Binance Smart Chain Reviewed | Binance's DeFi

Binance is currently one of the biggest cryptocurrency oriented companies in the world. They sell a multitude of services for investors and borrowers alike. Investors can choose to invest with cryptocurrencies and may choose to invest with fiat currencies. One of their new products is known as the Binance Smart Chain, which has taken the decentralized finance industry by the storm by issuing high interest rates on a brand new array of exciting projects. The Binance Smart Chain has it's own token variation of Binance's BNB coin and allows BEP20 tokens and cross-chain compatibility.

What is the Binance Smart Chain?

The Binance Smart Chain (BSC), a product of Binance, is a blockchain consortium that allows developers to build applications and cryptocurrencies. More relevantly, it serves as a major incubator for the booming industry of decentralized finance (DeFi). The BSC offers to fund projects around the world and integrates these projects into Binance's exchange. Binance has become a very real contender for cryptocurrencies that aim to build their own overarching networks for decentralized applications, like Caradano, Ethereum, EOS and Polkadot.

The tokens listed on the BSC are BEP20 tokens. This is simply another term for the type of currencies that can interact with the BSC. The BEP20 standard was built to be similar to Ethereums ERC20 tokens, and both token standards encourage cross-chain compatibility. It's important, therefore, not to confuse these tokens with cryptocurrency "coins." Cryptocurrencies, such as Bitcoin, Ethereum, and Doge, are measured in coins or fractions thereof. Just like with fiat currency, you can own 1 Bitcoin, 1/2 a Bitcoin, or even 1/10,000 of a Bitcoin (similar to small change).

Often, you'll be able to use your cryptocurrency to purchase items, make investments, and engage in other financial transactions (again, just like with fiat currency). There are even crypto-lenders, meaning, sites that lend cryptocurrencies utilizing a peer-to-peer framework. However, all of the above are valued in Bitcoin specifically, and in order to exchange them to some other currency, whether crypto or fiat, you'll to go to a currency exchange.

On the other hand, Binance tokens are cross-currency. To quote the Binance Academy, tokens are "transferable units of value issued on top of a blockchain." That means they are inflexible in terms of value, but highly flexible in use.

The Difference Between Binance and the Binance Smart Chain

The Binance Smart Chain began in April 2019, and Binance as an exchange, has been up since 2017. To begin with, let us first distinguish between the two: the Binance exchange and the Binance Smart Chain.

Binance

Binance is a centralized cryptocurrency exchange. This means they are a company, like any other, that provides investment services to anyone interested in purchasing cryptocurrencies.

Binance Smart Chain

Binance Smart Chain is a decentralized public blockchain which hosts a network where users can build applications, share ideas and transact. The development of the BSC has enabled a whole new array of decentralized, financial, instruments.

Crypto enthusiasts are quickly claiming that decentralized finance will likely change of the future of finance forever. In this blog, we are going to focus as much as we can on the Binance Smart Chain, and because the two are very interrelated, there will be limited commentary on Binance itself.

To use Binance's Smart Chain one can only use it through portals that connect to certain blockchain portals, a "Trust Wallet" or "Meta Mask Wallet" are two viable options.

The Trust Wallet

The Trust Wallet is a secured wallet designed by Binance's team to hold and stake multiple cryptocurrencies securely. If you are already a Binance userת you might be wondering how do you enjoy the benefits of yielding 90 - 120% of your current portfolio. The answer is, you have to use the digital wallet they developed. You can download it from AppleStore or the PlayStore.

It has a very simple design and lay out. If you're unfamiliar with digital wallets, what you can expect is, you open a wallet and upon opening, the wallet will randomly generate a few words. You must keep these words safe in the exact same order you see them. These are your private keys and are basically your only password into retrieving your funds when needed. You can fully use your wallet 'when your keys are secured. Once you're using your TrustWallet you can send your cryptocurrencies to, and from your wallet, without problems and the fees are comparatively small.

MetaMask

MetaMask is an online extension that you can add to your web browser. It is also a portal that will connect you a to a number of blockchain networks that you can then use to send and receive your tokens and coins. The same conditions with your private keys apply to the MetaMask.

In order to have your MetaMask fully functioning you may use the following steps:

Step 1: Open the MetaMask browser, select Networks, Custom RPC

Step 2: Fill in the following information

Network Name: Binance Smart Chain

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

Step 3: Press "Save"

After that, your wallet should be functioning properly. In order to get started with actually participating in the staking and liquidity pools you must first obtain some Binance tokens which can be purchased on multiple exchanges, but it would be best to purchase it from Binance itself.

Lender/Borrower Ecosystem

Investors have over a dozen ways of investing with Binance. Many of them involve lending money and staking, and investors can stake their capital with different cryptocurrencies. Staking is the act of putting your funds in a vault and allowing the system to use your tokens to keep the blockchain functioning. Investors can stake their capital in farms or directly lend out their capital to borrowers. Let's take a dive further and explain these concepts.

Staking/ Pooling Capital

Staking and pooling capital refers to individuals who pool all of their resources together to earn more rewards within the given blockchain. In this case, in the Binance smart chain, users can pool together their cryptocurrencies in order to earn more cryptocurrencies. This works under the concept of staking, which means that if you own a certain percentage of the coins market cap then you can "stake" that token, temporarily locking the coin, and it will earn more coins within the system. This is made possible for a few reasons, but most importantly, it is the essence of how the network functions.

Liquidity Capital

Liquidity pools is another way of earning with cryptocurrency exchanges. What it means is that you as an investor can supply the exchange, which ever it may be, with liquidity. You provide two assets, for example Bitcoin and Ethereum, and everyone who is trading their Bitcoin for Ethereum, or the other way around, can benefit from the liquidity you provide. This is because in most exchanges it's not the platform that sells the asset. It is the individuals who come to the marketplace to exchange goods. This liquidity does not only provide a speedy increase of transactions for those in the marketplace, but it also gives the traders the option to trade in derivatives. The derivative market exists for just about anything. In a nutshell, trading derivatives, means you agree to purchase a good or a product in the future for a fixed price.

Adding liquidity into the crypto marketplace allows investors and traders to participate in trading futures. Which to many investors is an essential feature of any good crypto exchange.

Non-Fungible Tokens(NFTs)

NFT's are digital signatures that claim a piece of content is the rightful owner of whoever owns the signature. For example, you can purchase the digital signature of Warren Buffets first tweet, or Facebook post. This can do two things for you. It can either be used as a royalty, if someone wants to use Warren Buffet's tweet he would have to pay the owner to use it. Or, for capital gains, in the future, someone else may find value in that tweet and want to purchase it at a marked up price.

Registration & Withdrawal

To use the Binance Smart Chain, you have to use either MetaMask or Binance's Trust Wallet.

Registration with Binance is quick and easy. It only takes a few minutes to have an account set up with Binance. In order to use Binance's more complicated features, users need to be verified.

Marketplace

The marketplace is incredibly vast and consists of numerous types of financial technologies. Nobody owns the marketplace, as it is shared by all the participants. Because of this, investors are at their own risk when investing. There are no guarantees or security when investing in Binance's Smart Chain. In their marketplace, investors can find portals to Pancakeswap, Bakeryswap, Sushiswap and so on. In order to reap the benefits of the newly booming crypto-market one would have to look into these portals to find profit and take it for themselves.

Binance Smart Chain Price

To make money on the cryptocurrency marketplace, you need to know how to track the value (price) of the various coins. You have to ask yourself, "Is the smart chain down?" "Am I making money?" To do so, you'll need to follow the data closely. Luckily, there are several great trackers available online. For example,

Investment Strategy

Due to the various ways of investing with Binance, the investment strategy will vary regarding risk, returns and investment style. You can either choose to exchange tokens in hopes that one will earn more capital gains, or you may pool in your funds with other investors to enjoy a hands off investing approach, or you may lend your capital out to either borrowers or liquidity pools.

There is no "automatic" investing where an algorithm will choose how to invest for you based on risk preferences. Cryptocurrency is always considered a very high risk investment. Because of this, investors are solely responsible for their own losses. Your investment strategy should consist of great due diligence and careful acquisition of cryptocurrencies that you understand and believe in.

In general, staking pools can be an option for many investors because once this investment is made it becomes a hands off experience.

Understanding Governance Models

Decentralized finance is very much like alternative finance, however, the rules of governing are different. In decentralized finance it is the investors and borrowers that own the system and in order to achieve progress and make decisions, there must always be consensus. In alternative finance, the company that services the marketplace owns the system. The reason why this is important is because if there are problems or new rules implemented in to the decentralized system, then the entire community decides through a dedicated system, how they would like to deal with changes and problems. Whereas, in a traditional company, it is just down to the CEO and partners.

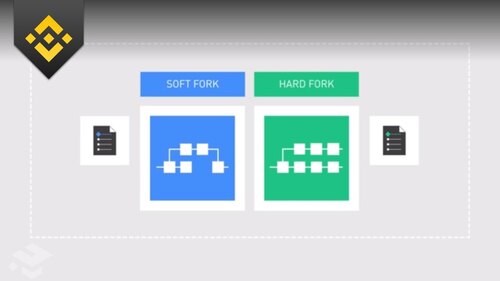

Decentralized Finance

Decentralized finance is decentralized: When one understands blockchain technology one becomes familiar with their unique features, soft forks and hard forks. When miners process blockchain transactions they are responsible for what is processed and what is not processed. They have voting power, miners have the ability to vote on whether they want an update to the system. Most soft forks are passed through the blockchain without issue, and they require a 51% majority from the miners in order to fully update. Hard forks, on the other hand, imply a drift between miners. What happens is, a significant percentage of the community do not recognize the new set of rules. This community becomes divided in half, and the new miners continue into their own chain with their new protocol. The opposing miners retain their old protocol, but become a new cryptocurrency.

Soft Forks

Soft forks refer to minimal software upgrades to the system and hardforks quite literally mean a bifurcation of the blockchain and the creation of a new token. The soft fork works to implement small changes such as, transaction size, speed or perhaps a visual change. The point being here, is that soft forks are no big deal to the block chain system.

Hard Forks

Hard forks refer to major software upgrades that generally speaking, divide the community. This split of the blockchain is bad for a few reasons, the first one being, the initial chain loses a substantial fraction of their processing power. Which means the blockchain becomes more easily congested and fees significantly increase.

Moreover, this is in some ways the most concerning elements of a blockchain. If the community is divided, there is no consensus. To make decisions for the entire network is very time consuming and can result in a complete halt of the system, which does not bode well for the participants of the network.

Cryptocurrency Governance Risks

This could all imply very high levels of risk, as well as overall failure of the system. Imagine a business or family that could never come to consensus. This is one of the potential risks of any cryptocurrency that aims to be a network for decentralized applications. The second incredibly high level of risk is the intrinsic nature of cryptocurrencies. Due to their inability to be regulated, they are incredibly volatile. Those who hold large market shares of cryptocurrencies, also known as whales, can manipulate the market with the power of their pocket alone. Interesting examples could include George Soros when he broke the British Pound, and Elon Musk when he caused an artificial pump and dump of the cryptocurrency Dogecoin.

Alternative Finance

Alternative finance is centralized: When we look at peer-to-peer lending companies like Mintos, PeerBerry, October and Propser, what we see is a centralized group of individuals managing an entire marketplace for millions of investors. When the heads of these companies see reason to make a decision, they simply do it. At times, there are shareholders weighing in, giving their two cents, and as holders, they are listened too. But even in this case, it is a handful of individuals, ultimately, responsible for the well-being of your investments.

This efficiency in decision-making and execution with peer-to-peer lending companies is unfortunately absent in blockchain technology. It's also may be concerning to imagine that the crypto economy is in the hands of the masses. We don't need to open an encyclopedia of ancient Greece to know the mob is not always right. We have also seen a fair share of peer-to-peer lending companies fall due to the pressure of COVID-19. Dozens of peer-to-peer lending platforms, some very well known ones, have had to halt operations due to having far more liabilities than assets. There is no shortage of companies out there with dishonest intentions, and operate as disingenuously as any ponzi scheme.

Peer-to-peer lending, absent the crypto, is still under regulated, under licensed and under development, it has much room to grow.

In comparison, new cryptocurrencies have also shown that they do not necessarily produce a kind of value or utility, as of yet. Because of this, it's difficult to even justify the amount of money that has been poured into this industry. Because of these two reasons, the untested governance model, as well as the volatility of it, it is reasonable to say that crypto is a very volatile investing avenue.

Transparency & Security

Returning to the Binance Smart Chain, in terms of transparency, everything that happens on the Blockchain is available for everyone to see. It is completely open source, and while there is a large degree of anonymity, all the transactions that occur are visible for everyone to see.

In terms of security, online currency exchanges are often victims of internet hackers who attempt to maliciously steal funds from exchanges. And if that isn't bad enough, there are horror stories all over the web about people with millions of dollars lost in Bitcoin because they forgot their private keys. Making sure your private keys are safe, secure and redeemable has proven to be a risk in itself.

Using cryptocurrencies and investing in cryptocurrencies require a great degree of self-responsibility. Because you're responsible for being your own bank and, therefore, you are liable for the security of your assets.

Crisis Management

During the COVID-19 pandemic, Binance and Binance Smart Chain were positively affected. The market seemed to favor cryptocurrencies in the presence of all the government issued relief packages.

Our Readers Have Asked:

Is it safe to invest with Binance?

No investment is ever "safe". There is an inverse relationship between risk and reward, the more risk you take the higher your reward, as well as the chances of losing your investment.

How much money will I make?

Due to high volatility, it is possible to make 300% in yearly returns by staking capital or supplying capital to liquidity pools. The percentage you will earn is also indicative of how much you may lose. It's possible to lose your entire investment and in many cases, it is likely.

What are the risks?

The risks of investing in cryptocurrencies is that the coin's value will decrease to the point of worthlessness, that the exchange will be hacked, or that you may lose your private keys. Each of those risks total loss of capital.

Why do I need to submit ID verification?

In order to deposit on Binance you will not need to submit ID verification. In order to withdraw, you will. This is because companies require to go through a protocol called know-your-customer (KYC). KYC is the method companies use to prevent fraud and malicious actors.

Is P2P Lending a Ponzi Scheme?

Concerns regarding Ponzi schemes are understandable, but in the case of P2P lending much of the fear is unwarranted. The majority of P2P sites are legitimate operations that merely facilitate decentralized lending and investing. That being said, there are always going to be unscrupulous entities, and caution is always warranted.

Where is Binance Located?

Binance is located in Malta.

Watch & (L)earn

Discover more about Binance in this short but informative video.

Pros, Cons and the Verdict

Pros

- Impressive Profits

Cons

- Highly Volatile

- Difficult UI and UX

Cryptocurrency is a very high-risk investment asset. It is known for its hyper-volatility, and is often described as "gambling." Cryptocurrencies should be approached with extreme caution. Having been founded in 2017, Binance, has only just begun. Binance is already the largest cryptocurrency exchange and is in the top 5 cryptocurrencies by market capitalization.

The Binance Smart Chain moves with Binance. It is Binance's other half, with projects founded and listed on the Smart Chain, and then brought to Binance. Their ecosystems are intertwined. The Binance Smart Chain has proven to be an incredibly interesting project, with high returns, a sophisticated interface, and a lot of market volatility.