Monthly Report June 2021 Entry #6

Please read P2PIncome's most recent investment-portfolio report for 2026.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

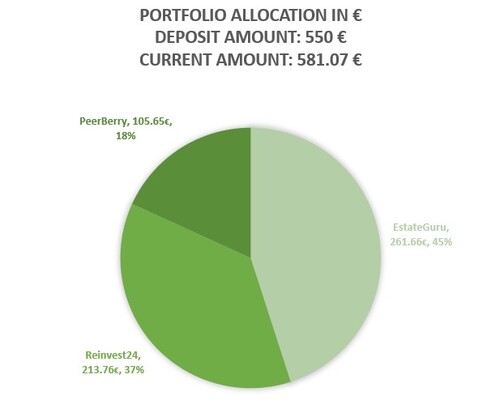

The current portfolio breakdown:

June proved to be a huge turning point for our Reinvest24 pay outs. Due to the successful execution of Reinvest24's investment strategy, we saw one of our property listings rise substantially in value. Effectively, giving Reinvest24 an unexpected additional 1% stake of our overall portfolio. This percentage was taken from EstateGuru. PeerBerry has been consistent, as always, which we are very happy about. EstateGuru started to lag again, which is at this point, to be expected.

ReInvest24

Reinvest24 is a new breed of real estate crowdfunding platforms. Reinvest24 sells loans to investors in exchange for temporary equity of the property. All properties are accompanied with a business plan to make profits from commercial enterprise or apartment rentals, all of which is provided to any interested investor. While retaining equity, investors receive two forms of return on their investments: capital gains and rental dividends. Reinvest24 has a 100 EUR minimum investment deposit and projects a yearly return of 14 percent.

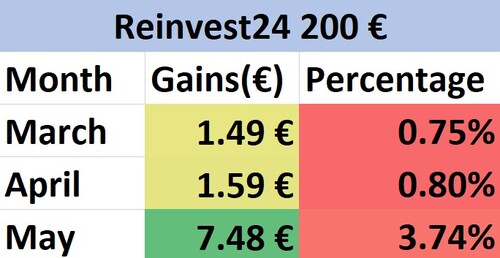

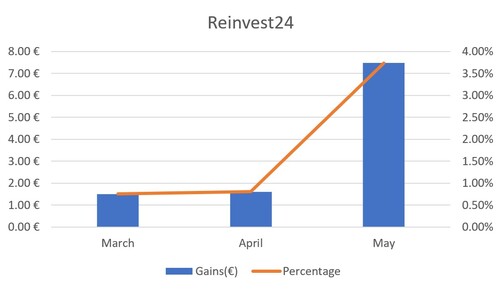

Starting Amount: € 200

After 8 Months: € 213.76

Total Percentage Increase: 6.88%

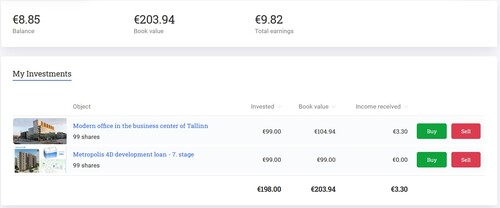

Reinvest24 took a big upwards turn this month with our modern offices increasing in value by almost 5%. This put Reinvest24 right at the top of our list as our top performer. On top of that, the previous development loan we were invested into, paid back principal in full. The earnings were rather consistent and reasonable. All in all, we were satisfied with the loan performance and that everything was paid back on time. We have decided to fund another development loan in the seventh stage.

Marketplace Review

In our experience, there is a fair bit of cash drag on Reinvest24, the platform still being fairly new does not have an impressive number of investors who are actively investing and selling. Reinvest24 recently built a secondary market where investors can invest from as little as 1 EUR. The secondary market is necessary for investors, especially on platforms like Reinvest24 that have loans that span from four months to two years.

As of this month we are very satisfied with this massive increase in capital gains. Our previous project did not enjoy such a drastic change in book value. This change also put Reinvest24 as the top performer out of our entire portfolio, which is certainly surprising, because in the past 8 months it has been more or less the bottom performer.

EstateGuru

EstateGuru is the largest real estate crowdfunding platform in Europe. They have processed over 370 million euros in loans. EstateGuru is the largest platform in Europe in terms of market cap, investors, portfolio size and location reach. If you're interested in learning more about mortgage based peer-to-peer investing platforms, you can read about them in our investment guide for real estate lending platforms.

To invest with EstateGuru there is a minimum investment entry of 50 EUR and yearly returns are projected to be 8 - 12 percent.

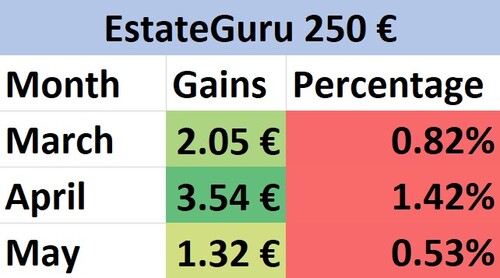

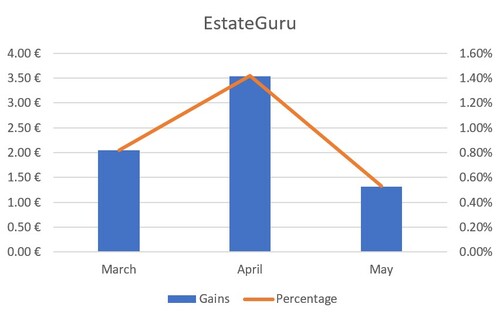

Starting Amount: € 250

After 8 Months: € 261.7

Total Percentage Increase: 4.86%

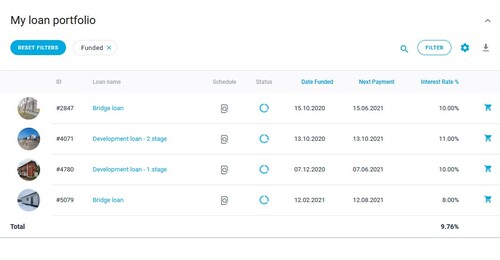

EstateGuru has been acting rather strangely over the last few months. Prior to our investments it was our understanding from reviews, financial statements and relevant communities, that EstateGuru was a safe bet. Our experience thus far has been cash drag and late loans with infrequent and dramatic payments. At this point considering the returns after 8 months and the progress of our loan cycles, we do not believe EstaeGuru will come close to it's promised IRR of 9 - 10 percent.

Marketplace Review

Our current portfolio consists of development loans and bridge loans. Developments are considerably safe, as they are loans that are designed for the purpose of finishing large scale real estate projects, such as residential condominiums or commercial enterprise. You can learn more about such projects in our investment guide on investing in development loans.

The other half of our portfolio consists of bridge loans. Bridge loans can be thought of as debt consolidation for real restate. These loans serve as short term liquidity solutions for borrowers who need refinancing. In other words, borrowers take bridge loans in order to cover their current debt. Bridge loans are generally considered high risk and accompanied with higher rewards. On EstateGuru, all bridge loans are backed by first or second rank mortgages which are supposed to reduce the overall risk. We still feel secure investing in EstateGuru, but this has for sure been less pleasurable than PeerBerry or Reinvest24.

PeerBerry

PeerBerry is a loan originator aggregator that has earned it's name as the fastest growing peer-to-peer lending platform in Europe. PeerBerry was founded by one of Europe's leading loan originators, Aventus Group. Aventus was initially on Mintos but shortly after seeing the platform's success, they sought to build their own peer-to-peer lending platform. PeerBerry was the end product.

Today, the platform boasts a very sophisticated auto-investing tool, an active market where loans are issued daily, and a very easy to use platform. There is a 10 EUR minimum investment entry to use PeerBerry and yearly return ranges from 9 to 12 percent.

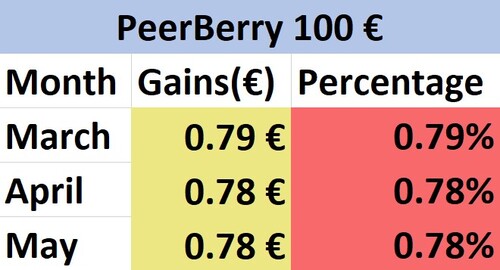

Starting Amount: € 100

After 8 Months: € 105.65

Total Percentage Increase: 5.65%

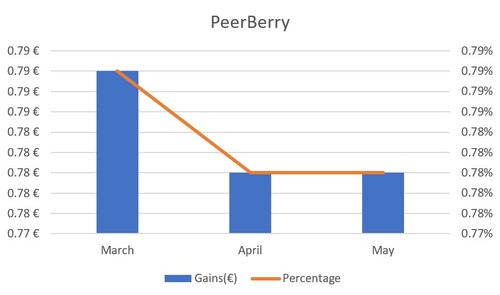

PeerBerry has been a very consistent investing experience, every month, we can expect 0.8 percent to 1 percent. This month, all loan contracts were completed and auto-invested the next day. Experiencing PeerBerry's auto-investing tool is always surprising due to how quickly it fills the loans of your choosing. For more information you can refer to our guide on investing with auto-investing software.

Marketplace Review

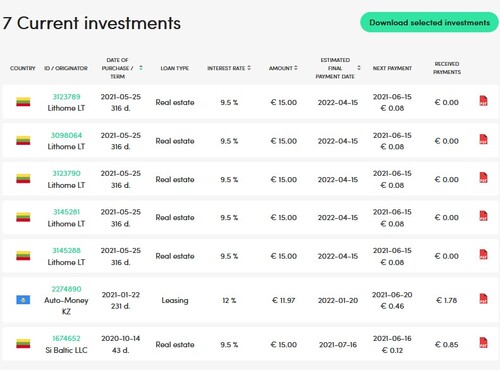

This month, PeerBerry was our weakest performer. Despite having great consistency, the payouts we have experienced as of late, have been 0.20 percent less. Making PeerBerry our weakest link of the three. Initially, PeerBerry was our top performer for the first four months, and we are convinced that they will make up for it. We are not positive as to why our auto-invest tool loaded all of our capital into Lithuanian loans from the same loan originator. It will most likely require optimization on our end.

All the loans are still in real estate, which is something we generally believe in. So far none of the loans on PeerBerry have been late and the loans we are invested in, now may bode well for our portfolio in the near future.

Comparing Platforms

When we first embarked on this investing portfolio we really wanted to see the difference between these two well-known platforms, PeerBerry and EstateGuru, specifically, in comparison to, Reinvest24. Reinvest24 really brings a new edge to peer-to-peer lending, to reap the benefits of dividends and capital gains through using equity as a transaction. Initially, we were concerned with the small payouts we were receiving, as our income from Reinvest24 indicated a much smaller yearly return. With the 5 percent increase on our modern office loans, it brought our overall gains by 2.5 percent.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 13.76 | 6.88% |

| EstateGuru | € 250 | € 11.7 | 4.68% |

| PeerBerry | € 100 | € 5.65 | 5.65% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Verdict

Reinvest24 really took first place with the successful execution of increasing the property value. EstateGuru has again taken a turn for the worse and PeerBerry has remained "good ol' PeerBerry". All things considered, all platforms have yielded decent returns. Be it our luck or expertise, none of our loans have defaulted. There have been a handful of late loans, but they are and few in between.

We are certainly looking forward to what our portfolio will bring next. As of this month we have had 5 loans finished and reinvested from PeerBerry, and one loan finished and reinvested on Reinvest24. Hopefully these 6 loans will continue to yield greater results for us. On the other hand, with EstateGuru, we are hoping to see that they step up to the plate.