Monthly Report Nov 2021 Entry #11

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

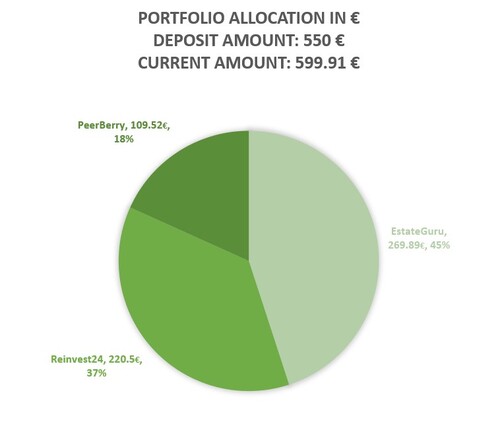

The current portfolio breakdown:

October, like September, was another good month for all three of our investments. EstateGuru still has two loans that are currently late, one 31 to 60 days and the other, 60 plus days. Every month EstateGuru tells us that there is a chance the borrower will pay it back in the coming month, and this is currently the third month that this has gone on. Otherwise, it is a good sign that our other three projects on EstateGuru are beginning to pay back. Reinvest24 and PeerBerry performed as they usually do, bringing about a 0.70 to 0.80 percent in monthly returns.

ReInvest24

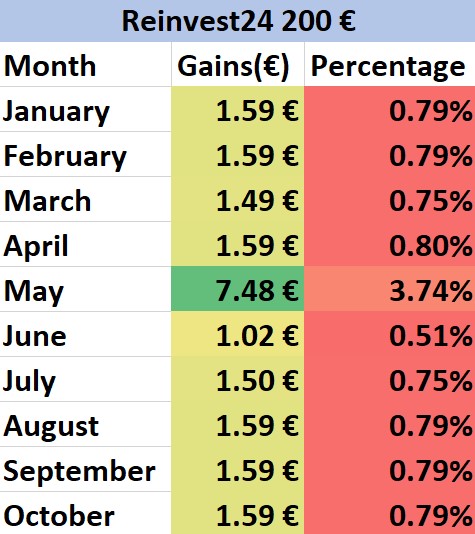

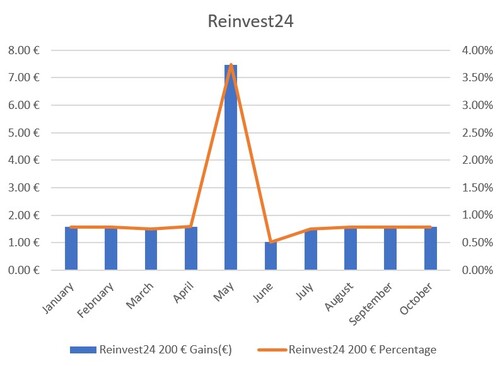

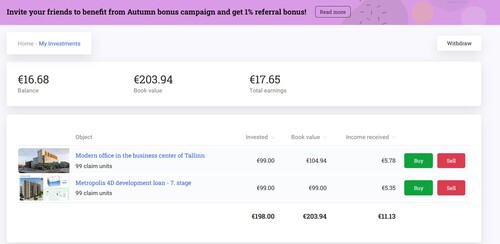

Specifically, in the last four months, we have received very consistent returns from Reinvest24. We are three months away from seeing if our acquired development loan will make a sale and increase our equity gains. We personally enjoy Reinvest24's service as well as their operations team. We got in touch with their CEO in a P2PIncome interview to find out how does Reinvest24 provide a service with such high returns while retaining a high degree of security.

Starting Amount: € 200

After 12 Months: € 216.36

Total Percentage Increase: 8.18%

Reinvest24 is a new age, peer-to-peer, innovation. The platform is a peer-to-peer lending service that aims to connect retail investors with property based businesses. The businesses receive investments in exchange for temporary equity of their listed properties. This is fundamentally different to other real estate crowdfunding platforms. On other platforms, investors simply provide capital for a loan and there is a structure with payout dates that the borrower needs to uphold. Reinvest24 provides their investors in-depth details on their rental projects as well as an execution plan so that investors can see the trajectory of their investment. The other main difference is that when investors hold the equity of the property they are also benefiting from capital gains. By and large, the value of property increases as time passes. We were able document one of these increases in capital gains on Reinvest24's platform that you can see in our sixth and seventh monthly report.

To simplify, there are two forms of returns made on Reinvest24: rental yields and capital gains. Reinvest24 explains in each loan contract how much you will receive on a monthly basis and how much you will receive if a project is sold. The rental yields are small yields that range between 0.70 to 0.80 percent in monthly returns which can is displayed in our table and graph. The increase in equity is a more dramatic increase that can go up to 5 percent when properly executed. Reinvest24 claims that investors on their platform will receive anywhere between 14 to 16 percent in yearly returns. However, even though Reinvest24 did not reach their yearly forecast, the yields were still very high and we are satisfied with the outcome.

Marketplace

Reinvest24's marketplace does not offer a large variety of projects in their primary marketplace. They do have a secondary marketplace which is relatively active and has a one percent transaction fee. Their team is constantly upgrading and updating Reinvest24's service to better the experience of investors. There is some cash drag on Reinvest24's platform but in general that can be expected from real estate crowdfunding platforms.

We are still very pleased with Reinvest24's performance, all three of our loan purchases performed very well. We hope to see more increases in equity as we had seen in the past.

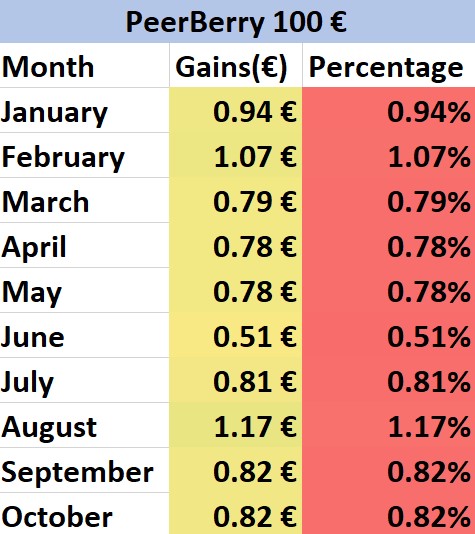

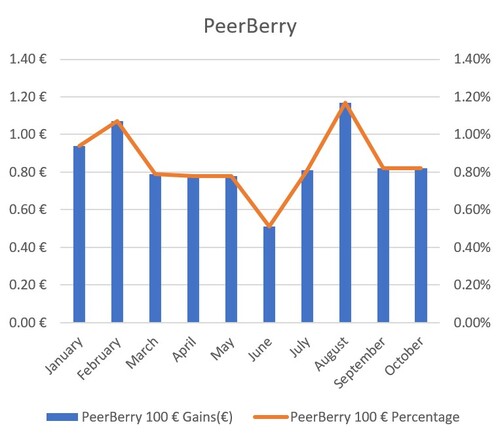

PeerBerry

PeerBerry provides easy investing solutions for investors who want a platform that will give them high yields without having to put in too much effort. PeerBerry's novelty as a peer-to-peer lending platform is their dual buyback guarantee structure as well as highly sophisticated auto-investing tool. Investments start from a small requirement of 10 EUR and the yearly interest ranges from 9 to 13 percent. There are various types of loans that investors can find on PeerBerry such as: consumer loans, mortgage loans, business loans, and so on.

Starting Amount: € 100

After 12 Months: € 108.71

Total Percentage Increase: 108.71%

Our experience with PeerBerry has been similar to our experience with Reinvest24. The payouts are both on time and predictable. The yields are roughly 9 to 10 percent, which is basically what PeerBerry had promised us. Over the course of 12 months of investing with PeerBerry we yielded a total 8.71 percent. Payouts on PeerBerry have remained fairly consistent with few small spikes up.

To very briefly comment on the nature of PeerBerry's buyback guarantee system: The wonderful thing about investing with PeerBerry is the amount of security you have as an investor. Even if you purchase a loan that appears to be faulty, your principal is in a safe position. If the borrower defaults on their loan, then the loan originator buys back the loan. If the loan originator defaults, than the entire ecosystem that is PeerBerry steps in to help the falling loan originator. Investors essentially have two shields protecting them. PeerBerry is also a very transparent company. They are highly contactable on many different platforms where executive officials are available for the inquiries and concerns of retail investors.

Marketplace Review

As mentioned, PeerBerry has a very diverse marketplace. There are many different types of loans that investors can choose from many different types of loan originators. PeerBerry is always adding loan originators to their marketplace to offer more loans to PeerBerry's constant growing pool of investors. And, they are continually issuing new loans in their primary marketplace that are both short and long term. There is no secondary market on PeerBerry. Investors who are opting for liquidity can invest in PeerBerry's 30 day short term consumer loans.

Investing with PeerBerry has been a pleasurable experience. We really like how accurate the reporting is, how on time the payments are, and the informative updates, if any are needed. Our auto-investing tool did a great job of re-investing our funds as soon as possible, there was minimal cash drag on PeerBerry and we really appreciated that.

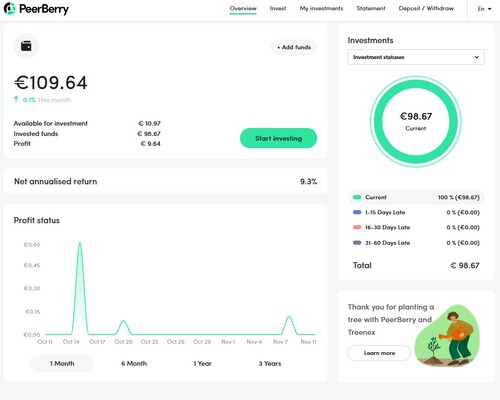

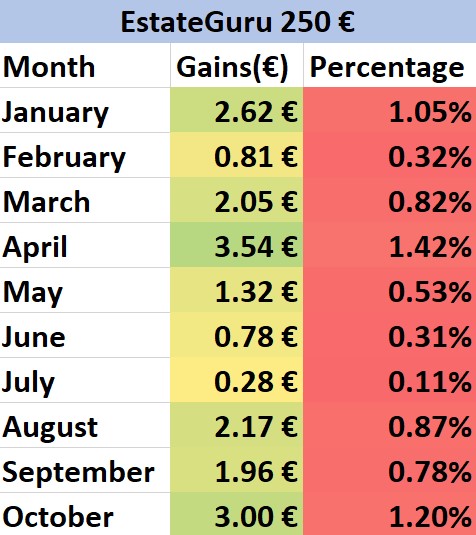

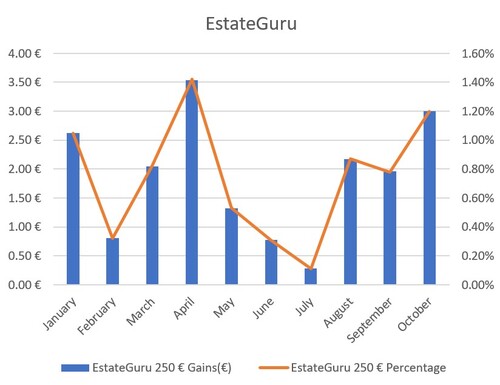

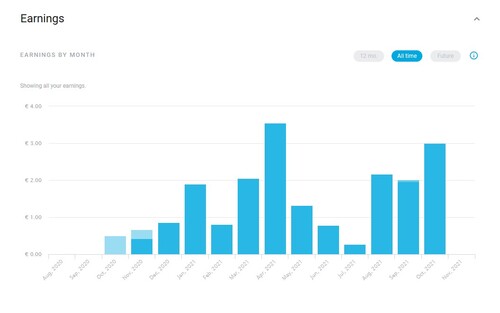

EstateGuru

EstateGuru is a titan compared to Reinvest24 and PeerBerry. They have funded more projects, have dealt with more investors and have been around for many more years. EstateGuru has properties developed across Eastern and Western Europe. The platform is run by the same people who founded EstateGuru, Marek Partel and Mikhell Stamm, as well as many other prominent real estate and finance veterans. All the loans offered on EstateGuru's marketplace come with either a 1st or 2nd rank mortgage as collateral. There is a 50 EUR minimum to invest in EstateGuru and expected yearly returns range from 8 to 12 percent in yearly returns. EstateGuru has a secondary market and auto-investing tool, the auto-invest can only be activated from portfolios of 250 EUR and more.

Starting Amount: € 250

After 12 Months: € 264.88

Total Percentage Increase: 5.95%

We are beginning to see real consistency from EstateGuru. The fact that EstateGuru has begun to pay reasonable amounts of interest for the last three months is finally a positive sign. There are still two developments that are late and continue to be late, and we have yet to receive a real response in regards to what is happening with these two loans.

Marketplace Review

EstateGuru continues to add many loans to their platform, and their secondary market is incredibly active with investors constantly buying and selling loans. We are still pretty disappointed with our entire experience with EstateGuru and hope that our two latest loans will be salvaged, including principal.

After considering this investment cycle with EstateGuru, we would be reluctant to suggest to beginner investors to choose EstateGuru.

Comparing Platforms

PeerBerry is closing the gap on Reinvest24. It would be interesting to see how these two platforms will compare with one another in a year from now. Despite all of EstateGuru's misgivings, it does have a chance to bring high yields. Investing doesn't exist within the time span of a few months or even a full year. It spans for as long as it needs to. EstateGuru still has time to catch to up Reinvest24 and PeerBerry. If EstateGuru continues on the same track it has for the last three months, there is a chance we would recommend them. But all things considered, it's difficult to give the green light on EstateGuru.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 20.50 | 10.2% |

| PeerBerry | € 100 | € 9.52 | 9.52% |

| EstateGuru | € 250 | € 19.89 | 7.95% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

Despite being a close call between PeerBerry and Reinvest24, Reinvest24 persists at the top position. The amount of pay outs, the consistency, and the dual earnings all make Reinvest24 a top-tier peer-to-peer lending platform. You might find it easier to use auto-investing tools that can be found on PeerBerry and EstateGuru, but if you are looking to make more money, Reinvest24 might be a more suitable place.