Monthly Report Sep 2021 Entry #9

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

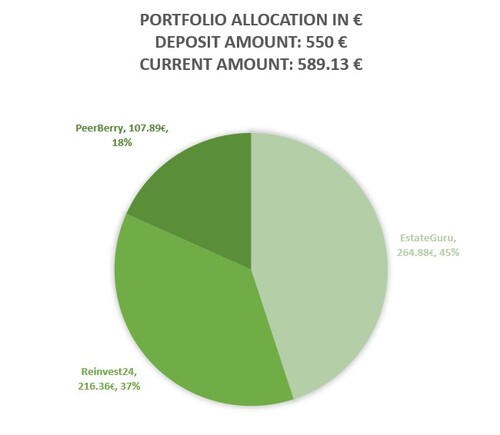

The current portfolio breakdown:

As August ends we find ourselves in a similar position as when we entered it. With similar conclusions and similar experiences, PeerBerry and Reinvest24 paid out slightly above average pay outs this month, EstateGuru paid out a few EUR, but still far too little to be considered a good sign. EstateGuru has assured it's investors that at least one of the two late loans will resume its loan contract on time and investors' funds are safe.

ReInvest24

Reinvest24 is a neat peer-to-peer lending service that uses new methods to construct their lending ecosystem. Reinvest24 does not sell traditional mortgages, instead, they sell temporary partial equity. The difference is, instead of being paid back like a traditional loan agreement you are paid back interest in the form of rental dividends. The upside being is that Reinvest24 has a business strategy and execution to sell all of their real estate property that they are offering. When they sell the projects the shares increase in value. So the investors on Reinvest24 benefit from two forms of income, rental dividends and capital growth.

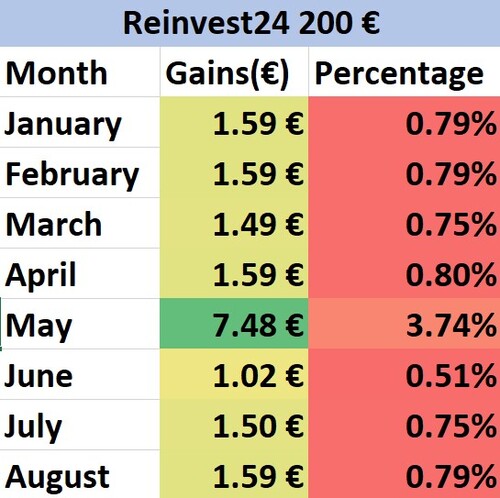

Starting Amount: € 200

After 8 Months: € 216.36

Total Percentage Increase: 8.18%

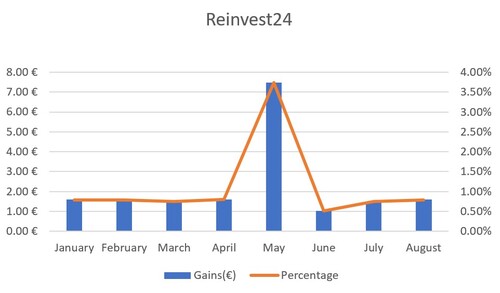

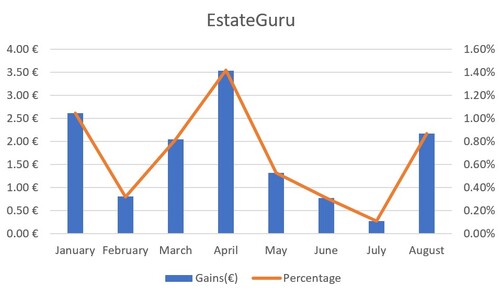

August showed, as usual, that Reinvest pays out similar amounts of interest. In our last monthly report and as can be seen by the chart above, that Reinvest24 pays a little under one percent on a monthly basis, with the exception of the large spike which signifies a capital gain which occurs when a property is sold. Because investors hold equity as opposed to a more regular loan contract, the owner's share also increases in value.

Generally speaking, investors can expect to receive anywhere between 0.70 - 0.80 percent in interest. The capital gains equation of the process appears to be a more arbitrary thing. In any rate, yielding 0.80 percent a month interest is considerably high for the low amount of risk we have experienced on Reinvest24 in our last 9 months of investing with them. We're still interested to see what will happen with our development loan in the seventh stage. If it finishes completion it may also be interesting to see what happens to it's value.

In any case, we can still foresee a minimum of a 9 percent yearly return with Reinvest24 not including our capital gains. That being the case, we are really quite pleased with our decision to invest with Reinvest24.

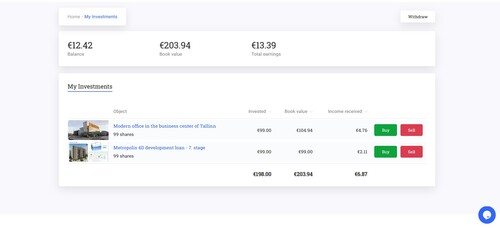

Marketplace

We're regularly checking to see how is Reinvest24's marketplace fairing, as well as the movement of their secondary market. Reinvest24 is making progress, though their primary market does not seem to add projects often. When we began our portfolio we only had two options to invest in. Currently, investors have four choices. While that it is better, it is only marginally better, as it indicates the platform does have a bit of cash drag. We have spoken to their team and they disclosed that they have many projects they wish to introduce, but must first increase their investor base.

We continue to be satisfied with our investment on Reinvest24, and we are hoping our development loan will rise in share value in the same way our modern offices value increased. Hopefully, by next month's issue, we will all see this desire come to light.

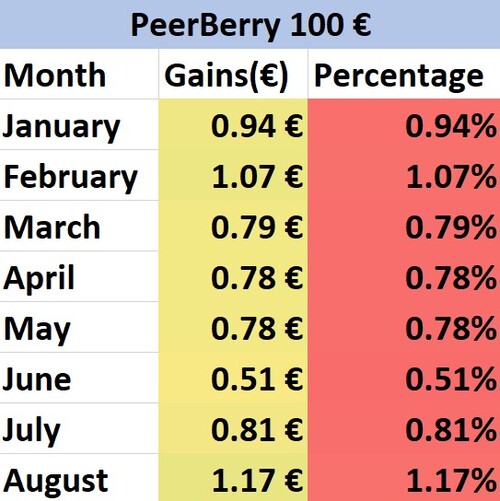

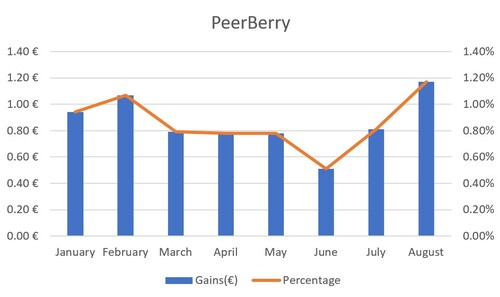

PeerBerry

PeerBerry was formed in 2017 by the loan originator Aventus Group, a very profitable lending organization in Europe. PeerBerry aggregates many loan originators, including Aventus onto their platform where they can offer them to retail investors like us. PeerBerry stands out from the rest of the peer-to-peer lending platforms due to extra security, high returns and ease of use.

Starting Amount: € 100

After 8 Months: € 107.89

Total Percentage Increase: 7.89%

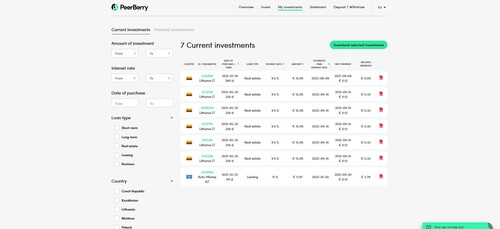

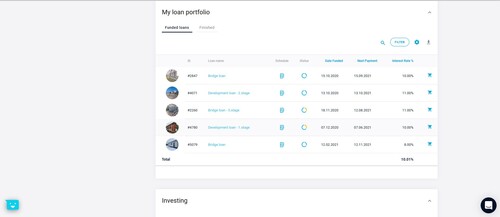

PeerBerry has been consistent with its payouts in both amounts and pay out time. Many of our current loans are in long term positions and will only end some time next year in June and July. Prior to these loans, which you can find in our investment guide, we have been invested in short term loans that spanned 30 days to a handful of months. It will be interesting to see how our portfolio will continue to function with our new types of loans. Long terms loans can be problematic due to PeerBerry's lack of liquidity. In no circumstance, will we have the ability to pull the capital out.

As we can see from the table and graph above, the returns with PeerBerry are also considerably high for a platform with very serious security protocols. PeerBerry has also shown itself to reliable and even praiseworthy. The communication from PeerBerry's end is consistent and is of high value. We could definitely recommend PeerBerry for peer-to-peer consumer lending.

Marketplace Review

We are regularly receiving income for all of our projects in our portfolio. All of them are similar except for Auto-Money. Other than Auto-Money, all our loans on PeerBerry are issued by a Kazakh loan originator that deals with real estate. We find that the safest investments tend to be real estate and generally opt for them in all of our investment strategies.

Even 12 months later we experience absolutely zero problems with PeerBerry in terms of pay outs, cash drag and auto-investing. PeerBerry has been without question a great place for us to invest.

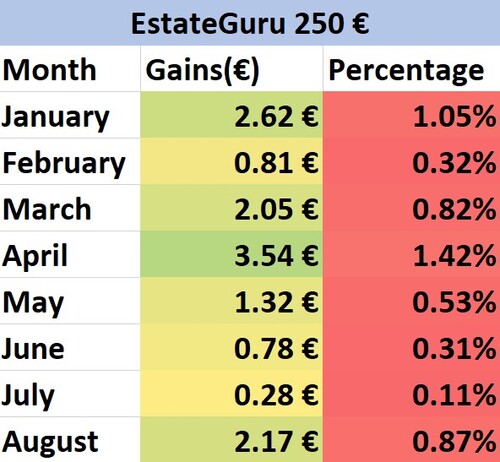

EstateGuru

EstateGuru is a real estate crowdfunding titan in Europe. The platform was formed in 2013 by a group of financial and property management veteran. Together they sought to bring large scale property developments and the tools of microfinance to usher in a new dawn of property lending. All loans on EstateGuru are backed 1st or 2nd rank mortgages. EstateGuru has a very active secondary market and sophisticated auto-investing tool. EstateGuru caters to the largest number of properties in Europe making for a very exciting marketplace where great projects get snatched up quickly. To invest with EstateGuru there is a minimum investment entry of 50 EUR and yearly returns are projected to be 8 - 12 percent.

Starting Amount: € 250

After 9 Months: € 264.88

Total Percentage Increase: 5.95%

EstateGuru finally paid out and by next months issue one of our loans should have found a resolution and no longer be late. Hopefully it will continue to pay in good faith. We received just a little bit over 2 EUR from EstateGuru this month, and they will really have to step it up to make good on their projected return. One of our loans is currently 30 days late and it will most likely default. Otherwise, our other projects are paying out minimally. EstateGuru's projected interest rate does not calculate the actual earnings from the loans, it only calculates the advertised return.

Marketplace Review

EstateGuru has a very diverse marketplace when it comes to property crowdfunding. As opposed to last months report, this month was much better, but it was still lacking. EstateGuru needs to resolve the situation with their late borrowers before it becomes unsalvageable and costly to investors.

Sadly, we remain greatly disappointed with our investing experience on EstateGuru. Reinvest24 and PeerBerry, which are brand new platforms show far greater opportunity and return on investment. For this month, we conclude that allocating a larger section of our portfolio to EstateGuru was a mistake.

Comparing Platforms

As you can see in the table below, PeerBerry's consistency is showing itself and quickly catching up to Reinvest24 gains. Depending on whether or not Reinvest24 makes a sale on one of their properties, PeerBerry may prove itself to be the more reliable platform for high earnings. In terms of safety, we can also conclude that EstateGuru is not as safe as these two competitor platforms. Also, from our experience, we would suggest that Reinvest24 and PeerBerry are both great platforms for high yields.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 16.36 | 8.18% |

| PeerBerry | € 100 | € 7.89 | 7.89% |

| EstateGuru | € 250 | € 14.88 | 5.95% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

This month's verdict was similar to last months verdict. A tug of war between PeerBerry and Reinvest24, with Reinvest24 stealing the spotlight by a very small margin. EstateGuru continues to lack in our portfolio. Technically, twelve months have passed and this monthly report would indicate our first year of peer-to-peer lending with Reinvest24, PeerBerry and EstateGuru. It's been a very interesting experience to compare these huge industry players. For this year, we would have to say that Reinvest24 has been our most successful investment.