Best Peer-to-Peer Mortgage-Lending Sites

Mortgage Lending

The best way to lend money is in the form of a mortgage. The lender gives the borrower enough cash so that the borrower may purchase a house or car. While the lender owns the asset, the borrower pays a monthly fixed amount and accrued interest back to the lender until the full amount for the asset is paid for.

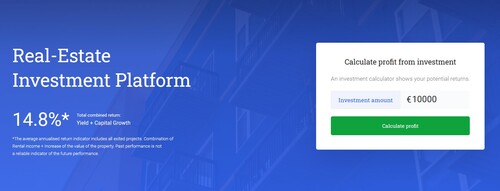

EstateGuru

EstateGuru is the king of real estate Peer-to-Peer lending. Based in Estonia they have expanded to encompass much of mainland Europe. They are incredibly profitable, a very safe investment and have been 100 percent successful in fund recoveries. Despite being in operations for a long time and having processed over hundreds of millions of euros they still show dedication and precision to quality work. Minimum investments on EstateGuru start at 50 EUR and the expected yearly return per project ranges anywhere from 8% to 12%.

EstateGuru primarily offers loans in the Baltic region of Europe. All loans are real estate based but users can invest in a few different types:

- Hotels

- Apartments

- Condominiums

- Houses

- Malls

- Offices

These different loan types come with their own general levels of risk and expected yearly yields. Other things to be expected from lending to different projects are the payment schemes. Apartments, rentals, offices will repay smaller amounts but more frequently than malls, condominiums and hotels, who will pay large sums in between long periods of time.

Estateguru boasts an easy to use website, percentage based bonuses on investing and an intuitive auto-invest feature. Unlike their competitors, Estateguru requires higher amounts of investment in order for it to be useful. Investors should have at the very least 250 EUR to use Estategurus auto invest feature.

Reinvest24

ReInvest24 is another very well known real Peer-to-Peer lender. They offer an equity based approach mentioned above to the industry by allowing lenders to receive equity based profit rather than a set and scheduled system of repayment. While Reinvest is fairly new, they have proven themselves in the market with consistent and profitable returns for their investors.

ReInvest24 is a much newer P2P lending platform in comparison to the rest of the market. They offer a small array of options to invest in but each investment is safe and guaranteed profitability. Reinvest24's strategy to P2P lending is by vetting and acquiring investments and allowing other to invest into it. ReInvest24's marketplace is small in number but high in quality. However, due to the size and the time it takes to find new projects investors can experience a cash drag and lack of diversity on Reinvest24.

The barrier of entry on ReInvest24 is higher than most platforms starting at 100 EUR to begin investing. There is also no auto-investing, investors are encouraged to do their proper due diligence if they wish to participate on ReInvest24's platform. Reinvest24 is a much more personal company, investors can speak with the CEO, and ask him directly about the platform and their concerns. The other sites on this article will not provide the same kind of personal touch Reinvest24 will be able too.

PeerBerry

PeerBerry is one of Europe's new favorite peer-to-peer lenders, who have begun offering real estate loans on their platform and are increasingly getting popular at servicing them. PeerBerry offers a very dynamic and active marketplace where investors can find dozens of daily new loan contracts to service. Lending with PeerBerry starts at 10 EUR and investors can expect an 9% - 12% yearly yield.

PeerBerry is profitable with their section that deals with peer-to-peer lending. PeeryBerry's strategy understands the high risk volatility in loans defaulting and poor investment decision. Therefore, PeerBerry itself, takes the risk of the loan and offers the potential profit from a smaller percentage of their overall lending portfolio. In order to meet the high demand on their platform, PeerBerry has the resources to simply originate more loans and allow lenders to participate.

In addition, PeerBerry has established within their ecosystem not only buyback guarantees but group guarantees. This means in the event of a defaulting loan all of the loan originators step in to financially assist the defaulted loan. This method keeps the ecosystem healthy and creates a safe environment for investors to lend money.

PeerBerry is incredibly liquid and loans are issued quickly and paid back quickly.

What's Good About Mortgage Loans?

Mortgage loans are favored both in consumer loans and business loans. Some people borrow credit to do things like renovations, fixing damage or maintenance, these are consumer loans. Consumers might also borrow credit because it's more economical and allows for more liquidity, they can pay off the debt overtime rather than incur a crippling bill. The borrowers in consumer loans are backed by their credit scores. Borrowers with high income and a good record of repayment are able to receive higher loans but when it comes to mortgage loans, the mortgage is based on the collateral. In the case of a house or a car, both assets are placed as collateral and a loan of equal value is issued.

Borrowers are in essence risking their collateral in order for the loan to be issued. The safety net here for the lenders is that if the borrower is unable to make their payments, then the lender is able to take the collateral from the borrower as a means of payment. Investing in mortgages is considered to be a tried and true strategy in lending markets.

Mortgage Lending in P2P Lending

While mortgage lending for consumer loans is still a very safe way to invest, there is an even more appealing route to mortgage lending. Rather than consumers who are looking to fix their shed or install a jacuzzi, there are some businesses who will let you in on their rental earnings. Not just rental earnings but earnings on some incredibly lucrative avenues, like hotels, AirBnBs, malls and shops. All who put up their physical property as collateral while promising a return to the borrower which is equivalent not to a fixed amount or interest rate but a percentage of equity. Through mortgage lending, lenders can now temporarily hold equity of the property and receive payments far higher than previously thought possible.

So what is it that makes real estate so much more attractive than other means of P2P lending? It's real. Real estate is something that is undeniably valuable. Investments on real estate lending platforms will always be backed by something that can be trusted, used and sold. This also shows in reality, as real estate lending companies by and large perform much better than their P2P counter parts. A majority of them report lower default rates and a higher percentage of successful fund recoveries. Even companies that do not primarily focus on real estate but dabble in it report successful endeavors in the market.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Verdict

Any lending platform that secures capital with something physical is a better platform than those that do not. We highly recommend avoiding unsecured loans as there is no guarantee that principal will be returned in the case of a defaulted loan.

Collateral can come in many forms, the best form of collateral is real estate. Real estate has traditionally been an investors first choice. Real estate can come with a consistent return, it can easily retain value and increase in value. Such reasons put real estate in the valuable position that it is in, and it can be trusted because the borrower is incentivized to protect his precious asset. Peer-to-Peer lending platforms that utilize the benefits of of real estate can be very financially appealing.

Out of the four platforms, EstateGuru has the best track record when it comes to Peer-to-Peer lending and above everything specializes in mortgage lending.