four different parties: the lender, the borrower, the platform, and the loan originator, the factor of multiple parties made it possible to change the position of liability in the loan agreement.

What does this mean?

What it means is that the lender can purchase loan rights from the platform, making the platform liable rather than the actual borrower. The reason the possibility was acted upon is because it is enticing for lenders to feel as if there is a guardian willing to bail them out if the lender chooses an unprofitable loan.

Another way of understanding it is, indirect investment structures are lending capital to the loan originator whereas, direct investment structures are lending capital directly to the borrower.

Buyback Guarantees

Buyback guarantees are the result of an indirect investment structure. What they proclaim is that if the borrower defaults the loan originator who issues the buyback guarantee, purchases the loan agreement back from the lender. Issuing all principal and accrued interest to the investor for the duration they held the loan contract.

This sounds great in theory but has not been perfectly attainable. Many platforms struggle to make good on their buyback guarantee. A buy back guarantee is only as good as the platform that issues it. Often enough, the loan originators that issue buy back guarantees go bankrupt along with their borrowers. A good examples would be Mintos, a platforms that albeit had buyback guarantees, was not properly able to trigger them due to loan originators not being unable to live up to the promise of their guarantees.

Buyback guarantees, simply mean that the loan originators will pay the loan back first, but still they'll still chase after the borrower for missing capital. If a loan originator is constantly triggering its buyback guarantee and their borrowers are defaulting, the company reaches a point where it's not so simple to be liquid and pay out to their lenders. This is a direct factor for loan originators going bust.

To summarize, Buyback guarantees do not fix the problem of a defaulted loan. They sweep it under the rug and hopefully, deal with it later. If you want to read more about platforms with buyback guarantees please refer to our guide on buyback guarantees.

Loan Originators

Loan originators(LO) are platforms that find borrowers to issue loans. They are generally big financial institutions that have a niche in certain industries and give out loans to those relevant industries.

Some platforms like Mintos, PeerBerry and RoboCash host a multiplicity of loan originators. They are in effect, Loan Originator Aggregators(LOA). With that, they encounter their own problems of managing and operating their lending/borrowing ecosystem.

Just because a platform is a loan originator or operates with them does not mean that they work with an indirect investment strategy. Often, platforms have different investment strategies to offer different investment models and packages to their investors. If you're interested in learning more on how other companies have implemented auto-investing features, then please take the time to check out our blog on the best P2P platforms for auto-investing.

What's Better for the Lender and Borrower?

There is no better or worse way. Both investment structures come with their own benefits. Some platforms like to utilize only one, and others make room for both investment structures.

One of the downsides to direct investment structure is dependent on the type of loan you are purchasing. For example, if you have a loan to a rental company that rents out homes, then you own a position in the rental companies activities. Which means, your capital carries the same risk that the rental company does.

An indirect investment structure here outranks a direct investment structure because in an indirect investment structure the lender would not bare the risk of the asset.

An indirect structure is often issued for unsecured consumer loans, meaning, the borrower goes through a credit check in order to verify that he is eligible to receive capital. He does not post up any collateral in order to receive his loan. So the investor, rather the lender, is put in a position where he can't do much about his losing his investment if his borrower chooses to default. So the loan originator can issue a buyback guarantee, and the LO claims that if the borrower stops paying, the LO will step in and cover the loans. This enables a sense of security for the lender.

The problem with a direct investment structure for borrowers is it allows the investor to come after them directly. Whereas, on an indirect investment platform everything is dealt with through the platform and loan originator.

Verdict

Platforms that issue reliable buyback guarantees are definitely platforms worth taking a look at. Some platforms may not offer buyback guarantees, but instead have collateral to ensure your principal is protected.

Guarantees are a product of indirect investment structure, and fund recovery strategies are a product of direct investment structures.

In the end, the value of the product is based off the details that you'll be presented with before agreeing to a loan contract. These details are what determine the success of your investment, as well as the platform offering the investment.

The details will vary in nature for either investment structure. For instance, in an indirect investment structure you should be concerned with the loan originators and the platform issuing the loan. In a direct investment structure it's important to understand the actual borrowers, why are they borrowing the loan, and are they capable of paying back the loan in a worst case scenario.