Monthly Report Aug 2021 Entry #8

Please read P2PIncome's most recent investment-portfolio report for 2026.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

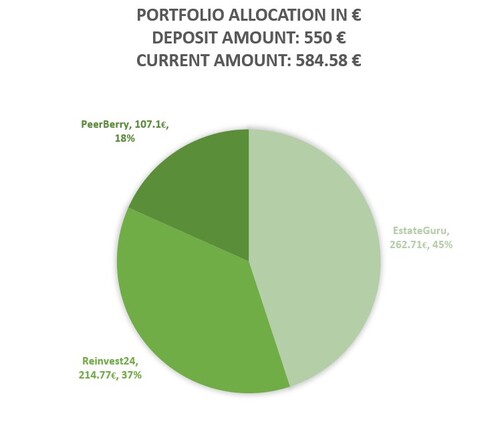

The current portfolio breakdown:

As we enter August we affirm that Reinvest24 was our most ideal pick, PeerBerry is still favorable and EstateGuru has become deeply concerning. Our second purchase on Reinvest24 appears to be yielding positively with zero issues, minimal cash drag and no late payments. Though, it still may be too soon to say with certainty that the newly purchased Metropolis 4D development loan was a good purchase. There have been no shifts in percentage in our total portfolio allocation. EstateGuru has been bringing in even smaller profits, with little to zero communication from the team regarding the late loans and their current status.

We got in touch with their support team to see about what may be happening in regard to our late loans, and their reply was an automated generic response redirecting us to our portfolio overview.

ReInvest24

Reinvest24 is a peer-to-peer lending platform that provides investors real estate equity in exchange for borrowing capital. Reinvest24 is essentially a loan originator primarily originating in Estonia and partially operates in other Eastern European countries. They act as mediators between borrowers and investors and successfully manage a high yielding and very secure peer-to-peer lending service.

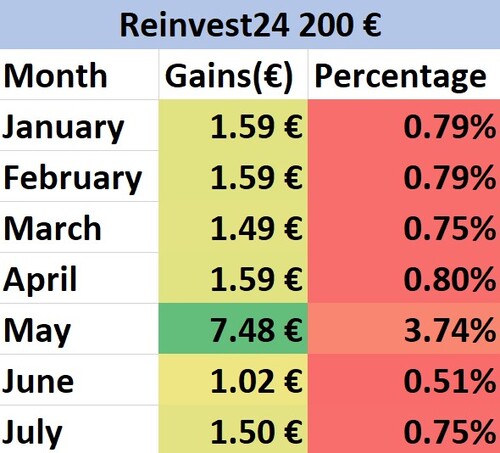

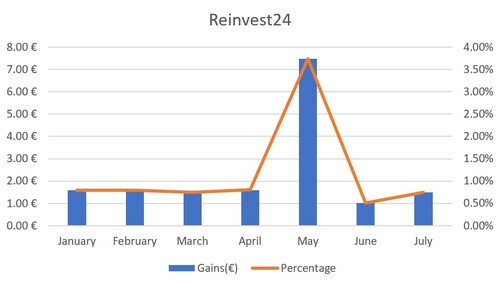

Starting Amount: € 200

After 10 Months: € 214.77

Total Percentage Increase: 7.38%

Reinvest24 paid out 1.50 EUR during the month of July. This is pretty standard considering the historical payouts from Reinvest24. There are still three months from this moment until the year ends, counting from when we first received interest, which means in order for them to make good on their projected IRR of 14.6 percent then they will need to sell the seventh stage development loan we recently invested in. All things considered, if they continue the way they are now, we will probably finish the year with an yield of 9 - 10 percent which is still a great amount of profit. You can learn more about such projects in our investment guide on investing in development loans.

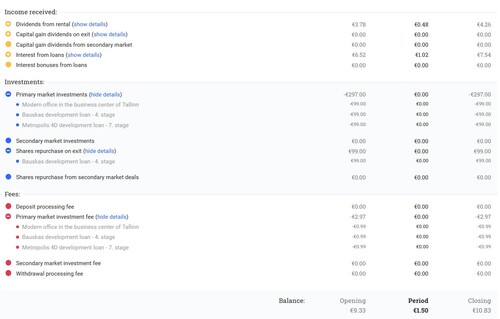

We have funded a development loan recently. It states that it is a "Modern Office in the business center of Tallinn. The modern office will run for 16 months, which means there are seven more months to go. The project started a valuation of 551,500 EUR and currently stands at 584,590". We are excited and positive for the remainder of the loan contract.

Marketplace Review

Ever since the establishment of Reinvest24's secondary market their marketplace has become a far more exciting place. Investors can purchase properties starting from only one EUR. Furthermore, all the properties listed on Reinvest24's marketplace have passed safety regulations and are backed by first rank mortgages. Reinvest24 has also updated their website and have opened up more details for investors to see for themselves.

We continue to be satisfied with our investment on Reinvest24, and we are hoping our development loan will rise in share value in the same way our modern offices value increased. Hopefully, by next month's issue, we will all see this desire come to light.

PeerBerry

PeerBerry was founded in Latvia in 2017, and ever since their establishment they have been known as one of the fastest growing peer-to-peer lending services. PeerBerry aggregates loan originators into a single ecosystem where investors can purchase loan contracts. PeerBerry delicately manages their lending borrowing ecosystem through a number of complex features. Most importantly, PeerBerry's track record is very impressive. The company has maintained a zero percent default rate, and they utilize a dual buyback guarantee protocol and provide one of the easiest platforms to use and navigate.

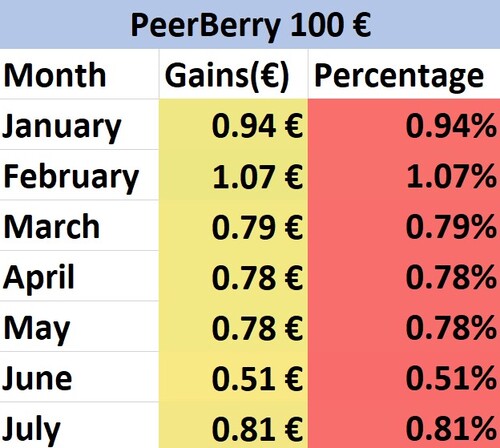

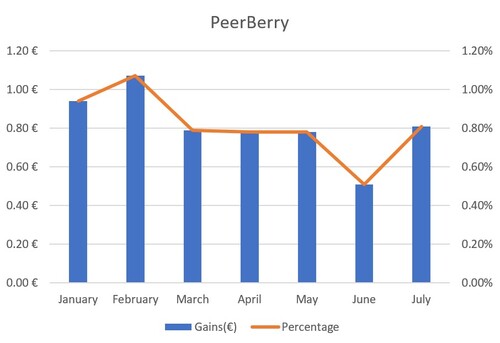

Starting Amount: € 100

After 10 Months: € 107.1

Total Percentage Increase: 7.1%

So far we have found that PeerBerry is a reputable peer-to-peer lending software that provides decent returns at a very predictable rate. Out of the three platforms that we showcase in our monthly report we find that PeerBerry is the most accurate one in regards to what it actually projects to its investors. We have yet to experience what it's like to see PeerBerry's buyback guarantee as none of our loans have defaulted or gone late.

In regards to PeerBerry's platform and auto-investing tool, we can only report very positively in regard to the matter. Without an optimization or changes, we find that at the end of each loan contract, PeerBerry's algorithms are quick to reinvest any capital we have sitting in our portfolio. This provides two great features onto PeerBerry: the lack of cash drag, and that our investments are regularly compounding.

Marketplace Review

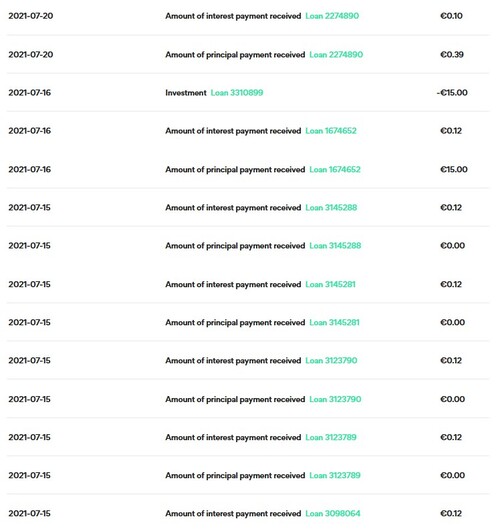

Currently, all of our loans on PeerBerry are no longer short term loans. All of them span at least 100 days, with the majority of them have 250 days before the contract finishes. Recently, we funded loan contract 3310899, another real estate based loan in Lithuania. We optimized our auto-investing tool to constantly provide us with loans that are low on risk and provide at least a 9 percent return. As you can see for this month we have a total of 0.82 EUR. We are pretty positive by the end of the full year from when we started investing we will have received an interest rate of about 9 percent, which is something we feel very positively about.

The fact that none of the loans we have financed have gone under or encountered any problems is something that reflects strongly on PeerBerry as a peer-to-peer lending service for investors. We can positively conclude that we would recommend PeerBerry as an investment service.

EstateGuru

In 2013, Estonia EstateGuru was founded by a group of financial and property management experts. Ever since, EstateGuru has dominated the crowdfunding real estate market for peer-to-peer lending investors. EstateGuru hosts the largest number of real estate related projects, in the highest number of countries and caters to the largest number of investors. EstateGuru subjects a great deal of resources onto risk and asset management. All loans on EstateGuru are backed by either a first or second rank mortgage. EstateGuru is known for having zero default rates and being successful at fund recoveries to protect their investors' capital. To invest with EstateGuru there is a minimum investment entry of 50 EUR and yearly returns are projected to be 8 - 12 percent.

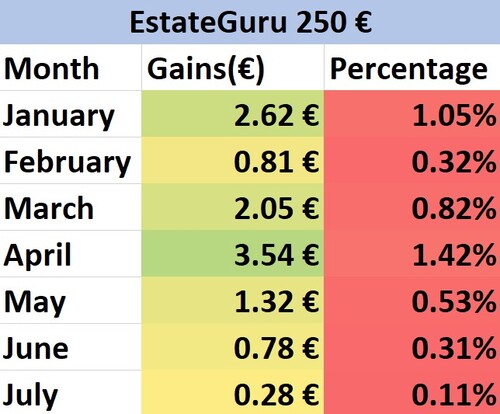

Starting Amount: € 250

After 10 Months: € 262.7

Total Percentage Increase: 4.86%

To use EstateGuru's auto-investing tool requires an account balance of 250 EUR. This is because each project on EstateGuru costs 50 EUR, and in order for the auto-investing tool to properly accommodate your preferences, it requires 250 EUR. In order to use EstateGuru's secondary market there is a 2% fee. Unfortunately for us, investing with EstateGuru has been a very uncomfortable experience, plagued with cash drag and unpredictably low, and late payments.

More importantly, the way the payouts are designed make EstateGuru far less profitable than many of it's competitors. The way EstateGuru makes payouts is by paying both principal and interest. Unfortunately, the principal being paid out from a 50 EUR loan is not enough to reinvest. This leaves a balance sitting in our portfolios which cannot be used. Hopefully, our current investments will cease to be late and we will be able to exit our position from EstateGuru completely.

Marketplace Review

EstateGuru has a large variety of different real estate loans. This variety includes loans such as, development loans, rental loans, commercial loans and mortgage loans. Below you can see that as of this month we received 27 cents despite holding more than 250 EUR in loan contracts with EstateGuru. Prior to that, we received a principal repayment. Currently we have 32.35 EUR sitting in our EstateGuru account balance and there is nothing that we can do with it.

Similarly to our most recent, July monthly report, we are profoundly disappointed with our experience on EstateGuru. Our investment on PeerBerry yields more interest on average than our EstateGuru account that holds two and half times the amount in capital. There are indications that these late loans will rectify themselves, but we will believe them once we see it.

Comparing Platforms

In many of our prior monthly submissions, we discussed how the entire investment experience felt like a tug of war. As of this month it no longer feels as if there are three competitors. EstateGuru is more or less out in terms of top profitability. Rather, both Reinvest24 and PeerBerry are coming to a close call. With both of them over 7 percent in yearly returns, PeerBerry provides a higher average percentage per month whereas, Reinvest24 sometimes sells properties in order to increase the total valuation of the portfolio. It will certainly be interesting to see how the portfolio pans out from this point on.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 14.8 | 7.4% |

| PeerBerry | € 100 | € 7.1 | 7.1% |

| EstateGuru | € 250 | € 12.6 | 5.0% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

Even though this month Reinvest24 beat PeerBerry by 0.3%, they still beat PeerBerry. Which places them as the top performing platform for this months report. We could recommend PeerBerry nonetheless. Just because they lost to Reinvest24 does not make them any less of a platform. At the of the day, it's not only about the platform, but also the loans that are chosen. The reason we single EstateGuru out is because two out of five loans have defaulted for almost a month each, and the loans that are still functioning properly are barely paying out.

On the other hand, Reinvest24 has provided both interest and capital gains, which it had promised to do.